Life Insurance Interview Questions: What to Expect (Comparisons + Quotes)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Most life insurance companies will require you to take a medical exam in addition to answering questions about your lifestyle

- Underwriters work for life insurance companies to assess the risk of the applicant

- If the owner of the life insurance policy differs from the insured, the underwriter will interview both people

Finding the best life insurance policy can be an overwhelming process — there are tons of options. Then the life insurance application questions can seem endless and invasive. If you’re unsure what to expect from life insurance interview questions, continue reading — you’re in the right place.

Approximately three out of five people have life insurance. So despite the optics, buying life insurance can be an easy process. Our guide will help you understand why there are so many questions on a life insurance application as well as how to best answer the interview questions.

However, before the interview process can begin, you must choose a policy to apply for. Comparison shopping is just as important as understanding how to answer life insurance interview questions.

By entering your ZIP code into our FREE quote tool, you’ll answer the first question on your life insurance journey.

Table of Contents

Life Insurance Underwriting Questions

There are three ways you can apply for life insurance: online, over the phone, or in person. Even in the age of the internet, some companies do not have online applications, meaning you must talk directly with an insurance agent.

In most cases, the insurance company will require a medical exam in addition to the various questions about your lifestyle and medical history.

An underwriter reviews the life insurance application and medical exam results to determine whether the insurance company should offer the applicant a policy, and if so, how much they should charge.

It is very important not to lie at any point during the application process. You can be denied, “red-flagged,” charged more, or your beneficiary may be denied the death benefit.

Let’s dive deeper into the nature of the life insurance interview questions.

Insurance Agent Interview Questions and Answers

So, who is asking the questions? It seems like a simple answer — the life insurance companies, right? In the grand scheme of things, yes. However, it isn’t only insurance agents.

Over the past few years, insurance companies have shifted to more automation when it comes to applications. With life insurance, this is mostly seen with policies that don’t require a medical exam. Approval is fast and easy.

It does bring to question whether healthy people are being overcharged or unhealthy people being undercharged. That is why life insurance companies still need underwriters: to make sure the rates are the fairest.

Watch this short video to learn more about the purpose of an underwriter.

So an underwriter is a person hired by the insurance company who is qualified to assess the amount of risk an applicant poses to the company. Underwriters need to have detective skills and analytic skills to reach the fairest rate for everyone involved.

How are the life insurance questions asked?

In a previous section, it was mentioned that you can apply for life insurance either online, over the phone, or in person. This clearly translates into how the questions are asked, but there is one more way.

Like we said, medical exams are often required by the life insurance company. The exam is performed by a medical professional that has a contract with the life insurance company. Parts of the exam include:

- Taking a blood and urine sample

- Questions about lifestyle habits

- Checking blood pressure and heartbeat

- Going over personal and immediate family’s medical history

- Checking height and weight

Typically the exam can be scheduled to take place at home, at the office, or in a clinic. The findings of the medical exam are handed over to the underwriter. If the underwriter has further medical questions, they can request records from your doctor.

Typical Life Insurance Questions

All the life insurance interview questions fall into four basic categories: personal identification, lifestyle, medical, and policy-related. If you understand these questions and are prepared to answer them, you will save time and avoid extreme frustration while applying for life insurance.

Don’t be discouraged by the number of questions. The more questions that are asked, the more accurate a picture of the applicant’s health is painted for the underwriter to assess. For healthy people, this generally means lower rates.

So, what questions do they ask for life insurance? Let’s jump into the most basic group of questions first: personal identification.

Life Insurance Personal History Interview

Life insurance companies need to verify that you are who you claim to be on the application. If the policy will be owned by someone other than the insured, many of these questions will be asked about the owner and insured.

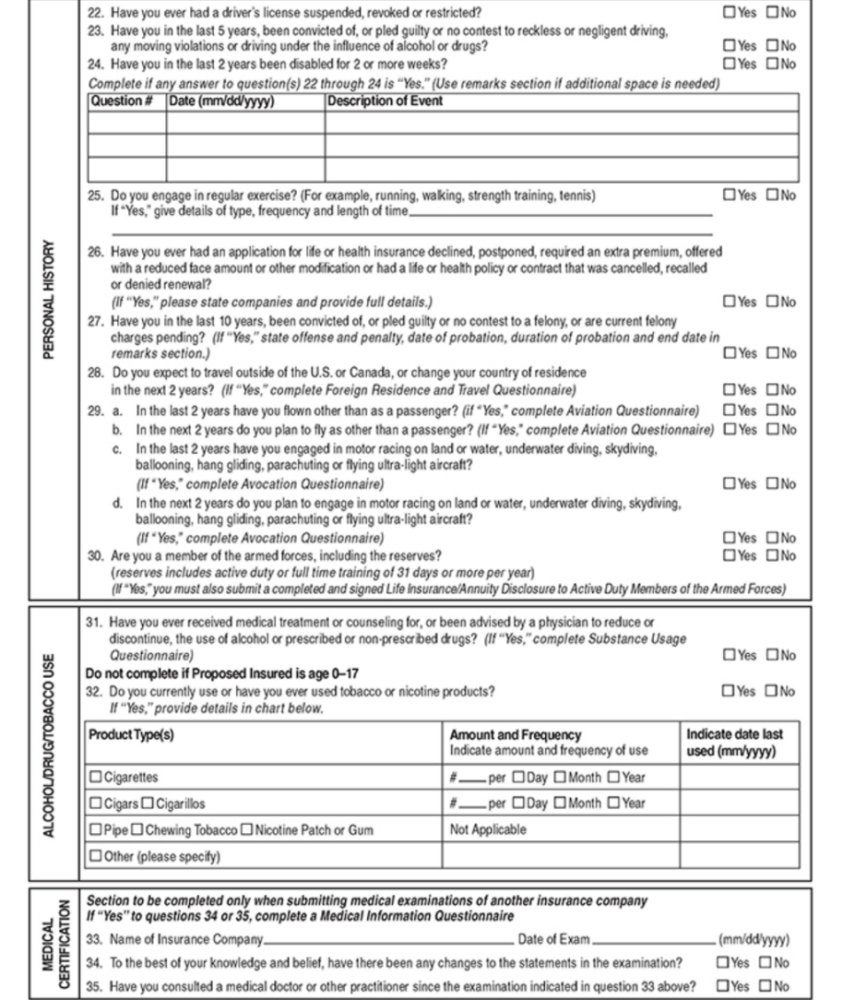

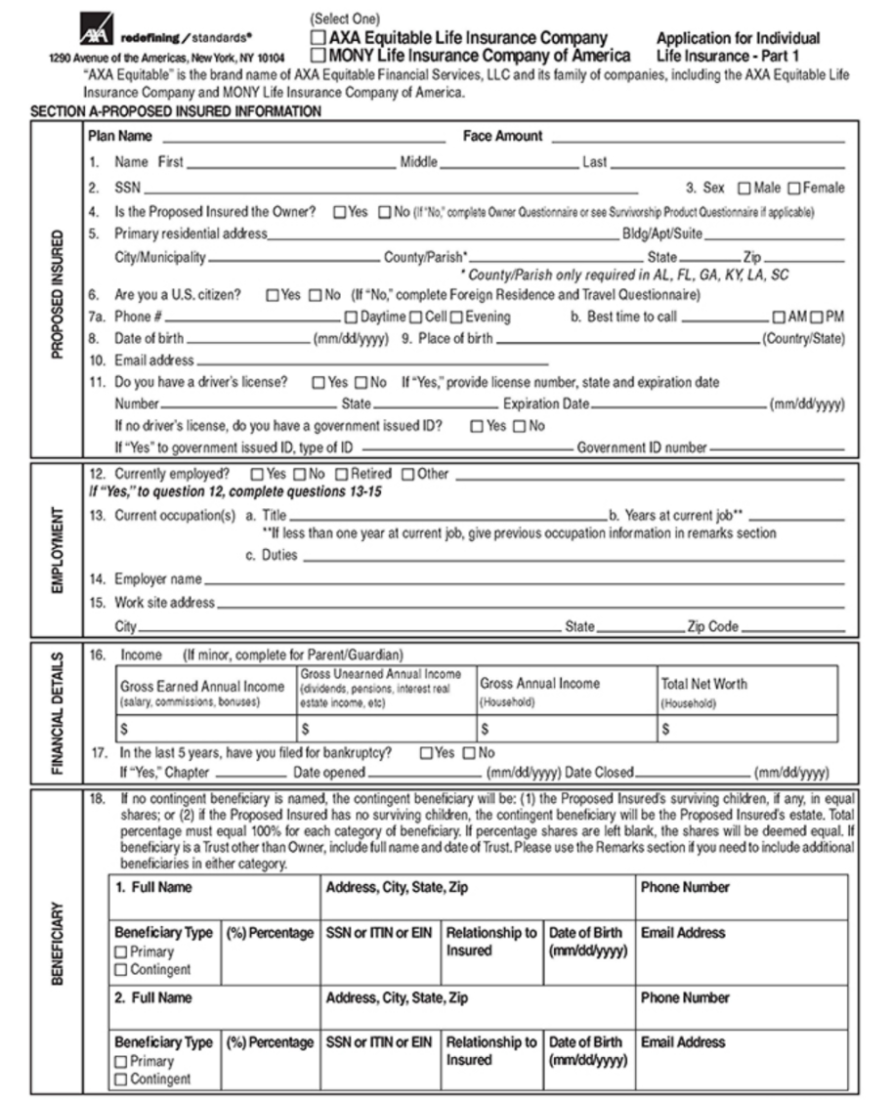

Here is an example of what this part of an application may look like:

If the owner and the insured are different people, how they are related will also be required. The owner will need to show proof of insurable interest, meaning the owner would be affected by the death of the insured.

You can’t take out a life insurance policy on a stranger.

For example, a wife can own a life insurance policy for her husband. A parent may own a policy on a child, or a company may have an insurance policy on a key employee.

The applicant will be asked to provide the following information:

- Full name

- Home address

- Home, work, and cellphone numbers

- Social Security number

- Proof of income

- Employer and job title

- Net worth

The first three bullet points are no brainers, but why would the insurance company need proof of income, the name of your employer, your job title, and your net worth? It seems a little redundant, but there is a logic behind it.

So let’s break it down. First, providing proof of income includes not only wages earned at a job but also things such as child support and alimony. The extra lines of income could be used to help pay for a life insurance policy.

An insurance company wants to know that you have enough income to pay the premiums on your policy. When it comes to asking about your employer and job title, it has less to do with the money you earn and more with how you earn it.

Those who have dangerous occupations are likely going to pay higher rates for life insurance. For example, an office worker is going to pay lower rates than a circus performer because the performer is more likely to have a potentially fatal accident while on the job.

By evaluating income, job title, and net worth altogether, life insurance companies can determine if the amount of insurance you are applying for is appropriate.

In more basic terms, insurance companies ask questions to figure out how much you can truly afford. If a 45-year-old who makes $25,000 a year applies for a $10 million life insurance policy, a big red flag would be raised.

Most people buy life insurance to replace their income when they pass away so their family will be financially supported. In most cases, the life insurance policy is worth a few years of annual income.

Some people who generally have a large net worth will buy life insurance to pay the estate taxes when they die. This allows their beneficiaries to inherit the full amount of the estate.

Let’s move on to the next group of questions.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Life Insurance Medical Questions

Unexpected death and injury happen, but generally, one of the best indicators of how long someone is going to live is the status of their health. Healthy people tend to live longer than unhealthy people.

However, two healthy people do not necessarily have the same life expectancy because of medical history.

To assess the probability of the applicant getting sick or dying earlier than the average life expectancy, the underwriter will sometimes request someone’s full medical records.

Check out this video below that talks about why life insurance companies request medical records.

Medications can sometimes be cause for concern. When answering any medical questions, have your prescriptions handy. You will need to specify the name of the drug, the dosage, the frequency, and the name of the condition for which it is prescribed.

Your answers will be crossed reference with the doctor’s notes in your file if the life insurance company had requested the records.

During most life insurance interviews, there will be a list of medical conditions to which you need to answer “yes” or “no” as to whether you have or had been diagnosed with a medical condition.

If you answer yes to any of them, you’ll need to indicate when you were diagnosed, the physician who diagnosed you, and what the treatment is or was. The life insurance companies even want to know about all your surgeries.

Whatever surgeries you had will need to be disclosed including, when the surgery was, what condition it was for, and what the outcome was — as well as the basics of who the surgeon was and the facility where it took place.

Of course, your medical history is not enough. The life insurance company will also need to know about your family’s medical history. The questions will mainly focus on your immediate family.

A few things you should know about your family are the ages of your parents and your siblings, and if they are living. If they are not alive, you’ll need to know the age at which they died.

Beyond those basics, you should also know if they have or had any major illnesses, such as cancer, high blood pressure, diabetes, stroke, or heart disease.

Let’s move on to exploring lifestyle questions that may be asked during a life insurance application interview.

Life Insurance Lifestyle Questions

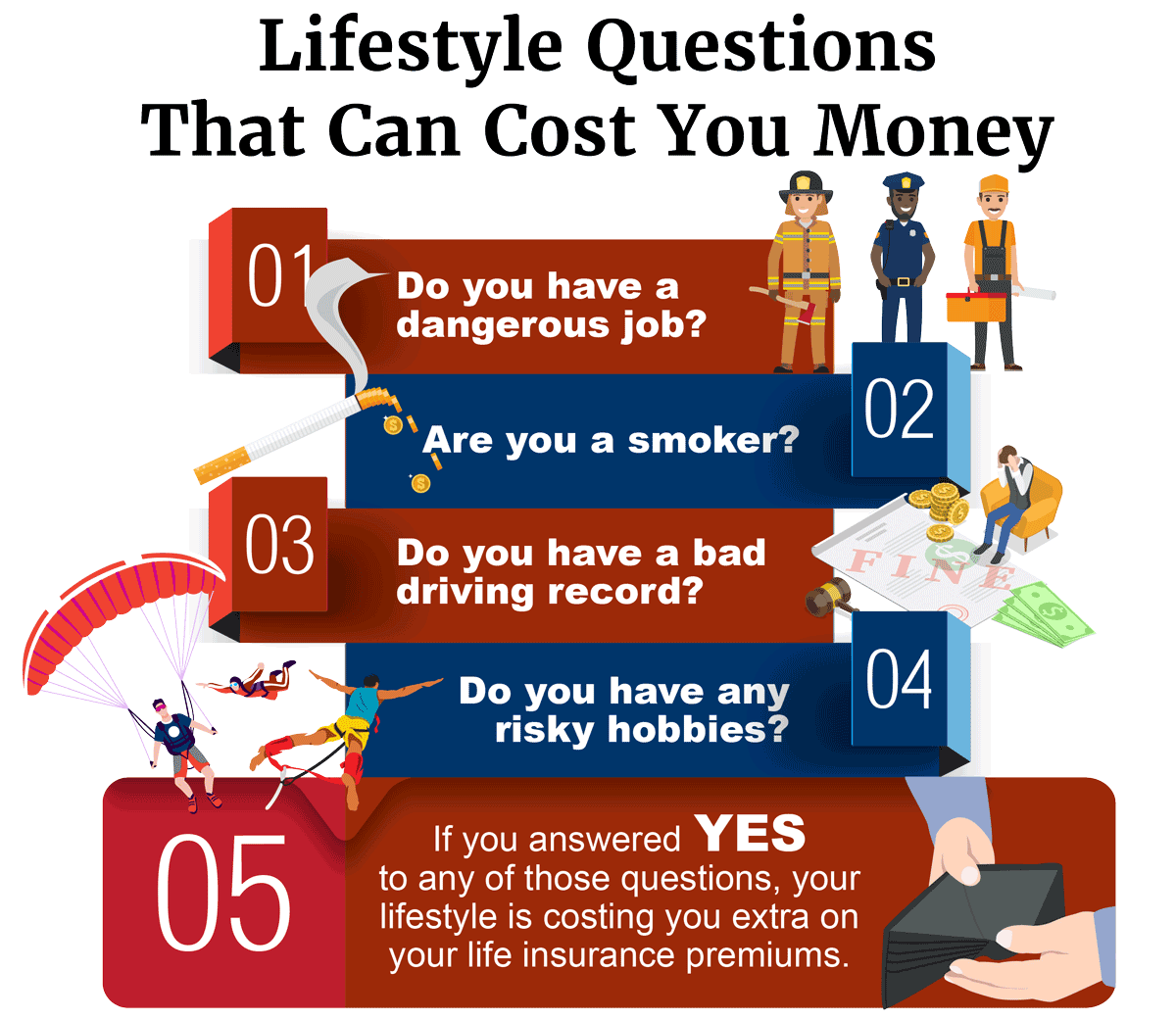

There are certain lifestyle questions life insurance companies will ask to assess the amount of risk your life is in on a daily basis. Dangerous habits, hobbies, or mistakes can shorten life expectancy and raise rates.

The most common lifestyle question asked during a life insurance application interview is: do you smoke? Smokers will pay a higher premium than non-smokers because of the obvious health risks.

Many people are often surprised when the life insurance company will request your driving record from the Department of Motor Vehicles, which will be obtained by asking for your driver’s license number. There is a reason for it.

Anyone with a driver’s license in the United States knows that there are some crazy, reckless, and sometimes under the influence drivers out on the road. Sadly, it is more common than it should be.

In 2018 a study from the National Survey on Drug Use and Health, approximately 20.5 million people drove while under the influence of alcohol and 12.6 million were under the influence of drugs.

It’s estimated that 10,511 deaths were attributed to alcohol-related crashes. There is not enough data to determine crash-related deaths that have occurred because of drug use.

A driving record with several moving violations or DUI/DWI convictions will increase life insurance rates.

There are common activities that people do for fun that are legal and can still hike up your life insurance costs. Simple things such as boating, fishing, or even hunting will add a few more dollars a month. But there are bigger ones.

You may be asked if you fly in small planes, race cars, skydive, or even bungee jump. Many people do things such as skydive once or twice in their lives. Most of the time insurance companies aren’t interested.

It’s necessary to disclose such participation in the dangerous activity only if you partake in it often. Take a look at this sample application interview form to see what kind of lifestyle and health questions are asked.

Let’s move on to the questions that are centered on what you need out of the policy.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Life Insurance Policy Questions — Insurance Interview Questions to Ask

Questions about the policy itself will be addressing what type of insurance, how much coverage, who the beneficiaries are, and if you want to add any riders to the policy.

The two types of life insurance are term and permanent. So, how long do you want your policy to be enforced? A term life policy usually has a 10-, 20-, or 30-year term. Permanent policies, on the other hand, stay enforced for the rest of your life.

When it comes to the amount of coverage you want, more thought is necessary. Not only does the policy need to be within your budget, but you must also know how much your family will need and for how long after you pass.

As mentioned before, some people purchase life insurance to replace their income if they were to die prematurely. Typically, a policy would be equivalent to a few years’ worth on the policyholder’s annual wage.

Then others purchase a life insurance policy as an extra precaution to protect their beneficiary’s inheritance by using the death benefit to cover the estate taxes.

Either situation calls for an analysis of one’s finances. There are tons of life insurance calculators out there to help pinpoint how much coverage one needs. These work great for people with simple financial portfolios.

The more complicated your finances are, the more likely you should discuss how much coverage you would need with a financial advisor.

As you might have guessed, a beneficiary is a fancy word for the person who receives the money after the policyholder’s death. You will need to provide for the full legal name, date of birth, and Social Security number for each beneficiary.

There are also additional features called riders that you can add on to your life insurance policy. These features can provide added protection for your family but vary from company to company, and they often come at an additional cost.

Just with any other part of the policy, be sure to understand any riders and the costs before you decide to move ahead with the purchase.

Now that we’ve gone over all the types of questions that you will encounter during a life insurance interview, let’s dive into why so many questions are asked in the first place.

No Questions Asked Life Insurance Underwriting

Some people may feel like lying about a medical condition is the only way, but in reality, that is how you make sure the life insurance company denies your application or your beneficiaries claim.

There are options for chronic medical conditions. So please do not lie on your life insurance application. Take a look at this video on how to get life insurance without an exam and limited questions.

Simplified and guaranteed issue life insurance will have either a graded or modified benefit plan. With graded policies, if the policyholder were to die within the first year of the policy, their beneficiaries would only receive 30 percent of the face amount.

If the death were to occur in the second year of the policy, 70 percent of the face value would be paid out. When the third year hits the whole benefit amount would be available. Modified benefit plans work slightly differently.

With modified benefits, if the policyholder passes away during the first or second year, all premiums paid would be returned along with 10 percent annual interest.

Now that we cleared that up, let’s compare simplified and guaranteed issue policies.

| Simplified Issue | Guaranteed Issue |

|---|---|

| No Medical Exam | No Medical Exam |

| Limited Health Questions | No Health Questions |

| 2–3x more expensive than traditional | 10x more expensive than traditional |

| Intended for fast and efficient approval | Intended for those with chronic medical conditions |

| Same face value amounts as traditional | Low face value amounts |

Get Your Rates Quote Now |

|

As we can see, no medical exam is required for either type of life insurance, but simplified life insurance still asks questions related to the applicant’s health. Simplified life insurance is geared towards healthy people getting approved quickly and efficiently.

Of course, simplified is more expensive than traditional life insurance because you are paying for convenience, and the life insurance companies are taking a slightly higher risk by insuring people without medical exams.

The type of life insurance policies that don’t require a medical exam or any interview questions are called guaranteed issue policies. As the name implies, applicants will not be denied coverage.

Of course, the less information the life insurance company has on a policyholder the more expensive the policy will be. Guaranteed life insurance is considered when the applicant would not qualify for another kind of policy due to chronic or terminal medical conditions.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

How do I prepare for a life insurance interview?

In addition to preparing all the necessary docs about your personal and medical history as well as your lifestyle, you can research the top life insurance companies by market share. That’s always a good place to start.

Top Life Insurance Companies by Market Share

Below is a table of the top five life insurance companies based on the direct premiums written in 2018 as well as the respective market share percentages.

| Rank | Companies | Direct Written Premium | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual Life | $10,517,115,452 | 6.42% |

| 2 | Metropolitan Group | $9,821,445,953 | 6.00% |

| 3 | New York Life | $9,295,848,300 | 5.68% |

| 4 | Prudential | $9,128,805,060 | 5.57% |

| 5 | Lincoln National | $8,769,303,174 | 5.36% |

Get Your Rates Quote Now |

|||

Now, you may not have heard of all five of the top companies listed here, and that’s not unusual. With the number-one ranked life insurance company only making up 6.42 percent of the market, it’s easy to see that there are many life insurance companies out there.

This next section is going to have example rates for life insurance. If you’re looking for personalized rates, you can use our tool at the top of the page.

Sample Life Insurance Rates

The first two tables in this section will display sample term life insurance rates for 10 randomly chosen life insurance companies. The rates displayed are monthly rates for a 20-year term life policy with $250,000 worth of coverage.

So, let’s move on to the first table which shows sample rates for men who do not smoke.

| Companies | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Banner | $12.96 | $19.31 | $40.16 | $110.17 |

| Mutual of Omaha | $13.55 | $20.64 | $45.80 | $134.59 |

| Sagicor | $14.14 | $17.03 | $45.47 | $160.33 |

| Transamerica | $15.48 | $26.66 | $50.96 | $113.95 |

| Allstate | $20.00 | $30.00 | $53.00 | $130.00 |

| Prudential | $20.35 | $24.50 | $45.50 | $129.07 |

| State Farm | $24.59 | $33.72 | $69.59 | $183.79 |

| Guardian Life | $25.00 | $33.00 | $77.00 | $198.00 |

| Farmers | $25.81 | $36.85 | $78.10 | $257.88 |

| Liberty Mutual | $33.75 | $55.13 | $144.68 | $399.83 |

Get Your Rates Quote Now |

||||

If you compare the prices in the column for 30-year-olds with the one for 60-year-olds, you will see a huge difference. Simply put, the older you are, the higher your rates.

For example, a 30-year-old man who doesn’t smoke would pay $20 a month at Allstate while a 60-year-old man would pay over six times that amount. But age isn’t the only factor that affects life insurance rates.

In the table for non-smoking men, Banner is the cheapest company.

There is no set algorithm on how to figure out what to charge for life insurance. Every company has to figure that out for themselves, causing such variations.

Age and smoking are two factors that can guide the rates. However, a third comes into play most often — gender. Below is a table representing term life insurance rates for non-smoking women, under the same circumstances.

| Companies | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Banner | $11.53 | $15.33 | $31.52 | $79.04 |

| Sagicor | $12.19 | $15.39 | $39.14 | $112.04 |

| Mutual of Omaha | $12.26 | $17.63 | $35.69 | $101.91 |

| Transamerica | $13.55 | $21.93 | $41.93 | $110.51 |

| Prudential | $17.28 | $22.53 | $40.03 | $89.91 |

| Allstate | $18.00 | $24.00 | $39.00 | $92.00 |

| Farmers | $19.14 | $36.02 | $73.72 | $226.63 |

| State Farm | $20.44 | $28.49 | $54.59 | $131.17 |

| Guardian Life | $21.00 | $29.00 | $52.00 | $132.00 |

| Liberty Mutual | $25.20 | $42.53 | $107.78 | $250.65 |

Get Your Rates Quote Now |

||||

Women are charged anywhere from a little under $2 to over $100 less than their male counterparts. For example, a 30-year-old woman who does not smoke would pay $12.26 at Mutual of Omaha. A man under the same circumstances would pay $13.55.

On the other end of the spectrum, a 60-year-old woman would be charged about $250 a month by Liberty Mutual. A 60-year-old man would be paying almost $400 a month.

Term life and whole life insurance are priced extremely differently. The next four tables will show monthly rates for a $250,000 whole life policy from five different life insurance companies.

Again, let’s begin with rates for men who don’t smoke.

| Companies | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Illinois Mutual | $201.96 | $281.16 | $401.06 | $638.44 |

| Minnesota Life | $202.03 | $301.36 | $455.97 | $768.05 |

| Foresters Financial | $216.52 | $326.33 | $499.36 | $802.33 |

| Assurity | $238.16 | $348.22 | $532.66 | $801.27 |

| State Farm | $260.14 | $375.62 | $578.12 | $988.97 |

Get Your Rates Quote Now |

||||

Right away you should be able to see that whole life costs a lot more than term life. For example, a 40-year-old man will spend $300 to $400 a month on a whole life policy compared to about $20 to $60 a month for term life.

Now take a peek down below at the rates for women, starting with those who do not smoke.

| Companies | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Illinois Mutual | $177.32 | $242.66 | $337.70 | $518.32 |

| Minnesota Life | $180.69 | $260.08 | $386.86 | $639.03 |

| Foresters Financial | $188.96 | $277.99 | $429.14 | $700.83 |

| Assurity | $207.71 | $303.41 | $454.14 | $670.55 |

| State Farm | $234.24 | $321.24 | $470.02 | $769.94 |

Get Your Rates Quote Now |

||||

Women who don’t smoke are charged anywhere from $35 to $220 more a month for a whole life policy than men who don’t smoke. Men who smoke pay anywhere from $70 to over $600 more a month than women who don’t smoke.

The above tables should give you a ballpark idea of what your life insurance would cost. They should also show you that rates are extremely variable, and you should get multiple personal quotes before choosing one.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Life Insurance Interview Questions: The Bottom Line

Life insurance application interview questions are used to gain information about the individual applying. The underwriter uses the information to assess what kind of risk the applicant would pose to the life insurance company if insured.

Remember that it’s very important not to lie about anything on your application. You’ll risk high rates or being denied altogether. Now that you understand what is on a life insurance application and why all the questions are necessary, are you ready to apply for a life insurance policy?

Use our FREE online quote tool below Start answering questions and comparing prices today.

Life Insurance Interview Questions FAQs

Here are some additional questions and answers to get you up to speed on what to expect from life insurance interview questions.

#1 – What happens if you lie on a life insurance application?

When someone is caught lying on their life insurance application, a few bad things can happen. First, either the application or the death benefit claim can be denied, depending on when the lie is discovered.

Second, if the application is denied due to lying, the company can then red-flag your name for all other insurance companies to see.

#2 – Do life insurance companies look into your credit score during the interview process?

Many life insurance companies will make a soft inquiry into your credit score. The report is used to find out things such as how consistent you are with payments. Soft inquiries do not affect credit scores.

#3 – How long does the life insurance application interview take?

The answering of all the life insurance application questions can take anywhere between 10 and 45 minutes to complete. For traditional underwriting, the approval process can take 3-8 weeks.

Whereas approval for a guaranteed issue or simplified issue policy is much faster, within minutes or a few days.

#4 – Why do life insurance companies ask if you have any plans to travel?

Generally, family vacations and normal business travel will be expected. The red-flags that life insurance companies are looking for are travel plans to war-torn areas or regions where a deadly disease is more easily contracted.

Any plans that show an increased risk of fatality, will no automatically disqualify you for life insurance. However, you can expect to pay higher premiums.

#5 – What are the most common health conditions life insurance companies ask about?

There are many conditions life insurance companies check for, but here are some of the main ones that they consider because of their potential impact on your mortality:

- High blood pressure

- Heart disease

- Cancer

- HIV/AIDS

- Obesity

References:

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption