Hartford Financial Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1810 |

| Current Executives | Chairman & CEO - Christopher J. Swift |

| President - Doug Elliot | |

| CFO - Beth Costello | |

| Number of Employees | 18,500 |

| Total Assets | $19,000,000,000 |

| HQ Address | 690 Asylum Avenue Hartford, CT 06155 |

| Phone Number | 1-860-547-5000 |

| Company Website | www.thehartford.com |

| Premiums Written | $15,800,000,000 |

| Financial Standing | $1,801,000,000 |

| Best For | Mid-sized Business Group Benefits (With Riders) |

Get Your Rates Quote Now |

|

Hartford Financial Group, better known simply as The Hartford, is a major player in both personal and commercial insurance. You’ve probably heard of them, especially in connection with their AARP-sponsored insurance programs.

Although they’re a top 10 group benefits company, most people don’t know them that way. If you’re searching for group benefits for your company, or if you’re an employee being offered voluntary benefits through work, you might not be sure if The Hartford’s programs are right for you.

Buying life insurance is a big deal, and choosing between group benefits, individual life, or a combination of the two can be confusing. What does The Hartford offer and is it worth investing in their group life programs? A little guidance can go a long way.

You’ll find what you need to know about The Hartford, and specifically their group life insurance program, right here.

Read on for details on the company itself, their financial status, what coverage is available through group benefits packages, and what added benefits are offered.

Group life can be a good choice, but it’s always wise to compare rates on individual life, too. We can help you do that right now. Just enter your ZIP code above.

Table of Contents

The Hartford’s Ratings

Let’s start our look at The Hartford’s ratings from trusted agencies.

| Rating Agency | The Hartford Rating |

|---|---|

| A.M. Best | A |

| BBB | A+ |

| Moody's | A2 |

| S&P | A |

| NAIC Complaint Index | .99 |

| J.D. Power | N/A |

| Consumer Affairs | 1.8/5 |

Get Your Rates Quote Now |

|

These ratings are all measures of how The Hartford is doing as a company, both from a financial standpoint and in terms of customer service. Let’s break them down.

A.M. Best

The first rating is from A.M. Best, which is probably the most recognizable of the financial rating services. The Hartford has various ratings for all of its underlying companies. The “A” rating here is for subsidiary Hartford Life and Accident Insurance Company, so it doesn’t include the company’s auto and home business. An A rating (Excellent) is the second-highest available from A.M. Best.

Better Business Bureau (BBB)

The Better Business Bureau (BBB) gives The Hartford a top A+ rating. There are 331 complaints on the file in the past three years, which isn’t high for a company of this size.

Moody’s

Moody’s ranks companies on financial outlook and stability. The Hartford has a solid A2 rating from Moody’s, which means the agency has no financial concerns.

Standard & Poor’s (S&P)

S&P is also a financial rating agency similar to A.M. Best and Moody’s. They rank The Hartford highly, with an A rating that indicates strong financial status. This means there’s no concern that the company will be unable to pay its claims now or in the foreseeable future.

NAIC Complaint Index

The NAIC Complaint Index provides a look at how a company is performing in terms of complaint volume when compared to other companies in their market. For group life, The Hartford has a complaint index of .99, which is just below average.

J.D. Power

Since J.D. Power doesn’t rank group life providers on its surveys, The Hartford isn’t listed in their life insurance study.

Company History

Established in 1810, The Hartford is a very old insurance company created to write fire insurance. The company has an interesting history. In 1825, they wrote the first insurance policy for a post-secondary school, covering Yale University. In 1861, they insured Abraham Lincoln’s Illinois home while he was in the White House.

The company paid out millions in claims throughout some of the nations’ biggest disasters, including the 1835 fire in New York’s financial district, the 1871 Chicago fire, and the 1906 earthquake that destroyed much of San Francisco. They also insured major landmarks like the Hoover Dam and the Golden Gate Bridge.

The Hartford has been the official home and auto insurance partner of AARP since 1984.

They entered the life insurance market in 1959 with the purchase of The Columbian National Life Insurance Company. They have since moved away from personal life insurance, selling their business to Prudential in 2013. Today, The Hartford offers life insurance only as a part of its group benefits.

Life insurance policies from Hartford are issued by subsidiaries Hartford Life Insurance Company and Hartford Life and Accident Insurance Company.

The Hartford’s Market Share

For the past four years, The Hartford has stayed between a rank of eighth and 10th on the list of the largest group life insurance companies in the nation, landing at number eight for 2018.

| Year | Market Share | Rank |

|---|---|---|

| 2015 | 3.90 | 9 |

| 2016 | 4.00 | 8 |

| 2017 | 3.70 | 10 |

| 2018 | 3.90 | 8 |

Get Your Rates Quote Now |

||

The Hartford has hung around the lower end of the top 10 group life insurance companies for the past four years. After a drop in 2017, they’ve climbed back up again in 2018 for an eighth-place rank. Their percentage of the market, however, peaked at 4 percent in 2016, which also gave them an eighth-place spot at the time.

That indicates that the market is spread out a little more that it was a few years back.

The Hartford is a large company with a lot of subsidiaries. They include:

- Hartford Life Insurance Co.

- Hartford Accident and Indemnity Co.

- Hartford Casualty Insurance Co.

- Trumball Insurance Company

- Hartford Life & Annuity Insurance

- Hartford Insurance Co. of the Midwest

- Hartford Life, Inc.

- Sentinal Insurance Company

- Hartford Life & Accident Insurance Co.

- Pacific Insurance Co.

- Twin City Fire Insurance Co.

- American Maturity Life Insurance Co.

- New England Insurance Co.

Although The Hartford saw a dip in premiums written for 2016, it was actually their best year for market share. The general trend has been an increase in premiums written year over year, although it’s not climbing by huge amounts.

| Year | Direct Premiums Written |

|---|---|

| 2015 | $1,292,513 |

| 2016 | $1,263,003 |

| 2017 | $1,330,721 |

| 2018 | $1,334,463 |

Get Your Rates Quote Now |

|

Some competitors saw dips in premiums written over the entire four-year period, so The Hartford seems to be doing just fine.

The Hartford posted a loss in 2017 but climbed back up in 2018. Since these numbers, provided by Macrotrends.com, represent the company’s overall net income, they likely reflect more on their larger areas of business, such as commercial, auto, and home insurance.

| Net Income | 2017 | 2018 |

|---|---|---|

| The Hartford | $-3,131,000,000 | $1,801,000,000 |

| Industry-wide | $50,600,000,000 | $41,200,000,000 |

Get Your Rates Quote Now |

||

The life insurance industry overall took a dip in this time, but The Hartford is on the upswing.

It’s vital to note here that a huge group of companies like The Hartford can lose money overall while an individual subsidiary company is still performing very well. So while a loss like the one posted for 2017 can ring alarm bells, it’s no reason to assume it means the company will have trouble paying its life insurance claims specifically.

The increase in premiums written between 2017 and 2018, along with the rise back into the black for The Hartford, are both good signs for their ability to pay claims.

The Hartford’s Position for the Future

As the Baby Boomer generation continues to move into retirement, The Hartford’s connection with AARP is likely to mean good things for the future. While the back-and-forth market share numbers are a sign this company is unlikely to move up a lot on the ladder, they are having no trouble staying fairly steady.

When it comes to the company’s future in the group life market, it’s also likely to stay steady.

The Hartford has been on the Fortune 500 list for 24 years and has maintained a position in the upper half of the list for most of that time. They ranked at number 161 for 2019. While they’ve had some dips in their revenue, all their financial ratings are stable, so there doesn’t appear to be any risk of The Hartford disappearing any time soon.

The Hartford’s Online Presence

Like most old companies, The Hartford still focuses quite a bit on the personal interaction of a customer with an agent. That said, they do have a strong online presence and have moved fairly smoothly into the modern age. That’s especially true for their personal insurance lines.

Group life by nature isn’t the kind of product people purchase online. As a result, companies like The Hartford don’t tend to dedicate as much online effort to that part of their business. Still, it’s easy to find the section of the website dedicated to group life insurance, and there is some detailed information offered online.

The Find An Agent tab is featured prominently at the top of the page, which will direct visitors to find local assistance. HR representatives will want to reach out to an agent working specifically with the group benefits part of the company rather than a personal lines agent.

The Hartford’s Commercials

The Hartford’s line of Consumer Humor commercials is aimed at using a touch of humor to help customers understand how their employee benefits work and why they should elect the coverage.

They’ve even managed to provide some humor to the decision to purchase life insurance in the above example of the series. That’s certainly no small accomplishment.

Generally seen as a serious, old-school company, The Hartford’s recent commercials have certainly lightened up their image.

The Hartford in the Community

The Hartford is involved in a lot of different programs and philanthropic efforts across the country.

The Hartford’s Human Achievement programs provide education and assistance in a variety of different areas. Human Achievement programs include:

- The Junior Fire Marshal Program, teaching fire safety to children nationwide

- Opioid Aware, a program aimed at reducing opioid addiction and use

- Ability Equipped, which helps provide adaptive sports and other equipment available to youth with disabilities

- HartMobs, providing assistance to small business owners

Other programs from The Hartford include:

- Environmental Stewardship programs

- Community giving programs involving a total of nearly 170,000 volunteer hours and more than $2 million in employee donations

The Hartford’s Employees

The Hartford is a large company with a lot of employees, and the experience can vary based on job and location.

According to Payscale, about 30 percent of the company’s employees are in the early portion of their career, with another 46 percent in the mid to experienced range. Almost 20 percent are in the late portion of their career.

Employees on Payscale report job satisfaction of 3.4 out of 5. They also report a high level of job stress. There is a similar report on Glassdoor, where employees report 3.7 out of 5 for job satisfaction.

As previously mentioned, this is a huge company with a lot of subsidiaries. What part of the company you work in is likely to impact stress levels and job satisfaction. The Hartford does have some accolades to support its claims of being a great workplace.

The company has been named to several important lists.

In 2019, Hartford Financial Group was named to the list of the World’s Most Ethical Companies by Ethisphere. The company was also named to the Human Rights Campaign’s 2019 list of Best Places to Work for LGBTQ+ Equality.

The Hartford landed on the 2019 list of Best Places to Work for Disability Inclusion. They also made the 2019 Bloomberg Financial Services Gender-Equality Index.

Shopping for Life Insurance

Because The Hartford doesn’t sell personal life insurance, there are no life insurance shopping resources on the company website. Most of those deciding whether to choose this company for group life will be representatives of companies shopping for group benefits.

Group life insurance doesn’t work the same way as an individual policy. Rates are determined based on the entire group and not on one person’s rating factors. This means quotes for group life benefits will be very different from company to company.

While we can’t provide much information on rates or the quoting process for The Hartford, we can take a look at their products and what they offer to businesses in terms of employee benefits.

Coverage Offered

The Hartford’s group life insurance plan is a term life policy. They don’t appear to offer a whole life program at this time.

Hartford group benefits include the option of a basic guaranteed issue life insurance plan paid for by the employer. Their voluntary life insurance can be offered in conjunction with that or as a standalone plan. Voluntary life insurance is 100 percent employee-paid.

For a company to be eligible for Hartford group life, there are a few basic requirements:

- 50 or more lives (or 50 people insured)

- Employees must work 20 hours a week

- Be under the age of 80

- Spouse coverage is available under age 80, child coverage under age 26

- No retirees, temporary, or seasonal employees may be included

Voluntary coverage is available in amounts starting at $25,000 up to $250,000. It can be increased in increments of $25,000. There is an annual buy-up option of one increment annually with no requirements for evidence of eligibility. Benefits are reduced by 50 percent at age 70.

This is may not be enough life insurance, so you might want to consider taking out a personal insurance policy, as well.

The amount of the guaranteed issue coverage depends on the number of lives on the policy:

- Less than 500 lives: $100,000

- 500-999 lives: $150,000

- 1,000-4,999 lives: $200,000

- 5,000+ lives: $250,000

Spouse benefits can include 100 percent of the employee’s voluntary benefits and a guaranteed issue amount of $50,000. Child benefits are available for $10,000-$15,000.

The rate structure for voluntary benefits is based on attained age in five-year age brackets. Your age at the time of issue will determine your rate, and rates increase by five-year age increments. As always, it’s cheaper to buy life insurance when you are younger.

The plan also includes added coverage riders at no additional cost:

- Accidental Death and Dismemberment coverage for the employee

- Premium Waiver with a nine-month elimination period

- Living Benefit Options with 80 percent of benefit available at 12 months or less of life expectancy and a $3,000 minimum payment

Additional benefits offered to employees include:

- Funeral Planning and Concierge Services

- Estate Guidance/Will Creation

- Beneficiary Assist, which provides help and counseling to the beneficiaries after a death

- Travel Assistance that includes emergency medical assistance

- Identity Theft Protection & Assistance

Group life from The Hartford is portable in most cases, so you can take it with you if you change jobs or even retire if you are under 65.

You can port up to $250,000 or a percentage of your coverage (50, 75, or 100 percent). Spouse and child coverage can also be ported. Bear in mind that portable life insurance means you are converting the coverage to a personal policy, and that comes with changes in your rates.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

It’s generally believed that group life insurance is entirely guaranteed issue, but that’s not true. While companies can offer a basic amount of guaranteed issue coverage, voluntary benefits can require some evidence of eligibility.

Group life rates are based on the group itself rather than each person’s individual rating factors. A group of younger employees, therefore, will earn a lower rate, and a company with older employees may skew to a more expensive premium.

The Hartford, like many group life insurers, uses age brackets to determine rates, which mitigates the impact of older employees on the rates offered to the younger ones. Still, the general risk represented by the group as a whole will impact rates.

Group life isn’t always the cheapest option, so it’s a good idea to compare rates. This is especially true if you are young and healthy.

To purchase the non-guaranteed portion of the coverage available from The Hartford, you will be required to answer some health questions, although the rate will be the same for all qualified employees.

The good news is that you can increase your coverage by one increment at every open enrollment period without having to show further evidence of eligibility. That means employees can steadily increase their coverage over time even if their health changes. That’s not the case with individual life insurance in most situations.

The Hartford’s Programs

The Hartford offers resources and information to all visitors to their website in the form of a blog called The Extra Mile. It can also be received as an email and covers not just insurance, but driving tips, home and car maintenance, travel, finances, retirement planning, and lifestyle topics.

It’s searchable, allowing visitors to find specific topics, and is filled with advice and general information.

Not surprising for a company that partners with AARP, the company also runs The Hartford Center for Mature Market Excellence®. The center performs research on topics like mobility and safety and publishes articles. In addition to research, there’s plenty of advice and guidance for seniors, caregivers, and family members.

The Hartford also publishes a blog, called Small Biz Ahead, aimed at helping small businesses. It’s a resource center that adds some value to their employee benefits products, with advice in a variety of areas for small business owners. They also have a separate section of the site dedicated to building and growing a business, called Business Owners Playbook.

Canceling Your Policy

There isn’t any specific information on The Hartford’s site regarding how to cancel a group life insurance policy. It’s not unusual for this to be the case since most people buy group life through work and don’t have a lot of contact with the insurance company directly.

Cancelation of a life insurance policy is generally done in writing, although some companies offer an electronic form. In most cases, there are no fees associated with canceling a life insurance policy. Policies with cash value may have a surrender charge, but since The Hartford only writes term life, that’s not an issue here.

For assistance with canceling a group term life policy, you can contact The Hartford’s customer service line at 1-800-523-2233.

You can also contact your company’s HR department for help with canceling your policy.

How to Make a Claim

Any insurance claim is hard to make, but none harder than a life insurance claim. Here’s what you need to know about accessing group life benefits at The Hartford.

Life insurance claims with The Hartford can be filed by calling the Group Life and Accident Claims line at 1-888-563-1124.

There is also an employee account login for group benefits. It’s unclear whether life insurance claims can be filed online through this portal. Since it is only accessible with a user name and password, it’s a good idea to leave this information with the beneficiary of the life insurance policy.

Calling the toll-free number or reaching out to the company’s HR department are likely the easiest methods of getting claims filed quickly.

While the company website doesn’t specifically state what is needed to file a life claim, we’ll mention several things common to all life claims.

First, you will need to verify the policy information. Hopefully, if you’re the beneficiary, you will have a copy of the policy. If you have an insurance policy, make sure a copy of it is provided to your beneficiaries to speed up the process.

If you don’t have the policy or the policy number, it can be looked up with some detailed information about the policy owner. With the policy number and confirmation that the policy was in force at the time of the insured’s passing, you can start the process of filing a claim.

The first thing required to file a life insurance claim is a copy of the death certificate. It’s a good idea to request more than one copy so you can provide one to the life insurance company and still have an extra on file if needed.

The Hartford will provide you with whatever forms you need to fill out to get the claim in motion. The beneficiary will need to fill out these forms and complete a statement, as well.

In most cases, the beneficiary can select how they’d prefer to receive the payment, and it will be issued within a short period of time from the receipt of all of the required documentation.

Design of Website/App

The Hartford’s site doesn’t give the initial impression of sales orientation. Although there’s a quote box readily available, a scroll through the page focuses mainly on the company’s programs in the community and on careers with The Hartford.

It’s easy to find what you need on the website, with all the basics located in the top-level dropdown menus. It’s just a few clicks to reach the group life section of the website.

The site functions well on a computer, phone, or tablet.

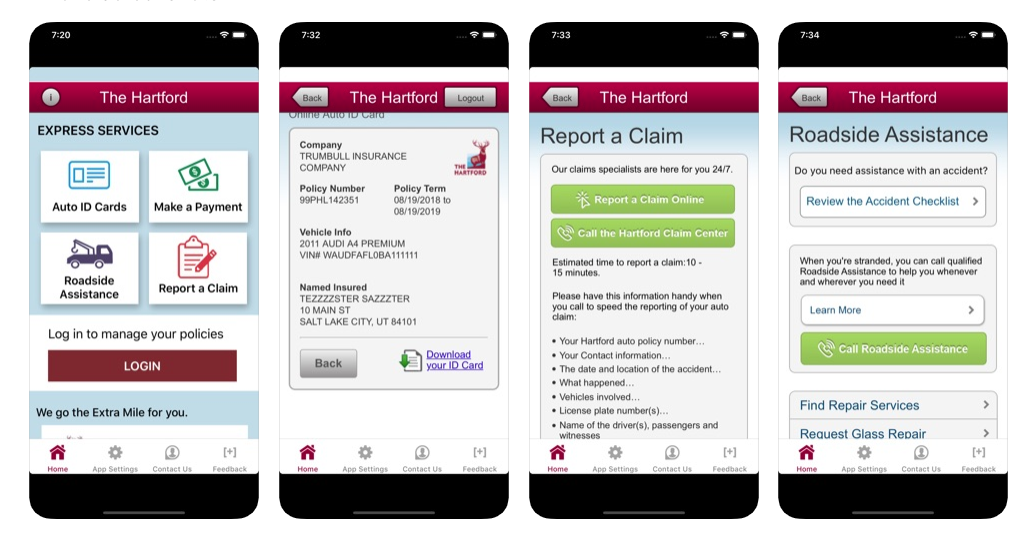

There is also a mobile app available for both Android and Apple. It’s aimed at the company’s personal lines insurance, specifically auto and home coverage.

The app can be used to file a claim for these lines of coverage, but there’s no access to group benefits or life insurance information.

Pros & Cons

Is The Hartford the right choice for your group benefits? Let’s break down some of the major pros and cons.

| Pros | Cons |

|---|---|

| Long-standing company with a lot of experience | Limited plan options, no whole life |

| Portable and convertible group life | No online claims filing for group life |

| Several included extra benefits and riders | Mobile app offers no group benefits access |

| Full service business insurance makes one-stop shopping for companies | Minimum of 50 lives insured means smaller companies will need to look elsewhere |

Get Your Rates Quote Now |

|

The Bottom Line

If you’re looking for a company with a long history and a brand that employees will recognize, The Hartford is a good choice. They are seen as a solid and trustworthy insurer, and their financial strength backs up that image. They’re a top 10 group life carrier and trusted by AARP, a very well-known organization. All of that is likely to inspire confidence.

They don’t offer the highest death benefit limits for life insurance, but they do make it easy to add more coverage and to take it with you if you change jobs. They are a solid choice for group life insurance.

The Hartford’s FAQs

Do you still have questions? Contact The Hartford directly or reach out to your HR department. We’ve covered a few common questions right here.

#1 – What happened to all of The Hartford’s personal life policies?

The Hartford sold all of its individual life insurance to Prudential in 2013. That means all the policies that were in force are now being serviced by Prudential. If you’re the beneficiary on a Hartford policy taken out before that time, your claim will be made through Prudential.

#2 – Can I be turned down for group life with The Hartford?

If your employer has chosen a guaranteed-issue, employer-paid plan, you can not be turned down for that amount of coverage. You can, however, be turned down for the voluntary portion of the life insurance. Group life, however, is not as stringent in terms of medical requirements as is individual life, and the rate won’t be more expensive due to health problems.

#3 – I have home and auto with The Hartford. Is there a bundling discount for life insurance?

Unfortunately, there’s no bundling discount because group life is separate from your personal insurance. Some companies do offer a discount on your home and auto if you take out a life insurance policy, but that only applies to individual policies.

Get your search for the right life insurance off to a good start right now. Just enter your ZIP code in the box below and let us help.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption