American Amicable Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1910 |

| Current Executives | President & CEO – S. Lanny Peavy |

| Number of Employees | 51-200 |

| Total Assets | $313,099,895 |

| HQ Address | 425 Austin Ave., Waco, TX 76701-2147 |

| Phone Number | 1-800-736-7311 |

| Company Website | www.americanamicable.com |

| Financial Standing (Total Capital and Surplus) | $63,146,180 |

| Best For | Burial and Final Expense |

Get Your Rates Quote Now |

|

American Amicable has a long history of providing quality life insurance products to customers across the nation. Officially registered out of Texas, American Amicable products are available through independent agents in over 40 states.

American Amicable products provide a wide range of flexibility. With an easy application process, customers can obtain quality life insurance through a quick consultation with an agent. In some cases, insurance products can be approved without medical exams or bloodwork.

For more details, check out this review of American Amicable. If you are looking for life insurance, click here to get a FREE quote.

Table of Contents

American Amicable’s Ratings

Whether you are shopping for insurance products online or working with an agent, you want to feel assured you are ultimately purchasing products from reputable companies that will be around for the long haul. American Amicable is a highly rated company. A quick review of the ratings below can help you determine if American Amicable insurance is right for you.

A.M. Best

A.M. Best is the only global credit rating agency that specifically focuses on the insurance industry. Their rating methodology focuses on financial strength and creditworthiness. When you purchase insurance, you want to make sure that your company won’t have any issues in executing claims.

A.M. Best provides reviews and guidance information for the strength of a company’s financial standing. They do this by reviewing where a company’s capital and assets are invested and assessing whether capital is readily available to meet any outstanding claim obligations. Insurance companies should be managing risk properly to ensure that when they need to pay out, they have cash available.

Strong credit and financial strength are important indicators, and American Amicable appears to have strong ratings in both areas.

American Amicable has an A (Excellent) rating from A.M. Best. An A (Excellent) rating means A.M. Best is in great shape to meet any ongoing insurance obligations. They also have an “a” rating for creditworthiness. A company’s credit rating is important. Companies that have poor credit could struggle to meet claim payments.

Better Business Bureau (BBB)

Most people are familiar with the Better Business Bureau. Typically, unhappy customers with complaints will file a complaint with the Better Business Bureau when they have an issue with a company that isn’t getting resolved. American Amicable has an A+ rating from the Better Business Bureau. The company has a 4.5-out-of-five-star customer review rating, and although there are 15 complaints on file, most of the complaints are marked resolved or answered.

Company History

American Amicable is a Texas-based company that considers itself a progressive special markets insurer. Tracing its roots back to 1910, American Amicable was originally known as the Amicable Life Insurance Company, or ALICO, and began its initial operations from the well known ALICO building in Waco, Texas. Fans of the HGTV television show “Fixer Upper” may be familiar with the building (See above).

American Amicable Life Insurance Company of Texas was originally part of the American Amicable Group of Companies, which included the IA American Life Insurance Co, Occidental Life Insurance Company of North Carolina, Pioneer American Insurance Company, and the Pioneer Security Life Insurance Company.

In 2010, the American Amicable Group of Companies was acquired by Industrial Alliance Insurance and Financial Services, Inc. The new parent company creates a much larger organization, offering insurance and financial services products nationwide. The larger conglomerate employs over 5,000 employees and administers over $109.5 billion in assets. It is a Canadian company, with headquarters in Quebec.

American Amicable Life Insurance products are available in select states nationwide through a network of independent sales agents.

American Amicable’s Market Share

American Amicable is not a publicly traded company, and so financial reporting and market share information is limited. However, data extracted from the NAIC Market Conduct Annual Statement of 2016 provides at least a recent market share picture that may be helpful. The table provided below extracts the line items from the NAIC report specific to American Amicable.

American Amicable conducts business in approximately 40 of the 50 states. From the table below, you can see that the company has stronger footholds in California, Florida, North Carolina, and Georgia. However, the bulk of American Amicable’s business is still conducted in its home state of Texas.

Overall, American Amicable is a smaller insurance provider. Where some of the largest insurers could control up to 3 percent or more of market share for life insurance in a particular state, American Amicable does not get anywhere near even 1 percent in any market area.

Search the table below to see how much business American Amicable is doing in your home state.

| State | Premiums | State Market Share |

|---|---|---|

| AK | $76,916.00 | 0.00021 |

| AL | $2,379,996.00 | 0.0014 |

| AZ | $1,926,526.00 | 0.00108 |

| CA | $7,735,745.00 | 0.00059 |

| CO | $827,449.00 | 0.00042 |

| CT | $511,383.00 | 0.00025 |

| DC | $153,588.00 | 0.00061 |

| DE | $272,906.00 | 0.00032 |

| FL | $7,733,938.00 | 0.00102 |

| GA | $4,841,729.00 | 0.00133 |

| HI | $355,242.00 | 0.00056 |

| ID | $188,755.00 | 0.00043 |

| IL | $3,242,035.00 | 0.00061 |

| IN | $1,984,576.00 | 0.00099 |

| KS | $255,303.00 | 0.00023 |

| KY | $1,028,563.00 | 0.00088 |

| LA | $1,838,051.00 | 0.00099 |

| MD | $2,516,214.00 | 0.00109 |

| MN | $550,976.00 | 0.00014 |

| MO | $1,788,309.00 | 0.00088 |

| MS | $2,169,691.00 | 0.00234 |

| NC | $5,295,914.00 | 0.00147 |

| NE | $120,902.00 | 0.00014 |

| NM | $234,180.00 | 0.0005 |

| NV | $553,690.00 | 0.00065 |

| OH | $3,425,872.00 | 0.00088 |

| OK | $1,279,844.00 | 0.00099 |

| OR | $836,461.00 | 0.00084 |

| PA | $2,551,096.00 | 0.00051 |

| SC | $3,639,340.00 | 0.00227 |

| SD | $91,269.00 | 0.00012 |

| TN | $3,020,650.00 | 0.0014 |

| TX | $14,945,185.00 | 0.00177 |

| UT | $373,577.00 | 0.00034 |

| VA | $2,086,796.00 | 0.00069 |

| WA | $735,774.00 | 0.00039 |

| WI | $834,769.00 | 0.00044 |

| WV | $317,740.00 | 0.00073 |

| WY | $73,735.00 | 0.00033 |

Get Your Rates Quote Now |

||

American Amicable’s Position for the Future

As previously mentioned, in 2010 American Amicable was acquired by the Industrial Alliance Insurance and Financial Services, Inc., a Canadian company. As a smaller operator in Texas, there isn’t much information regarding American Amicable’s strategy for growth in the future. Industrial Alliance (IAG) is a public company with common shares trading on the Toronto Stock Exchange(TSX).

A look at the most recent IAG quarterly earnings shows the company is in a strong financial position, with 17 percent earnings per share growth (EPS) and positive performance across all business lines, including its insurance business, which accounted for $.06 EPS growth.

American Amicable’s Online Presence

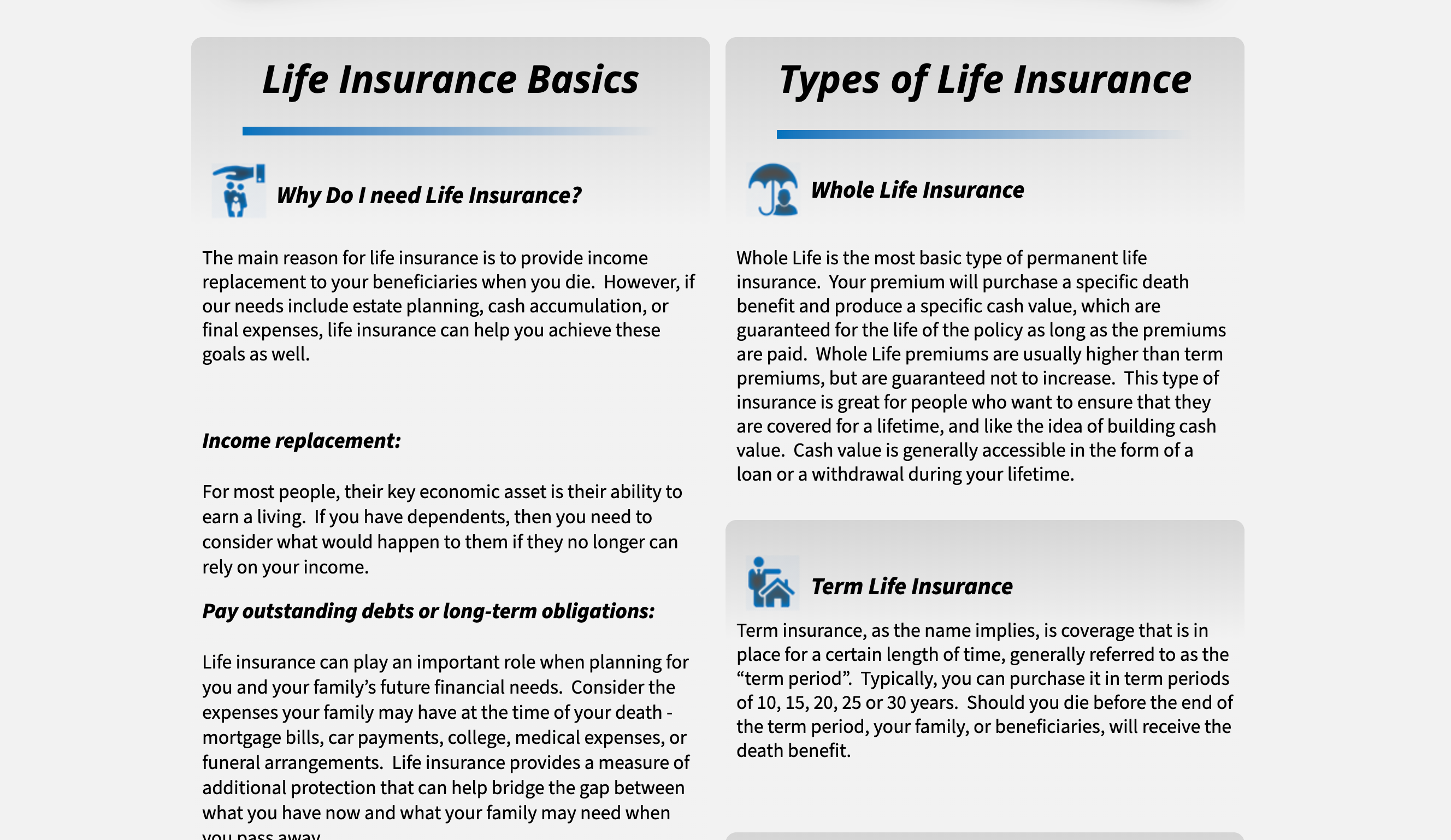

American Amicable provides general information on its website. You can find the company history and basic information on its life insurance products: final expense, simplified term, universal life, and modified life. However, to go any further, you will either need to submit information on the “Find an Agent” page or the “Products” page. The home page is well laid out and provides clear navigation.

Clicking on Life Insurance Basics will take you to an informational page that provides general definitions for different terms and product types.

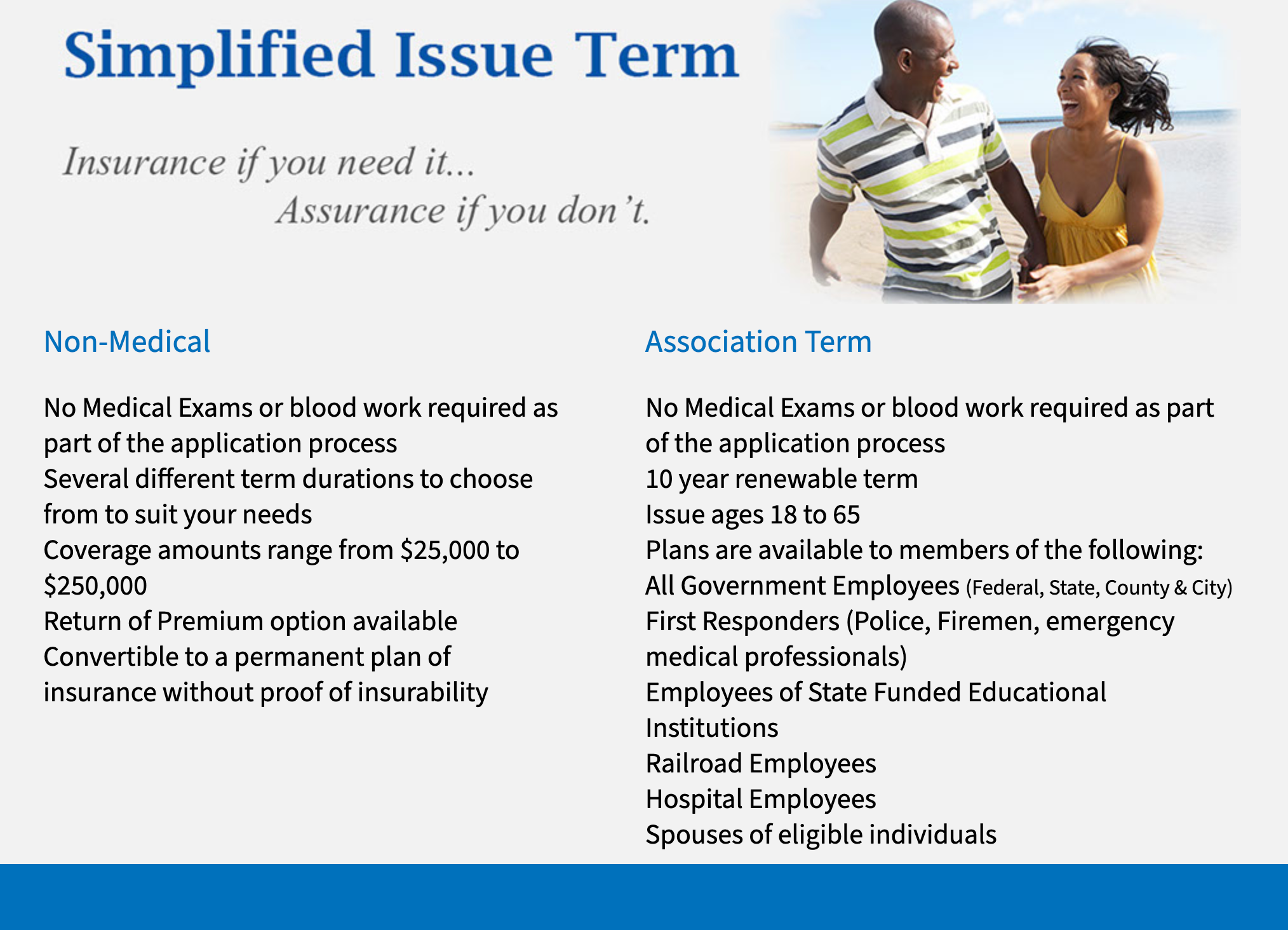

To get to information specific to American Amicable products, navigate from the home page to the products page. Each tab on the products page provides some highlights for American Amicable featured products. For example, the Simplified Term Page highlights its non-medical and association term options.

American Amicable’s Commercials

Although many larger insurance company competitors seem to be on television constantly, American Amicable does not have a presence on national or local television. Most of the company’s marketing efforts are channeled directly through its network of sales agents.

American Amicable in the Community

While American Amicable has a large presence in the Waco, Texas, community, the company does not provide any information on organizations that it partners with around the local community. Specific charitable donations or partnerships are not provided on its website.

American Amicable’s Employees

American Amicable is a smaller insurance company with less than 200 employees, according to statistics provided to the Better Business Bureau and information found on Glassdoor.

With only one review submitted anonymously on Glassdoor, American Amicable seems to fly under the radar when it comes to making headlines as an employer in demand. The company seems almost fully staffed in its Waco headquarters office with just one open position listed, however American Amicable does seem to be actively recruiting partner agents.

The company does not contract directly with agents or agencies. Instead, American Amicable will refer you to one of its established Independent Marketing Organizations. Agents can obtain more information by submitting a request on the American Amicable careers page.

Shopping for Life Insurance

Shopping for life insurance is one of those things everyone knows they need to do but find so easy to put off. The first question most consumers have is when exactly is it the right time to purchase life insurance?

Generally speaking, purchasing a life insurance policy is a good idea whenever you have obligations to take care of a family member. An obvious example would be the head of a household, someone with children, a mortgage and some credit card bills. In this instance, a life insurance policy would provide some ease of mind in the event of a death or disability.

A less obvious example would be a twenty-year-old with student loan debt that was co-signed by a significant other. Although you are otherwise young and healthy, getting affordable attention in the event of an unexpected turn of events would help relieve the burden on your loved one. Additionally, purchasing a term policy when you are younger allows you to lock in a lower premium for that term.

Check out this short segment from Bloomberg television that lays out the benefits of purchasing life insurance.

Once you’ve made a decision to purchase life insurance, the next step is to determine where and how to find a policy. With so many providers out there, many people find it helpful to work with an agent. However, it’s always helpful to do your own due diligence before you start setting meetings.

Average American Amicable Male vs Female Life Insurance Rates

One of the most important considerations you will have when shopping for life insurance is how much it will cost. While you will likely have to submit personal information to an insurance company to get a specific quote, we can look at some general rates to give you an idea for how American Amicable rates compare.

To get a general sense of rates, we have to look at five components. The first three are your age, whether you are male or female, and whether you smoke. Companies will normally put you in a class of customers to determine your rate. Common classifications are listed in the table below.

| Type | Details |

|---|---|

| Preferred Plus | The most affordable rate awarded for excellent health, normal weight and no family risk factors. |

| Preferred | Rates for excellent health but with minor risks or family history. |

| Standard | Rates for those with normal life expectancy, but with potential issues. Patients that are over standard weight or that have pre-existing conditions could be considered Standard. |

| Smoker | Tobacco users. |

Get Your Rates Quote Now |

|

The last considerations are for the duration of the term and for how much insurance you would like to purchase. American Amicable offers terms of 10, 20, and 30 years. The company also offers whole life insurance, but for simplicity’s sake in comparing rates, we will focus on term rates.

The cheapest rate provided would be for a 25-year-old female non-smoker looking for $100,000-coverage for a 10-year term. Yearly premiums are $138.24. This comes in a bit lower than the average of the top 10 insurance providers, which would be about $160.57.

For a 25-year-old male non-smoker, yearly premiums are indicated around $168.48. The average for the top 10 providers is about $178.54. Based on these initial indicators, it seems American Amicable offers competitive rates. As you probably notice, female rates are slightly lower than male rates.

Smoking will significantly impact your rate.

That same 25-year-old female looking at the same 10-year/$100,000-policy can expect her yearly premium to jump to $248.75. That is a difference of nearly 80 percent. Its because of this that some insurance companies have programs to help motivate you to quit smoking. You will have to check with your agent to see if American Amicable provides these services.

Coverage Offered

As a life insurance provider, American Amicable focuses on four general types of insurance: simplified term, universal life, modified life, and final expense. Before we get into the specific details of American Amicable plans, here is a quick summary of what each of these insurance types is meant to protect.

- Simplified Term – Simplified Term is American Amicable’s product for term insurance. Term insurance provides coverage for a set period of time, usually 15, 20, 25, or 30 years. During that term, your premiums will remain the same. This is a great option for healthy, young individuals that might want protection from unexpected events. Term insurance purchased at younger ages can help lock in cheaper premiums.

- Universal Life – Universal Life plans are usually known as whole life insurance. Unlike term insurance, which will expire at the end of a set number of years, Universal Life will continue coverage as long as premium payments are made. For some policies, a cashback option is available. This means a component of the premiums will accumulate over the life of the policy and will be set aside to collect interest. Premiums are flexible and may be adjusted over the life of the policy. Coverage amounts depend on the policy type.

- Modified Life – These products can be a term or whole life, but they include cash accumulation options.

- Final Expense – This insurance is intended to provide coverage for any costs occurred at the time of death. This could include funeral costs, debt payoff, or mortgage expenses. This is a good option if you want to make sure your family won’t have additional financial burdens that might transfer at the time of death, but you don’t want to assume the costlier premiums whole or term life policies might carry.

Types of Coverage Offered

American Amicable products are available through independent agents. A brief summary and characteristics of the company’s offerings are below, but since the company only markets through agents, you will need to contact an agent to get more details on current options.

Term

American Amicable provides two categories for its term insurance offering. Both are under the umbrella of its Simplified Term Insurance Category. American Amicable is looking to simplify the process of obtaining life insurance by providing products that do not require a lengthy underwriting process.

Non-Medical Simplified Term

Customers might be concerned with having to go through a full medical exam or submit blood work to secure insurance. American Amicable’s Non-medical Simplified Term alleviates these burdens. This product does not require a medical exam or blood work and offers a choice of term options.

Additionally, this insurance has a Return of Premium option available. This means a portion of premiums could be returned to you at the expiration of the policy term. Coverage amounts can range from $25,000 to $250,000.

Association Simplified Term

A secondary option for customers is the Association Term. This policy is limited to government employees, first responders, employees of state institutions, railroad employees, and hospital employees. Spouses are also eligible.

These policies are limited to a 10-year term but are renewable. Medical exams and blood work are still not required, but eligible ages are limited to between 18 and 65.

Universal

American Amicable offers universal life options for customers looking to protect for more than a defined term. Again, American Amicable offers two options.

Non-Medical Universal Life

American Amicable provides an option for flexible premiums, adjustable benefits, and an option to accumulate cash value without a medical review. There is a 15-year non-lapse of coverage guarantee as long as premium payments are made. Coverage amounts can range from $25,000 to $250,000.

Fully Underwritten Universal Life

For customers looking for more coverage than that available through the non-medical option, or who might be looking for more affordable premium options, American Amicable offers the opportunity to complete and submit a medical history and undergo a full underwriting evaluation. Similar to the non-medical universal life policy, there is a 15-year non-lapse coverage guaranty and flexible premiums.

Modified Life

For customers that aren’t sure whether they want a term option or whole life, or are looking for something different than the aforementioned non-medical policies, American Amicable offers modified policies that provide a cash accumulation option.

These products are customized and require an underwriting process, but you will need to consult with your agent to obtain more information.

Final Expense

For customers looking to secure coverage for expenses that might come at the end of life, American Amicable offers Final Expense insurance. The features of American Amicable’s Final Expense program is that premiums won’t increase even if your health conditions change. Benefits are paid directly to the beneficiary and are not taxable. No medical exam or blood work is required to qualify.

American Amicable final expense plan options can be level, graded, or modified. The difference in plan types is the timeline for which the death benefits become available.

A level plan indicates 100 percent of the benefit payout is available the day the plan is in place. Graded benefits scale up over a period of three years.

For a graded plan, the maximum benefit payout for the first year a plan is in effect is 30 percent. In the second year, the payout grows to 70 percent, and in the third year and beyond, the full payout amount becomes available.

The modified option provides a different payout scale. If a person acquires a plan and passes on within the first three years from the plan’s start date, the plan will pay out 100 percent of all premiums paid to date, plus 10 percent. For example, if your monthly premium is $50 and you paid six months of premiums, the benefit at that point in time would pay out $330. After three years, the full policy amount is eligible.

Additional riders are also available for terminal illness, accidental death, and additional coverage for children or grandchildren.

Factors That Affect Your Rate

At the end of the day, you want to know exactly how much you will have to pay for insurance. Some companies provide general guidance on rates, but final rates are usually not established until you go through a process called underwriting. Underwriters compile a number of factors around your life to determine overall risk and in some cases might deny coverage. The higher the risk, the higher your rate.

American Amicable provides a number of policy options that do not require a physical. However, you might be able to get a lower rate if you are generally healthy and submit for a physical or bloodwork. For all policies, you will need to do a phone interview where you might need to provide information on your general health history. To prepare, gather the information below ahead of time.

Demographics

Underwriters want to know common statistical information about you. Obvious factors like whether you are male or female could impact your life expectancy. Your height, weight, and age are important pieces of information an underwriter needs to assess your risk.

Other questions that factors that might not be so obvious are:

- Where you live

- Your relationship status—whether you are single, married, or divorced

- Your employment status and occupation

- Your financial status

Current Health & Family Medical History

Your current health and family medical history is extremely important factors in determining your underwriting risk, and in turn, your rate. Even if you are otherwise healthy, insurance companies will want to look at whether you have any family history of diseases like cancer, heart disease, mental health issues, or diabetes.

Most companies will want to know if you have a history of high blood pressure and will inquire whether you exercise regularly and watch your diet. Taking care of yourself with good exercise and healthy eating habits could be factors keeping your rates low.

High-Risk Occupations

Some occupations are considered high risk. This could be because they are dangerous occupations, like skyscraper window cleaners. Other occupations might not be an obvious health risk but are still considered high risk. For instance, farmers are considered high risk because of the high potential for accidents from operating heavy machinery.

American Amicable provides first responders, policemen, firemen, and other high-risk occupations an option for the Associated Term Insurance described above. Since American Amicable does write Modified Life insurance policies, customers in other high-risk occupations might still have some options with customized policies.

High-Risk Habits

Risky behavior will cost you when it comes to getting insurance. If you smoke, drink alcohol regularly, or partake in using illegal substances of any kind, you may not be able to acquire a life insurance policy— or at the very least, will have to shop around to get a decent rate. Take a look at the rate comparison in the table below between average rate for non-smokers versus those for smokers from American Amicable.

| Age | $250,000/10-year Non-Smoker Male | $250,000/10-year Smoker Male | $250,000/10-year Female Non-Smoker | $250,000/10-year Female Smoker |

|---|---|---|---|---|

| 25 | $22.50 | $43.65 | $16.43 | $34.43 |

| 30 | $20.48 | $48.15 | $16.88 | $36.68 |

| 35 | $22.73 | $52.43 | $19.13 | $38.93 |

| 40 | $27.68 | $76.28 | $22.50 | $57.83 |

| 45 | $37.80 | $120.38 | $28.35 | $91.13 |

| 50 | $51.08 | $189.68 | $37.80 | $142.20 |

| 55 | $78.30 | $298.58 | $54.00 | $219.83 |

| 60 | $128.93 | $468.23 | $88.88 | $328.05 |

| 65 | $206.33 | $725.18 | $139.28 | $478.80 |

Get Your Rates Quote Now |

||||

Rates for smoking are nearly double for those for non-smokers in earlier years, but the older you get, rates can almost three times as expensive.

Even hobbies that seem benign could affect your rate. Something a simple as taking your motorcycle out on sunny days could impact your risk and make obtaining a policy costlier. Underwriters factor in the risks of hobbies like hunting, mountain climbing, skydiving, and surfing.

Veteran or Active Military Status

American Amicable does provide policies to active service members in the military. In 2006, a class action suit was settled between 42 states, the District of Columbia, Guam, and American Amicable for improper sales of insurance and investment services to service members.

According to a filing by the Securities and Exchange Commission, the suit filed in 2006 claimed American Amicable improperly marketed term insurance products as investment or wealth building products. The company settled, paying $10 million in damages to approximately 57,000 military personnel.

Since 2006, no additional suits have been filed against the company.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Getting the Best Rate with American Amicable

If you are shopping for the best rate, it will help if you start by understanding exactly how much insurance you will need. Purchasing too little insurance could leave you exposed, and purchasing too much insurance could mean extra costs for no value. There are a few helpful tools online that can help you calculate what you might need.

If you are shopping for a term policy, you can start by working out how much insurance is right for you. A general rule of thumb has been to look for seven to 10 times the head of the household’s salary, but to ensure you are covering all your expenses, you may want to go into a bit more detail.

Add up all your student loan debt obligations, car payments, credit card payments, and mortgage payments, and factor that into your family budget, along with any salary amount you wish to include.

Once you have a general number for the amount you want to cover, you can decide on the term for which you want coverage. Starting with term insurance might be your best bet because most policies will allow you to continue coverage at the end of term, and you’ll save money for the duration of the term when compared against a whole life policy.

The tables below provide some sample rate information for American Amicable. Since we are looking at obtaining the cheapest rates, this assumes the candidates are generally in good health and are non-smokers.

The first table provides information for different ages and different terms for just $100,000 in coverage.

| $100,000/10-year | $100.000/20-year | $100,000/30-year | ||||

|---|---|---|---|---|---|---|

| Male | Female | Male | Female | Male | Female | |

| 25 | $14.04 | $11.52 | $14.67 | $11.88 | $17.19 | $13.77 |

| 30 | $13.05 | $11.61 | $14.40 | $12.15 | $17.37 | $14.76 |

| 35 | $13.86 | $12.51 | $15.57 | $13.41 | $19.80 | $16.65 |

| 40 | $15.48 | $13.68 | $19.98 | $16.20 | $26.10 | $21.60 |

| 45 | $18.99 | $15.93 | $27.99 | $21.06 | $37.26 | $29.70 |

| 50 | $24.30 | $19.62 | $39.06 | $28.08 | $51.21 | $40.59 |

| 55 | $35.37 | $25.83 | $57.51 | $38.61 | $78.93 | $60.30 |

| 60 | $56.25 | $40.50 | $88.47 | $59.40 | NA | NA |

| 65 | $87.57 | $61.38 | $136.80 | $100.17 | NA | NA |

Get Your Rates Quote Now |

||||||

This next table will give you an idea of how your premiums might change if you increase the coverage to $250,000. You can see that premiums rise a considerable amount with the increase in coverage. Calculating your needs in advance can help you understand exactly what you need before you speak with an agent.

| $250,000/10-year | $250,000/20-year | $250,000/30-year | ||||

|---|---|---|---|---|---|---|

| Male | Female | Male | Female | Male | Female | |

| 25 | $22.50 | $16.43 | $25.65 | $17.78 | $31.50 | $22.95 |

| 30 | $20.48 | $16.88 | $26.10 | $19.35 | $32.63 | $25.65 |

| 35 | $22.73 | $19.13 | $29.25 | $23.85 | $39.15 | $31.05 |

| 40 | $27.68 | $22.50 | $40.28 | $31.05 | $55.58 | $43.88 |

| 45 | $37.80 | $28.35 | $59.85 | $42.98 | $80.78 | $63.00 |

| 50 | $51.08 | $37.80 | $87.75 | $58.50 | $116.10 | $90.00 |

| 55 | $78.30 | $54.00 | $132.75 | $84.83 | $183.38 | $137.48 |

| 60 | $128.93 | $88.88 | $190.35 | $136.35 | NA | NA |

| 65 | $206.33 | $139.28 | $330.53 | $238.73 | NA | NA |

Get Your Rates Quote Now |

||||||

You can see from the dramatic increases in rates that the best way to keep rates low is to lock in your policy as early as possible and carefully assess exactly how much coverage you will need. Additionally, watch out for additional costs for expensive add-on riders. Purchase what you need for your security but be careful to avoid the extras.

American Amicable’s Programs

American Amicable’s website provides only general information. Since the company markets its products through a network of agents, any special programs the company offers are not presented in any materials on its site. To find out about any incentives or special programs the company offers, you will need to speak to an agent or customer representative.

Canceling Your Policy

Canceling a life insurance policy is a major decision. If you are considering canceling your policy, you should understand the consequences and costs. The most important consequence of canceling your policy is that your loved ones will no longer be protected.

Still, there are some consumers that have other means to provide financial security for their family members and carrying a policy is no longer beneficial for them. For instance, you might have been carrying final expense insurance to cover the funeral costs and pay off some credit cards, but you have successfully paid all your debts and have cash on hand to cover any funeral costs.

In other instances, you might have found a better deal or have new requirements. and you are looking to get out of an existing policy.

In the event that you are looking to cancel your policy with American Amicable, the step-by-step process below should provide you with some guidance on how to proceed.

How to Cancel

Before you start the process of canceling your policy, dig out and dust off the policy from wherever you have tucked it away and give it a proper read through. If the policy is new, you might have a grace period where you can cancel without recourse.

If it is a term policy, take a look through it and refresh yourself on the length of the policy. Also, familiarize yourself with any tax incentives the policy might have offered and understand the policy guidelines on forfeiture of any premiums.

Once you have completed your own review, follow the steps below to start processing your cancelation.

#1 – Review Your Policy with Your Tax Advisor or Accountant

If you are canceling a policy that will return cash value, usually a whole life policy, it might be taxable as part of your ordinary income. Consult with your accountant to understand the implications of receiving cashback and what that will cost you when tax time comes around.

Also, review with your accountant or tax software service to see if there are any additional surrender fees or penalties for canceling your policy.

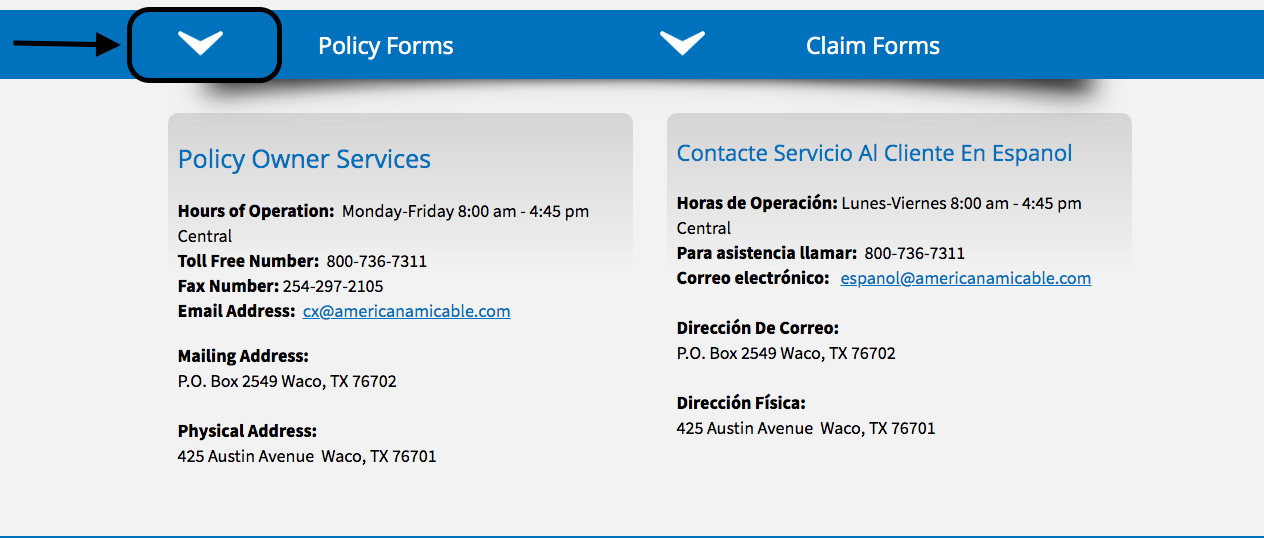

#2 – Contact American Amicable Policy Services

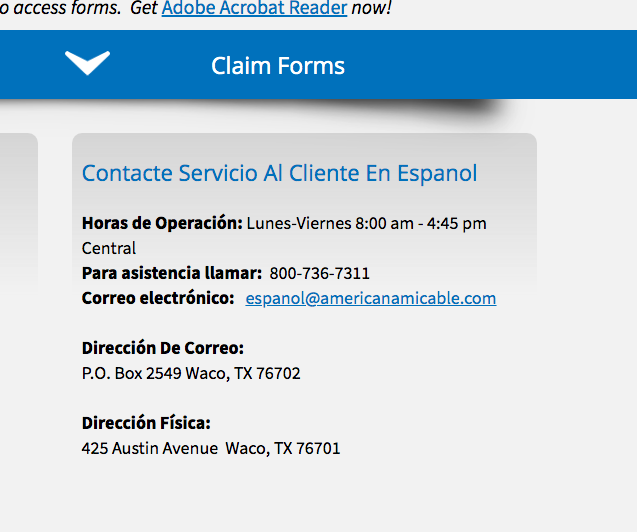

You will want to reach out to American Amicable to understand what they require to officially cancel a policy. Although the website has links to a simple cancellation form, you will want confirmation from a representative of all the items required to cancel. Some companies will want an official letter sent to the company requesting cancellation in addition to any required forms. You can reach American Amicable Policy Services here:

- Hours of Operation: Monday-Friday 8:00 a.m. – 4:45 p.m. Central Time

- Toll-Free Number: 800-736-7311

- Fax Number: 254-297-2105

- Email Address: cx@americanamicable.com

#3 – Complete the American Amicable Policy Request Form

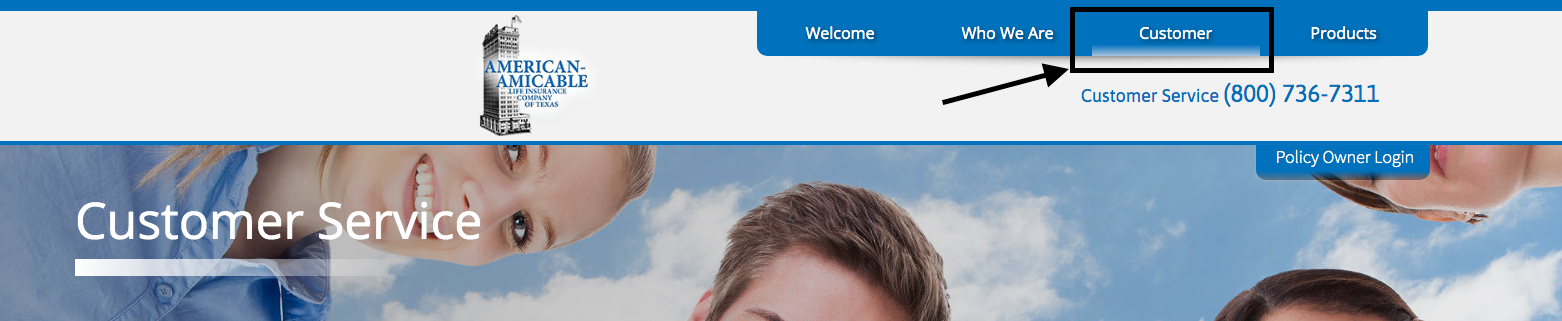

After notifying the Policy Services team at American Amicable, you will need to complete a Policy Cancellation Request. To obtain a form, you can navigate from the home page by first clicking on the “Customer” tab located at the top right side of the page.

From the “Customer” Tab you can find the “Policy Forms” Section as you scroll halfway down the screen. Click on the arrow to the left of the “Policy Forms” tab and you will see a pop-up menu.

The pop-up menu will have the following selections:

- Beneficiary Change Request

- Ownership/Pay or Change Request

- Changes to Policy Plan

- Policy Cancellation Request

- Bank Draft Authorization

Select Policy Cancellation Request to download and print the proper form.

The form will require you to select whether you prefer any refunded amounts or cashback to be sent by check or returned by direct deposit. If you prefer the latter, you will need to provide your banking information.

You can mail or fax the form. The contact information is provided on the site page and on the form. Remember to keep a copy for yourself of anything you might submit to the company.

#4 – Look for Your Policy Cancellation Notification

A letter from American Amicable should arrive shortly after you submit your requests confirming the cancellation of your policy. Retain this letter for your records.

#5 – Cancel Your Auto Payments

Many providers require you to set up auto payment when you purchase a policy. To ensure no further funds are withdrawn, remember to cancel any auto payments you might be making from a bank account or credit card.

How to Make a Claim

To file a claim on your policy, you can visit americanamicable.com and click on the “Customer” tab located on the top right-hand side of the landing page. On the “Customer” page, you can find the Claims Forms section.

Click on the down arrow and select the relevant claim form. The form will pop up for you to print and complete. Some claims might require you to provide a death certificate or attending physician statement. You can call Policy Services for assistance to determine if any additional information needs to be provided with your claim. You can consult with American Amicable Policy Services to understand how quickly a claim is processed and paid.

How to Get a Quote Online

Unfortunately, the option to obtain a quick quote online from American Amicable is not available. You will need to fill out a customer contact form and wait for an agent or representative to contact you. To get started, here are some helpful steps.

#1 – Call American Amicable

Call American Amicable to provide some information so they can put you in touch with an agent. You can call 1-800-736-7311 to get started.

#2 – Speak With an Agent

An independent agent will contact you. Be prepared by understanding the type of insurance you are interested in pursuing: term, universal, or final expense. Also, run your preliminary review to list the major financial obligations you have and would like to cover.

#3 – Be Prepared to Follow Up with Medical Information

An agent will be able to provide you with some baseline information and will submit an application on your behalf to get initial approval. However, some additional questions, concerns, or medical information might be required to get a definitive rate.

Design of Website/App

American Amicable has a general website to provide baseline information to customers. However, all product inquiries must be directed through an agent. American Amicable does not have an app available for tablets or smartphones.

The website does have login access for policyholders and agents. Without direct access, it is assumed that policyholders can log in to obtain information and manage their accounts. Agents can likely log in to access sales tools and submit customer applicant information.

Pros & Cons

American Amicable has a long history of providing customers with options for insurance. As a smaller provider working only through independent agents, you will find their products available in over 40 states. Customers have their own needs when it comes to insurance, so have a look and see if these pros and cons line up with you.

Pros

- American Amicable offers a wide range of products that do not require a medical pre-exam or bloodwork.

- The Modified Life option provides customers with the ability to find a product that meets their needs.

- American Amicable products are competitive in price with average life insurance products.

- American Amicable has a great financial rating with leading independent rating services.

Cons

- American Amicable product information is not widely available. You will need to speak with an independent agent to get any detailed information.

- American Amicable has had some legal issues in the past with how it has marketed its products to some customers.

- Online tools do not seem to be accessible for servicing products. It seems that to service products, customers need to reach out directly to the Policy Services for help.

The Bottom Line

As a smaller insurance provider, American Amicable offers competitive term, universal, and final expense options. You may not be able to shop directly online for American Amicable products, but a wide network of independent agents across the country might present these products to you as an option.

If you are looking to get set up with a policy quickly and without spending a lot of time in the doctor’s office, American Amicable provides a number of options that do not require a medical exam. The process to submit an application seems to be simple and as fast as the time it takes to sit with an agent for a consult.

In general, American Amicable provides a lot of flexibility in the products if offers. However, when it comes to life insurance, as with any other company, you need to be careful that obtaining a policy with additional features doesn’t add up to unnecessary costs.

American Amicable’s FAQs

Before you speak with an agent about American Amicable’s line of life insurance products, review these common questions to arm yourself with some baseline information.

#1 – Are American Amicable products available to me?

American Amicable products are available nationwide through a network of independent agents. To learn more about American Amicable products and find an agent near you, you can visit americanamicable.com and complete the contact form.

#2 – I already have a life insurance policy. Can I purchase additional insurance with American Amicable?

Although there are no rules against purchasing an additional policy, you will want to consult with your agent to determine if you need an additional policy. Additionally, you will need to inform American Amicable of any current coverage you have when shopping for a second policy.

#3 – Can I file a claim with American Amicable online?

To file a claim with American Amicable, you will need to complete a physical claim form and either mail or fax the form to the company. Online claim servicing is not available from the website, and American Amicable does not support any smartphone applications at this time.

#4 – Do I need to get a physical to be approved?

American Amicable provides a wide range of products for customers with no pre-exam or blood work required. However, if you are in good physical health, you may want to submit medical history and information to determine if you can get a better quote.

#5 – What is the earliest age I can secure an American Amicable policy?

Term products are offered for customers as young as 18 years of age.

#6 – What is the oldest I can be to secure an American Amicable policy?

The maximum age requirements depend upon the product type. Generally, term options are available to customers up to age 75. Final Expense and whole life products are available to customers up to age 85.

#7 – I am a smoker. Can I still obtain an insurance policy?

Although you may pay a higher premium, American Amicable products are available to smokers.

#8 – How much will life insurance cost me every month?

Rates will differ based on your current health, age, and other factors. Get a FREE quote by clicking below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption