Allstate Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1931 |

| Current Executive | CEO - Tom Wilson |

| Number of Employees | 45,700 |

| Total Sales / Total Assets | $32,200,000,000 / $112,200,000,000 |

| HQ Address | 2775 Sanders Road Northbrook, IL 60062 |

| Phone Number | 1-800-255-7828 |

| Company Website | www.allstate.com |

| Premiums Written - Individual Life | $956,578,048 |

| Financial Standing | -29.4% |

| Best For | Strong Financial Ratings |

Get Your Rates Quote Now |

|

When shopping for life insurance, knowing what kind of coverage you need and which companies you should trust can be difficult. When it comes to something as important as protecting your family in the future, you want to make sure you have all the information you need.

Allstate has been providing insurance protection for customers since 1931. Though the company began as an auto insurance company, it has expanded to include home, life, renters, and business insurance.

Keep reading and use this guide to help you decide if Allstate is the best option for you and your family.

Don’t wait! Get FREE life insurance quotes now by clicking the quote tool above.

Table of Contents

Allstate’s Ratings

The following ratings provide an overview of Allstate’s financial standing and relationship with its customers.

A.M. Best

Credit ratings from A.M. Best are independent, objective opinions regarding a company’s creditworthiness. Allstate has a superior A+ rating, meaning it’s in strong financial standing and is able to handle its financial obligations.

Better Business Bureau (BBB)

Ratings from the Better Business Bureau (BBB) aren’t based on financial standing. Instead, they look at how a business is likely to interact with their customers.

The BBB rating is based on customer complaints, information received from the businesses directly, and public data. Allstate currently has an A+ rating from the BBB, indicating minimal complaints that were resolved quickly.

Allstate is not a BBB-accredited business.

Moody’s

Moody’s long-term obligation ratings measure a company’s credit risk. Allstate has an A1 (good) rating from Moody’s. An A1 rating indicates financial security and low credit risk.

Standard & Poor’s (S&P)

Similarly to A.M. Best and Moody’s, Standard & Poor’s long-term ratings measure a company’s overall credit risk. Allstate has received an A+ (strong) from Standard & Poor’s, indicating financial strength and stability.

NAIC Complaint Index

The National Association of Insurance Commissioners’ (NAIC) complaint index compares a company’s performance to other companies in the market. The index is set at 1.00, so any number above 1.00 indicates a higher number of complaints expected for the market.

In 2018, Allstate scored a 1.53 on the complaint index, indicating a higher number of complaints expected for the market.

Company History

Allstate was founded in 1931 by Robert E. Wood, the Chairman of Sears Roebuck and Company. In 1939, Allstate developed its first-rate system that gave better rates to safe drivers.

During World War II, the company created a program that trained women to become Allstate agents.

Throughout the 1950s, the company introduced several new ideas and programs. At the beginning of the decade, the company created its famous “You’re in good hands” slogan. In 1952, Allstate opened its first drive-in claims office. The following year, the Allstate Foundation started a grant program that trained educators to teach driver’s education.

In the 1960s, Allstate worked with Congress to pass driving safety legislation.

The company worked with the government to pass laws regarding seat belts and air bags.

Allstate introduced its Helping Hands program in 1976. Helping Hands supports and encourages the volunteer efforts of Allstate employees. In 1996, the company formed a catastrophe response team after the devastation caused by Hurricane Andrew.

Allstate’s Market Share

In 2016, Allstate had .52 percent of the market share with $804.48 million in written premiums. The following year, the company increased its share to .54 percent of the market, with $877.14 million in written premiums.

In 2018, Allstate continued to increase its market share with .58 percent and $956.58 million in written premiums.

| Rank | Company | Direct Written Premiums | Market Share | Cummulative Market Share |

|---|---|---|---|---|

| 1 | Metropolitan Group | $11,890,212,278 | 7.65% | 7.65% |

| 2 | Northwestern Mutual | $10,067,144,919 | 6.48% | 14.13% |

| 3 | New York Life | $8,714,565,090 | 5.61% | 19.73% |

| 4 | Prudential of America | $8,530,929,470 | 5.49% | 25.22% |

| 5 | Lincoln National | $6,902,867,866 | 4.44% | 29.66% |

| 6 | Mass Mutual Life Insurance | $6,638,837,098 | 4.27% | 33.93% |

| 7 | Aegon US Holding | $4,602,544,288 | 2.96% | 36.90% |

| 8 | John Hancock | $4,552,016,364 | 2.93% | 39.82% |

| 9 | State Farm | $4,387,432,631 | 2.82% | 42.65% |

| 10 | Minnesota Mutual | $3,902,003,708 | 2.51% | 45.16% |

| 43 | Allstate | $956,578,048 | 0.58% | 82.83% |

Get Your Rates Quote Now |

||||

The table above compares Allstate’s market share in 2018 with the top 10 companies in the market.

Allstate’s Position for the Future

Allstate saw a significant loss in profits during 2018 due to the wildfires in California and Hurricane Michael. The California wildfires resulted in $679 million in losses.

Overall, profits decreased by 29 percent in 2018.

However, the company also had a 36 percent increase in policies in force. Allstate also has strong and stable financial ratings. Given these factors, Allstate is still in a good position for the future.

Allstate’s Online Presence

Allstate has multiple social media platforms including Facebook, Twitter, Instagram, Pinterest, YouTube, and LinkedIn. Allstate doesn’t update its Twitter regularly with marketing posts. However, the company does use the Twitter account to answer customer questions regularly.

Allstate updates its Facebook page more frequently, with posts every few days.

The company also has a “Find an Agent” tool on its website. After you enter your ZIP code, it will give you a list of agents in your area along with their contact information. You can also see agent reviews from other customers.

The website features the Allstate Blog, which has articles that provide tips and information about a variety of subjects including auto, home, life, and small business insurance. Topics on the life insurance blog include:

- Term Life Insurance 101

- Permanent Life Insurance 101

- What is a Life Insurance Beneficiary?

- Is Life Insurance Taxable?

Allstate’s Commercials

Allstate has a series of well-known commercials featuring the character, “Mayhem.” The commercials show Mayhem causing problems such as car accidents and house flooding.

The focus of the ads is to show how Allstate can help you when Mayhem strikes.

The company also has a series of ads featuring actor Dennis Haysbert.

This ad focuses on Allstate’s safe driving features. Each of Allstate’s commercials ends with their famous slogan, “Are you in good hands?”

Allstate in the Community

The Allstate Foundation supports multiple non-profit organizations and philanthropic efforts. The foundation has four primary goals:

- Empower youth

- End domestic violence

- Transform communities

- Develop nonprofit leaders

The Allstate Foundation Good Starts Young program supports school programs that help students develop the five core social and emotional skills:

- Self-awareness

- Self-management and emotion regulation

- Relationship and social skills

- Responsible decision-making

- Social awareness

In 2019, 14 million students were in programs sponsored by the Allstate Foundation.

The Allstate Foundation Purple Purse® program aims to help end domestic violence. The foundation provides resources and online classes to help women become financially independent. Since 2005, the program has helped 1.7 million women achieve financial independence.

Founded in 1976, the Allstate Foundation Helping Hands® supports the volunteer and charitable efforts of the company’s employees and agents. In 2018, Allstate employees volunteered 258,000 hours and helped 2,983 groups in the community. Some $7.5 million was contributed the same year.

Helping Hands® also offers grants for nonprofit organizations that employees have spent four to 16 hours volunteering for. Employees can nominate an organization to receive a $500-$1,000 grant.

The Allstate Non-Profit Leadership Center offers an online leadership development program. Created in partnership with Northwestern University, the program is available for free for nonprofit employees.

About 1,000 nonprofit employees have completed the program since 2014.

Allstate’s Employees

Allstate is currently based out of Northbrook, Ill. and has more than 45,000 employees across the globe. The company offers career opportunities in the following areas:

- Claims

- Continuous improvement and industrial engineering

- Customer service and support

- Data science and analytics

- Finance

- Human resources

- Legal

- Marketing and corporate relations

- Product and pricing

- Sales

- Technology

On Glassdoor, employees have given the company a 3.4 out of 5 rating. Seventy-four percent of employees say they approve of the Allstate CEO.

As part of its commitment to diversity, Allstate offers the following resource groups for employees:

- Allstate Asian American Network (3AN)

- African American Working Network (AAWN)

- Abilities Beyond Limitations and Expectations (ABLE)

- Allstate Veterans Engagement Team and Supporters (AVETS)

- Allstate Women’s “I” Network (AWIN)

- Allstate Foster and Adoption Network (FAN)

- Intrapreneurs@Allstate (I@A)

- Allstate PRIDE

- Professional Latino Allstate Network (PLAN)

- Parents Working Together (PWT)

- Young Professionals Organization (YPO)

Allstate has also received the following recognition and awards as an employer:

- World’s Most Admired Companies – Fortune

- Management Top 250 – The Wall Street Journal

- Beston Companies for Multicultural Women – Working Mother magazine

- Top 50 Companies for Diversity – DiversityInc

- Best-of-the-Best Corporation for Inclusion – National LGBT Chamber of Commerce

- Top Companies for Executive Women – National Association for Female Executives

- Top 50 Companies for Supplier Diversity – Black Enterprise

- Diversity Best Practices Inclusion Index – Diversity Best Practices

- Top Performer – Leadership Council on Legal Diversity

- Employer Gold Award – Military Friendly

- Spouse Employer – Military Friendly

Allstate has, without a doubt, earned its fair share of awards and honors.

Shopping for Life Insurance

According to the 2018 Insurance Barometer Study from Life Happens and LIMRA, one in five people who have life insurance thinks they don’t have enough coverage.

As you shop for a life insurance policy, you should have an idea of what you want to be covered. This way, you can make sure you end up with the amount of coverage you actually need.

When thinking about the amount of coverage you need, you have to consider short-term needs and long-term needs. Short-term needs are the immediate expenses your family will need to cover such as funeral costs and medical bills.

Long-term needs include mortgages, child care costs, college tuition, and any outstanding debt such as student loans. You also need to determine how much income replacement you’d like to leave behind.

Allstate has a life insurance needs calculator to help you figure out how much coverage you need. The calculator asks questions regarding your income replacement, mortgage balance, other debts and expenses, education expenses, and assets.

After you answer the questions, you’ll have a better idea of the amount of life insurance coverage you’ll need.

Coverage Offered

In addition to life insurance policies, Allstate offers a wide variety of coverage, including:

- Auto

- Home

- Renters

- Condo

- Motorcycle

- Business

- Roadside

- Identity

Let’s take a closer look at the life insurance policy options Allstate has to offer.

Types of Coverage Offered

Allstate offers term, whole, universal, and variable life insurance policies. Let’s break down these policies.

Term

Term life insurance is temporary coverage that pays out a death benefit during a specified time period. While most insurance companies offer term life insurance in five- or 10-year increments, Allstate’s TrueFit® allows you to choose any term length between 10 and 30 years.

For example, you could choose to have a 12-, 19-, or 27-year policy. You have the ability to convert your term coverage into a permanent life insurance policy. However, you can’t convert to permanent coverage during the last two years of your policy.

Term life insurance coverage at Allstate can start at $24.64 per month for 20 years at $250,000.

Whole

Whole life insurance is permanent coverage with a guaranteed death benefit and the ability to accumulate cash value. The cost of whole life premiums is based on your age when you buy the policy and remain level. As long as you pay your premiums regularly, your beneficiaries will receive the death benefit.

With whole life insurance policies, a part of your premium goes toward your life insurance coverage while the other goes toward building a cash value.

The interest accrued by the cash value is tax-deferred.

Allstate’s Whole Life Advantage® lets you earn extra credits that can be received in cash and used to buy additional life insurance coverage or help lower premium payments.

Universal

Universal life insurance is whole life insurance that builds cash value. Universal life policies offer more flexibility than traditional whole life policies.

With a universal life policy at Allstate, you can adjust your policy as your financial needs change. You can adjust your premium payments as well as increase or decrease your death benefit.

Allstate’s universal life policies also provide more options for your cash value. You can link your cash value to stock market index funds. However, there are limits on how much you can gain or lose. You can also choose a guaranteed annual return.

You could also have a combination of stock market index funds and a guaranteed annual return.

Allstate also offers variable universal life policies. Variable universal life insurance policies offer the widest variety of investment options for the cash value.

Variable universal life policies have subaccounts that work similarly to mutual funds. You can choose these subaccounts, fixed accounts, or asset allocation programs for your cash value.

These policies come with higher growth potential, but also a higher risk. Unlike Allstate’s traditional universal life policies, variable universal life policies don’t have a limit on how much cash value you gain or lose.

The value of your policy depends on how well your investments perform in the market.

Riders

Allstate offers the following riders with its term life policies:

- Living benefits: Allows you to access part of your death benefit early if you’re diagnosed with a terminal illness and have a life expectancy of a year or less. It also allows you to access part of the death benefit early you become confined to a nursing home for at least one year.

- Children’s level-term insurance: Allows you to add children under the age of 18 to your life insurance policy.

- Accidental death benefit: Pays an extra benefit amount to your beneficiary if the cause of your death is an accident.

- Waiver of premium benefit: If you become disabled, the premium will be waived. The definition of disability is determined by Allstate.

Factors That Affect Your Rate

As you shop for a life insurance policy, there are certain factors that affect the price of your premium. Your age, gender, medical history, occupation, and habits all play a role in your rate.

Let’s take a closer look at the ways these factors could impact your premium.

Demographics

Demographic information such as your age and gender plays a large role in the price of your premium. As you age, it becomes more likely that the insurance company will have to pay out your policy. Therefore, the older you are, the higher your premiums are. The younger you are, the lower your premiums are.

Your gender can also affect your rate. Since men have a shorter life expectancy than women, men pay higher premiums than women. The average life expectancy for men is 84 years, while the average life expectancy for women is 86.5 years.

For example, a 45-year-old man would pay $29 for a 10-year $250,000 term life policy with Allstate. A 45-year-old woman would pay $24.

Current Health & Family Medical History

Your overall health and medical history also factor into the price of your premium. Generally, healthy people are expected to live longer, so their insurance premiums are lower.

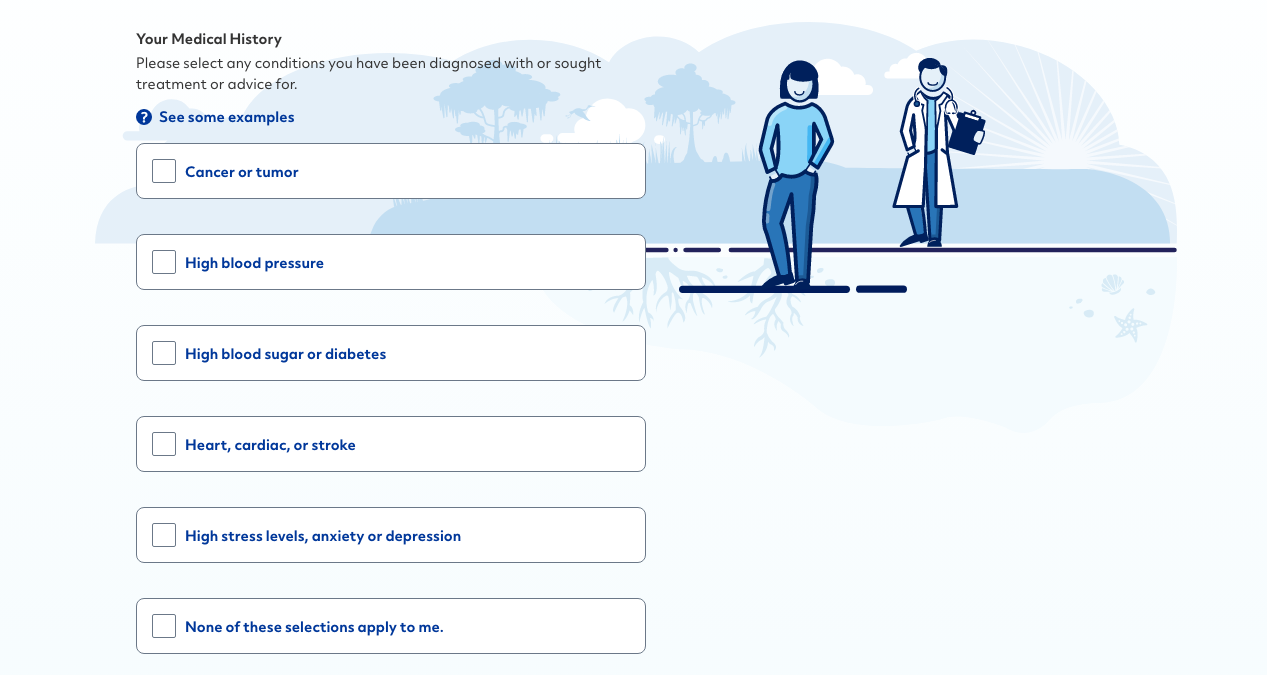

As part of the underwriting process, life insurance companies will have you fill out a medical questionnaire about your medical history, previous diagnoses, and prescription medication.

Your life insurance company may also require a medical exam. For a life insurance medical exam, the company will send a paramedical examiner to your home. They will record your height, weight, and vitals. They will also take blood, urine, and saliva samples.

As part of the application process, the company will ask for your medical records and view your Medical Information Bureau Profile.

Life insurance companies also look at your family’s medical history when you apply for a policy. If there is a history of serious illness in your family, such as heart disease, your premium could be higher.

High-Risk Occupations

If your job is considered a high-risk occupation, you’ll likely pay more for life insurance. Jobs with a higher number of fatal work accidents and injuries are considered to be high-risk.

In 2018, the Bureau of Labor Statistics found that the following industries had the highest number of fatal work-related injuries:

- Construction

- Transportation and warehousing

- Professional and business services

- Agriculture, forestry, fishing, and hunting

- Government

- Manufacturing

Police officers and firefighters are also considered to be in high-risk occupations.

High-Risk Habits

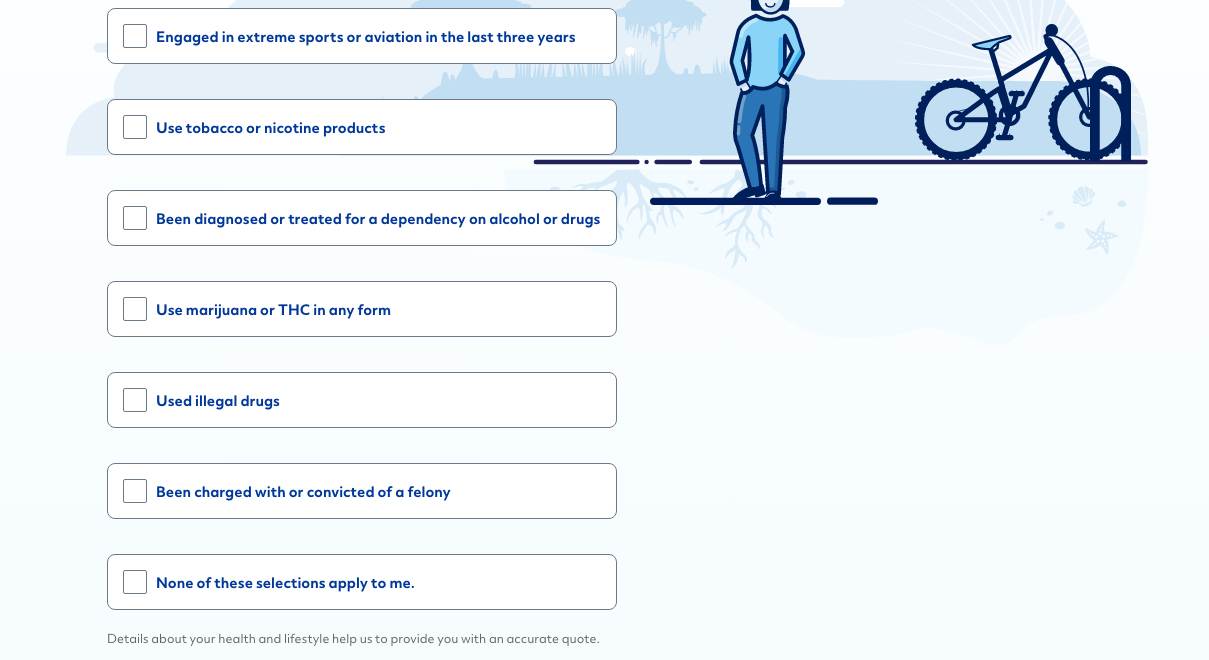

There are certain high-risk habits life insurance companies look for that could impact the price of your premium. The high-risk habit that could have the strongest effect on your premium is smoking.

Across age groups and genders, smokers pay more for life insurance. For example, a 35-year-old man who doesn’t smoke will pay $27 for a 10-year $500,000 policy with Allstate. A smoker of the same age and gender will pay $76 for the exact same policy.

Other high-risk habits can include private aviation, skydiving, bungee jumping, racing, and scuba diving. A one-time event won’t change your rate, but a pattern of high-risk habits could negatively impact the price of your premium.

Veteran or Active Military Status

Similarly to the other occupations listed above, active military status is considered a high-risk occupation. They pay much higher premiums than people in regular occupations. Some companies don’t provide life insurance coverage to members of the military.

Getting the Best Rate with Allstate

Now that you’ve learned about Allstate’s policies, let’s discuss how you can get the best rate on your policy.

The first step in getting a good rate is to get a quote. When you get a quote, you can assess what expenses you need to be covered and get an estimate of how much that coverage will cost.

Once you determine what you want to be covered, you can make sure you aren’t overpaying for coverage that doesn’t suit your family’s needs.

Even though life insurance isn’t a high priority for most young people, it’s important to buy life insurance when you’re younger. The younger you are, the less you pay for a life insurance policy. Buying life insurance when you’re younger will lock you into a much lower premium.

As we mentioned earlier, your health can also have a major impact on your premium. Overall, healthy people pay less for life insurance. By going to your checkups and keeping yourself in good health, you can make sure your premiums remain lower.

Allstate’s Programs

Allstate has bundling options that allow you to save money on multiple policies. The company lets you bundle your life insurance policy with home and auto coverage.

Bundling your Allstate home, auto, and life insurance policies offer the largest discount. When you get a quote on the Allstate website, you can choose which policies you want to bundle.

Allstate’s website also has two life insurance calculators to help you determine which policy is right for you. The first calculator helps you get an estimate of how much life insurance coverage you’ll need based on your needs, expenses, and assets.

The second calculator compares potential rates of return for term and universal life insurance policies.

Canceling Your Policy

Though many policies such as Allstate’s variable and universal policies give you the flexibility to change your policy and death benefit, you may find your policy no longer works for you.

If you can’t adjust your policy to better fit your needs, you can cancel your policy.

How to Cancel

You can cancel a life insurance policy at any time, but you may have to pay fees. Some term policies charge a fee if they are canceled before a particular date. For example, you may be charged a fee if you cancel before five years on a 10-year policy.

Canceling whole life insurance policies may result in fees as well. Usually, your insurance company will charge a surrender fee. The surrender fee is then assessed against the cash value.

Your insurance company will then pay you the surrender value, which is the cash value minus the surrender fees. To cancel an Allstate policy, you have to contact an agent directly.

How to Make a Claim

The first step in filing a claim with Allstate is to get the policyholder’s personal information including:

- Policy number

- Name

- Social Security number

- Date of birth

- Date of death

- Place of death

After you have the insured’s personal information, you can start your claim by downloading the claim notification form, calling 1-800-366-3495, or visiting your local Allstate agent.

Once the company has been notified of the claim, they will send you a claim kit with forms and instructions for the next step.

After you complete the forms, mail the claim kit, a copy of the death certificate, and any other requested documentation to one of Allstate’s life claim departments.

Once your claim has been approved, you’ll receive a payment. You can track the status of your claim by calling 1-800-366-3495 or contacting your local Allstate agent.

How to Get a Quote Online

Now that you know what kind of policies Allstate has to offer, you can get a quote to know what kind of prices they offer as well. Here’s how to get a quote on Allstate’s website.

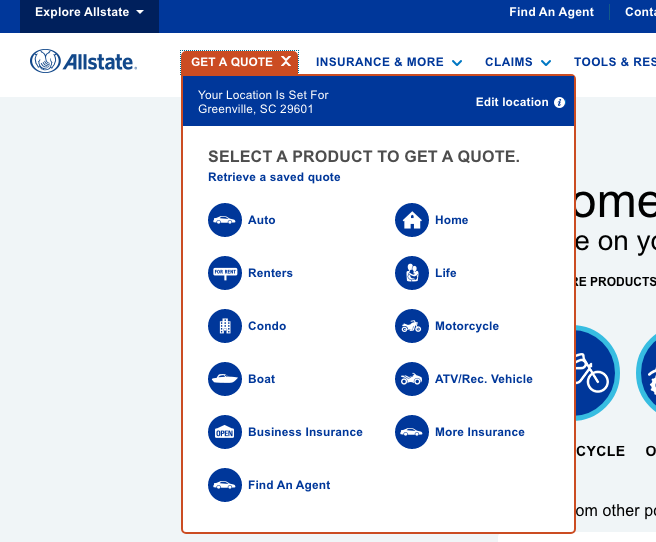

#1 – Click the “Get a Quote” Button

Click the orange “Get a Quote” button on the homepage.

#2 – Click on “Life Insurance”

Click “Life Insurance” on the drop-down menu.

#3 – Select Your Coverage

Select term life and any other insurance coverage you want to be bundled in your quote.

#4 – Enter Your Personal Information

Enter your personal information including your name, birthday, and gender.

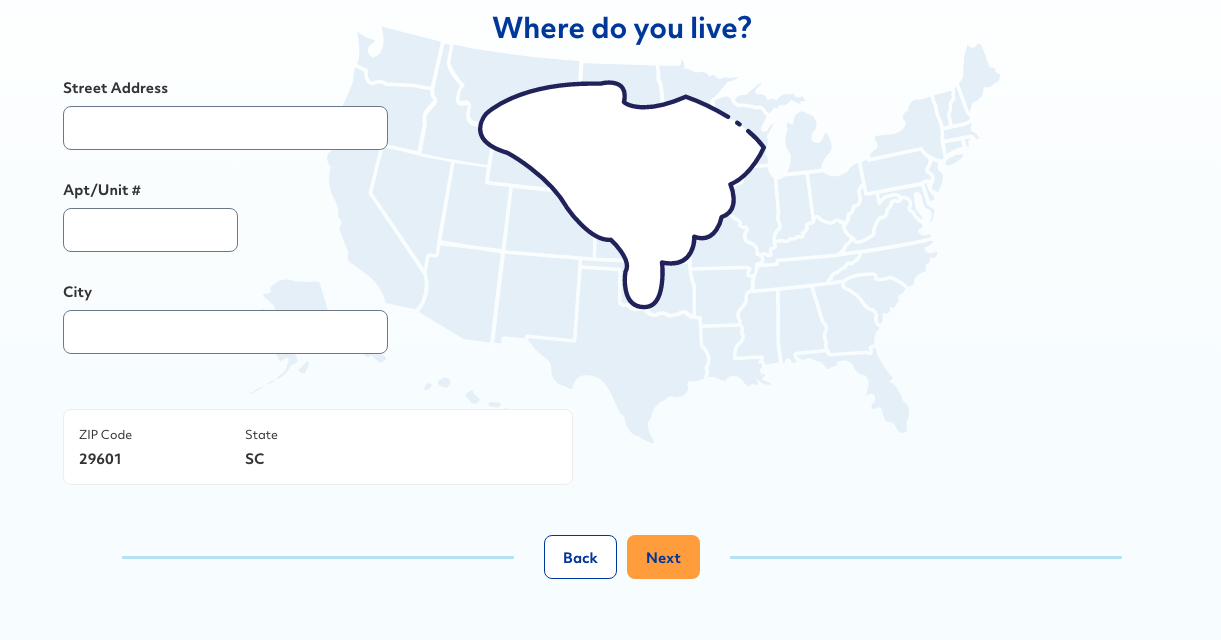

#5 – Enter Your Location

Enter information about where you live.

#6 – Enter Your Email Address

Enter your email address on this page. You can use your email to save your quote and come back to it at another time.

#7 – Enter Your Height & Weight

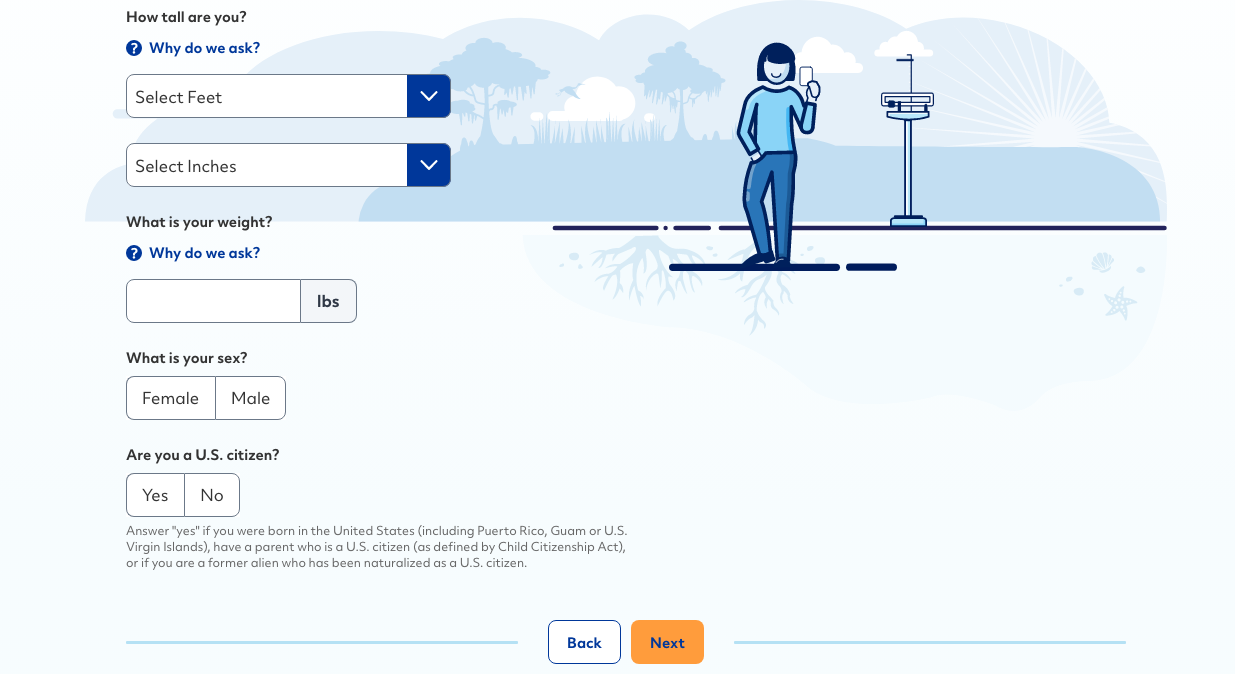

Enter your height and weight. This page also asks about your gender and citizenship status.

#8 – Fill Out Your Medical History

Answer questions regarding your medical history.

#9 – Answer Questions About Your Habits

Answer questions about your habits, including nicotine and alcohol use.

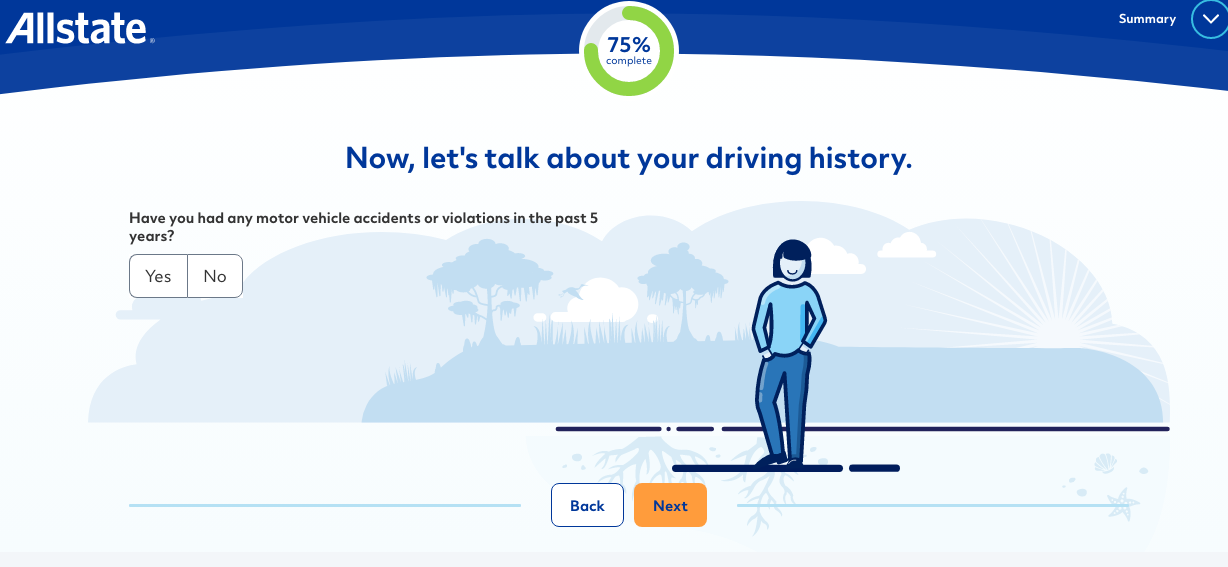

#10 – Answer Questions About Your Driving History

Answer the question regarding traffic accidents and violations.

#11 – Get Your Quote

After you’ve filled out all the information, click Continue to get your quote.

Design of Website/App

Overall, the Allstate website is easy to use. It’s easy to find information about all the types of insurance coverage Allstate offers. The quote tools, search bar, and customer service portal are easy to locate as well.

The one downside to the Allstate website is that it provides so much information, the webpages can become overcrowded with text and difficult to read.

Allstate also has a mobile app. On the app, you can:

- Access your policies and ID cards

- Pay your bills

- Report claims

- Get roadside assistance

- Contact your agent

The app currently has 4.8 out of 5 stars based on 357,000 reviews in the iTunes app store.

Pros & Cons

Now that you have an overview of Allstate, let’s take a closer look at the pros and cons of buying an Allstate life insurance policy.

Pros

Allstate’s life insurance plans offer a lot of flexibility. Allstate’s TrueFit® allows you to choose any term length between 10 and 30 years, so you could pick a plan that’s 16 or 23 years long.

The company’s universal life policies also allow you to change your premiums and death benefit if your financial needs change.

Allstate’s bundling options mean you can save money on multiple policies. If you combine your life policy with their home and/or auto coverage, you’ll receive a discount.

Cons

There isn’t a lot of information regarding the specifics of Allstate’s life insurance policies online. If you want more details about a particular policy, you’ll have to contact an agent directly.

The Bottom Line

Allstate doesn’t have a wide variety of life insurance policy options. However, the policies they do offer come with flexibility and rewards unique to Allstate, such as Whole Life Advantage.

The company’s bundling options also give you the potential for savings and discounts on multiple policies.

Use this review to help you decide if Allstate is the right company for you.

Don’t wait! Get life insurance now in your ZIP code by clicking on our FREE online quote tool below.

Allstate’s FAQs

#1 – How can I pay my bill?

You can pay your bill online, by phone at 1-800-901-1732, or you can send a check to the mailing address on your policy statement.

#2 – How do I find out who my agent is?

Your agent’s name and contact information can be found on the back of your insurance card or by logging into My Account.

#3 – How long does the claims process take?

The claims process usually takes seven to 10 business days after the claims kit and necessary documents have been received.

#4 – I’m already retired, is it too late for me to purchase life insurance?

No, it’s not. Retirees, too, can benefit from purchasing a life insurance policy. Specifically, life insurance can help with the following:

- Pay for final expenses

- Establish emergency funds

- Replace income

- Pay for unexpected medical expenses

#5 – Can I still submit a life insurance claim if I’m missing some of the required information?

It depends. However, your local Allstate agent can help you by taking into consideration the specifics of your situation. You can also call 1-877-810-2920 to speak with an Allstate professional, send an email, or tweet @Allstate for assistance.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption