A Guide to Term Life Basics (Coverage Comparisons + More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Term life insurance provides temporary coverage when you need it most

- It’s the most affordable type of life insurance for most people

- You can choose from a variety of term lengths and death benefits

- Term life can pay for funeral expenses, child support, debts, and more

Term life is one of two major types of life insurance (the other being whole or permanent) on the market today.

This type of policy is designed to pay out a death benefit if the insured dies during the period of time specified by the policy. Because term life coverage can end before the insured dies, it’s sometimes referred to as temporary life insurance.

Term life is a popular choice because it gives you a lot of coverage for your money. According to the American Council of Life Insurers, 40 percent of new policies issued in 2017 were term life. Those policies accounted for 70 percent of the total face value of policies issued.

What that means is that the majority of life insurance coverage in force, in terms of the actual death benefits those policies represent, is term life.

What is term life, how does it work, and why do so many people choose it? We’ll dig into all of the basics, and help you get quotes right now. Just enter your ZIP code above to get started, and read on.

Table of Contents

What is term life?

Term life insurance is a policy that provides a death benefit during a pre-determined length of time, after which the coverage comes to an end. It’s temporary coverage that ensures financial security for those left behind if the insured passes away during that time period.

It’s one of the practical ways to get your life together for the sake of your loved ones.

Term life is generally purchased to provide a death benefit when it’s needed most. It’s not intended to provide lifelong coverage, but to be a temporary provision that won’t be needed in the future.

There are a lot of reasons you might want to buy a term life policy. Let’s get into who should look to term life insurance as the right choice.

Who Should Buy Term Life

Term life is right for you if you need a large death benefit to provide financial protection for a specific reason.

There are a lot of people for whom term life is always the right choice:

- Parents

- Homeowners

- Married couples

- Small business owners

- Students with loans

- Anyone with a lot of debt

- Anyone with a financial goal for a specified period of time

However, term life isn’t always the right choice. It won’t work for:

- Anyone wanting lifelong protection

- Seniors who are seeking final expense coverage

- Anyone unsure of how long they need to be covered by life insurance

- Those that want a cash account

Here’s an example of how term life can work for you.

You’re recently married and have just purchased a new home. There’s a baby on the way, and your partner has decided to be a stay-at-home parent. As the family breadwinner, you want to make sure your family won’t have to struggle financially if something happens to you.

You want to make sure there’s money to help your partner raise the child, along with any other future children, and stay in your home, as well. Once the kids are grown and moved out and you’ve paid off a large chunk of that mortgage, you don’t feel you’ll need the coverage anymore.

Term life is the perfect choice in this scenario. It can be purchased with a large enough death benefit to cover all of these needs at a more affordable price than whole life. And when the family’s financial need isn’t so great, it can be allowed to lapse.

What Term Life Covers

There are a lot of reasons to buy term life. While your life insurance benefits can be used for any reason at all, even just to leave a bequest to loved ones, there are several specific reasons to take out a term policy.

Life insurance is generally used to cover two types of obligations: immediate and future.

Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all of the expenses (either planned or unexpected) you want to pay for after your death. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

Specific examples include the following:

- Provisions for raising children until they are adults

- Paying off a mortgage

- Paying off other large debt (such as student loans)

- Providing college tuition money

- Ensuring loved ones can maintain their standard of living

- Protecting your small business

- Paying for final expenses

Of course, there are different types of life insurance out there for good reason. Life insurance isn’t one size fits all. Term life is a great choice for a lot of situations, but it’s not good for some specific needs.

Term life isn’t the best choice for:

- Paying for final expenses regardless of when you pass away

- Leaving a bequest that isn’t time-sensitive (the need doesn’t end at a certain age)

- Providing for a special needs child that will require lifelong care

- Paying for anything that doesn’t have a clear end date

Average Cost of Term Life

The cost of a term life policy depends on a lot of factors, which means the average rate varies quite a bit, as well. Term life is generally cheaper than whole life because there’s an end date to the coverage.

The insurance company uses a lot of information about you to determine the likelihood of a claim on the policy — the odds that you will pass away during the policy term.

The shorter the term, the smaller the chance of a claim, which is why you will pay a lot less for a 10-year term policy than for a 30-year term. How much you as an individual will pay also depends on your age, gender, health history, current health, lifestyle factors, and weight (or BMI).

Finally, how much coverage you want to purchase will also impact the rate. A $500,000 policy costs more than a $100,000 policy.

In most cases, the premium you pay for a term life policy stays the same throughout the duration of the term.

It’s important to know exactly what to expect from your premiums before you purchase a policy. It’s also a good idea to err on the side of a longer-term if you aren’t sure just how long you will need the policy.

While you can renew your term life in most cases even after 10 or 20 years, you will pay a higher rate since you’re older and a higher risk to the company.

To ensure rates are the same throughout the term, look for a guaranteed level term policy. This type of policy guarantees a locked-in rate throughout the policy.

That means a 30-year guaranteed term policy will not go up, no matter what happens in that time period.

We’ve gathered rates from more than 30 life insurance companies and averaged out the cost of a policy at three different term lengths and three different face values for comparison. Bear in mind these rates are based on a person in good health with no major risk factors.

| 30-Year-Old Male Non-Smoker | 10-year Term | 20-year Term | 30-year Term |

|---|---|---|---|

| $100,000 | $10.85 | $12.53 | $16.36 |

| $250,000 | $13.45 | $17.45 | $24.41 |

| $500,000 | $18.56 | $26.22 | $37.93 |

Get Your Rates Quote Now |

|||

As a general rule, women pay a little less for life insurance than men.

| 30-Year-Old Female Non-Smoker | 10-year Term | 20-year Term | 30-year Term |

|---|---|---|---|

| $100,000 | $9.86 | $11.68 | $15.34 |

| $250,000 | $11.32 | $14.88 | $21.52 |

| $500,000 | $14.63 | $20.89 | $31.42 |

Get Your Rates Quote Now |

|||

Term vs Whole

How does term life stack up when compared to whole life? Here’s a comparison of the two.

| Term | Whole |

|---|---|

| Ends at a specified date | Lifelong |

| More affordable | More expensive |

| No cash account | Cash account that can be accessed |

| Convertible | Not convertible |

| Premiums locked in for term | Premiums locked in for life |

Get Your Rates Quote Now |

|

Term life is the better choice when you need a lot of coverage for a specific period of time. It’s affordable and can provide a large death benefit for a small premium.

You will want to consider whole life, instead, if you need lifelong coverage or if you aren’t sure if even the longest available term will cover you for a long enough period.

Can a term life insurance policy be converted to whole life?

The cost of term life insurance for people who are young and in good health is ridiculously low. The main reason for this is that hardly anyone dies at the younger ages from a life insurance mortality standpoint.

Most of us live until age 65 and beyond. Why not purchase the entire amount of life insurance coverage that you will need in the form of term insurance, and then gradually convert parts of it as you grow older and your income increases?

Convertible term life insurance is just that, life insurance that guarantees the policy owner the right to convert the term policy to a permanent policy regardless of one’s health, occupation, background or any other detrimental aspect of one’s lifestyle or medical condition.

Develop a Plan and Stick To It

If a plan is well-thought-out with early term insurance to be converted later to permanent coverage can be laid out, it is a very logical and useful program for a lifetime of security.

For example, if you have an entry-level employee, who is 25 years old, who earns $60,000 per year, has two young children, and he earned no more income until age 65, he would earn a total of $2,400,000 during his career.

He could be a professional person, a government worker, or a self-employed business person. It is likely to assume that a person in this category would increase his income over the years.

The purchase of a large amount of convertible term insurance, say of 1,500,000 would be easy to justify to an insurance company allowing this level of coverage.

The price of this policy would be a relatively modest one in light of the large death benefit.

A plan of converting the convertible term insurance to permanent insurance on a schedule which could be tied to increases in salary would be a reasonable plan.

The purpose of having the permanent insurance would be for having coverage later in life when the term expires, for possible estate liquidity purposes, and for the cash value purposes for retirement.

It should be noted that permanent life insurance of some kind is preferable in estate planning circles because it will last as long as the person does for whom the estate is being planned. Convertible term insurance could be used, and if the principle person needs to, in the case of illness, the term could be converted to a permanent whole life policy.

Options Are Your Friends

Consumers like having several options. When it comes to insurance, it’s even more important for people to compare the various options before making their final decision. For example, having the option to be able to convert term life insurance to permanent life insurance gives a term life insurance policyholder maximum flexibility in how to manage their overall life insurance portfolio.

There is very little predictability in the long term outcomes of life in general, and having this kind of control over the makeup of one’s life insurance is critical to the family or business involved.

Term Life Death Benefits

The death benefit is just what it sounds like. It’s the amount of money the life insurance company will pay to your beneficiary if you pass away while the policy is active.

A term life policy pays out when the insured passes away within the time period specified by the policy, as long as the policy is in force. “In force” means the policy is up to date on premium payments and hasn’t been canceled for any other reason.

How the Death Benefit Works

While the death benefit is generally the same amount as the face value, there are a few exceptions. Not many of them apply to term life, since this type of policy doesn’t have cash value, but it does depend on the policy.

Cash value accounts are associated with whole and universal life policies and are not usually a feature of term life.

Term life is more simple and straightforward. As a general rule, they will pay out exactly the amount that is written on the policy. In the case of a decreasing or increasing term policy (more on that shortly), that amount depends on where you are in the policy term.

The death benefit may also be reduced if you have taken advantage of an accelerated death benefit rider. This add-on to your term policy allows you to access some of the money from the policy while you are still alive in the event of a terminal diagnosis. Any amount you take out using this rider will reduce the death benefit available to your beneficiaries.

Unlike the more flexible terms of a universal life policy, term insurance locks in that death benefit amount. You generally can’t change it after it’s issued. You can, however, add a second policy to provide a larger death benefit.

How much coverage do you need?

Calculating how much life insurance coverage you need is one of the more difficult parts of the process. A life insurance calculator can help you to determine how much to buy based on a set of common guidelines. It can’t, however, help you to foresee future changes in your need.

The Insurance Information Insititute provides an overview of the most commonly used approaches to calculating life insurance needs. Most calculators look at how much income you would need to replace, as well as how much debt you would leave behind.

The rule of thumb for life insurance coverage is generally 10 times your income.

Some recommend an additional $100,000 per child on top of that amount. The III also covers some of the items that are often overlooked by these calculators.

One of these is the hidden income you might not consider, such as how much of your health insurance is covered by your employer, a coverage your family would lose if you were to pass away.

The general approach to calculating life insurance is to use a multiple of your income and to consider how long your family would need the proceeds to maintain their standard of living. You should then calculate in things like:

- Debt that would need to be paid off

- Whether you want to provide mortgage payoff funds

- Final expenses

- Anything you want to fund specifically, such as college tuition

However, you may also need to consider changes down the line, too.

What if your coverage needs to change?

Here’s where it gets tricky. You’re calculating based on the current state of financial affairs. But what if things change?

There are several reasons your life insurance needs might change. These are a few of the more common ones:

- You have a child (or more children)

- Your spouse becomes a stay-at-home parent

- A spouse or child becomes disabled

- Your debt increases

- You change jobs and lose group coverage

Of course, it’s impossible to foresee every possible nuance of financial need, since many life changes are unexpected. But the more thought you put into it when you first take out your life policy, the less you’ll have to worry.

And you’ll pay less for the coverage if you buy more when you’re young and healthy versus needing to buy supplemental coverage in the future. If you do need to increase your coverage down the line, however, there are a few things to consider.

If your health status has improved in the intervening years, you may qualify for a better rate on a larger policy. In that situation, it might be best to purchase a new policy and cancel the old one.

The second option is to take out a second term life policy to make up the difference in coverage. Since you are older, the coverage may be more expensive, and any health concerns that have cropped up will also affect the rate of the new policy.

What to do if your health has changed so much you struggle to qualify? Your first step should be to see what group coverage is offered at work. From there, you may need to consider a guaranteed issue policy as a last resort.

You can also plan for this possibility with a Guaranteed Insurability Rider. This rider isn’t available on all policies, but it guarantees that you can purchase more insurance at the end of the policy term regardless of any changes in your health.

Types of Death Benefits

There are a few main options for the death benefit of your term life policy. These basics can be adjusted and supplemented to a certain degree with riders. For example, an Accidental Death Benefit rider usually provides an increased benefit if the insured dies as the result of an accident.

For most people, a level term death benefit is the best choice. You’ll pay the same monthly amount for the same death benefit throughout the entire duration of the policy term.

The two other options are decreasing term and increasing term. Let’s take a look at each and see how they compare.

Level Term

A level term policy provides a set death benefit that doesn’t change throughout the policy period. So if you buy a $100,000 policy for 10 years, that death benefit remains the same through that period.

You might run into some policies called guaranteed level term. While this sounds reassuring, in truth all level term policies come with a guarantee of level rates and death benefit throughout the policy term. That’s how they are designed to work.

Level term policies are a popular choice because they’re simple and straightforward.

You select a death benefit amount, and you pay the premium for the duration of the term. If you die during that time period, the company pays out the death benefit as written in the policy.

They’re perfect for anyone that needs coverage for a specific amount of time and who doesn’t anticipate that the need will change. Level term policies are particularly popular with parents looking to provide income replacement during the years when the children are still living at home.

Let’s consider the breadwinner in a family with two children under five years old. Our breadwinner makes $50,000 a year. By the “10 times” rule, they need $500,000 in coverage. If we’re also added $100,000 per child, they wind up with $700,000 as the death benefit.

Since they anticipate the children will be independent by the time they are 21, our sample insured purchases a 20-year term policy in that amount.

Fifteen years into the policy, the insured passes away, having paid the same level premium on the policy that entire time. The family receives the $700,000 death benefit. This would be the case no matter when in the 20-year term the insured was to pass away.

Decreasing Term

Decreasing term life has a death benefit that goes down over time. This type of policy is most frequently sold as mortgage protection insurance. This is not the same thing as Primary Mortgage Insurance(PMI), which you may be required to have by your lender.

The policy is designed to decrease over time as the amount you owe on your mortgage goes down. The theory behind this is that you don’t need as much coverage over time, so the death benefit can go down.

Although the amount of the death benefit goes down, the premium does not.

You’ll pay the same amount for the life of the policy regardless of what the death benefit amount is.

Decreasing term policies are usually priced affordably, making them a popular pick for those that only care about covering a specific debt. The premiums are level to account for the increased risk that the insured will die as they grow older.

Most people will do better to choose a level term policy over a decreasing term, since they get a level death benefit that can be used to pay off not only the remaining mortgage but provide for other needs, as well.

If the mortgage is your only financial concern, however, or another specific decreasing need, you might get a better price on a decreasing term policy.

It’s important to note that the death benefit may not cover the mortgage if you add anything to the loan, such as refinancing to use equity for home renovations.

Consider a new homeowner that wants to make sure their family will be able to pay off the home in the event of their death. With a mortgage of $250,000, this homeowner opts for a decreasing term policy that follows the 30-year life of the mortgage. As the mortgage is paid off steadily, the death benefit decreases accordingly.

With 10 years remaining on the mortgage, the insured passes away. the policy pays out enough to pay off what’s left of the mortgage, and the beneficiaries now own the home in full.

Increasing Term

The opposite of a decreasing term policy is an increasing term policy. Over time, the amount of the death benefit increases, usually annually.

Unlike level or decreasing term policies, the premium on an increasing term policy also increases over time.

This is to cover the higher amount of the death benefit as well as the increased risk that goes along with age.

An increasing term policy can help to protect against both inflation and other increased needs that crop up over time. As we discussed earlier, there are a number of reasons the need for coverage might go up over time.

An increasing term policy can take away the worry that you won’t have enough insurance and won’t be able to add additional coverage.

This type of insurance is a good choice for anyone still at the beginning of the need for life insurance and isn’t quite certain how much that need will increase. This can include changes like an increase in income, buying a new house, and having more children.

A good example here is a newlywed who has baby number one on the way. The couple plans to buy a larger house and have more children in the future, but the breadwinner wants to buy life insurance now. With uncertainty as to what amount of coverage will be needed in the future, they choose to purchase increasing term coverage.

Ten years later, with a big, new home and three children, a new health problem crops up. The insured is no longer able to take out a new policy, but the increasing term coverage has provided a higher death benefit over time, so the family is still protected.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Choosing a Type of Term Life

The type of term life or more specifically the term length is the amount of time during which the insurance will be in force. There are a variety of lengths available to suit every need.

Term life insurance is available starting at one-year terms. This is what is known as an annual renewable term policy. For this type of policy, rates increase each year as you get older.

From there, term lengths increase in five-year intervals, going up to 30 years. The term lengths available vary by company. Popular term lengths are 10, 20, and 30 years.

How do you know what term length you should select? There are a few steps to making that decision.

- First, determine what you want to cover. Knowing what you need the insurance for will help you with the next step.

- With the need in mind, consider how long you will have that need. Ten years? Twenty years? It’s a good idea to overestimate here since you can’t add time to the policy, but you can cancel if you don’t need it anymore.

- Consider the choice of level term, decreasing, or increasing term benefits and choose what works best.

- Get quotes and compare rates.

- Select the term length and death benefit combination that best suits your needs.

Increasing Term Insurance

With an increasing term policy, death benefits increase as the policy matures. Plans can be structured so that premium payments remain constant for the life of the policy or increase as the benefits increase.

Who should consider increasing term insurance?

Increasing term insurance is useful for people who bought whole life or universal life insurance but found that their policy’s benefits became insufficient over time.

By purchasing a supplemental increasing term policy, they can keep their whole life policy in place and use the increasing term insurance to buffer any cost-of-living increases over time.

For example, let’s say you bought a whole life policy for $500,000 10 years ago. At the time, a $500,000 policy and your savings and retirement plans covered any living expenses if anything were to happen, allowing your loved ones to live at the same level of comfort.

Since then, cost-of-living increases, taxes, and expenses from medical costs have created a situation where you don’t think your loved ones will be able to maintain the same life quality if anything happens to you.

Even worse, with increasing care costs every year, you may need even more in another 10 years.

Getting a supplemental increasing term policy allows your whole life policy to cover most of your expenses, while the increasing term covers only the year-after-year increases you foresee.

You can lock in a defined premium that might be slightly higher today, but expect that your benefit will adjust over time to meet the increased benefit you will require.

How much does an increasing term policy cost?

An increasing term policy is usually set up in a way that you will be paying more in premiums now for higher benefits later. In this sense, the policy is expensive at first but eventually, the benefit will catch up.

Since your benefit grows as you grow older and become a higher risk, you can expect that an increasing term policy premium will be higher than a level term.

Actual rates depend on whether you decide upon a level premium payment, the duration of the term, and your overall risk.

Decreasing Term Insurance

The opposite of increasing term insurance, decreasing term insurance provides you greater benefit today while decreasing until the policy matures. In some instances, providers refer to this type of insurance as mortgage protection insurance.

If you buy a home today, you’ll want to make sure that if anything happens to you, your family can pay off the principal loan on the home and live worry- and payment-free.

Today the loan principal amount might be $250,000. Over 20 years, that principal could drop to $80,000. By getting decreasing term insurance, you can get the benefit of a lump sum payout to meet the principal loan amount, whatever it is.

Who should consider decreasing term insurance?

To understand how decreasing term insurance could help a policyholder, consider the examples below.

- As in the example above, anyone with a mortgage can consider a decreasing term policy.

- For older couples, a decreasing term policy may be a good option for specific situations. For instance, if you have kids in college and a high income to replace, you may want a higher benefit. Over time, your lifestyle will require less, so you may not need as much benefit.

- Businesses might consider having a decreasing term policy to protect their heavy initial investment costs. When you start a business, you might have to borrow a large amount of money from investors or use your own cash to get things started. If anything should happen while the business is young and struggling, you’ll want to make sure your insurance meets the costs of those loans. As the business becomes stable and you reduce debt and retain cash, the need for a higher benefit might become obsolete.

How much does decreasing term insurance cost?

Similar to increasing term insurance, specific rates will depend upon risk factors and the way the policy is structured. When looking for a decreasing term policy to protect your home or business, working with an agent or financial advisor might be best.

How to Compare Term Life Policies

Comparing term life insurance policies is not a process that is for the faint of heart, even given the online quote systems. Many insurers will call and email once you put in a quote. They will all seem to have very different systems in place, which can make the whole process more involved.

Take control by keeping a wishlist and needs list posted where you can see it. Compare against that list anytime you are reviewing potential policies from different insurance companies. It will keep you on target for getting the policy you need at the most competitive price from a reliable insurance carrier.

In addition, keep a notebook, or a file on your computer to stay organized. The process can take a few weeks, and a journal is a useful tool to recall who you spoke to when. It also sets straight term life benefits and policy rates.

It is wise to buy both from an employer and on your own. Many employers continue to provide some degree of life insurance at either a deep discount or as a full benefit. Though if you lose your job, you lose your death benefit, in most cases. Additionally, you may be limited by the amount of insurance you can buy through the workplace.

To recap, face your fears and get through the big inconvenience of shopping for life insurance. Your family is counting on you in life and in death. Make strides by keeping a list of your wishes with you while shopping for your term life coverage. It will keep you on track.

Reasons to Choose a Shorter Term

As mentioned above, the shortest available term is one year. This is known as annually renewable term life. Not all companies offer this type of policy, however. Some will start at five years and others at 10 years.

The shorter the term, the less you will pay for coverage, since the odds of dying during that time period are lower. That makes a shorter-term more affordable, but it means you won’t be covered for as long.

If you have a short-term need for coverage and don’t anticipate further need in the future, you might want to choose a shorter-term length. A good example of this is to provide coverage for a debt that you expect to have paid off in a reasonable amount of time.

Reasons to Choose a Longer Term

The longest available term life insurance policies last for 30 years. If you need coverage for a longer period of time, you might want to look at permanent life insurance, instead.

The longest-term policies available are a good choice for anyone that anticipates needing coverage for a long time. Purchase a long term policy if you expect to have children to provide for over the duration of that term or debt that will take a long time to pay off.

Long term policies are also good if you aren’t sure how long you will need coverage and want to plan for the long-term in spite of uncertainty.

A 20- or 30-year term policy will help you to plan for the future and provide coverage for many years. It will also cost more. Because of the length of time for which the insurance company is extending coverage, the risk is high. You may take out a 30-year policy at 25 years old and be 55 years old when the term ends. Age increases risk as well as bringing more health problems.

The earlier you purchase a policy, the less you will pay for the duration since rates will be locked in at that age.

Below you will find rates for three of the top five companies. These rates are for a 30-year-old applicant in good health and show three different term lengths for a $500,000 policy.

| Company | 10-Year Term | 20-Year Term | 30-Year Term |

|---|---|---|---|

| MassMutual | Male: $15.68 Female: $13.93 | Male: $23.48 Female: $20.03 | Male: $37.83 Female: $31.78 |

| Lincoln National | Male: $13.96 Female: $11.99 | Male: $20.31 Female: $17.20 | Male: $32.69 Female: $27.39 |

| Prudential | Male: $30.63 Female: $23.63 | Male: $33.25 Female: $27.13 | Male: $35.44 Female: $31.50 |

Get Your Rates Quote Now |

|||

As you can see, it doesn’t cost as much as you’d think to select a longer-term. Depending on the company, it may mean a difference of as little as five dollars per month.

What happens at the end of the term?

When a term life policy reaches the end of the chosen years of coverage, it expires. If you don’t need any further coverage, you will pay your final premium and that will be the end.

In most cases, you won’t see any money back at the end of the term. There’s one exception to this, which we’ll look at shortly,

If you reach the end of the term and you do want to continue to be covered with life insurance, you have a few choices. You can choose to convert the policy to a permanent option or you can elect to renew the coverage.

Not all policies can be converted or renewed, but most can. There are several things to know about these options, and we’ll cover those in the next section.

Return of Premium Term Life

The one situation in which you can get money back at the end of a term policy is if you have a return of premium policy. In most cases that option is added as a rider to your policy.

Return of premium policies are designed to pay back the premiums you have paid if you outlive the policy term. In most cases, you only get the money back if you keep the policy for the full duration.

That sounds like a pretty good deal since most term life insurance doesn’t give you anything back if you outlive the term length. There are some cons to consider, however.

The major downside to return of premium life is that it’s more expensive than standard term life.

That’s because the insurance company will need to return the money to you, they charge you higher premiums for the privilege.

With few exceptions, the insurance company will keep all of the premiums, earning interest off of the investment you’re paying into. You won’t be earning interest yourself on that money. Of course, you wouldn’t earn interest on a regular term life policy, either, but you could invest the difference in premiums.

Return of premium life might be a good choice for anyone that can afford to pay the added premium and wants to get a chunk of money back tax-free in the future. It provides a combination of a guaranteed death benefit with the guarantee that you’ll also be able to see your money again if you outlive it.

Renewing & Converting Term Life

As you reach the end of your policy term, you need to decide as to whether you still need to be covered by life insurance. If the answer to that question is no, you don’t need to do anything else.

But what happens if the need for coverage is still there? What can you do? There are three main options for continuing coverage when you reach the end of the term. First, you can simply take out a new policy.

The other two options are to either renew or to convert your policy to whole life.

Renewing Term Life

Most term life policies have the option to be renewed when you reach the end of the initial term. You will need to speak with the insurance company to find out which renewal options apply specifically to your policy.

It’s best to begin the process before you reach the end date of the policy. In most cases, you won’t need to reach out to the insurance company; instead, you will likely get a renewal notice in the mail. To renew, simply follow the instructions.

If you don’t get a renewal notice, call your insurance company or your agent to find out how to start the process.

While you can renew the policy and continue coverage, you won’t be able to continue with the same rate.

Your term life rate is locked in at the beginning of the term for the length of time you selected. After that, the insurance company can renew your policy at a new rate, which is impacted by your age.

Most renewals don’t require a full application or a medical exam, and they rate based on your health at the time of the original issue.

Some policies offer what is known as a guaranteed renewal. Regardless of what changes occur in your health status or how old you are, the company will not decline you if you choose to renew the policy. That doesn’t mean they can’t charge you a much higher rate, but it does mean you don’t have to worry about not being able to qualify for coverage.

Since renewing term life insurance is usually handled without health status updates, most are already guaranteed renewal. Some companies, however, have a limit on issue age that you might be able to get around with a guaranteed renewal option.

Let’s say you took out a 20-year term policy at the age of 25. You’re now 45, and you still want to keep the coverage for at least another 10 years. You receive a renewal notice from the insurance company that quotes the new rate to continue the coverage.

Before you accept the offer of renewal, get some quotes for a new policy from a variety of companies. Renewal isn’t always the best choice in terms of what you will pay, especially if you are in good health.

Your age will still affect the premium, and a new company will require a full new application, while renewing doesn’t require that you re-apply. When comparing rates, take into consideration whether you want to go through a full physical. Sometimes the medical exam uncovers things you weren’t aware of.

With several rates to compare to the renewal option, you can then decide which choice is best for you. If the new policy rates are close to the renewal rate, you might choose to go that route since you won’t have to re-apply.

Converting Term Life

If you reach the end of your term life policy and decide you’d prefer to make your life insurance coverage permanent, you can consider conversion. Most term life policies can be converted if the life insurance company also writes permanent coverage.

Conversion changes the term policy over to a permanent policy. You can choose either a whole or universal life policy if the insurance company offers both. In some cases, only whole life is available.

To convert your policy, you will need to contact the insurance company before you reach the end date of the current term. Some companies may send you an offer of conversion along with the renewal option.

Like a renewal, conversion usually doesn’t require a new application and medical exam. You might have to answer some questions about changes to your health.

The rate for the permanent life policy will be based on the age you are now, which means it will be more expensive than if you had taken it out when you were younger.

Here’s an example of how conversion can work. At 25, you took out a 20-year term policy. During that time, you had a child with special needs, and you now know that you will need to provide financial support to that child for their lifetime. Conversion will allow you to continue to be covered for the rest of your life without having to take a new medical exam.

| Option for Continued Coverage | Medical exam? | Lifelong coverage? | Can you increase the death benefit? | Will rates increase? |

|---|---|---|---|---|

| Take Out a New Policy | Yes | Yes, with whole life | Yes | Depends on the company and policy |

| Renew | No | No | No | Yes |

| Convert | No | Yes | No | Yes |

Get Your Rates Quote Now |

||||

What if your health status has changed?

As we have already touched on above, changes in your health status can affect your ability to qualify for new life insurance when you reach the end of the term.

Most companies will not require you to take a new medical exam to renew or convert your policy. Most also won’t look at changes in your health if you’re renewing a policy.

If you took out the term policy at a young age, odds are good you are not in the same good health you were back then. Renewal and conversion options allow you to continue coverage in spite of new health problems that have cropped up in the intervening years.

While you can renew an existing policy regardless of health status, you won’t be able to increase your coverage.

The lack of health questions makes these options good for anyone who is worried a new exam might disqualify them or send rates skyrocketing.

Definitive Guide on How to Buy Term Life

Term life insurance comes in two forms: group and individual. First, let’s delve into group term life insurance.

Group Term Life

Group term life insurance can be a great employee benefit offered as part of a comprehensive compensation package. If you are currently employed by a company that offers both competitive salaries and other non-monetary benefits, you know that it feels nice to be offered coverage that will protect your family and help them survive if you pass away. The extra employer-sponsored benefit can add to your insurance portfolio and can even help family members that are not classified as insurable get the coverage that they need to cover financial burdens and obligations. Start comparing life insurance rates now by using our FREE tool above!

While there is a long list of benefits that are associated with electing to pay for your group life insurance, there may also be drawbacks that you should be aware of. Many times, you are limited in just how much group life coverage you are allowed to carry. This limit is typically a multiple of your annual income, which can really be limited when you are not a high wage earner. Another drawback is that there is a chance that a portion of your benefit for group life will be taxable when it comes time to file. Read on, and learn more about group life insurance and when it may be considered taxable income.

Benefits of Carrying Group Life Insurance

You should always be able to weigh the pros and cons of all products before you elect or reject them. Group life is considered to be an employer-sponsored benefit because your employer will pay for a portion of your premiums.

The fact that your employer pays for some or all of your premiums will reduce your out-of-pocket expense for the coverage.

If cost is very important to you, group policies tend to be the most affordable because you will receive discount rates and because you are not left to pay all of the premiums on your own. Cost alone is enough to drive you to find a job where group life is available, but that is not the only advantage. Here are some additional benefits to consider:

Guaranteed Insurability

What separates group policies from individual policies is that applicants cannot be denied coverage for pre-existing conditions, hazardous occupations or for their age. If you are not in an age range where insurance is inexpensive or you have been diagnosed with a condition that will affect your ability to find insurance, group insurance is a great alternative. The less-stringent underwriting guidelines make it possible for people who may not be able to get insurance on their own to purchase at least some protection.

Quick Issuance

Some individual policies can take 30 to 60 days to underwrite and then issue. If you want immediate protection, it is nice to know that most group policies are issued in days when the benefit is made available to you. No checking on the status of the insurance or worrying about being denied.

Paid For with Before-Tax Dollars

There is nothing worse than letting your policy cancel because you overlooked a payment due date. This is possible with an individual policy but not with a group policy. Group premiums will come directly out of your paycheck and are paid for with your before-tax gross earnings, which may also be called a pre-tax payroll deduction. This means that you can actually lower your tax bracket and ultimately lower your taxable income by paying for coverage that you need either way. You get the coverage that you need and the federal and state government takes a smaller share in the process. You also do not have to worry about lapses or making payments during your free time.

What is your tax liability when you carry group life insurance?

As you can see, there are some major benefits to working for a company that offers their employee base great life benefits. With the benefits become other drawbacks that might not apply if you shop for your own plan. One of the drawbacks may be your tax liability as the employee. The tax implications between group term life and individual term life are very different. When buying an individual policy, you will never be taxed on the benefit that you carry. While you are not always taxed for group benefits, in some scenarios you can be.

Why Individuals Life Policies Are Not Taxable

When you carry an individual life insurance plan, you are the party who chooses which carrier to apply through. You are also the owner of the policy and can make changes as you please. One major difference when it comes to tax liability is that you will not pay taxes on the benefit each year that the policy is in force. This is because you paying the benefit on your own with after-tax dollars that is not affecting what the government can stake claim to. The benefit that you receive is also not employer-sponsored, which plays a significant role in why there is no need to worry about some or all of the benefit being added as taxable income.

Why is group life insurance classified differently?

In terms of tax liability, group life insurance is classified differently because of how the premiums are paid. When you are shopping for life insurance through your employer, you receive discounted wholesale rates because the employer is buying in bulk.

Some of these discounted premiums are paid by the employer and the remainder is deducted from the employees check with pre-tax dollars.

This is what really differentiates group life from individual life in terms of tax liabilities. Since pre-tax dollars are used, there is a tax liability that will lie with the employee in certain scenarios. The imputed cost of the group coverage that is carried by the employer will be subject to both Medicare and Social Security taxation.

Scenarios Where Group Term Life Insurance are Taxable

Group Term Life Insurance, also known as GTLI, is only considered to be a tax liability for the employee who is receiving the benefits when the coverage limit is in excess of the limit set by the Internal Revenue Service. According to section 79 of the IRC, the IRS will exclude the first $50,000 when considering the taxability of the benefit.

When the employer-provided benefit is in excess of this $50,000 limit, the remainder will be subject to taxes and will be included in income for the tax year. Any benefit that is given to the employee’s spouse or children is subject to taxes if it exceeds a lower limit of $2000. It is important to realize that benefits that exceed the $50,000 or $2000 limits are not fully taxable.

How is the taxable portion of the GTLI calculated?

If you are interested in calculating how much of your group life benefit will be considered income, there is a basic formula that you can use. Your employer may give you a W-2 at tax season, but doing the math on your own will help you decide if it is best to get your own insurance or to still take advantage of the employer-sponsored benefit. Here are the steps that you need to take to calculate the taxable portion of your GTLI benefit:

- Determine what the excess amount is by subtracting $50,000 from your benefit

- Divide this excess amount by 1000

- Use the age-appropriate value tax table to determine the value per thousand

- Once you locate the value, multiply this value by the result of step 2

- Multiply this result by the number of months you received coverage

- Subtract any of the after-tax paid during the tax year from the figure

The final number will be the amount that will be added to the employee’s income for the tax year. This is the same number that will show in your W-2 when they are sent out in late January the following year.

Other Drawbacks of Group Life

Tax liabilities are one of the drawbacks of group life plans. Unfortunately, there are other drawbacks to consider. Some plans are very limited in what the benefit can do for the beneficiaries. Some plans may offer only accident coverage, which does not apply if the insured falls ill from a medical condition. Another drawback is that your employer owns your policy.

If the company wants to cut costs, they can eliminate this benefit at any time, leaving you uninsured.

It is good to take advantage of benefits, but you should always have your own individual policy as well. If you do not currently have a plan of your own that you own, you should start to price the cost of even a small term insurance plan. If you are healthy and you are still young, you can buy a good policy for cheap.

Because of their general simplicity, term life insurance policies are among the easiest to buy for individuals. You can do so in several ways: online, directly with the insurer, or through an independent agent.

Individual Term Life

Now, let’s discuss the one that will most likely apply to you: individual term life.

Getting a Quote

You wouldn’t purchase a car without first looking at the sticker price, and the same is true of life insurance. Before you make a purchase decision, you need to know the cost of the policy.

There are two main ways to get quotes: online or through an agent.

Online

Whole life insurance has a lot of variations and more factors that influence its premiums. As such, many companies don’t give out quotes for them online.

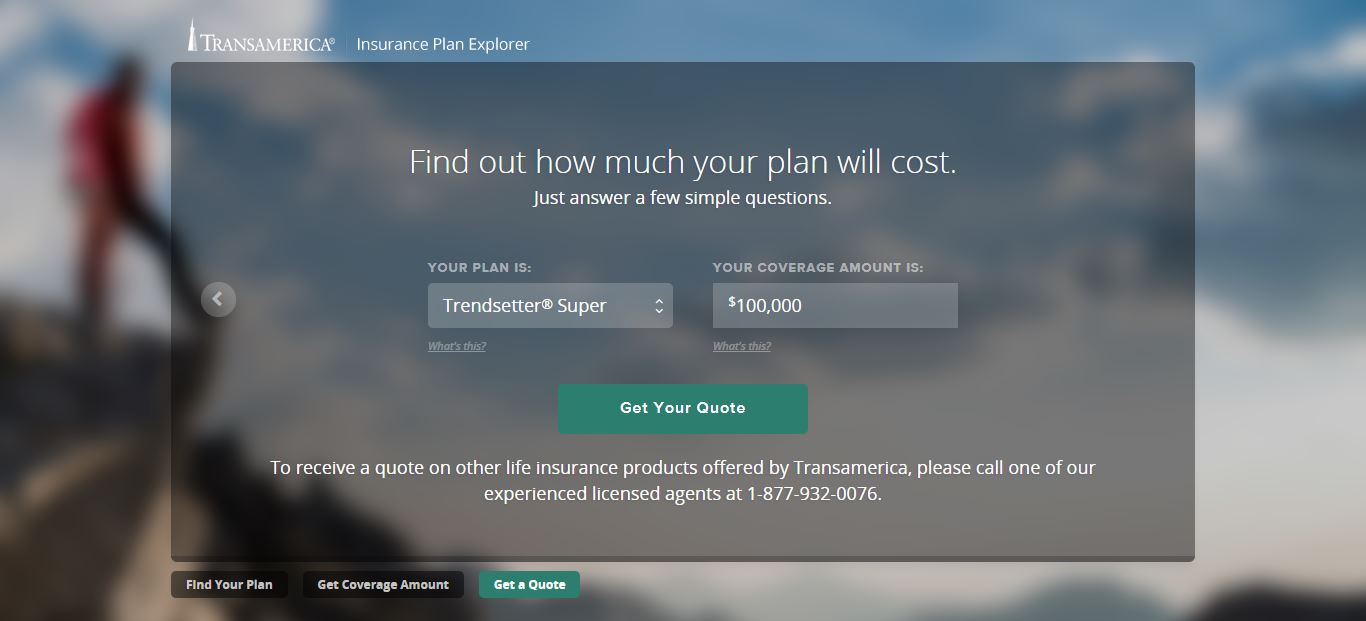

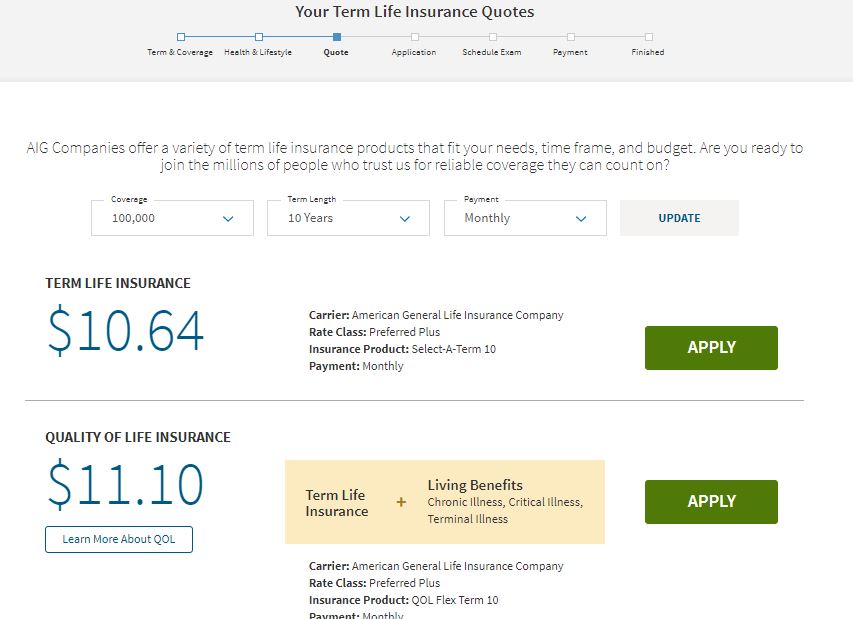

On the other hand, term quotes are widely available.

Many insurers have quote tools on their website. You simply choose your desired coverage, enter some basic personal information, and the tool will return an estimated cost.

There are also independent quote tools (like the ones on this page) which will provide you with quotes from multiple insurers at once, allowing you to compare prices quickly.

Some insurers also sell direct term policies. After getting your quote, you can immediately apply for the policy online without ever having to talk to an agent.

Agents

A majority of life insurance policies are sold through agents, even if the insurer provides online quotes. Insurance agents fall into one of two categories: the independent agents or the captive agents.

An independent agent is free to shop and sell policies from multiple agencies to find the best policy for their clients.

A captive agent works for a single insurer, and will only market and sell their employer’s policies. Think of them more as customer service reps than actual insurance brokers.

One is not necessarily better than the other.

If you want to compare costs and policies across multiple insurers, you can only do so with an independent agent.

If you’ve already done the homework yourself and have decided on a specific insurer, the captive agent can help you choose the right policy and tailor it to your financial needs.

Most insurers have an agent finder tool on their websites. You enter some basic personal information, location, and type of coverage you want, and agents will contact you to discuss your options.

Unfortunately, not all company websites make it clear whether they are connecting you to a captive agent or an independent one.

If you know you want to see policies from multiple providers, you might be better off seeking out an independent life insurance agency on your own, rather than being directed to one by an insurer.

Medical Exams

When applying for term life, insurers will require you to fill out a health questionnaire and may request your medical records. Some will also require a complete medical exam and bloodwork.

The basic life insurance medical exam process looks like this:

- The customer fills out a life insurance application and medical questionnaire

- The insurer schedules an in-home medical exam

- The medical examiner conducts a brief oral interview

- The examiner measures height, weight, and vitals, then takes a urine sample, blood sample, and oral swab

- Lab results are sent to the underwriter for review

- The insurer will assign a risk classification and inform the applicant of final premiums

Some term life insurance policies advertise the fact that they don’t require a medical exam. That’s a big selling point for some, but it’s a benefit that might cost more in the long run.

A young, healthy person might not see much of a difference in rates between an exam and no-exam policy, but older people can expect to pay more.

A no-exam policy represents a greater risk to the insurer. They pass that risk along to you in the form of increased premiums.

Depending on your health, taking the exam could show the insurer that you’re a lower risk than they might assume you are with a no-exam policy.

Tips for Finding the Best Policy

Here are some important tips to remember as you shop for a term life insurance policy.

#1 – Buy from a Reputable Company

Make sure the company you’re buying from is reliable.

Start by researching their market share. If they have a significant presence in the industry, with a lot of policies written, then they’re more likely to be an established, respectable company.

From there, read company reviews that focus on policy offerings, financial stability, and reputation. You can also do your own research in those areas by using the following resources:

Third-party rating agencies like A.M. Best, the financial services company Moody’s, and Standard & Poor’s (S&P) measure an insurer’s financial strength and its ability to pay all of its policy obligations.

J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

The Better Business Bureau uses 13 factors, such as time in business, open complaints, resolved complaints, and legal action against a company to assign one of thirteen letter ratings, A+ through F.

The National Association of Insurance Commissioners Complaint Index lists the number of complaints registered against an insurer each year ad compares it to that of other companies.

All of these resources can help you decide if a company is reputable.

#2 – Compare Policies

Compare the policy offerings of each company to find the one that suits you best. It’s important to make sure you compare policies of the same type.

A level term policy has different benefits and drawbacks than an increasing term policy of the face value. The same is true of an increasing term policy versus a decreasing term, a renewable versus a convertible, etc.

#3 – Get Quotes

Life insurance quotes are the only way to compare prices between various policies and the insurers that write them.

Quotes are available online through convenient quote tools or through local insurance agents.

Try to find the policy with the greatest benefit for the lowest annual cost.

Pros & Cons

Term life has both advantages and disadvantages, and they all need to be considered before you buy them. We’ve already covered a lot of them, but now we will break them down.

Pros

- It’s more affordable -When looking at term vs whole life insurance, term is almost always more affordable. That’s because there’s an end date to the coverage, which limits the insurance company’s risk.

- It’s simple -Term life policies are straightforward and easy to understand, which makes them appealing to those that want to select coverage fast and not get into the more confusing aspects of permanent life.

- It can be renewed -Term life can be allowed to expire if you no longer need it, or renewed if you do.

- You get more for your money -Term life offers a larger death benefit at a lower price. That makes it easier to afford a much larger amount of coverage if you need it.

- It’s there when you need it most -Term life has an end date so you can be covered when you really need it and stop paying for it when it’s no longer needed.

Cons

- If you need to continue coverage, it will cost you –Term life insurance rates are only locked in for the original term length. If you need to continue coverage, the cost will go up.

- You may not qualify for coverage later -Although you can usually renew or convert your term policy, serious changes to your health might affect your ability to qualify. And if you miss that renewal or conversion window, getting a new policy could be hard or impossible.

- It has no cash value -Unlike whole life, a term policy doesn’t provide a cash accumulation account that you can borrow or withdraw from if needed.

- It’s not flexible -There isn’t much flexibility to term life, unlike a universal policy that offers a lot of flexibility.

- You have to guess how long you will need it -Choosing a term length requires some foresight. You need to decide today how long you will need the coverage. If you’re wrong, you will face higher rates for a new policy or renewal.

The Bottom Line

Term life is an affordable way to provide financial protection for your family when they need it most. It’s a great choice for a wide variety of needs. With a lot of options for term length and death benefit, it fits the bill for a lot of people.

The important thing to remember is that the price you pay is largely based on your age and health. The sooner you buy, the lower the rate you can lock in for the duration of the coverage.

Term Life FAQs

#1 – Where can I get affordable term life insurance for seniors?

Term life insurance for seniors still might be a good alternative. It will certainly be cheaper than whole life. Whole life combines a cash value feature that is designed to keep the premiums level on the policy.

Keeping in mind that term life insurance can have level premiums, but the policy will expire sometime before life expectancy.

According to most companies, life expectancy is age 100. Most term life policies will cover a person until age 85, but no further.

A good strategy might be to purchase a term policy that has convertible features.

If a term policy is convertible, then it can be switched to a permanent policy at any time during the term regardless of a person’s state of health.

Most term policies are convertible until age 65. If a term policy is purchased prior to that age, it could be converted to permanent insurance just before age 65.

For example, if a senior at age 70 purchased a 15 year, level term policy that might be a good strategy to pursue.

The initial costs would probably be affordable, and the policyholder would have the security of knowing that the term policy would be in force until age 85 when it would expire.

The Problem With Term At Older Ages

In the previous example where a person who is age 70 purchased a 15-year term insurance policy, it seemed to be a solution that might fit a typical situation.

The reason a 15-year plan is given as the example is that that is probably the longest any life insurance company will issue a policy.

What a tragedy it would be if that 70-year-old were to pay the premiums for the 15 years, the policy expires, and the individual dies at age 86. That is the drawback of term life insurance.

Term life insurance will only pay during the time that it is in force, and once it expires there is no more coverage.

Possible Remedies

One remedy would be to go ahead and purchase the term insurance for 15 years and purchase an additional whole life policy for an amount that would cover final expenses.

At least if a person were to outlive the term insurance, there would be some life insurance benefit for burial.

A person could purchase a policy called Guaranteed Universal Life. This is a combination of a low-cost permanent plan, but there is very little cash value, making the cost of the plan very low for a permanent plan.

The amount of coverage might start at $50,000, but it is worth looking into for the sake of having insurance in older ages.

#2 – Where can I find top-rated term life insurance?

Once you have qualified the companies you can start to price the cost of their term products.

You can either visit each companies official website, locate their 1-800 number, or visit a local brokerage or agency, but all of these options require a great deal of time.

If you want to a platform that will only provide you with the rates available through top-rated term life insurers, try using an online rate comparison tool.

Rate comparison tools are systems that have been developed by a third-party. The developer has built relationships with reputable insurers offering term insurance and has incorporated their rates into their quoting system.

It benefits the insurer because it promotes their brand and benefits consumers because they are able to shop the rates charged by many companies by visiting just one website.

If you want to make the process of finding term life coverage from a top-rated company quick and easy, use an online quoting system that gives you power as a consumer. Be sure to do your own independent research on any provider that offers low prices so that you can rest assured that they are financially stable and reputable.

Once you use the online resources to your advantage to qualify the company, you can choose the most competitive rate and begin the application process by filling out your personal application for term life insurance coverage.

#3 – How can I buy term life insurance online?

You’ve got two options when buying term life insurance: the easy way or the hard way. The hard way is going to each individual company site and getting quotes one at a time. The easy way is using our FREE tool below and comparing multiples quotes from multiple companies in a matter of minutes. Again, what are you waiting for?

#4 – Can you cash in your term life insurance?

Even though a term life insurance policy cannot be cashed in as such since it has no reserve that is available to the policyholder, the low cost and higher coverage possibilities give the term concept great popularity.

When buying term insurance that is convertible, an individual has great flexibility for coverage that can be extended to longer periods.

It is difficult to totally plan exactly when to drop life insurance coverage and when to keep it going, as life’s twists and turns are many times unpredictable.

People need to have some life insurance all of their lives, not just when they are young.

We still need to have life insurance if we have any debts, mortgages, and burial funds for our last expenses, no matter how old we are.

Term life coverage that we have in our younger ages can be guaranteed to be converted to lesser amounts as we get older.

Waiting just means you will pay more. Enter your ZIP code below to get started comparing rates on term life today.

Related Articles

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption