Indexed Universal Life Insurance: Expert Tips (Comparisons + Quotes)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Universal life plans are some of the most popular insurance products available today and include traditional, indexed, and variable life options

- Indexed universal life allows a policyholder to gain value in their plan by earning returns consistent with popular stock market indexes

- Indexed universal life is a permanent insurance policy with adjustable premiums and adjustable benefit payments

- You can borrow against any cash value in a plan through tax-free loans

- An indexed universal life policy can be a valuable component of an overall retirement plan that includes 401(k) investments, IRAs and other tax-incentive savings tools

Indexed universal life insurance plans are featured by life insurance companies today. Why? Consumers seem to like the savings component that comes with all permanent life insurance plans but truly appreciates the opportunity to earn returns on any savings invested in line with stock market index returns.

Read on — our guide will provide indexed universal life insurance expert tips.

This article will help you learn the ins and outs of universal life insurance and help you compare indexed life insurance rates and companies. We’ll discuss indexed universal life insurance vs 401k plans and determine the best way to incorporate indexed life insurance into your overall financial portfolio.

As you read our review of indexed universal life products, you may want to know how rates compare with other whole life insurance plans. Before you do, take a second to enter your ZIP code above and get an instant quote in seconds.

Table of Contents

Top Indexed Universal Life Insurance Companies by Market Share

According to LIMRA, indexed universal life accounted for a quarter of all individual life insurance sales for the first quarter of 2019. As one of the most popular products in life insurance, you can be sure that all of the top 10 insurance providers offer some type of indexed life product.

The table below provides a list of the top 10 life insurance providers by market share for 2018.

| Rank | Companies | Direct premiums written | Market share |

|---|---|---|---|

| 1 | Northwestern Mutual Life Insurance Co. | $10,547,469 | 8.2 |

| 2 | Lincoln National Corp. | $7,467,869 | 5.80 |

| 3 | New York Life Insurance Group | $7,331,015 | 5.70 |

| 4 | Massachusetts Mutual Life Insurance Co. | $6,171,213 | 4.80 |

| 5 | Prudential Financial Inc. | $5,806,118 | 4.50 |

| 6 | John Hancock Life Insurance Co. | $4,651,894 | 3.60 |

| 7 | State Farm Mutual Automobile Insurance | $4,593,999 | 3.60 |

| 8 | Transamerica | $4,567,999 | 3.60 |

| 9 | Pacific Life | $3,770,584 | 2.90 |

| 10 | MetLife Inc. | $3,724,165 | 2.9 |

Get Your Rates Quote Now |

|||

Although indexed universal plans offerings will vary from provider to provider, our own research puts Northwestern Mutual and Protective Life Insurance at the top of the list and are good places to start shopping.

Sample Monthly Life Insurance Rates

Here are sample average monthly whole life insurance rates from some of the top insurers by market share for non-smokers at key ages to give you a ballpark of what you may find.

| Companies | Age 30 | Age 40 | Age 50 | Age 60 |

|---|---|---|---|---|

| Illinois Mutual | $201.96 | $281.16 | $401.06 | $638.44 |

| Minnesota Life | $202.03 | $301.36 | $455.97 | $768.05 |

| Foresters Financial | $216.52 | $326.33 | $499.36 | $802.33 |

| Assurity | $238.16 | $348.22 | $532.66 | $801.27 |

| State Farm | $260.14 | $375.62 | $578.12 | $988.97 |

Get Your Rates Quote Now |

||||

Now that you have seen some perspective on rates, let’s dive into some basics about indexed universal life insurance.

What is indexed universal life insurance?

Indexed universal life is one type of universal life insurance or permanent insurance. This means that once you purchase a policy, as long as you meet any premium requirements, your coverage will last for your entire life.

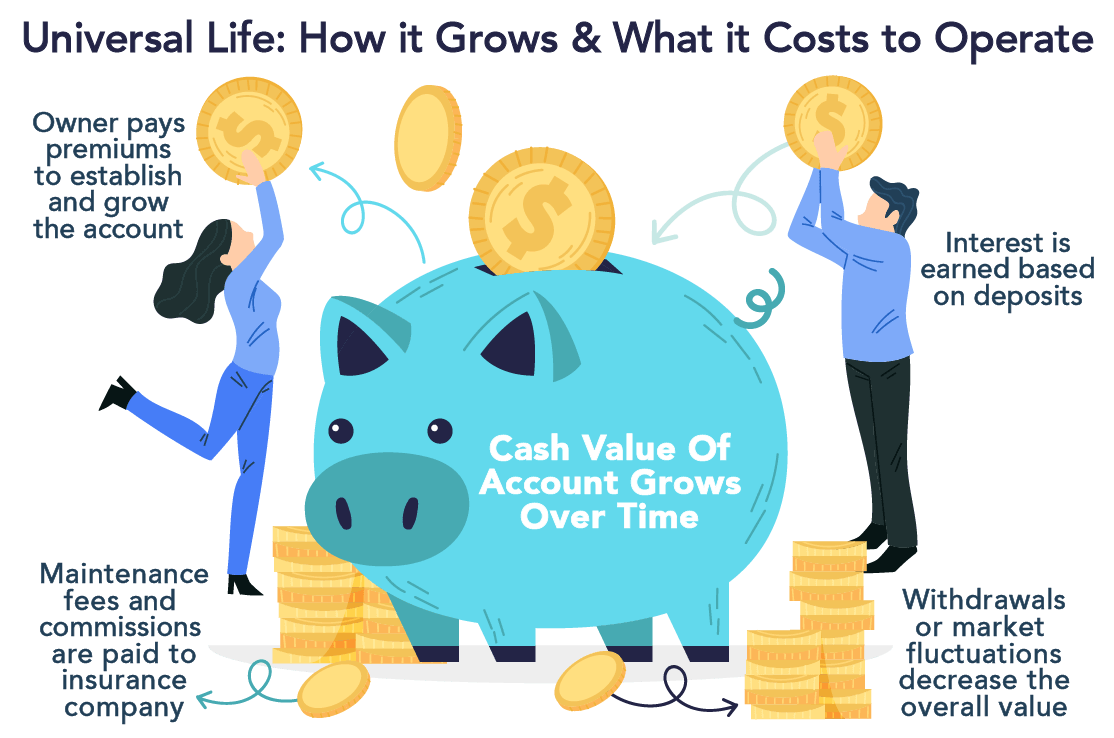

Like other types of whole life insurance, indexed universal life provides policyholders the ability to set premium payments so that a component of the premiums gets set aside to build cash value in the insurance plan.

But indexed universal life allows a policyholder the ability to adjust both premiums and benefit coverage amounts over time, providing policyholders with a lot of flexibility.

However, indexed universal life is a very specific product with very specific features. Most whole life insurance policies, including traditional universal life insurance, provide a fixed interest rate of return for the cash component of the policy.

Indexed universal life pins the return on any cash held in the policy against the return of a specific stock market index, like the S&P 500. However, although you’ll receive a return that matches the index performance, you aren’t actually invested in the index itself.

Take a look at this quick video for a good explanation of how your money gets invested with indexed universal life.

Instead, the insurance company will provide you a capital return at the same rate the index is returning. So, if you were pegged against the S&P 500 and the S&P 500 returned a 6 percent gain, the insurer would give you a return of 6 percent minus applicable fees and considering any caps.

This is an important distinction because this insulates you from very volatile markets. Since your plan will settle up at different intervals (i.e. monthly, quarterly, annually), you won’t have to worry about what happens in the index daily.

An additional benefit of an indexed universal life fund is that you’re protected from any negative returns.

Most indexed universal life funds offer a 0 percent interest minimum return.

This means if the index goes negative, you’ll be protected. Even though you won’t make a return, you won’t lose your original capital.

This may all sound too good to be true. If you can only earn the upside for performance on an index and be protected from any negative returns, why wouldn’t you jump in? Before you jump into an index universal life insurance plan, let’s have a look at the details.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

How does an indexed universal life policy work?

Indexed universal life plans provide an option for some consumers to earn higher returns on any savings allocations on the cash any policy. Although that sounds great, there are a few things you should consider before you assume indexed universal life will work for you.

First, it’s important to understand how your contributions will work.

When you’re provided a premium quote from an insurance provider, they’re usually quoting you the minimum contribution amount you’ll need to make for a specific period.

This is important because to accumulate any cash value, you’ll need to contribute more than the minimum on a regular basis. For example, if you’re quoted a monthly premium of $25, this amount will only cover the administration costs and benefits coverage for the plan.

To accumulate any savings, you’ll have to contribute more. You will want to use an indexed universal life calculator to help you figure out the right premium payment to help you achieve your target cash value.

The good news is that unlike retirement investment plans and other investment plans, there are no maximum contribution limits.

This means that you can contribute a significant amount to your plan to achieve market returns.

The next thing to consider is that indexed universal life is an insurance plan and not a retirement plan. We’ll get more into the details and comparisons of true retirement plans and indexed universal life later, but the main point to consider is that a significant amount of your premium contribution goes to manage the policy and ensure your life insurance benefit coverage.

So, assuming that you can make a monthly contribution more than the minimum, here’s what happens with the cash value component in your account.

Your insurance provider will give you at least one market index option to allocate your cash value against. The options provided are usually well-known and widely used equity market indexes.

You’re probably familiar with the S&P 500, but other indexes like the Dow Jones Index or the Russell 2000 Index are also popular options that you might find in the top five list of indexes. You can find a list of the most popular U.S. stock market indexes at the Securities and Exchange Commission site.

This video briefly describes the Dow Jones index, S&P 500, and NASDAQ.

Historically, these stock market indexes have provided returns over a long time that are better than standard returns marked to interest rates set for treasury markets.

The idea is that your money will be able to gain more of a return between now and when you may want to access the money in the future.

The insurer will take your cash allocation and provide periodic returns that are the same percentage return reflected by the index you chose. Additionally, the insurer limits downside risk by providing a minimum interest rate return, usually anywhere from 0 to 1 percent. So if the index doesn’t perform well and begins to lose money, your cash value allocation remains protected.

Your cash value will accumulate over time and you will have options, later on, to take out tax-free loans against the value, withdraw the value (but with tax consequences), or just leave your beneficiary with a higher benefit amount than you might have with a traditional universal life policy.

You should speak to your insurance company provider to see if your plan is a 7702 indexed universal life plan. This will allow for special tax handling if you choose to liquidate the plan. The rules for handling indexed universal life plans can be tricky so tax professionals and investors should consult with the IRS rules.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

What is an indexed universal life insurance maturity date?

To ensure that life insurance policies issued have some definitive end date, insurers set maturity dates to specify the expiration of a policy. For term life policies, the end date of the policy is defined by the term, which can usually range from 10 to 35 years.

For permanent life insurance policies, whether they are whole life policies or universal life policies, having an end date to a policy seems counter-intuitive. The policy, after all, is meant to be permanent.

However, insurers need a way to “clear the books.” If a claim is never made against a policy, the insurer remains on the hook to cover the benefit payout amount.

Over time, unclaimed policies or policies that still have living policyholders will add up.

Insurers are required to keep capital reserve amounts. These amounts are closely monitored by organizations like the American Academy of Actuaries. The higher the amount of insurance liability they have outstanding, or insurance in force, the more capital the company will need to keep in reserve.

To address this, insurers set maturity dates for every permanent policy. The maturity date of a permanent policy is set far off into the future. As an example, many policies set the maturity date for a policyholder’s 121st birthday.

The idea is that most of us won’t live till our 121st birthday, so the policy will likely be executed before then and a claim will be made.

However, people are living longer, so it’s important to understand what happens if you outlive your maturity date.

So what happens if you do reach your maturity? It may seem unlikely for many of us to reach our 121st birthday. In fact, until recently, policy maturity dates were set for a person’s 101st birthday. When more people started living past 100, insurance companies changed policy maturity dates.

Reaching a policy maturity date can be a problem for a policyholder. When you reach your maturity date, the insurer will automatically close the policy. This has three consequences for the policyholder:

- The policy is expired, meaning the policyholder no longer has benefit coverage for the policy beneficiaries.

- Any cash value that’s held in the policy is returned to the policyholder and any gains in value become taxable.

- At an advanced age, the policyholder may not be able to attain new or suitable coverage.

So what can you do if your policy is about to mature?

The first thing is to know your policy maturity date. If you don’t know when it will expire, the date may come and go, and you’ll be left with little option. Next, you should reach out to your insurer and request an extension of the policy date. Most insurers will work with you to accommodate this.

Finally, speak to your insurer about having conversion options for your policy. If you’re able, build into the policy an automatic conversion to a term policy or something that will allow you to still remain covered.

How Indexed Universal Life Insurance Builds Cash Value

Time is the secret to building value in indexed universal funds. This is because whether you’re invested in funds or invested in interest rate-backed assets, you make money over time with compound interest.

With an index fund, you’re betting that the underlying index will perform better than market interest rates. And, with compounding interest, every gain you get grows your principal base.

As you grow your principal, you have more money that’s earning interest.

So, if you have a longer timeline, you’ll earn more. Check out the table below. Look at the difference just a few interest rate points or a longer timeline does for your return.

| Time in Years | 5% Rate of Return | 6% Rate of Return | 10% Rate of Return | 11% Rate of Return |

|---|---|---|---|---|

| 5 | $12,763 | $13.382 | $16,105 | $16,851 |

| 10 | $16,289 | $17,908 | $25,953 | $28,394 |

| 15 | $20,789 | $23,966 | $41,722 | $47,846 |

| 20 | $26,533 | $32,071 | $62,275 | $80,623 |

Get Your Rates Quote Now |

||||

Index funds are deemed safe investments, but be wary. Markets can change overnight, so to manage your policy gains, you’ll want to manage your risk as you get closer to when you might want to use the cash value in your policy. Similar to a 401(k) plan, you’ll want to hold more cash as you get older to protect any of your gains from sudden market swings.

Indexed Universal Life Insurance Premium Distributions

When you’re quoted a premium for a universal life fund, it’s likely that you’re quoted the bare minimum contribution necessary to keep the fund serviced.

This is important because if this is all you contribute, you’ll never earn any real cash value.

To really have any earnings potential, you’ll need to invest more than the minimum required. The good news is that you usually don’t have any contribution caps with an indexed universal life fund.

Premium Payment Planning

As previously mentioned, when it comes to building value, time is your friend. This is because when you first purchase a policy, there is no cash value.

Over time, the cash value will build as your premium payment contributions are made and your underlying investments appreciate.

When the plan has enough cash value, you can decide to withdraw funds, take a loan against the funds, or simply use the funds to continue to service the premium payments on the plan.

This is helpful because there are times when you may not be able to meet the premium requirements. Using the cash value to avoid lapses in payments prevents any plan cancellations or changes to benefit coverage.

How to Access Cash Value

You can withdraw your cash at any point, but there are different consequences depending on how you access the cash. Pay attention to the tax consequences when you do so to avoid losing a significant amount of the value in the plan. There are three ways you can extract cash from your plan.

Withdrawal

You can request a withdrawal of all or part of the cash value in the plan. If you do so part of the amount withdrawn will be subject to income taxes. You should also be aware that your plan may never regain the value since the performance of the plan depends on how the index performs in the future.

You also will want to pay attention to how much cash is in the plan. If the overall plan isn’t funded sufficiently, your benefit amount might be reduced.

Surrender

Surrendering your policy is another way of canceling your policy. When you do so, the full amount of cash value will be delivered to you. At that time, any benefit you had will be lost. If your policy value gained from returns on investments made, you’ll have to pay income tax. You could also lose significant value if your early surrender is subject to termination fees.

Loan

For most people, the idea of a loan can put people off. If the money is yours, why would you borrow against it? When it comes to indexed universal life insurance, the ability to borrow against your cash value is an incredible feature, though.

This is because you can borrow against your loan at a predetermined interest rate and pay yourself back over time, or use the benefit of the policy to pay the loan off after you die.

The loan proceeds aren’t taxable as income, which makes taking a loan preferable to withdrawing cash. If you do borrow against your policy and continue to make your premium payments, you won’t lose any benefit value in the policy.

So when does a loan make sense? Check out this scenario.

Tom is 72 years old and has some unexpected medical expenses that he cannot afford. He needs about $100,000 to pay off his medical bills, but his fixed income leaves him nothing after his monthly expenses.

Tom’s kids are grown and successful and his wife has already passed away. His indexed universal life policy has a cash value of $200,000 saved up over time and would pay a benefit of $1.5 million to his beneficiaries. After speaking with his children, they suggest he consult with his financial advisor to see how much he might sell his policy as a cash settlement.

Tom’s financial advisor returns with an estimated sale price of about $800,000 for someone to purchase the policy today, but after taxes, he would only get about $640,000. However, the financial advisor requests that Tom consider another option.

He suggests that Tom take a loan of $200,000 against the cash value of the policy. He can pay off the $100,000 in medical payments and use the remaining $100,000 to pay his premiums and loan payments on the policy.

Tom’s financial advisor calculates that if Tom lives until the age of 92, he would still have about a $90,000 balance left on his loan. However, his benefit would payout $1.5 million to his kids tax-free. After paying the balance of the loan from the benefit of the policy, Tom’s kids would get a net benefit of about $1.41 million.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Indexed Universal Life vs Whole Life

Indexed universal life and whole life insurance are both permanent insurance plans.

Whole life is indexed universal life’s more conservative brother. With whole life insurance, you know exactly what you’re paying and exactly what you’re getting at all times. Let’s take a look at what each plan has in common and where each is different to see which option might be right for you.

Similarities

Whole life and indexed universal life are both permanent insurance plans, as we previously mentioned. This means that, as long as you continue to make premium payments, you will be covered. This is important, especially as you grow older and qualifying for life insurance becomes an issue.

Unlike with term insurance, once you qualify for permanent life insurance, you remain covered. With term insurance, your insurance policy expires with the term period.

Both whole life and universal indexed life have a cash value component and policyholders can borrow or withdraw from the cash value as needed.

Whole life and universal life insurance guarantee death benefits if all premiums are paid on time. Insurance claim benefits paid to beneficiaries are tax-free for both policies.

Differences

The differences between whole life and universal life insurance are extremely important to understand.

First, whole life premiums and benefits are static. This means that when you purchase your policy, you agree to a specific premium amount for life with the expectation that you’ll receive a specific benefit when a claim on the policy is made.

You also will have a single, predictable rate of return for the cash value of your policy. Since your premium payments and interest rate of return are pre-determined, you’ll know exactly how much your cash value will be at any point in time.

For indexed universal life, you have much more flexibility and much less predictability.

First, you can increase or decrease your premium payments over time within certain minimum and maximum ranges.

However, adjusting your premiums also means that your cash value can increase and decrease. In fact, if you decrease your premium too much, you can decrease the amount of benefit in the plan as well.

Additionally, your cash value is tied to the performance of the underlying index. Unlike whole life insurance, where you may have a pre-determined rate of 2.5 percent, indexed universal life will provide you a range of return from 0 percent to some maximum cap set by your insurer.

Indexed universal life fees and expenses are usually higher due to the costs of managing the plan and the popularity of the plan type.

Finally, whole life plans can payout periodic dividends or guaranteed cash returns where indexed universal life plans do not.

Which one should you choose?

Determining which plan is right for you will depend upon your individual needs and risk tolerance. Let’s take a look at a few scenarios.

Scenario 1 – Risk-Friendly

Mark is 53 and in great health. He expects to retire at 65 and wants to purchase a life insurance plan that will pay for itself after he retires. He believes that he will live late into his 80s based upon family history and so he needs the plan to pay for itself for at least 25 years.

When he prices a whole life plan out that guarantees a 2.5 percent annual return, he realizes that his monthly premiums would be unaffordable.

He looks at a universal life plan that follows the S&P 500 index. The S&P 500’s long-term return is mediocre, averaging a return over 20 years ranging from 4.5 percent to 8 percent over the time period Mark reviewed. Mark realizes that he could afford a lower premium but contributes a part of his bonus every 5 years until retirement.

He calculates that if he contributes until 65 this way, he will have $100,000 in cash value at 65 years of age. This would leave him about $420 per month to continue to service his plan for the next 20 years.

Mark decides to take the risk.

Scenario 2 – Risk-Averse

Juan is 45 and wants to retire from his position as a lower-circuit judge at 60. He has a great 401(k) plan and has money put aside for him and his wife to retire in South Carolina. Juan wants to ensure that his two children will be taken care of when he passes and wants them to each have $1 million in benefits from his life insurance.

Juan does not want to bother with any risk and doesn’t trust the financial markets. He sits with his financial advisor to calculate out his exact contributions each month so that he will have a $1 million in benefits and $1 million in cash value if he continues to make payments until he’s 75.

Finding the right type of insurance means understanding your timeline, risk appetite, and needs.

For most people, it’s best to work with a financial advisor or life insurance agent to determine what works for you.

If you are shopping for life insurance for the first time, or are just looking to compare prices, you should start by gathering a few term life insurance rates. Why term life? Because term insurance quotes will offer the cheapest rates giving you a baseline to start your shopping with.

If you are wondering how to get a term life rate, just enter your ZIP code here and get an instant quote in seconds.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Is an IUL better than a 401k for retirement?

Life insurance products are sometimes marketed as investment options, but we would advise anyone not to think of indexed universal life or any type of insurance policy as a wealth-building tool.

With most traditional investments, you’re investing to obtain more wealth or establish income.

When you invest in life insurance, you’re investing in financial security.

This is an important distinction because indexed universal life will often underperform true investment and retirement tools such as IRAs, 401(k) plans, and mutual funds. This is simply because insurance products have higher fees and caps on potential returns.

That said, when it comes to life insurance, indexed universal life does provide the potential for a better return than products like whole life insurance vs term life insurance.

Is indexed universal life worth it?

Indexed universal life is just one type of universal life insurance. Depending on your risk tolerance, you might opt for a lower risk option like traditional universal life, which acts very much like a whole life insurance plan but provides more flexibility.

Where whole life insurance imposes fixed premiums for a predictable fixed benefit and rate of return, traditional universal life provides a fixed rate of return but allows the policyholder to adjust the benefit and premium over time.

If you have a higher risk tolerance, you can opt for variable universal life, which allows you to pin your cash value returns to the performance of riskier groups of equities, mutual funds, or stocks.

If you’re concerned whether the cost of indexed universal life insurance is worth it, you might just opt to purchase a low-cost term life insurance and invest any savings directly into an index fund. However, this approach requires that you maintain your savings discipline and regularly adjust your plan investments.

There is a lot of buzz about indexed universal life as a bad investment. You don’t have to look much further than on an indexed universal life insurance Reddit message board or investment gurus like the indexed universal life Dave Ramsey review. However, for people who have maxed out tools like Roth IRAs and 401k plans, indexed universal life might be a worthwhile tool.

Also, you should beware that with this approach you can sustain losses.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Indexed Universal Life Pros & Cons

We’ve shared a lot of information on indexed universal life with you. After digesting it all, are you asking yourself, “What are indexed universal life insurance pros and cons?”

Pros of Indexed Universal Life Insurance

Indexed universal life features are intended to provide policyholders with a distinct opportunity to gain value over the life of the policy. Here are its primary features.

- IUL is permanent insurance and will last your lifetime

- IUL has adjustable premiums and benefits so you can adjust the plan with your needs over time.

- Plans have a cash value component that can earn a higher return than whole life plans by investing in riskier products.

- Plans limit any downside risk with zero percent return floors.

- Benefits paid are tax-free if paid to beneficiaries.

- You can borrow or withdraw your funds from the cash value at any time.

Discuss these features with your financial advisor to ensure these features would benefit your financial portfolio.

Cons of Indexed Universal Life Insurance

The summary of the cons below should also be considered as you compare indexed universal life plans against other options.

- Indexed universal life plans can have high administration fees, termination fees, and expenses.

- Gains on investment are limited by caps on returns and participation fees.

- Indexed universal life plans can be complex and difficult to understand.

- Forecasting how much you’ll have at different periods in the plan’s lifetime isn’t possible since so many components can vary.

Of course, competing products could have similar downsides like high fees and limited gains.

Indexed Universal Life Insurance: The Bottom Line

Indexed universal life insurance puts an interesting spin on a piece of security that we all know we need but don’t care too much to think about.

With indexed universal life, you gain the opportunity to invest in your plan and not only invest in your family’s financial well-being and certainty but also use a powerful tool that can provide you with financial rewards within your lifetime.

Our rule of thumb is that if you’re thinking about buying life insurance, then you probably need it. With just a few minutes of your time, you can compare real indexed universal life insurance rates from the top providers around. Enter your ZIP code below to get an instant life insurance quote in seconds.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption