Exclusive: Why You Should Buy Life Insurance (Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Life insurance protects your family by paying your final expenses and outstanding debts

- Term life insurance provides coverage for a limited time

- Whole life insurance provides permanent coverage as long as you live

- Final expense policies have low face values meant mostly to cover funeral costs

If you’re married or have children, buying life insurance is one of the most important decisions you can make. Unfortunately, that’s a fact that many discover after it’s too late.

There’s a good chance that you either know or have heard of someone who faced serious financial hardship after the death of a spouse left them with limited income and a mounting stack of bills.

After an unexpected death, many families struggle to pay medical bills and funeral expenses, drain savings accounts to make up for lost wages, and even lose houses because they can’t afford the mortgage payments alone.

According to the 2018 Insurance Barometer Study from Life Happens and LIMRA, 35 percent of households would be financially impacted within one month of the primary wage earner’s death. Yet, almost half of all adults in the country don’t have any life insurance.

If you’re one of those without coverage, this guide is designed to not only illustrate the importance of life insurance, but also to give you a complete overview of policy types, costs, and the buying process to help you make the best decision for you and your family.

Start comparing life insurance rates now by using our FREE quote tool above.

Table of Contents

What is life insurance?

At its most basic definition, a life insurance policy is a contract between you and the insurer. You pay a regular fee, and in exchange, the insurance company promises to pay a lump-sum payment to your loved ones upon your death.

Life insurance has many variations, each with its own benefits and drawbacks, which this guide will discuss shortly.

Like any specialized business, the life insurance industry has its own unique glossary of terms you should familiarize yourself with before diving into policy types, cost, the application process, and the general how’s and why’s of life insurance.

Here are some of the ones you’re likely to come across most often.

| Term | Definition |

|---|---|

| Agent | An authorized insurance representative who sells and services policies |

| Beneficiary | The person designated by the policyholder to receive the proceeds from a life insurance policy |

| Death Benefit | A tax-free lump sum of money paid to the beneficiary upon the death of the insured |

| Face Amount | The amount of coverage provided by a life insurance policy |

| Final Expenses | Expenses incurred at the time of a person's death such as funeral costs, current liabilities, and taxes |

| Policy | The legal document stating the terms of the life insurance contract |

| Policyholder | The owner of the policy, typically the insured |

| Premium | The money paid to the insurance company in exchange for coverage |

| Risk Classification | The process which determines the risk associated with an applicant, which decides how much the insured’s premiums differ from the standard |

| Underwriter | The person who reviews the life insurance application, assigns a risk classification, decides if the applicant is acceptable, and determines the premium rate |

Get Your Rates Quote Now |

|

Now that you know the lingo, you’re ready for a deep dive into the why and how of life insurance.

Why Consider Life Insurance

An unexpected death is likely to burden your family with a wide and varied list of expenses. Some of them present themselves immediately after your passing, while others might not be realized for years to come.

The best way to protect your family against that eventuality is through a life insurance policy with a sizeable benefit that can pay those expenses as they arise.

The beneficiary can use the death benefit from a life insurance policy any way they choose, but it’s generally meant to cover two types of obligations: immediate and future.

Immediate obligations are those expenses that need to be paid soon after your death. They include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all the expenses (some planned and some unexpected) that need to be paid in the years following your death. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

Some of these larger obligations can be particularly devastating to your family’s finances if they aren’t prepared for them.

What Life Insurance Covers

Everyone’s financial situation is unique, but there are several obligations that are shared by a growing number of families and are the ones most commonly paid with a life insurance death benefit.

The odds are high that everyone dealing with the unexpected death of a loved one will be faced with figuring out how to pay for at least one of the following.

Funeral Costs

There’s no delicate way to put it: dying is expensive. The current national average funeral cost is $7,360, and that number continues to climb every year. The Bureau of Labor Statistics found that the price of funerals in the United States has risen almost twice as fast as prices for all other consumer items and services over the past three decades.

From 1986 to 2017, funeral prices rose nearly 230 percent while all other prices only rose around 120 percent.

The National Funeral Directors Association has a breakdown of average funeral costs by region, which takes into account all your different choices such as casket type, facility type, service options, burial options, and more, which can either raise or lower your overall costs.

The following table gives the average cost of a funeral with a viewing and ceremony followed by either burial or cremation.

| Region | Funeral & Burial | Funeral & Cremation |

|---|---|---|

| New England (CT, ME, MA, NH, RI, VT) | $7,469 | $6,598 |

| Middle Atlantic (NJ, NY, PA) | $7,421 | $6,431 |

| South Atlantic (DE, FL, GA, MD, NC, SC, WV, VA) | $7,078 | $6,078 |

| East South Central (AL, KY, MS, TN) | $6,921 | $5,973 |

| West South Central (AR, LA, OK, TX) | $7,196 | $5,921 |

| East North Central (IL, IN, MI, OH, WI) | $7,595 | $6,364 |

| West North Central (IA, MN, KS, MO, ND, SD, NE) | $7,816 | $6,763 |

| Mountain (AZ, CO, ID, MT, NV, NM, UT, WY) | $6,681 | $5,721 |

| Pacific (AK, CA, HI, OR, WA) | $6,626 | $5,611 |

| National Average | $7,360 | $6,260 |

Get Your Rates Quote Now |

||

A surprise $7,000 bill is more than enough to severely affect the finances of most families. Dealing with that unexpected stress while simultaneously trying to deal with the emotional trauma that comes from losing a loved one could be too much to bear.

A life insurance policy can cover these expenses and give your family some peace of mind during that difficult time.

Mortgage Debt

One of the most significant debts families have to deal with after the loss of a loved one is the mortgage.

Not only are they dealing with the loss of a spouse and parent, but they also have to face the prospect of losing their home if the surviving spouse doesn’t have enough income to pay the mortgage alone.

There is currently $9.5 trillion in total outstanding mortgage debt in the United States. That translates to about $200,000 per borrower.

That average varies from state to state, with some much higher than others.

| State | Average Mortgage Debt |

|---|---|

| Alabama | $140,659 |

| Alaska | $223,430 |

| Arizona | $202,148 |

| Arkansas | $128,842 |

| California | $363,537 |

| Colorado | $258,026 |

| Connecticut | $225,386 |

| Delaware | $185,452 |

| Florida | $187,440 |

| Georgia | $174,275 |

| Hawaii | $344,819 |

| Idaho | $169,603 |

| Illinois | $177,150 |

| Indiana | $120,354 |

| Iowa | $131,709 |

| Kansas | $137,542 |

| Kentucky | $126,310 |

| Louisiana | $151,763 |

| Maine | $136,963 |

| Maryland | $252,583 |

| Massachusetts | $252,207 |

| Michigan | $132,523 |

| Minnesota | $175,085 |

| Mississippi | $121,608 |

| Missouri | $139,320 |

| Montana | $180,926 |

| Nebraska | $139,626 |

| Nevada | $225,095 |

| New Hampshire | $178,409 |

| New Jersey | $239,362 |

| New Mexico | $160,967 |

| New York | $236,093 |

| North Carolina | $162,366 |

| North Dakota | $162,702 |

| Ohio | $122,765 |

| Oklahoma | $134,244 |

| Oregon | $224,503 |

| Pennsylvania | $145,206 |

| Rhode Island | $185,646 |

| South Carolina | $159,359 |

| South Dakota | $150,913 |

| Tennessee | $155,844 |

| Texas | $176,736 |

| Utah | $213,771 |

| Vermont | $147,236 |

| Virginia | $242,794 |

| Washington | $262,641 |

| West Virginia | $110,729 |

| Wisconsin | $138,935 |

| Wyoming | $184,625 |

Get Your Rates Quote Now |

|

The benefits from a life insurance policy can ensure your family has a roof over their head long after you’re gone, without them having to worry about how to make monthly payments without your income.

Credit Card Debt

Credit card debt is perhaps the easiest form of debt to accumulate. Credit approvals often take only seconds to process, balances can be run up on impulse with the simple swipe of a card, and interest rates are much higher than most consumer loans.

With that in mind, it’s easy to understand why there is currently an estimated $1.1 trillion in credit card debt in the United States. That breaks down to an average of $6,000 per cardholder.

If $7,000 in funeral costs is enough to negatively impact your family’s finances, so is $6,000 in credit card debt.

College Tuition

Much has been made in the news about the student debt crisis in this country, and for good reason. Student loans represent the second-largest credit debt for Americans, trailing only mortgage loans.

There is nearly $1.5 trillion in total student loan debt in the United States. The average American is responsible for $35,359 of that total. Your family generally isn’t responsible for paying your student loans after you die (unless your spouse cosigned a private student loan).

However, if your spouse has outstanding student debt or if your child incurred student loans that you committed to pay, the loss of income resulting from your death could make it hard for them to pay it.

Likewise, you might wish to pay for a young child’s college tuition in the future. The average cost of a four-year degree is around $30,000. If you die before saving enough, your child’s education could be in jeopardy.

Here is a look at the average cost of a four-year degree by state for both public and private institutions.

| State | Public, In-state | Public, Out-of-state | Private |

|---|---|---|---|

| United States | $20,050 | $25,657 | $43,139 |

| Alabama | $19,673 | $24,939 | $26,164 |

| Alaska | $18,373 | $21,284 | $26,887 |

| Arizona | $22,629 | $26,067 | $22,939 |

| Arkansas | $17,479 | $20,061 | $30,828 |

| California | $22,081 | $29,173 | $47,410 |

| Colorado | $21,514 | $29,846 | $35,152 |

| Connecticut | $25,182 | $33,741 | $54,819 |

| Delaware | $22,371 | $29,356 | $26,928 |

| Florida | $14,896 | $18,241 | $37,336 |

| Georgia | $17,705 | $21,957 | $40,414 |

| Hawaii | $21,201 | $31,019 | $28,858 |

| Idaho | $15,455 | $22,601 | $13,488 |

| Illinois | $25,089 | $28,618 | $45,046 |

| Indiana | $19,297 | $28,805 | $43,764 |

| Iowa | $18,426 | $26,214 | $37,380 |

| Kansas | $17,963 | $22,615 | $30,240 |

| Kentucky | $20,745 | $24,632 | $35,948 |

| Louisiana | $18,835 | $21,632 | $49,452 |

| Maine | $19,500 | $26,939 | $49,994 |

| Maryland | $21,177 | $24,353 | $55,685 |

| Massachusetts | $25,229 | $29,774 | $59,559 |

| Michigan | $22,665 | $37,600 | $36,664 |

| Minnesota | $20,420 | $20,736 | $42,716 |

| Mississippi | $17,718 | $19,691 | $25,774 |

| Missouri | $18,106 | $19,519 | $34,623 |

| Montana | $15,800 | $23,678 | $33,739 |

| Nebraska | $18,449 | $20,555 | $34,598 |

| Nevada | $16,810 | $21,176 | $36,163 |

| New Hampshire | $27,570 | $28,130 | $47,030 |

| New Jersey | $26,542 | $28,649 | $50,321 |

| New Mexico | $15,803 | $17,533 | $33,620 |

| New York | $22,343 | $21,662 | $53,659 |

| North Carolina | $17,343 | $24,274 | $44,050 |

| North Dakota | $15,998 | $19,021 | $22,511 |

| Ohio | $21,674 | $24,098 | $42,254 |

| Oklahoma | $16,263 | $20,200 | $35,542 |

| Oregon | $22,710 | $30,487 | $50,617 |

| Pennsylvania | $25,795 | $27,129 | $53,239 |

| Rhode Island | $24,280 | $29,013 | $54,877 |

| South Carolina | $22,132 | $30,919 | $34,421 |

| South Dakota | $16,421 | $12,060 | $32,157 |

| Tennessee | $18,951 | $25,378 | $37,162 |

| Texas | $18,271 | $24,937 | $43,866 |

| Utah | $14,174 | $20,168 | $15,389 |

| Vermont | $27,782 | $38,968 | $56,172 |

| Virginia | $23,427 | $33,428 | $33,658 |

| Washington | $18,323 | $28,263 | $48,518 |

| West Virginia | $17,803 | $21,032 | $21,300 |

| Wisconsin | $16,544 | $23,500 | $43,332 |

| Wyoming | $14,486 | $13,731 | N/A |

Get Your Rates Quote Now |

|||

Once again, a life insurance policy can cover the cost of existing student loans or set enough aside to ensure your child doesn’t go into debt in pursuit of higher education.

Income Replacement

If your family depends on your income, the sudden loss of it could leave them in a serious bind. Social Security does offer some protection, but it likely isn’t enough.

As long as you are fully vested, Social Security provides survivor benefits to your spouse and children if they meet the following qualifications.

- A widow (or widower) age 60 or older (age 50 or older if he or she is disabled) who has not remarried

- A widow (or widower) at any age who is caring for the deceased’s child (or children) who is under age 16 or disabled

- An unmarried child of the deceased who is younger than age 18

The average monthly survivor benefit is $1,470, which translates to $17,640 per year. At the same time, the average household income in the United States is around $63,000.

If your family depends on your salary, there could be a very significant shortfall between the income they’re used to and the benefits they’d receive.

The death benefit from a life insurance policy can close that gap and completely replace your income for as long as your family would need to become financially dependent without you.

Who Should Buy Life Insurance

Anyone who wants to leave behind any sum of money when they die, for whatever reason, should consider buying a life insurance policy. More specifically, those in the following situations owe it to their loved ones to explore their coverage options.

- Spouses: Life insurance protects your spouse from the large shared debts they would be obligated to pay, while also providing income replacement and emergency savings.

- Parents: Death benefits can pay for the costs of raising a child, as well as future needs like college tuition.

- Estate planners: Those leaving behind significant assets can use the tax-free benefits from a life insurance policy to protect them by using the proceeds to establish a strong trust or simply paying the tax on the taxable asset.

Likewise, there are specific groups for whom a life insurance policy isn’t as necessary.

- Single: If nobody depends on your income or shares any of your debts, there is little reason to leave behind a death benefit.

- Debt-free: If you don’t have any major debts, there is less need for a large face-value life insurance policy.

- Self-insured: If your savings are enough to cover your debts and future financial obligations, it isn’t as necessary to pay regularly for a life insurance policy that will do the same thing.

Types of Life Insurance

Life insurance policies fall into one of two general categories: term or whole.

Term life insurance provides temporary coverage for a set period while whole insurance provides permanent coverage for as long as you live. The financial needs of your family, as well as your personal financial goals, can help you determine which type you need.

To aid in your decision, we’ve compiled an overview of each.

Term

Term insurance provides coverage for a specified period, usually between 10 and 30 years. Once that period expires, the insurer cancels the coverage unless you opt to renew or convert the policy.

Term policies are generally meant to cover final expenses and outstanding debts in the event of an unexpected death.

Watch the below video for a quick overview of term life insurance.

Term insurance is the type of policy that represents less of a risk to the insurer. There is always a chance that you’ll outlive your term and they won’t have to pay.

When it comes to life insurance, a higher risk always means higher premiums. Because term policies are lower risk, they will always cost less than a whole policy with the same face value.

Term life has the following variations.

Level

A level term policy is the simplest form of term insurance. The premiums never increase, and the amount of the death benefit remains the same throughout the entire term.

Term policies are typically sold in terms of five to 30 years, in five-year increments.

Increasing

For an increasing term policy, the death benefit increases each year you have the policy at an established rate, usually between 2-10 percent. As the death benefit goes up, so will your premium.

For example, a $100,000 increasing term policy might increase by 10 percent every year. So in year two, the death benefit would be $110,000. In year two, it would be $121,000, and so on.

An increasing term policy might not be the best option for those who want long-term coverage.

For example, on a lengthy 30-year policy, the death benefit will have grown significantly after a few decades. That means that the premiums will have risen along with it.

At some point, those higher premiums will reduce the overall value of the policy. The premiums could even increase at a higher rate once the benefit crosses a certain threshold.

Decreasing

Decreasing term insurance is sometimes called mortgage protection insurance. The benefit decreases every year of the term.

Many people buy term insurance to protect their families against large debts, like a mortgage. Theoretically, you should be paying that bill down regularly during your term.

If you are, the overall amount of debt you need to be protected against gradually decreases every year. With a decreasing term policy, your face value shrinks along with your debt obligation.

The premiums don’t decrease with the benefit. Instead, decreasing policies offer a lower premium from the start that stays level throughout the term.

Renewable

Renewable term policies allow you to extend or renew your policy for an additional term after the expiration date with no new medical exam.

Some renewable policies automatically renew every year up to a specific age (typically 65). Policies that renew annually usually have an increase in premiums each year as well. Other policies automatically renew for your original length once your policy term ends.

Convertible

A convertible term policy allows you to convert your term policy into a permanent policy at any time, usually without taking a new medical exam.

Converting from term to whole insurance will increase your premiums. Some insurers also place age limits on conversions. Typically, you must convert before age 65.

Riders

Life insurance policies can be customized with riders that add additional coverages and benefits.

The most common riders for term policies are:

| Rider | Description |

|---|---|

| Accidental death benefit | Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries |

| Terminal illness | Gives early access to a percentage of the death benefit if diagnosed by a physician as having 12 months or fewer to live |

| Child | Pays a death benefit to the insured parent upon the death of an eligible child |

| Spouse | Pays a death benefit to the insured parent upon the death of an eligible spouse |

| Waiver of premium | Waives the policy premiums if the insured becomes totally disabled |

| Disability income | Pays a monthly income of 1 – 2% of the face value if the insured becomes disabled |

| Guaranteed insurability | Guarantees you the right to purchase additional insurance, without proof of good health, at specified dates in the future |

| Return of premium | The insurer will return your premiums at the end of the term, minus the additional cost of the rider |

| Term conversion | Allows you to convert term life insurance into whole life insurance without undergoing a medical exam |

Get Your Rates Quote Now |

|

Keep in mind that not all riders are available with every insurer.

Whole

Unlike term life, whole life insurance (sometimes called permanent insurance) provides coverage for as long as you live. If your premiums are current, the insurer will pay a guaranteed benefit, regardless of when you die.

In addition to a guaranteed death benefit, most whole polices also include a savings account that builds a cash value either at a fixed interest rate or through investments similar to a retirement account.

Many whole policies also allow you to take out personal loans against your cash value, which must be paid back with interest.

Watch the below video for a quick overview of whole life insurance.

Whole policies come in the following variations.

Traditional Whole

A traditional whole life policy (sometimes called ordinary life) is the most common form of permanent insurance. It is also one of the simplest.

Your cash account operates similar to a traditional savings account. A portion of your premiums is placed in an account that grows at a fixed interest rate (typically around 3-8 percent).

This makes it the least risky option. You’re always guaranteed to see positive growth in your cash value. It doesn’t depend on any market factor that could experience a downturn. The downside is that they are the least flexible. You often can’t change your death benefit or adjust your premium payments.

Universal

Universal policies offer the flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low while maximizing cash value.

That cash value grows at a fixed rate, similar to an ordinary life policy.

These policies offer more flexibility than the traditional option, but less than other universal and variable options, particularly when it comes to how you invest your premiums.

Indexed Universal

Indexed universal life policies offer all of the flexibility of a universal policy, with the added benefit of choosing how you invest your premiums. They allow you to allocate your cash to an equity index account such as the S&P 500 or the Nasdaq 100, rather than growing at a rate set by the insurer.

They are riskier in that growth is not guaranteed, but they do come with the potential for higher returns than a traditional whole or universal policy. Some also come with the option to take a break from the index and temporarily invest in the stable, traditional savings account.

Guaranteed Universal

Guaranteed universal life policies exist somewhere between a term policy and a traditional whole policy. They offer fixed premiums and guaranteed no-lapse coverage.

Unlike most permanent life insurance policies, guaranteed universal policies do not accumulate a cash value that you can access.

They are more like term policies that simply don’t expire as long as you pay your premiums. That might be considered a drawback for someone who wants to use their policy as an investment.

Variable

Variable policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401(k).

Variable policies come with the greatest risk, but also some of the highest growth potential.

Depending on how the stock market performs, you could lose some of your cash value and possibly see your face value decrease. However, many policies do come with a minimum death benefit guarantee.

Variable Universal

Variable universal policies combine the benefits of a universal and variable policy.

They have the adjustable premiums and face values of a universal policy, along with the potential investment options of a variable policy. That also means they come with the same risks as a variable policy.

Riders

Whole life policies can also be customized with riders. The most common are as follows.

| Rider | Description |

|---|---|

| Accidental death benefit | Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries |

| Terminal illness | Gives early access to a percentage of the death benefit if diagnosed by a physician as having 12 months or fewer to live |

| Child | Pays a death benefit to the insured parent upon the death of an eligible child |

| Spouse term | Provides term insurance (not whole) on an eligible spouse |

| Waiver of premium | Waives the policy premiums if the insured becomes totally disabled |

| Disability income | Pays a monthly income of 1 – 2% of the face value if the insured becomes disabled |

| Guaranteed insurability | Guarantees you the right to purchase additional insurance, without proof of good health, at specified dates in the future |

| Term life | Allows you to add supplemental term coverage to your whole policy |

| Income for life | Converts the cash value into a guaranteed, regular income stream |

| Lapse protection benefit | On variable policies, coverage is guaranteed not to lapse despite market performance, as long as the required minimum premiums are paid to guarantee the death benefit |

Get Your Rates Quote Now |

|

Keep in mind that not all riders are available with every insurer.

Final Expense

Final expense insurance (sometimes called burial insurance) is a special type of whole life policy.

Final expense policies offer the same guaranteed, lifetime coverage of a traditional whole policy, but with much smaller face values.

This type of coverage is easier to obtain than most whole insurance because they pay out so much less. Face values typically range from $2,000-$25,000, with no medical exam required.

The money can be used for anything, but final expense insurance is specifically designed to cover funeral costs immediately after your passing. Just like term and whole policies, final expense insurance comes in several variations.

Level

Level policies are sometimes called immediate benefit policies. The entire face value of the policy is in effect the day the application is approved. When the insured person dies, the beneficiary receives the full death benefit immediately.

Graded Benefit

Graded policies have a waiting period before the death benefit is paid in full. If you die immediately after purchasing the policy, your beneficiary will only be paid a partial amount.

The waiting period is typically two years. During that time, the insurer will pay a percentage of the full benefit, which increases every year until it reaches 100 percent at the end of the waiting period.

In the event of a suicide, premiums are typically refunded, with no benefit paid. Some may pay a small percentage of the benefit in addition to the refund, but most do not.

The main drawback of a graded policy is that the benefit may not be enough to cover final expenses if you die during the waiting period.

Modified Benefit

A modified policy is a hybrid of level benefit and graded benefit. These policies pay the entire face value for accidental death from the day the application is approved.

However, they have a waiting period for non-accidental deaths (age and health-related). The limited value is typically a refund of the premiums paid to date plus an additional 10 percent.

Once the waiting period is over, they pay full value for both accidental and natural deaths. Like graded policies, insurers typically refund premiums in the event of a suicide.

Modified policies have fewer drawbacks than a graded policy if you die an accidental death, but more if you die a natural one.

If you die of age or health-related causes during the waiting period, you run a higher risk of the benefit falling short of your final expenses since modified policies pay significantly less.

Guaranteed Acceptance

The most common form of final expense insurance is the guaranteed acceptance policy. They provide coverage with no medical exam. If you apply, you’ll be approved.

Like graded policies, they pay out a limited death benefit during an initial waiting period. The main drawback is the price.

Because they don’t require a medical exam, insurers automatically assign you to the highest health risk category. As a result, these can be the most expensive forms of final expense insurance.

How much coverage do you need?

The process for determining how much coverage you need is different depending on whether you choose a term or whole policy.

For a whole policy, you only need to calculate a face value amount that will cover all of the financial goals outlined earlier. For a term policy, you need to decide both face value and a term length.

Face Value

As discussed earlier, a life insurance policy needs to cover two types of obligations: immediate and future.

The most common among those are income replacement for a spouse, tuition savings for a child, mortgage balances, and miscellaneous debts.

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need, but there are simple formulas you can use to give yourself a general idea.

One popular method used by many online insurance calculators is the DIME method. DIME is an acronym which stands for the following:

- D – Debt

- I – Income

- M – Mortgage

- E – Education

Adding up your total obligations in those four categories will give you the minimum face value you need.

Watch the below video for a quick look at how life insurance benefits are used to cover debt.

Here’s a quick example.

A husband and father of one is shopping for life insurance. He and his wife both work full time. His annual salary is $80,000. The family has a remaining mortgage balance of $100,000, $10,000 left on a car loan, and $7,500 in credit card debt.

They also plan to save $30,000 in a college savings fund for their child.

The mortgage is the largest annual expense. With it gone, his wife will be less dependent on his income and can live on hers alone. Still, he plans to leave her five years’ worth of his salary as an emergency fund should her financial situation change.

After factoring in an average funeral cost of around $7,500, the man’s insurance needs are as follows:

- Debt – $10,000 car loan + $7,500 credit card + $7,500 funeral costs = $25,000

- Income – $400,000

- Mortgage – $100,000

- Education – $30,000

- Total need – $555,000

To meet all of those obligations, he would need a life insurance policy with a face value of around $600,000.

Length of Coverage

If you buy a whole policy, you don’t need to decide on a term length, since you have lifelong coverage. However, if you choose a term policy, you need to choose a term length that covers all of your obligations.

For example, if you have 20 years left on a 30-year mortgage, you should choose a 20-year life insurance policy.

Here’s a list of things to consider when determining a term length:

- Number of years your spouse will depend on your income (years to retirement)

- Number of years dependent children will be living with you

- Number of years until shared debts (such as a mortgage) are paid in full

- Number of years until your savings grow enough to cover future obligations

You should choose a term that extends until your furthest milestones are reached. After you’ve reached the last one, you’ll have much less need for insurance coverage.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Shopping for Life Insurance

In addition to all of your policy options, there are some important things about cost and providers you should understand before you set out into the life insurance marketplace.

Average Cost of Life Insurance

Cost is a major deciding factor when it comes to purchasing most products. Life insurance is no different.

Your life insurance costs will depend largely on what type of policy you choose. As discussed, a term policy will be significantly cheaper than a whole policy. However, there can also be a lot of variation within those categories. Rates can rise or fall based on several different factors.

Factors That Affect Rates

There is no industry-standard price for life insurance. Rates vary for everyone. Your premiums are determined by several factors, primarily the following.

- Age – Age is a critical factor in determining insurability. The older you are, the closer you are to death. Therefore, the longer you wait to buy a policy, the higher your rate will be.

- Gender – Statistically, women live longer than men. Because of that, they usually pay lower premiums.

- Health history – The healthier you are, the longer you’re likely to live. Longer life expectancy translates to lower premiums. To determine your overall health, insurers may require a complete medical exam.

- Family medical history – Many diseases are hereditary, so most insurers will also inquire about the health history of your immediate family during your application.

- Occupation – Some jobs come with a higher risk of accidental death than others. The more dangerous the profession, the more likely an insurer is to pay out an early death benefit, which means higher premiums.

- High-risk habits – Regular, high-risk habits such as flying, racing, or mountain climbing could result in increased premiums.

- Tobacco use – The most common high-risk habit that insurers look for is tobacco use. Smokers pay higher rates than non-smokers in every demographic.

Sample Rates

To give you an idea of how much life insurance coverage might cost you, here is a look at cumulative average sample rates for a non-smoker from the top 10 life insurers in the country.

20-Year Term:

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $11.03 | $10.02 | $22.10 | $12.91 | $23.19 | $19.04 |

| 30 | $11.12 | $10.07 | $15.31 | $13.02 | $23.85 | $19.26 |

| 35 | $11.12 | $10.07 | $15.42 | $13.02 | $24.07 | $19.26 |

| 40 | $12.65 | $11.12 | $17.94 | $15.21 | $29.10 | $23.63 |

| 45 | $14.57 | $13.31 | $21.55 | $19.69 | $36.32 | $32.60 |

| 50 | $18.60 | $17.20 | $30.19 | $27.02 | $53.60 | $47.26 |

| 55 | $24.51 | $20.61 | $42.88 | $34.35 | $78.98 | $61.91 |

| 60 | $35.88 | $27.48 | $71.10 | $50.86 | $135.41 | $94.94 |

| 65 | $51.06 | $37.76 | $109.82 | $75.14 | $212.85 | $143.51 |

Get Your Rates Quote Now |

||||||

Whole:

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $93.70 | $84.91 | $201.90 | $179.97 | $396.07 | $352.22 |

| 30 | $107.71 | $97.35 | $238.33 | $211.60 | $468.50 | $415.25 |

| 35 | $128.24 | $112.93 | $289.26 | $251.86 | $569.70 | $495.33 |

| 40 | $153.90 | $132.15 | $350.98 | $299.62 | $692.47 | $590.19 |

| 45 | $190.79 | $156.17 | $434.71 | $365.30 | $859.29 | $720.90 |

| 50 | $234.90 | $191.66 | $538.74 | $449.58 | $1,066.47 | $888.81 |

| 55 | $294.84 | $243.17 | $678.64 | $574.34 | $1,344.73 | $1,137.02 |

| 60 | $399.24 | $311.63 | $895.65 | $735.39 | $1,777.01 | $1,457.58 |

| 65 | $528.00 | $421.69 | $1177.24 | $978.84 | $2,338.00 | $1,942.51 |

Get Your Rates Quote Now |

||||||

Premiums on whole policies range anywhere from 200 to 600 percent higher than 20-year term policies at the same age and with an equal face value.

Final Expense:

Before looking at the rates for a final expense policy, there are some things to keep in mind.

Final expense policies guarantee acceptance with no medical exam. Because of that, the insurer automatically assumes you are in a higher risk pool, whether your health actually reflects that or not.

For the insurer to make a profit off of a risky, guaranteed payout, they charge high premiums relative to their low death benefits.

| Age | $10,000 - Male | $10,000 - Female |

|---|---|---|

| 40 | $24.02 | $20.43 |

| 45 | $27.16 | $22.65 |

| 50 | $43.20 | $32.91 |

| 55 | $50.06 | $38.89 |

| 60 | $57.86 | $45.98 |

| 65 | $71.02 | $55.60 |

| 70 | $88.55 | $69.69 |

| 75 | $114.80 | $91.51 |

| 80 | $163.18 | $126.89 |

| 85 | $230.74 | $181.52 |

Get Your Rates Quote Now |

||

As a result, final expense policies can sometimes cost 10 times as much as comparable term policies, as evidenced by the above table of cumulative average monthly rates of some of the top 10 insurers by market share for a $10,000 policy.

Do rates change over time?

Premiums on term insurance can increase annually, depending on the type of policy you choose, but they are generally fixed for the life of the term. The only time you should expect an increase is if you renew your policy for an additional term once the original expires.

Whole rates are also generally fixed, but you do have more flexibility in how you pay them. Depending on the option you choose, your payments could vary from year to year.

With universal policies, you can change the amount and frequency of your premium payments.

For example, you can pay higher premiums or a lump sum early in the year, then pay less later.

Even though you don’t have to pay on a set schedule, you do still need to pay a minimum amount each year to keep your policy active.

Some policies also come with a limited pay option. You can pay for the policy in full over the course of 10-20 years so that you aren’t still paying premiums long into your life.

For policies with increasing death benefits, you can sometimes reduce or stop your out-of-pocket premiums by using your cash value to pay them instead.

How to Get a Quote

Quotes are an easy way to compare prices between companies and policies. There are two main ways to get one: online or through an agent.

Online

Whole life insurance has a lot of additional factors that influence its premiums. As such, many companies don’t give out quotes for them online. On the other hand, term quotes are readily available. Many insurers have quote tools on their website.

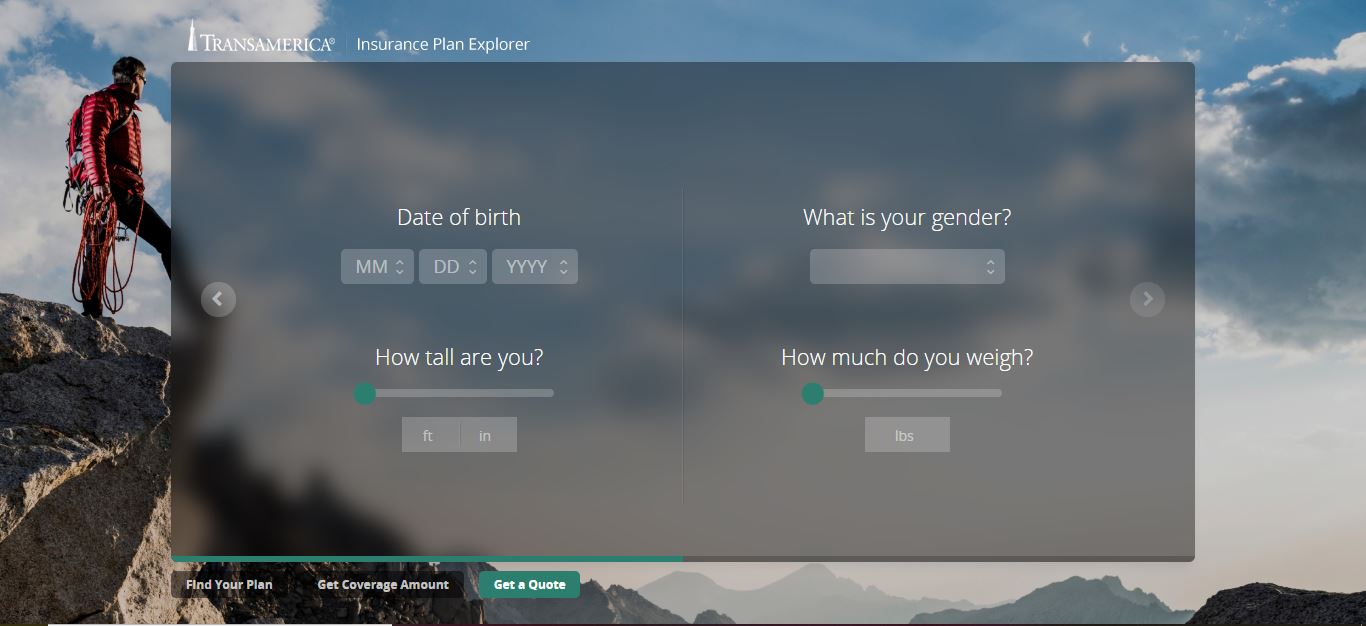

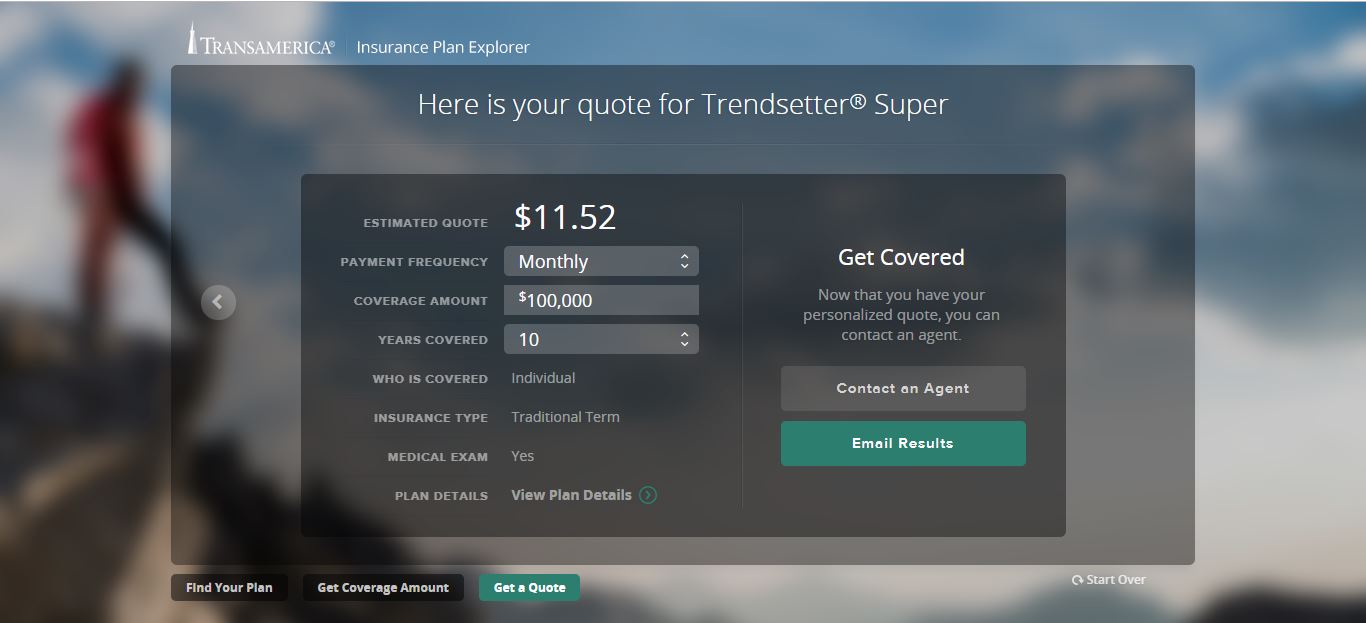

You simply choose your desired coverage, enter some basic personal information, and the tool will return an estimated cost.

There are also independent quote tools (like the ones on this page), which will provide you with quotes from multiple insurers at once. You can compare prices easily without having to jump between multiple webpages or manually keep track of all your previous quotes.

Some insurers also sell direct term policies. After getting your quote, you can immediately apply for the policy online without having to go through an agent.

Agents

A majority of life insurance policies are sold through agents. Even when an insurer gives out quotes online, you’ll most likely still have to go through an agent to complete the sale. Insurance agents fall into one of two categories: independent agents or captive.

An independent agent is free to shop and sell policies from multiple agencies to find the best policy for their clients.

A captive agent works for a single insurer and will only market and sell their employer’s policies. They are more like customer service reps than they are insurance brokers.

If you want to compare costs and policies across multiple insurers, you’ll need to seek out an independent agent.

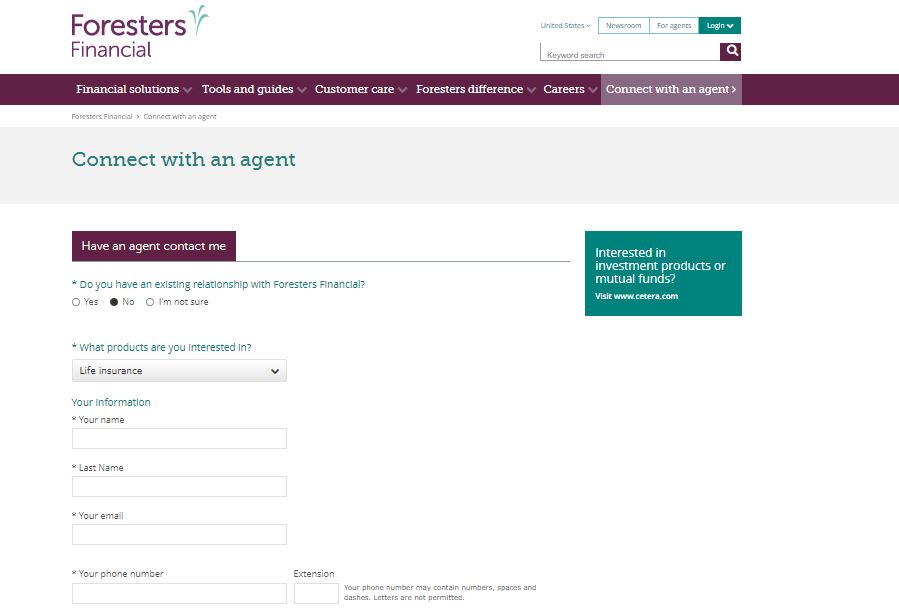

Most insurers have an agent finder tool on their websites.

You enter some basic personal information, location, and type of coverage you want, and agents will contact you to discuss your options.

Not all company websites make it clear whether they are connecting you to a captive agent or an independent one.

If you’re going the agent route and already know that you want to compare multiple providers, you might be better off finding an independent agency on your own, rather than being referred by an insurer.

Medical Exams

When applying for term life, insurers will require you to fill out a health questionnaire and may request your medical records. Some will also require a complete medical exam and bloodwork.

Watch the below video for some tips on taking the medical exam.

The basic life insurance medical exam process looks like this:

- The customer fills out a life insurance application and a medical questionnaire.

- The insurer schedules an in-home medical exam.

- The medical examiner conducts a brief interview.

- The examiner measures height, weight, and vitals, then takes a urine sample, blood sample, and oral swab.

- Lab results are sent to the underwriter for review.

- The insurer assigns a risk classification and notifies the applicant of final premiums.

Some term life insurance policies advertise the fact that they don’t require a medical exam. That’s a big selling point for some, but it’s a benefit that might cost more in the long run.

A young, healthy person might not see much of a difference in rates between an exam and no-exam policy, but older people can expect to pay more.

A no-exam policy represents a greater risk to the insurer. They pass that risk along to you in the form of increased premiums. Depending on your health, taking the exam could show the insurer that you’re a lower risk than they might assume you are with a no-exam policy.

How to Find the Best Provider

Here are some important tips to remember as you shop for life insurance.

#1 – Buy from a Reputable Company

Make sure the company you’re buying from is reliable.

Start by researching an insurer’s market share. If they have a significant presence in the industry, with a lot of policies in force, then they’re more likely to be an established, respectable company.

If you haven’t heard of them and you can’t find their name on any notable lists, you might want to look elsewhere.

Any of the top-ranking companies would be a good place to start.

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $10,877,337,000 | 6.7% |

| 2 | Northwestern Mutual | $10,550,806,000 | 6.5% |

| 3 | New York Life | $9,385,843,000 | 5.8% |

| 4 | Prudential | $9,170,883,000 | 5.6% |

| 5 | Lincoln National | $8,825,314,000 | 5.4% |

| 6 | MassMutual | $6,874,972,000 | 4.2% |

| 7 | Transamerica | $4,867,311,000 | 3.0% |

| 8 | John Hancock | $4,657,312,000 | 2.9% |

| 9 | State Farm | $4,636,147,000 | 2.9% |

| 10 | Securian | $4,426,864,000 | 2.7% |

| 11 | Guardian Life | $4,055,519,000 | 2.5% |

| 12 | Pacific Life | $3,770,584,000 | 2.3% |

| 13 | Nationwide Mutual | $3,365,469,000 | 2.1% |

| 14 | AIG | $3,346,570,000 | 2.1% |

| 15 | AXA | $3,097,395,000 | 1.9% |

| 16 | Voya | $2,668,108,000 | 1.6% |

| 17 | Brighthouse | $2,525,047,000 | 1.6% |

| 18 | Protective Life | $2,406,629,000 | 1.5% |

| 19 | Primerica | $2,376,601,000 | 1.5% |

| 20 | Torchmark | $2,367,072,000 | 1.5% |

Get Your Rates Quote Now |

|||

From there, read reviews of the company that focus on policy offerings, financial stability, and reputation. You can also do your own research in those areas by using the following resources.

- Third-party rating agencies like A.M. Best, the Moody’s Investors Service, and Standard & Poor’s (S&P) measure an insurer’s financial strength and its ability to pay all of its policy obligations.

- J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

- The Better Business Bureau uses 13 factors such as time in business, open complaints, resolved complaints, and legal action against a company to assign one of thirteen letter ratings, A+ through F.

- The National Association of Insurance Commissioners Complaint Index compiles the number of complaints filed against an insurer each year and compares it to that of other companies.

#2 – Compare Policies

Once you have a list of reputable companies, compare the policy offerings of each to find the one that suits you best. It’s important to make sure you compare policies of the same type.

For example, a guaranteed universal policy is much different than an indexed-universal policy. They have different benefits and drawbacks and could have widely varied costs.

You can’t accurately compare two policies unless they are similar in nature.

#3 – Get Quotes

Quotes are an easy way to compare prices between companies and policies. Quotes are available online through convenient quote tools or local insurance agents.

Try to find the policy with the greatest benefit for the lowest annual cost.

Changing Your Policy

If your financial situation changes during the life of your policy, you have some options for adjusting your coverage.

Whole life policies are more flexible than term, but both usually allow you to make some changes to your original contract.

Renewing Your Policy

You can renew many term insurance policies for additional terms once the original expires. Some allow you to do so without a new medical exam.

Every time you renew the policy, you run the risk of increased premiums since you’re starting a new term at an older, riskier age than when you originally applied.

Some insurers sell policies that renew at a guaranteed fixed rate, but they tend to have higher premiums from the start. Most plans have an age limit on renewals, typically 65 years old.

Since whole policies last your entire lifetime, there is no need to renew.

Converting Your Policy

Many term life plans can be converted to whole life plans. Some can be converted at any point, while others must be converted during a certain period, such as within the first 10 years.

Like renewals, most insurers place an age limit on conversions.

The opposite is not true of whole life plans. If your financial situation changes, and you no longer need permanent insurance, you can’t convert down to a term plan.

In that situation, your best course of action is to cancel your policy and purchase a new, cheaper term plan. Just know that doing so will likely result in some fees charged against your cash value.

Changing Your Death Benefit

During the course of your policy, you might acquire new debts which would necessitate more coverage or pay off some obligations which would mean you have less of a need. If so, you have some options.

Most policies (both term and whole) allow you to increase your death benefit. Some only let you increase during a certain time period, while others let you do so at any time before a cutoff age.

Most face value increases will require new underwriting, which means a new medical exam.

Many insurers also allow you to decrease your face value to a set minimum without forfeiting your coverage. Some allow for a single change, while others allow for multiple changes at any time.

You won’t get a refund on your premiums if you decrease your coverage. Also, just like canceling your policy, decreasing the benefit on a whole policy could result in fees imposed against your cash value.

The Bottom Line

Life is expensive, and death can be even more so. If you want to shield your family from potential financial disaster, you should explore one of your many life insurance options.

| Policy Feature | Term Life | Whole Life | Final Expense |

|---|---|---|---|

| Death benefit | Can be level, increasing, or decreasing | Level | Can be level, graded, or modified (limited face values $2,000 – $25,000) |

| Premium | Level (with the exception of an increasing term policy); paid monthly or annually for the life of the term | Level; can be paid for the life of the term or at a higher rate for a shorter period | Level |

| Cost | Less expensive | More expensive | Moderately expensive compared to benefit |

| Length of coverage | Set term, usually 1 – 30 years | Lifetime | Lifetime |

| Cash value | None | Tax-deferred growth | None |

| Policy loans | None | Loans can be taken against cash value | None |

| Online quotes | Readily available | Not easily available | Readily available |

| Online purchase | Some policies available for direct purchase | Not available | Some policies available for direct purchase |

Get Your Rates Quote Now |

|||

Whether you want to leave a large inheritance, pay off significant debts, or simply want to cover your funeral costs so your family has one less thing to worry about in the emotionally-trying days immediately following your death, there is a life insurance policy to help.

Start comparing life insurance rates now by using our FREE quote tool below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption