Smart Advice on Term vs Whole Life Insurance (Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Term life insurance provides coverage for a limited time

- Whole life insurance provides permanent coverage as long as you live

- Term life is less expensive than whole life

- Term life is best for families on a budget

- Whole life is best for high-income families with specific financial goals

The insurance industry is a massive and varied enterprise. If there’s a product, service, or situation that would benefit from financial protection, someone, somewhere, is selling it.

Your life’s journey probably included multiple pit stops to pick up different types of coverage along the way: equipment replacement on your first cell phone, auto insurance on your first car, health insurance with your first job, or mortgage insurance on your first home.

Life insurance is often one of the last stops.

It tends to be bought later in life because the need doesn’t always seem as immediate. However, if life’s journey also brought you to a wedding chapel or a hospital delivery room, you should consider buying sooner rather than later.

Life insurance is unique from other forms of coverage in that it’s one of the only types that doesn’t directly benefit the insured. Instead, life insurance is designed to protect the insured’s family.

Admittedly, life insurance can get a little complicated based on your personal needs, but the concept itself is relatively simple.

At its most basic definition, a life insurance policy is a contract between you and an insurance company. You pay regular premiums, and in exchange, the company promises to pay a lump-sum payment to your loved ones upon your death.

That payment can be the difference between financial security and financial hardship for those you leave behind.

According to the 2018 Insurance Barometer Study from Life Happens and LIMRA, 35 percent of households would be financially affected within one month of the primary wage earner’s death. Because of that, 90 percent of people surveyed agreed that a family’s primary wage earner needs to own life insurance.

Still, almost half of all adults in the United States don’t. Of those that do, 20 percent feel their coverage is insufficient to meet their financial needs. If you have a family that depends on you, you owe it to them to explore your life insurance options.

Life insurance coverage falls into one of two general categories: term or whole.

This extensive guide is designed to give you a completed overview of both, as well as to compare them side-by-side to help you decide which type is right for you and your family.

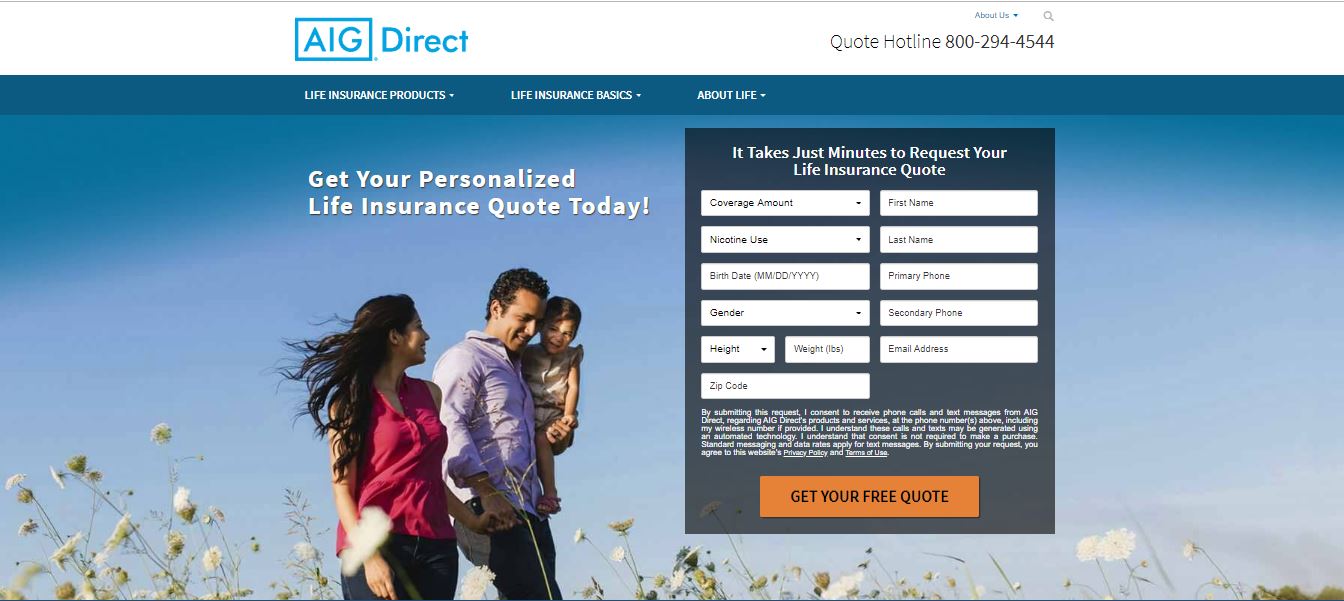

Start comparing life insurance rates now by using our FREE quote tool above.

Table of Contents

How do term & whole insurance differ?

As mentioned, life insurance policies fall into one of two general categories.

Term life insurance provides coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you opt to renew at a new, higher rate.

Whole life insurance (often called permanent insurance) provides coverage for as long as you live. If you pay all your premiums, the insurer will pay a guaranteed benefit, no matter when you die.

For example, if a 30-year-old man buys a $500,000, 30-year term policy, that coverage ends at age 60. If he dies before 60, the insurer pays $500,000. If he dies anytime after, they don’t pay anything.

A simple way to look at it is like buying an extended warranty on an appliance. When you buy a refrigerator, you might pay extra money out of pocket for five years’ worth of replacement protection.

Once the extended warranty expires, you can no longer get the refrigerator replaced, even though you paid extra money for protection.

On the other hand, let’s imagine that the same man bought a $500,000 whole life insurance policy instead. As long as his payments were current at the time of death, the insurer would pay his beneficiaries $500,000, regardless of his age.

Going back to the same analogy, it’s like paying for a lifetime warranty on an appliance, rather than just an extended one. No matter when it ultimately breaks down, the company will replace it.

Many whole policies also allow you to take out personal loans against your cash value, which must be paid back with interest. Term policies don’t.

What Life Insurance Covers

The beneficiary can use the death benefit from a life insurance policy any way they choose, but it’s generally meant to cover two types of obligations: immediate and future.

Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all of the expenses (either planned or unexpected) that you want to pay for after your death. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

The financial needs of your beneficiaries within those categories, as well as your personal financial goals, can help you determine whether you need a term or whole policy.

Reasons to Buy Term Life

Term coverage is the simplest and cheapest form of life insurance. It represents less of a risk to the insurer. There is always a chance you’ll outlive your term and they won’t have to pay, while a whole policy guarantees that they’ll have to pay.

When it comes to life insurance, a higher risk always means higher premiums. A term policy will always cost less than a whole policy with the same face value.

Many whole policies also come with savings and investment components that can prove overly complicated for someone looking for basic financial protection.

For those reasons, many financial planners and consumer advocacy organizations, such as Consumer Reports, suggest a term policy is a better choice for a majority of families.

Specifically, those in the following situations would probably benefit more from a term policy than a whole.

To Maintain a Budget

The 2018 Insurance Barometer Study from Life Happens and LIMRA found that 61 percent of people don’t buy life insurance because they have other financial priorities.

Also, 44 percent of millennials overestimate the cost of insurance by five times the actual amount. They’re scared off by the price tag before actually reading what it says.

Term policies are perfect for families on a budget because they offer large benefits for a low price.

Depending on your age and health, you can often get $500,000 in coverage for less than $1 a day.

To Pay Off Large Debts

One of the main reasons for buying life insurance is to pay off outstanding debts so your loved ones aren’t burdened with the expense after you die.

Many of those large debts, such as mortgages, are designed to be paid off after a set period of 15 to 30 years. Once they’re paid, insurance coverage isn’t as necessary.

Term insurance allows you to buy insurance for a term that matches your payoff timeline. If you die during the term, the debt is paid. If you pay it off in your lifetime, your policy ends with the obligation. That way, you aren’t paying extra for permanent coverage that you don’t need.

To Protect Large Investments

If you already have a good savings and investment strategy to cover your future needs, such as income replacement and college tuition, you won’t see as much need for life insurance.

However, an unexpected death could derail those savings before they mature to their desired value.

Term insurance allows you to buy temporary coverage that lasts until you reach your savings goals, after which you can cancel your policy or simply allow it to expire.

Reasons to Buy Whole Life

Because whole life has a guaranteed death benefit (whereas a term policy might expire before an insurer has to pay a claim), it is naturally the more expensive of the two options.

Whole life also has multiple variations, many of which come with a built-in savings component. Every month, a portion of your premiums are placed into an interest-bearing account.

Those funds accumulate and build cash value in addition to the face value of your policy. That means you have the potential to leave behind a significant additional benefit on top of your guaranteed death benefit.

Some policies also pay annual dividends. Many whole life insurers are mutual companies, meaning that policyholders are partial owners of the company who are entitled to profit sharing. Those dividends are often added to the cash account or used to pay policy premiums.

For these reasons, whole policies are often advertised as being a useful investment tool, as they allow you to save (and sometimes earn) money while paying for life insurance.

That lifetime coverage, combined with the cash growth element, can be good for those in the following situations.

To Plan an Estate

If you’re leaving behind a large estate, your heirs could be on the hook for a significant tax bill. The current maximum estate tax rates are nearly 40 percent.

That amount is due nine months after your passing. If you aren’t leaving behind cash, your heirs may have to use their own money to pay the tax bill. Fortunately, the money from life insurance policies is typically tax-free. Your beneficiaries can use the death benefit to pay the taxes and preserve the estate’s value.

To Protect Assets

If you need to protect your assets against liens and creditors, life insurance could be a practical part of your strategy. Laws vary by state, but most consider life insurance money to be an uncollectible asset.

To Establish a Trust

Similar to asset protection, the proceeds from a whole life insurance policy can be used to create a strong trust. Trusts are often used to transfer substantial assets, such as real estate or businesses.

To Preserve a Business

If you own a business, the proceeds from a whole life insurance policy can be used to cover any financial losses resulting from your death. It can also provide the liquidity necessary to keep it running and grow into the future.

To Save for Retirement

Whole life insurance policies aren’t subject to contribution limits like an IRA or 401(k). You can contribute as much premium as you’d like to increase your cash value.

If you’ve already reached your maximum contribution to your traditional retirement savings accounts, you can take advantage of additional tax-deferred growth through your whole life investments.

To Continue Providing Long-Term Care

If you’re the primary caregiver for a permanently disabled spouse or a loved one with special needs, the proceeds from a whole life policy can be used to set up a long-term care plan to ensure they’re provided for after you’re gone.

Average Cost of Term Life vs Whole

As we’ll show, term life is cheaper than whole at every age and demographic. However, before we compare the two, you need to understand the factors that affect your rate.

Factors That Affect Rates

There is no industry-standard price for life insurance. Rates vary for everyone. Your premiums are determined by several factors, primarily the following:

- Age – Age is one of the most critical factors in determining insurability. The older you are, the closer you are to death. The longer you wait to buy a policy, the higher your rate will be.

- Gender – Statistically, women live longer than men. Because of that, they typically pay lower premiums.

- Health history – The healthier you are, the longer you’re likely to live. Longer life expectancy translates to lower premiums. To determine your overall health, insurers may require a complete medical exam.

- Family medical history – Because many diseases are hereditary, most insurers will also inquire about the health history of your immediate family during your application.

- Occupation – Some jobs come with a higher risk of accidental death than others. The more dangerous the profession, the more likely an insurer is to pay out an early death benefit, which means higher premiums.

- High-risk habits – Insurers will also inquire about high-risk habits such as flying, racing, scuba diving, or any other regular activity that has a high potential for injury or death.

- Tobacco use – The most common high-risk habit that insurers look for is tobacco use. Smokers almost universally pay higher rates than their non-smoking counterparts in every demographic.

Sample Rate Comparison

To give you an idea of how term rates compare to whole rates, here is a look at sample premiums for a non-smoker with one of the top 10 life insurers in the country.

20-Year Term

| Age | $100,000: Male | $100,000: Female | $250,000: Male | $250,000: Female | $500,000: Male | $500,000: Female |

|---|---|---|---|---|---|---|

| 25 | $14.53 | $12.70 | $23.27 | $18.72 | $34.79 | $27.39 |

| 30 | $14.96 | $13.22 | $24.59 | $20.44 | $37.39 | $29.59 |

| 35 | $17.57 | $15.40 | $26.09 | $22.19 | $40.04 | $32.19 |

| 40 | $21.40 | $18.62 | $33.72 | $28.49 | $54.79 | $45.69 |

| 45 | $26.54 | $22.97 | $45.47 | $37.42 | $79.19 | $66.14 |

| 50 | $36.02 | $29.32 | $69.59 | $54.59 | $126.14 | $96.99 |

| 55 | $50.98 | $38.11 | $105.72 | $78.97 | $203.14 | $143.99 |

| 60 | $84.91 | $60.20 | $183.79 | $131.17 | $355.39 | $248.84 |

| 65 | $144.51 | $97.44 | $323.42 | $220.99 | $625.09 | $432.84 |

Get Your Rates Quote Now |

||||||

Whole

| Age | $100,000: Male | $100,000: Female | $250,000: Male | $250,000: Female | $500,000: Male | $500,000: Female |

|---|---|---|---|---|---|---|

| 25 | $93.70 | $84.91 | $225.12 | $203.14 | $444.14 | $400.19 |

| 30 | $107.71 | $97.35 | $260.14 | $234.24 | $514.19 | $462.39 |

| 35 | $128.24 | $112.93 | $311.47 | $273.19 | $616.84 | $540.29 |

| 40 | $153.90 | $132.15 | $375.62 | $321.24 | $745.14 | $636.39 |

| 45 | $190.79 | $156.17 | $467.84 | $381.29 | $929.59 | $756.49 |

| 50 | $234.90 | $191.66 | $578.12 | $470.02 | $1,150.14 | $933.94 |

| 55 | $294.84 | $243.17 | $727.97 | $598.79 | $1,449.84 | $1,191.49 |

| 60 | $399.24 | $311.63 | $988.97 | $769.94 | $1,971.84 | $1,533.79 |

| 65 | $528.00 | $421.69 | $1,310.87 | $1,045.09 | $2,615.64 | $2,084.09 |

Get Your Rates Quote Now |

||||||

As you can see, premiums on whole policies range anywhere from 200 to 600 percent higher than 20-term policies at the same age and with an equal face value.

Do rates change over time?

Premiums on term insurance can increase annually, depending on the type of policy you choose (discussed later in this guide), but they are generally fixed for the life of the term. The only time you can expect an increase is if you renew your policy for an additional term once the original expires.

Whole rates are also generally fixed, but you do have more flexibility in how you pay them. Depending on the option you choose, your payments could vary from year to year.

With universal policies, you can change the amount and frequency of your premium payments. For example, you can pay higher premiums or a lump sum early in the year, then pay less later.

Even though you don’t have to pay on a set schedule, you do still need to pay a minimum amount each year to keep your policy active.

Some policies also come with a limited pay option. You can pay for the policy in full over the course of 10-20 years so you aren’t still paying premiums long into your life.

For policies with increasing death benefits, you can sometimes reduce or stop your out-of-pocket premiums by using your cash value to pay them instead.

How much coverage do you need?

The process for determining how much coverage you need is different depending on whether you choose a term or whole policy. For a whole policy, you only need to calculate a face value amount that will cover all of the financial goals outlined earlier.

For a term policy, not only will you need to calculate a face value to cover all of your financial obligations, but you’ll also need to settle on the appropriate term length.

Face Value

As previously discussed, a life insurance policy needs to cover two types of obligations: immediate and future.

The most common among those are income replacement for a spouse, tuition savings for a child, mortgage balances, and miscellaneous debts. A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need to cover all of those obligations.

In the meantime, there are simple formulas you can use to give yourself a rough estimate.

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym which stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you the minimum face value you need.

Here’s a quick example: a wife and mother of two is the majority wage earner in her family, with a husband who works full time. She has an annual salary of $80,000.

The family has a remaining mortgage balance of $100,000, and $10,000 left on a car loan.

The mortgage is the most significant annual expense. With it paid, the husband will have less need for her income. Therefore, she plans to leave only five years’ worth of her salary as emergency savings.

She also wants to leave $35,000 to cover the average cost of four years of in-state tuition at a public university for their child.

After factoring in an average funeral cost of around $7,500, her insurance needs are as follows:

- Debt – $10,000 car loan + $7,500 funeral costs = $17,500

- Income – $400,000

- Mortgage – $100,000

- Education – $35,000

- Total need – $552,500

That total means she would need a life insurance policy with a face value of around $600,000. If she wanted to buy a whole life policy for one of the scenarios discussed previously, she would also need to factor in that amount.

For example, if she wanted to establish a trust to transfer assets to her child, she would need to add those additional costs to her DIME total.

Length of Coverage

If you buy a whole policy, you don’t need to decide on a term length since you have lifelong coverage. However, if you choose a term policy, picking the correct term length can be as important as determining the correct face value.

For example, if you have 20 years left on a 30-year mortgage, you should choose a 20-year life insurance policy.

If you want to pay for your child’s college tuition and have a savings account set up that will take 10 years to reach the desired value, you should choose at least a 10-year policy.

Here’s a list of things to consider when determining a term length:

- Number of years your spouse will depend on your income (years to retirement)

- Number of years dependent children will be living with you

- Number of years until shared debts (such as a mortgage) are paid in full

- Number of years until your savings grow enough to cover future obligations

Ideally, you’d choose a term that lasts until the last of those milestones is reached. After you clear those events, you’ll have much less need for insurance coverage.

Types of Term Life

All term life insurance follows the basic model of providing coverage for a limited amount of time. Within that general category, there are several variations:

- Level term

- Increasing term

- Decreasing term

- Renewable term

- Convertible term

Each type of term life differs.

Level

A level term policy is the simplest form of term insurance. The premiums never increase, and the amount of the death benefit remains the same throughout the entire term.

Term policies are typically sold in terms of five to 30 years, in five-year increments. Some companies offer single-year policies that renew annually.

While it’s true that the premium remains the same throughout the term, since each term is technically only one year, you could see annual rate increases with this type of policy.

Increasing

For an increasing term policy, the death benefit increases each year within a certain limit, usually between 2-10 percent. As the death benefit goes up, so will your premium.

For example, a $500,000 increasing term policy might increase by 2 percent every year. So, in year two, the death benefit would be $510,000. In year two, it would be $520,200, and so on.

An increasing term policy might not be the best option for those who want long-term coverage.

For example, on a 30-year policy, the death benefit will have grown substantially after a few decades. That means that the premiums will have risen along with it.

At some point, those higher premiums will reduce the overall value of the policy. The premiums could even increase at a higher rate once the benefit reaches a set amount.

Decreasing

Decreasing term insurance is sometimes called mortgage protection insurance. The benefit decreases every year of the term.

It’s designed around the fact that that you’ll be paying down the balance on whatever debt you intend the insurance to cover (usually a mortgage). As that balance shrinks, so does the amount of coverage you need.

The premiums don’t decrease with the benefit. Instead, decreasing policies offer a much lower premium from the start that you pay continually throughout the term.

Renewable

Renewable term policies allow you to extend or renew your policy for an additional term after the expiration date with no new medical exam.

Some renewable policies automatically renew every year up to a specific age (typically 65). Policies that renew annually could also see annual premium increases. Other policies automatically renew for your original length once your policy term ends.

Convertible

A convertible term policy allows you to convert your term policy into a permanent policy with the same face value, usually without taking a new medical exam.

Converting from term to whole insurance will increase your premiums (as discussed earlier). Some insurers also place age limits on conversions. Typically, you must convert before age 65.

Riders

Life insurance policies can be customized with riders that add additional coverages and benefits.

| Rider | Description |

|---|---|

| Accidental death benefit | Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries |

| Terminal illness | Gives early access to a percentage of the death benefit if diagnosed by a physician as having 12 months or fewer to live |

| Child | Pays a death benefit to the insured parent upon the death of an eligible child |

| Spouse | Pays a death benefit to the insured parent upon the death of an eligible spouse |

| Waiver of premium | Waives the policy premiums if the insured becomes totally disabled |

| Disability income | Pays a monthly income of 1 – 2% of the face value if the insured becomes disabled |

| Guaranteed insurability | Guarantees you the right to purchase additional insurance, without proof of good health, at specified dates in the future |

| Return of premium | The insurer will return your premiums at the end of the term, minus the additional cost of the rider |

| Term conversion | Allows you to convert term life insurance into whole life insurance without undergoing a medical exam |

Get Your Rates Quote Now |

|

In the table above are the most common riders for term policies.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Types of Whole Life

All whole life insurance policies are the same in that they come with the promise of coverage for as long as you live and a savings account that builds a cash value.

Whole life has the following variations:

- Traditional whole life

- Universal life

- Variable life

- Variable universal life

- Guaranteed universal life

As with term, each type of whole life differs.

Traditional Whole

A traditional whole life policy (sometimes called ordinary life) is the most common form of permanent insurance. It is also one of the simplest.

Your cash account operates similar to a traditional savings account. A portion of your annual premiums is placed in an account that grows at a fixed interest rate (typically around 3-8 percent).

This makes it the least risky option. You are always guaranteed to see positive growth in your cash value. It doesn’t depend on any market factor that could experience a downturn.

That simplicity and safety come at the cost of flexibility. You often can’t change your death benefit or adjust your premium payments.

Universal

Universal life policies offer the flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low while maximizing cash value.

That cash value grows at a fixed rate, similar to an ordinary life policy.

These policies offer more flexibility than the traditional option, but less than other universal and variable options, particularly when it comes to your investment.

Indexed Universal

Indexed universal life policies offer all the flexibility of a universal policy, with the added benefit of choosing how you invest your premiums.

These policies allow the owner to allocate the cash value amounts to an equity index account such as the S&P 500 or the NASDAQ 100, rather than growing at a rate set by the insurer.

They are riskier in that growth is not guaranteed, but they do come with the potential for higher returns than a traditional whole or universal policy. Some also come with the option to take a break from the index and temporarily invest in the stable, traditional savings account.

Guaranteed Universal

Guaranteed universal life policies fall somewhere between a term policy and a traditional whole policy. It offers fixed premiums and guaranteed no-lapse coverage.

Unlike most permanent life insurance policies, guaranteed universal policies don’t accumulate a cash value that you can access.

They are more like term policies that simply don’t expire as long as you pay your premiums, which could be a drawback for someone who wants to use their policy as an investment.

Variable

Variable policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401(k). These policies come with the greatest risk, but also some of the highest growth potential.

Depending on how the stock market performs, you could lose some of your cash value and possibly see your face value decrease.

However, many policies do come with a minimum death benefit guarantee.

Variable Universal

As you can probably guess from the name, variable universal policies combine the benefits of a universal and a variable policy.

You get the flexibility of adjustable premiums and face values, along with the potential investment rewards of a variable savings account. Of course, that also means they come with the same risks.

Riders

Whole life policies can also be customized with riders.

| Rider | Description |

|---|---|

| Accidental death benefit | Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries |

| Terminal illness | Gives early access to a percentage of the death benefit if diagnosed by a physician as having 12 months or fewer to live |

| Child | Pays a death benefit to the insured parent upon the death of an eligible child |

| Spouse term | Provides term insurance (not whole) on an eligible spouse |

| Waiver of premium | Waives the policy premiums if the insured becomes totally disabled |

| Disability income | Pays a monthly income of 1 – 2% of the face value if the insured becomes disabled |

| Guaranteed insurability | Guarantees you the right to purchase additional insurance, without proof of good health, at specified dates in the future |

| Term life | Allows you to add supplemental term coverage to your whole policy |

| Income for life | Converts the cash value into a guaranteed, regular income stream |

| Lapse protection benefit | On variable policies, coverage is guaranteed not to lapse despite market performance, as long as the required minimum premiums are paid to guarantee the death benefit |

Get Your Rates Quote Now |

|

In the table above are the most common whole life riders.

Flexibility of Term Life vs Whole

If your financial situation changes during the life of your policy, you have some options for adjusting your coverage. Generally, whole life policies are more flexible than term, but both allow you to make changes to your original contract.

Renewing Your Policy

You can renew many term insurance policies for additional terms once the original expires. Some will even allow you to do so without taking a new medical exam. Every time you renew the policy, you run the risk of increased premiums since you’re starting a new term at an older, riskier age than when you originally applied.

Some insurers sell policies that renew at a guaranteed fixed rate, but those policies usually come with higher premiums from the start.

Most plans have an age limit on renewals, typically 65 years old. Since whole policies last your entire lifetime, there is no need to renew.

Converting Your Policy

Many term life plans can be converted to whole life plans. Some can be converted at any point, while others must be converted during a certain period, such as within the first 10 years.

Like renewals, most insurers place an age limit on conversions.

Unfortunately, the inverse is not true of whole life plans. If your financial situation changes during the life of your policy and you no longer need permanent insurance, you can’t convert to a term plan.

In that situation, your best course of action is to cancel your policy and buy a new, cheaper term plan. However, doing so will likely come with surrender fees, which are charges imposed against your cash value.

Changing Your Death Benefit

It’s not unrealistic to think that your financial situation might change over time, which could affect your life insurance coverage. You could incur new debts, which would require a higher face value, or pay off old ones, which would require less.

Most policies (both term and whole) allow you to increase your death benefit. Some only let you increase during a certain time period, while others let you do so at any time before a cutoff age.

Most increases will require new underwriting, which means a new medical exam.

Most insurers also allow you to decrease your face value to a set minimum without forfeiting your coverage. Some allow for a single change, while others allow for multiple changes at any time.

Keep in mind that if you decrease your coverage, the insurer won’t refund the premiums you already paid for the higher face value. Also, decreasing the benefit on a whole policy could result in surrender fees.

Shopping for Term Life vs Whole

Because of their overall simplicity, term policies tend to be easier to shop for than whole.

How to Get a Quote

The purchase process for any life insurance policy should start with getting a free quote. These sample rates allow you to compare prices with multiple competitors to make sure you’re getting the lowest possible premiums.

There are two main ways to get quotes: online or through an agent.

Online

Whole life insurance has a lot of variations and more factors that influence its premiums. Few companies give them out online. You’ll likely have to go through an agent if you want to shop for several different providers.

On the other hand, term quotes are widely available.

Many insurers have quote tools on their website. You simply choose your desired coverage, enter some personal information, and the tool will return an estimated monthly or annual cost.

There are also independent quote tools (such as the ones on this page), which give quotes from multiple insurers at once, allowing you to compare prices immediately without having to keep entering the same information across multiple sites and manually keeping track of their sample rates.

A few insurers sell term policies directly online. After getting your quote, you can apply for the policy immediately.

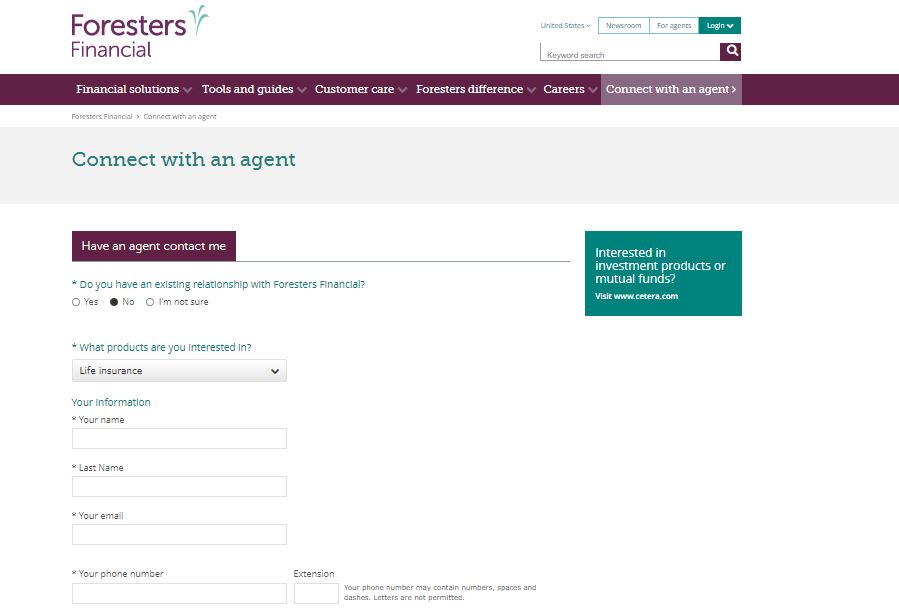

Agents

Most life insurance policies are sold through agents, especially whole policies. Even if an insurer provides online quotes, many will then redirect you to an agent to apply.

Insurance agents fall into one of two categories: independent or captive.

Independent agents are brokers who sell policies from multiple insurers. The fact that they can shop multiple companies puts them in a better position to find the best overall policy for their clients.

A captive agent works for a single insurer, and will only market and sell their employer’s policies. They more closely resemble customer service agents than insurance brokers.

If you want to compare costs and policies across multiple insurers, you can only do so with an independent agent.

Most insurers have an agent finder on their website that operates like a quote tool.

You enter some basic personal information and type of coverage you want, and local agents will typically contact you within one business day to discuss your options or set up an appointment.

Medical Exams

Once you apply for a life insurance policy, insurers will require you to fill out a health questionnaire and may request your medical records. Upon acceptance, most will also require a complete medical exam and ask you to submit bloodwork.

The basic life insurance medical exam is a fairly simple process:

- The customer fills out a life insurance application and medical questionnaire.

- The insurer schedules an in-home medical exam.

- The medical examiner conducts a brief oral interview.

- The examiner measures height, weight, and vitals, then takes a urine sample, blood sample, and oral swab.

- Lab results are sent to the underwriter for review.

- The insurer will assign a risk classification and inform the applicant of final premiums.

Some term policies don’t require a medical exam, depending on your age, health, and the coverage amount, but that convenience could cost you in the long run.

A no-exam policy represents a bigger risk to the insurer, which is usually passed onto you in the form of higher premiums.

If you’re healthy, completing a medical exam can help place you into a lower risk classification, resulting in lower rates.

The only no-exam whole life insurance policies aren’t traditional life insurance at all. They are supplemental policies meant only to cover burial costs and small miscellaneous final expenses.

They are often called final expense insurance, guaranteed acceptance whole life, or simplified whole life, and have limited face values, which typically range from $2,000-$25,000.

Pros & Cons

Term life and whole life both come with their benefits and drawbacks. Here are some of the biggest to consider.

Term

The pros and cons for term life insurance are as follows:

Pros

- Simpler

- Cheaper

- No investment risk

- Online quotes easily available

- Can sometimes be purchased directly online

- No-exam options

Cons

- Not very flexible

- Coverage expires

- No potential for cash growth

Whole

The pros and cons for whole life insurance are as follows:

Pros

- Guaranteed lifetime coverage

- Potential for cash value growth

- Flexible premium options

Cons

- More complicated

- More expensive

- Potential investment risk

- Few online quotes available

- Must be purchased through an agent

- Medical exam required

The Bottom Line

Term life insurance is the simplest form of coverage. It is the type recommended most for families because of its large benefits and lower costs.

Term policies are also among the easiest to buy. Within minutes, you can get a quote, compare prices, and schedule an appointment with many of the top providers. Some also allow you to purchase instantly online.

However, while whole policies are a more complex and expensive option, there are specific groups of people for whom they might be the better choice. High-wage earners, business owners, and those with significant assets to pass on could benefit from the guaranteed coverage and investment component of permanent insurance.

| Policy Feature | Term Life | Whole Life |

|---|---|---|

| Death Benefit | Can be level, increasing, or decreasing | Level |

| Premium | Level (with the exception of an increasing term policy); paid monthly or annually for the life of the term | Level; can be paid for the life of the term or at a higher rate for a shorter period |

| Cost | Less expensive | More expensive |

| Length of Coverage | Set term, usually 1 – 30 years | Lifetime |

| Cash Value | None | Tax-deferred growth |

| Dividends | Not eligible | Eligible, depending on insurer |

| Policy Loans | None | Loans can be taken against cash value |

| Online Quotes | Readily available | Not easily available |

| Online Purchase | Some policies available for direct purchase | Not available |

Get Your Rates Quote Now |

||

Regardless of which you choose, you can rest assured knowing that your family and financial interests are protected for years to come.

Start comparing life insurance rates now by using our FREE quote tool below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption