Child life Insurance: Buyer’s Guide [2020 Quotes]

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Child life insurance premiums are generally inexpensive and can provide long-term cash value for your child

- Getting insurance for your child secures your child’s insurability as an adult

- Approval for a child life insurance process is normally fast and easy and doesn’t require a medical exam

- You can lock in the lowest rates for your child by securing a plan at the earliest age possible

The immediate purpose of a child life insurance policy is to protect you and your family from being burdened with unexpected costs if your child were to pass away. As parents, buying life insurance for your child and everything it symbolizes is the last thing we want to think about.

Understanding whether you should be buying life insurance for your child deserves a few minutes of your time, as it can benefit your child by providing a financial head start into adulthood. In this article, we will explain how a child life insurance policy can help you protect and provide for your child now and in the future and how your current term life insurance plan might allow you to do this quickly and easily.

After reading this article, you’ll be able to decide if the features of a child life insurance plan can be a useful tool in your overall financial family plan.

Since buying life insurance for your child is such an important component of your family’s financial security, start shopping right now by obtaining a quick no-hassle quote. Simply enter your ZIP code above and get a customized child life insurance quote in seconds.

Top Providers for Child Life Insurance

When it comes to finding a provider for child life insurance, you won’t have to look far. Most large insurers offer an option for a child insurance rider on term life plans or will be able to offer a whole life plan for your child. However, large insurers are mainly focused on providing solutions for the adult market.

There are two prominent names in the insurance business that focus on child insurance solutions. Global Life and Gerber Life, the companies named earlier in this article, are the leading names for child life insurance.

If you are looking for basic whole life plans, Gerber and Global Life Insurance provide core solutions.

If you are looking for anything a bit more complicated, like a universal life plan for your child, you may have to work with your regular insurance plan to create a solution that’s right for you.

For both companies, you will see eye-catching promises for low child life insurance costs.

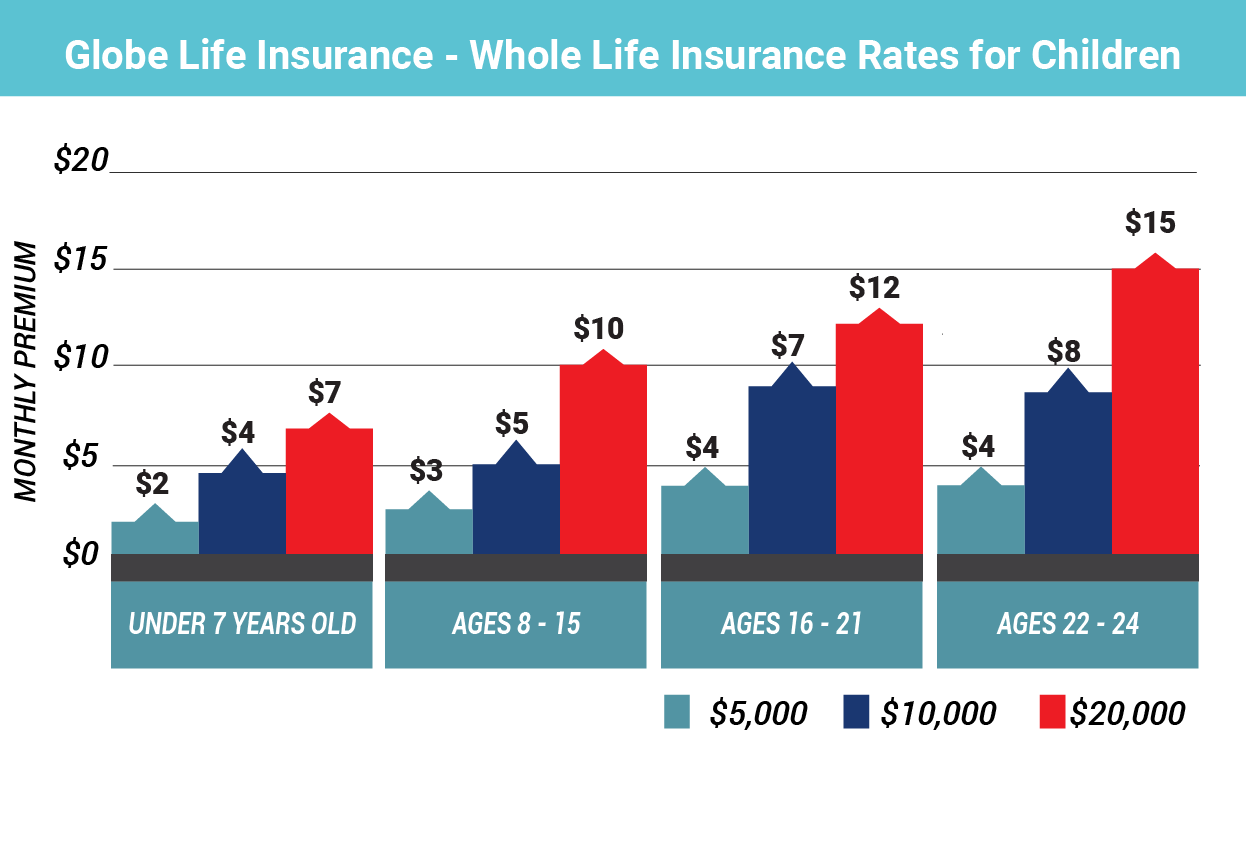

Global Life proclaims that you can receive $20,000 in coverage for just $1. Looking at the fine print reveals that $1 will cover your first month’s premium. So technically, you will receive $20,000 of coverage for $1 but only for your first month of premium payments. After that, premiums for the same $20,000 will be adjusted based on your state and child’s age.

How much is life insurance for a child?

The table below will give you an idea of the actual monthly premium you can expect to pay with Global Life after the first month by the different age group buckets.

| Ages | $5,000 | $10,000 | $15,000 | $20,000 | $25,000 |

|---|---|---|---|---|---|

| 0–7 | $2.17 | $3.82 | $5.46 | $7.11 | $8.76 |

| 8–15 | $3.25 | $5.41 | $7.58 | $9.74 | $11.90 |

| 16–21 | $3.84 | $6.55 | $9.27 | $12.00 | $14.73 |

| 22–25 | $4.33 | $7.58 | $10.82 | $14.06 | $17.31 |

Get Your Rates Quote Now | |||||

As you can see, after the first monthly premium, you can expect to pay anywhere from $7 to $14 per month for a $20,000 benefit.

Gerber Life promises coverage for “as little as $1 per week.” This low rate is for the youngest age bracket, 0–7 years of age, and covers a $5,000 benefit. For a child within the 0- to 7-year-old age range in New Jersey, the rate will be just under $4 a month. However, if you increase your child life insurance coverage to $10,000, that rate doubles.

| Total Coverage | Monthly Rates |

|---|---|

| $5,000 | $3.73 |

| $10,000 | $7.45 |

| $15,000 | $11.19 |

| $25,000 | $17.91 |

| $35,000 | $25.07 |

| $50,000 | $35.82 |

Get Your Rates Quote Now | |

As you can see, since rates increase so dramatically as you acquire more benefit coverage, to keep rates low it’s best to purchase just the coverage you need.

In fact, if you are only buying insurance to guarantee insurability for your child later in life, you might want to buy the lowest coverage benefit possible and reserve any additional money to invest in an alternative to child life insurance.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Why do I need life insurance for my child?

Child life insurance is exactly what it sounds like. Putting it bluntly, child life insurance is a policy that will pay the beneficiary, usually the child’s parents, a benefit amount in the event of their child’s death. The policy is held by the parents, grandparents, or relatives that purchase the policy, but the policy covers the life of a specified child.

Today’s policies are built to offer additional features that make the idea of child life insurance less objectionable. Child life premiums are set up as savings vehicles that help you to begin providing for your child’s future at an early age.

In fact, some policies can be set up to help pass money on to children and grandchildren that will provide tax-advantaged payouts when the child becomes an adult.

Having coverage for a child also helps ensure that the child will be able to get insurance coverage when they become adults.

For many parents, if a tragedy occurs, the last thing you want to deal with is unexpected financial constraints. For the cost of a few dollars a month, the opportunity to start saving for a child while alleviating any concerns with raising funds during a tough time makes a good case for having a policy.

Here’s a video about the top three reasons to buy life insurance for children.

Now, let’s talk about how it all works.

How Child Life Insurance Works

Life insurance for children is inexpensive. This is because, fortunately, child fatality rates are low. In fact, fatality rates for children are so low that many people don’t take the time to learn about it.

However, if you work with a dependable insurance agent or financial advisor, they’ve probably presented a few life insurance plans to you in some form.

The video below provides a pretty good overview of why child life insurance can be important to your family.

Child life insurance can be purchased in one of two methods: as a standalone policy or as an add-on rider to an adult life insurance policy.

When you purchase child life insurance as a standalone policy, the plan is sold as a basic whole-life policy. Like all whole-life policies, child life insurance policies provide a fixed benefit amount that will never change, and policyholders pay a fixed premium that will never increase.

Additionally, child life insurance policies set apart a component of the premium to help build cash value in the policy.

The second method of acquiring child life insurance is by adding a child life insurance rider to an adult term life policy. When you purchase an adult life insurance policy, you’re presented with several add-on options that can be bundled with the basic insurance coverage.

Keep in mind, and if you’re wondering what are life insurance riders, as designed, each rider adds to the premium amount.

When you purchase term life insurance for yourself, a child life rider will present the opportunity to purchase an additional amount of insurance. This is usually for a small benefit amount between $5,000 to $25,000 that will cover your child only for the term of the policy.

Whichever method you use to purchase child life insurance, either as a separate whole life policy or rider added to your term-life policy, having insurance for a child has one key feature.

Having a policy for a child makes them eligible for insurance without requalification when they become an adult.

This can be important for children with health concerns or with a family history of health issues that could make it harder for them to obtain insurance even in their early adult years.

If you purchase an add-on rider to your term plan, your child will only remain covered during the term of the policy. Once the term expires, your child’s coverage will end.

For a child whole life policy, coverage will continue as long as premium payments are made. The coverage will convert to an adult policy when the child becomes an adult. It will last until the policy hits a pre-defined maturity date well into the future.

Child Life Maturity Date & How It Works

To understand the maturity date on a child’s life insurance policy, you must first understand the significance of a maturity date and how it applies to any life insurance policy.

The fact is even permanent life insurance doesn’t last forever. Permanent life insurance is structured to end on a date far into the future that, frankly speaking, is well beyond a policyholder’s expected lifespan. This makes sense.

As a policyholder, you want to make sure that your permanent insurance will cover you for as long as you live or pay your beneficiaries if you pass on.

However, people can lose or forget about policies. In 2013, nearly $1 billion in lost or forgotten policy benefits went unclaimed. The National Association of Insurance Commissioners (NAIC) has set up a life insurance policy locator service to help manage and assist policyholders with lost or forgotten policies.

A maturity date on your policy will trigger the expiration of the policy. When a whole-life policy reaches its maturity date, the policy is canceled and any cash value in the policy is returned to the policyholder.

For insurance companies, having a maturity date allows companies to manage the insurance liability and cash value that the insurance company is on the hook to pay out. In most instances, it’s expected that a policyholder will not live until the maturity date.

For example, maturity dates are set for a policyholder’s 100th or 121st birthday.

Knowing your policy maturity date is important for a few reasons. First, if a policy expires, the cash value of the policy is returned to the policyholder and the policyholder loses any benefit coverage. This is an issue because not only will you lose coverage, but your beneficiaries will no longer be eligible to receive any benefit payment.

Second, when the money comes back to you, any value that you gained over the life of the whole life policy could result in you losing a lot of value in what you had intended to leave to your beneficiary.

So how does this all apply to child life insurance?

With child insurance, the rules for maturity are pretty much the same except that, for a child’s life insurance plan, maturity is set with a much shorter duration.

For example, the most widely known child life insurance plan, the Gerber Child Life plan, effectively matures when a child turns 21 years old. Before that time, the parent is the true policyholder.

Your child life insurance age limit is determined by when your insurance company determines adulthood.Thus is normally at an 18th or 21st birthday.

For example for the Gerber plan when a child turns 21, the plan continues to exist but becomes a traditional whole life policy, which is just one type of whole life policy, and the child that was covered becomes the new policyholder. The policyholder can add coverage without having to prove insurability or can keep the same coverage.

When the policy changes over from parent to child at age 21, the plan is effectively restructured. Although the child plan has matured or expired, a new maturity date is set for a date for into the future — for example, on the new policyholder’s 21st birthday.

Who should consider child life insurance?

The million-dollar question is whether you should buy life insurance for your child. Reading various financial blogs on the internet could lead you to believe that child life insurance is a waste of money.

Many financial gurus will make the point that, with so many options and places to invest, putting money into life insurance is not money well spent when compared to other investments that you could make to secure your child’s future.

Let’s take a closer look at that line of thinking. When reviewing life insurance options, whether for a child or an adult, it is critical to make a distinction for why you would buy one product versus another.

Life insurance is not an investment in the traditional sense, where your goals might be wealth accumulation or retirement savings. Life insurance is intended to help you absorb financial costs and obligations that result from the death of someone who depends upon you.

The core intention of insurance is to protect you from the unexpected and make difficult times at least financially manageable.

So, it’s not really fair to gray the lines between deciding on investments for your child’s future and deciding on obtaining life insurance for your child.

That being the case, let’s take a look at who should consider child life insurance.

- People with a challenged emergency fund – It doesn’t matter whether you make $100 per month or $100,000 per month. If what you take in has to be spent to keep up with your expenses, building your emergency fund is impossible. A low monthly premium payment into a child whole life plan can help you sock away money for your child’s future while ensuring that if you did need to depend upon it, the funding to cover expenses from a tragic loss is there.

- Parents of children with special needs – Some children might have special health considerations which can make it difficult for a child to obtain insurance as an adult. In these instances, it can be useful to obtain insurance for your children which will ensure they are covered as adults. Obtaining coverage as a child allows the child to continue coverage into adulthood without submitting to a requalification process or completing a medical review.

- Children who contribute financially – If your family depends upon any income that comes from a child’s trust or occupation, you might want to get coverage. For example, if your child receives income as an actor and your family depends upon the income to pay for day-to-day expenses, an insurance plan for your child will protect you should anything happen.

- Wealthy parents or grandparents – Most tax-friendly investment plans have maximum contributions. For some parents and grandparents, contributions made to these plans are intended to be passed down through inheritance. If contributions to these other plans are maxed out, child life insurance provides another avenue for putting money away for a child.

Even if you don’t fit into one of the specific cases above, is child life insurance worth it to consider just for protection with an inexpensive premium.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

What is the best life insurance for a child?

A life insurance provider might be willing to customize a solution for your family, whether through a family insurance plan or with a more complex type of universal life insurance plan for your child.

Here’s a quick overview of the types of child life insurance available to give you a better idea of what’s right for your family.

Whole Life Insurance

A whole-life child insurance plan is the most well-known child life insurance plans you’ll find. You may have heard about plans such as the Gerber Life Grow Up® Plan or the Globe Life Insurance Plan. These plans are permanent insurance policies that guarantee coverage for your child’s life as long as premiums are paid on time.

Plans require fixed premium payments that begin from the first day of coverage and plan benefits never change.

For example, a $3 monthly premium that purchases a benefit of $15,000 will never change for the life of the policy. With some policies, benefit coverage may increase when the child turns 18 and last until the child’s 21st birthday. At that time, the policy would effectively convert to an adult whole life policy.

Also, a component of your premium will contribute to the cash value of the plan. The longer you make premium payments to the plan, the more cash value you will accumulate as this example of whole life insurance from Globe Life shows.

The cash value will earn interest at a pre-determined rate throughout the life of the policy, which allows a policyholder to take advantage of compounding interest. For some parents, this is a great way to put away money for a child’s future.

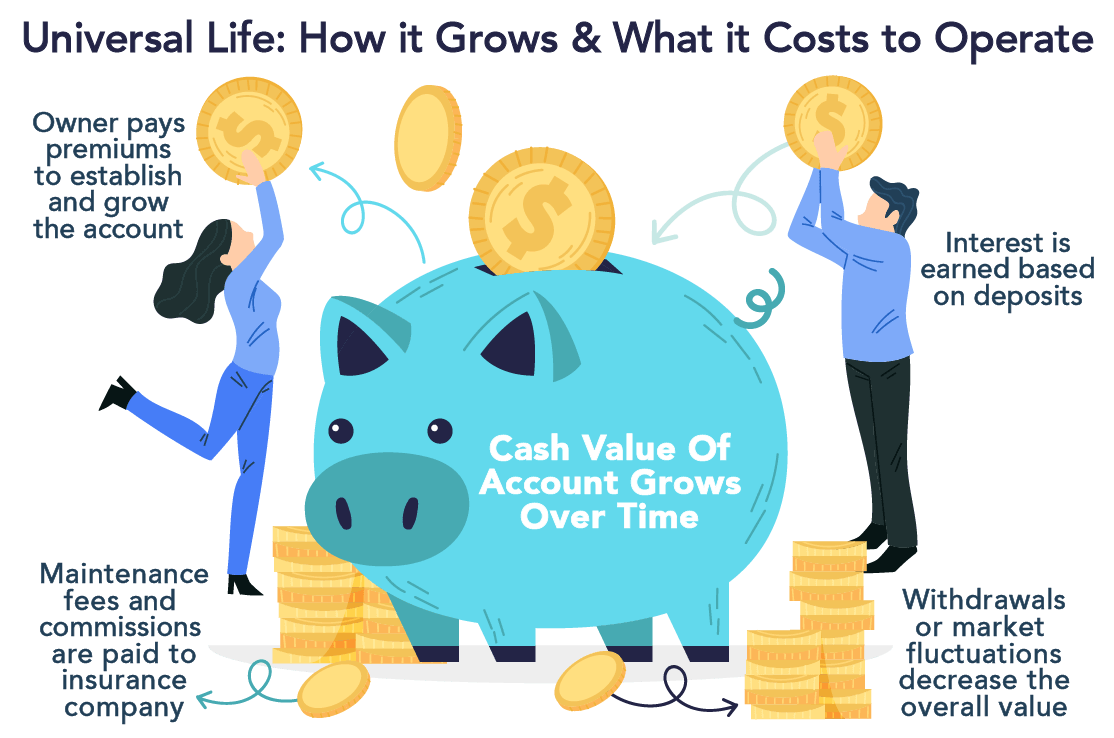

Universal Life Insurance

Some insurance companies offer child life insurance as an opportunity for parents and grandparents to provide financial security for children and grandchildren through a universal life insurance plan.

Universal life insurance is a type of whole life insurance. It is permanent child life insurance, meaning your child’s life insurance plan can cover not only childhood but also through adulthood. Like traditional whole life insurance, a cash value component allows the policyholder to build capital in the plan that can be used later.

The key difference between universal life and traditional whole life is that with universal life, the benefit and the premium contributions are flexible. This means that a policyholder can contribute more when funding is available and manage the amount of benefit so that as a person’s lifestyle changes, the benefit can increase or decrease.

With a child life universal plan, a parent or grandparent would purchase a policy in the child’s name. Once the policy is approved, the parent or grandparent can shelter additional sums by contributing higher premiums to the policy. This increases the cash value in the policy.

You might ask, why wouldn’t the parent or grandparent just take out insurance for themselves with the child or grandchild as a beneficiary? Some parents or grandparents may have a difficult time getting approved for insurance. Due to their higher ages, the premiums for these policies will be costlier as well.

A child insurance plan rarely requires a medical exam or extensive health review, and a policy for a child will have lower premiums.

Here’s the value in a universal child life plan. When a child becomes an adult, a loan can be granted against the cash value built in the premium. If the child that is insured keeps the policy and premiums are paid consistently, the policyholder can now borrow a good amount against the policy each year.

If structured properly, when the policyholder eventually dies, the loan can be paid with the benefit amount in the policy.

In this manner, setting up child universal life plans are an accessible and capable option to help fund your child’s retirement.

Child Life Insurance Riders

In many instances, parents may not feel like making the effort to shop for a child life insurance plan. An easy solution is to just purchase an additional rider on your existing term life plan.

This option is probably the least expensive way to get coverage for your kids.

However, as with all term insurance, this method does not provide any opportunity to build savings or value that your child can use later.

When your policy ends, so will the coverage on your child. To avoid any exposure, you’ll need to keep track of when your term life policy ends and create a plan to maintain coverage afterward. Most term policies allow for some type of conversion to a whole life policy.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

How Child Life Insurance Builds Cash Value

For any permanent life insurance plan, a component of your premium is allocated to serve the plan administration and cover the benefit payment. Any premium amount remaining is set aside to earn interest or be invested, depending on the plan type.

For child life insurance, it’s pretty much the same. So, what are the net cash values of life insurance? In this case, as you make premium payments into the policy, it does build cash value. Your life insurance agent should be able to work with you to determine the best way to set this up for your child.

For example, if you purchase a whole life policy, you may opt to make a higher premium payment with a lower benefit amount. This would reserve a larger component of the premium to build up cash value at the interest rate offered.

When your child becomes an adult, significant value can be available in the policy. Your child as an adult can decide to borrow against the cash value when needed or withdraw the cash.

A universal plan offers a few additional features. Aside from flexibility in premium payments and benefit amounts, plans can be offered as indexed or variable life plans.

In these cases, instead of earning a straight interest rate, a policyholder can choose to allocate the cash value component into an index fund or individual stocks and funds. The intent is that the funds will perform better than the interest rate offered on whole or traditional universal life products.

Historically, markets do outperform low-interest savings rates over a long period of time.

However, if you are looking at this approach you will likely need to work closely with your financial advisor. In many cases, they will review your financial situation to gauge your suitability for such products.

Once you do have cash value built into a child life plan, the question becomes: How can your child use the value?

There are three ways to extract cash value from a child life insurance plan. The first is to surrender the policy, which is equivalent to canceling the policy. When a policyholder cancels the policy, the cash value in the plan is returned to them as a lump sum and any insurance coverage is canceled.

This could be the costliest way to extract cash value from your plan for two reasons. First, you lose any coverage that you might have had after making years of premiums. Second, any money returned that might have appreciated in value will be taxable as income.

The second way to extract cash is to continue to make premium payments but to request a dividend payout from the cash value of the plan. In this case, you can’ extract all of the cash value since a minimum amount must be kept to service the policy.

However, you should be aware that any dividends paid are subject to income taxes.

The last scenario for extracting cash value is for a policyholder to borrow against the cash value in the policy. In this case, the policyholder could take out yearly loans of a small amount, taking care that the total loan amount plus interest never exceeds the value of the death benefit for the policy.

Money can be distributed tax-free, and when the policyholder dies, the death benefit can be used to pay off the total outstanding loan amount.

Of course, all of these options can get pretty complicated, so consult with your financial advisor when considering a cash value payment.

How does child life insurance work as an investment?

If you purchase whole life or universal child life policies, you are making an investment that your child will benefit from in the future. Some popular investment advisors warn against the dangers of purchasing child life insurance. Just check out some of the child life insurance Dave Ramsey videos.

The video below provides a great explanation for how investing in child life insurance not only sets up an emergency fund for your child but also guarantees your child’s insurability.

The video summarizes the benefits of having a child life insurance policy pretty succinctly, but many financial gurus still argue against the viability of child life insurance when compared with other investment tools.

Child life insurance can have higher fees and offer more conservative returns than other tools like IRAs, Roth IRAs, and 529 college savings plans. For a parent, it’s important to understand the goals of any investment for your child.

If you’re looking to help your child later in life by making it easier for them to maintain good life insurance, other retirement options and 529 college plans won’t really help you.

However, if you are looking purely to secure your child from a financial standpoint or provide funding for a specific objective such as paying for college tuition, you may want to look at other pure investment-based tools.

Shopping for Child Life Insurance

Whether you are shopping for life insurance for yourself or for a child, you’ll need to answer the same basic questions.

- Why do you need insurance?

- What options do you have to obtain insurance?

- How much insurance do you need and how much will it cost?

Let’s break these down.

Why you need insurance will depend on your personal situation, but it will usually boil down to one of a few motivations. It could be that your child has special needs or concerns that could make finding coverage as an adult harder. Or you might be looking to invest in a way to transfer wealth to your child in a manner that avoids high taxes.

Based on the reason you are considering insurance, you can determine which options are available to you.

For a child with special needs looking for guaranteed insurability, getting the cheapest whole life policy for a low benefit amount — or even purchasing a rider on your term policy — might do the trick.

If you’re looking to build up your child’s financial nest egg, you might consider universal life plans that offer the opportunity to invest in more diverse assets with higher potential returns.

Finally, you have to decide how much insurance you would need and determine how much it will cost. As you look at different providers, just be careful of the promise of insurance coverage offered “for $1 a month.”

Child life insurance is often marketed as “$1 buys you XXX amount of insurance.” The fine print states that the $1 is only for the first month’s premium.

After your first monthly payment, your fixed monthly rate will increase and can increase substantially.

For any complex universal plans, it’s important to request information on any fees before making a commitment.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Alternatives to Child Life Insurance

We’ve discussed why you might want to purchase child life insurance and pointed you to tools to get child life rates. If your goals are not only to secure your child’s insurability but also to maximize the amount of financial help you can provide later in life, here are some options you might consider.

Invest Directly into a Fund or Equity Index

It’s important to be aware that the goals of a child life insurance plan are, first and foremost, to provide benefit coverage in the event of a tragedy. Any savings or cash value benefit is secondary.

This is important because when you are comparing a child life insurance plan against a direct investment into a long-term investment fund, you should find that a child life insurance plan garners higher fees and could be structured with maximum earnings caps.

Fees and earnings caps could severely limit the earnings potential of the money you are investing for your child.

For example, let’s compare a child universal life policy with a strategy of purchasing cheap whole life insurance and putting any additional funding into a Vanguard index fund.

Let’s assume that both the universal life and the Vanguard fund are modeled after the S&P 500 index.

Assuming that, like many universal life insurance plans, an earnings cap is imposed at any gains above 11 percent. This means if your fund performs better than 11 percent, you will not receive those additional gains.

With a Vanguard fund, you keep what you earn.

Let’s say the S&P 500 provides an annual return of just 13 percent in the first year you’ve invested. This means that if you invested in a universal child life plan, you would lose about 2 percent of your potential earnings.

In real dollar terms, let’s say you contributed $10,000 into the cash value component of your universal plan. Using a simple future value calculation a $10,000 investment returning 11 percent after one year amounts to $11,100.

With the uncapped return invested in a Vanguard fund, your 13 percent uncapped return would be $11,300.

A difference of $200 might not seem like much, but consider that the $200 is more than enough to cover your premiums for a child’s whole-life plan for that year.

What is child term life insurance?

If your goal is not to invest in your child’s future but to cover any unexpected expenses if something should happen, then paying for an additional rider on your own adult term plan could provide you all the coverage you need without purchasing a dedicated child life insurance plan.

An additional rider will help you cover any funeral expenses should they arise and will usually be cheaper than purchasing a dedicated child whole life policy.

A child life rider on your policy can also sometimes help with the insurability of the child when they become adult age.

Take a look at this quick video to learn more.

Next, let’s talk about tax-advantaged investment products as an alternative to child life insurance.

Purchase Tax-Advantaged Investment Products for Child Education

If your goal is to put money away for a child’s college tuition, then another option you’ve probably considered is to invest in a college 529 savings plan.

In this video, Casey Robinson of Waldron discusses the risks and benefits of investing in a 529 savings plan:

College 529 plans offer the ability to accumulate earnings free of federal income tax. If the funds are used to pay for a college education, the earnings remain tax-free.

When comparing a college 529 plan against using a child life insurance plan to accumulate earnings for a child’s education, the first things to consider are the fee structures for each plan.

Although it depends on the state of residence you are in and the type of plan you choose, some college 529 plans could cost as much as 10 percent over 10 years. For example, if you contribute $10,000 over 10 years into a high-cost plan in Alabama, your fees could add up to over $1,000.

Aside from the fees, if you choose a college 529 savings over life insurance as a savings vehicle but decide not to use the money for education, any earnings will become taxable.

With a child life plan, you have the option of taking out a tax-free loan from the cash value of the plan to use for anything, including funding a college education, starting a new business, or supporting expenses for a gap year.

Pros & Cons of Child Life Insurance

Does purchasing child life insurance make sense for you? Take a moment to review the pros and cons of child life insurance to see if your situation might benefit from acquiring having a plan.

Pros of Child Life Insurance

- Child life insurance is inexpensive and can ensure expenses are covered during difficult times.

- Life insurance for children is whole life insurance which enables your child to obtain life coverage as an adult without having to requalify.

- Child life insurance is a forced savings vehicle and your child will have access to tax-free loans against the cash value of the plan.

- Your child will have access to tax-advantaged loans against the policy when they grow up.

Cons of Child Life Insurance

- Child life insurance policies can have high fees and cap returns on investments.

- Statistically, children under 21 are generally low-risk and don’t contribute income, so life insurance for children is generally deemed unnecessary by most financial experts.

- When compared to investment tools such as 529 college savings plans, Roth IRA and IRAs, and index and equity funds, life insurance for children can be more expensive and limiting in the long run.

- Cashing out on the cash value of a child life insurance plan can trigger an income tax event.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Child Life Insurance: The Bottom Line

Although the line between investment tools and insurance products often gets crossed, here’s something important to consider: Investment products are useful in helping you to plan for the future, but life insurance tools such as a child life insurance plan can help you plan for the future while protecting you today,

The bottom line is that child life insurance, like any insurance product, should meet your lifestyle needs and requirements. You probably realize the value in planning out your financial future and retirement, but have you ever considered your full insurance risk assessment?

Child life insurance might be a valuable component to help you not only manage your risks but the risks your family might face down the road.

If you’ve read through to the end of this article, you are asking all of the right questions and are doing the work to get to the right answers. The next step is to start pricing options for your insurance needs.

Ready to consider buying child life insurance? Use our FREE instant quote too below to get started.

References:

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption