Variable Life Insurance: Insider Tips [2020 Quotes]

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- The owner is responsible for investing the cash portion of the account. You will choose from sub-accounts offered by the insurance company. The performance of these accounts can increase or decrease your cash account value and your death benefit.

- The death benefit will not decline beyond a minimum level, even if the investment account has dropped in value. This gives a death benefit minimum payment.

- Premiums on a variable life contract are typically fixed, so they cannot be decreased if you can no longer afford the premiums. Compare premiums before signing the contract to make sure you get the best price.

Is it wise to get life insurance? Planning for your loved ones’ future can often feel like a daunting task. It may feel like there are a million things to consider. In this article, we will give you some life insurance tips and strategies on variable life insurance and give you sample rates from the best life insurance companies around.

We’ll take a look at the often-overlooked type of policy that will not only provide coverage for your family in case of an accident but will also provide the money you can use on expenses later in your life.

Ready to start looking for your variable life insurance policy? Use our FREE quote tool to find your rates.

Table of Contents

Top Life Insurance Companies by Market Share

Before we go any further, let’s talk about what you really want to know: how much is this going to cost? We’ll start by discussing some of the best companies that offer this type of policy.

When it comes to financial ratings, it’s important to pick a company that has a strong and stable history of honoring its obligations in terms of paying out the death benefit and the cash value when the time comes.

According to A.M. Best, Northwestern Mutual has a superior financial rating (A++), and with how long they’ve been around, they know how to stay stable in the life insurance business. They offer three types of variable policies so you can truly get what you need.

Customer service is also a very important factor when deciding to work with any company, not just life insurance.

Nationwide currently has an A+, the best rating that the Better Business Bureau (BBB) offers, for their commitment to meeting their customers’ needs. Nationwide’s policy provides the chance to earn additional cash value and the option to receive your death benefit tax-free as long as you structure it correctly.

While Northwestern Mutual and Nationwide are just two examples, other companies offer this type of policy as well. Below is a table of variable life insurance companies organized by how much of the life insurance market that they hold.

Top 5 Variable Life Insurance Companies by Market Share| Variable Life Companies | Market Share |

|---|---|

| Northwestern Mutual | 6.42% |

| Prudential | 5.57% |

| Lincoln National | 5.36% |

| MassMutual | 4.19% |

| State Farm | 2.83% |

Get Your Rates Quote Now |

|

All these companies have maintained this hold on the market through continued service to their customers.

Sample Monthly Life Insurance Rates

Here are some average monthly sample rates from some of the top 10 insurers by market share for non-smokers at key ages.

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $93.70 | $84.91 | $201.90 | $179.97 | $396.07 | $352.22 |

| 30 | $107.71 | $97.35 | $238.33 | $211.60 | $468.50 | $415.25 |

| 35 | $128.24 | $112.93 | $289.26 | $251.86 | $569.70 | $495.33 |

| 40 | $153.90 | $132.15 | $350.98 | $299.62 | $692.47 | $590.19 |

| 45 | $190.79 | $156.17 | $434.71 | $365.30 | $859.29 | $720.90 |

| 50 | $234.90 | $191.66 | $538.74 | $449.58 | $1,066.47 | $888.81 |

| 55 | $294.84 | $243.17 | $678.64 | $574.34 | $1,344.73 | $1,137.02 |

| 60 | $399.24 | $311.63 | $895.65 | $735.39 | $1,777.01 | $1,457.58 |

| 65 | $528.00 | $421.69 | $1177.24 | $978.84 | $2,338.00 | $1,942.51 |

Get Your Rates Quote Now |

||||||

Now that you have seen some perspective on rates, let’s dive into some basics about variable life insurance, including who should consider it.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

What is variable life insurance?

Whether it be the seemingly endless advantages and disadvantages of policy options or the myriad companies swearing they offer the best deals, no one would blame you for being lost among the shuffle. Even if you learned everything there was to know about the life insurance game, you may be surprised at how quickly it can all change.

So let’s focus on variable life insurance.

Variable life insurance is a permanent life insurance policy that allows for cash value investments into mutual-fund type investment accounts. This option allows for extra coverage with the ability to accrue additional wealth based on the performance of the investment option.

Based on the investment, your cash value may be higher than it would have been with a typical whole life policy. However, if the market does poorly, your cash value could drop and leave you with less.

The option to choose which investment you put your cash value is a benefit that gives you the control over your cash value.

This is also appealing because the investment income isn’t taxable like the typical cash value would be. If you plan your withdrawal later in life correctly, you may even be able to get the cash value without it being taxed at all.

How Variable Life Insurance Works

Like whole life, variable life insurance covers your whole life and also has a cash value component. But unlike whole life, your cash value will be invested into sub-accounts to give you the maximum return on your investment.

You also get the option to choose which investment your cash value will be placed in. Some examples of this include:

- An indexed investment allows you to allocate how much you would like into different investments and will stop accruing value after a certain amount, but it also protects from potential losses.

- A money market account will allow you to place invested amounts in separate accounts that are independent of your life insurance company and are susceptible to bigger gains as well as losses.

- An emerging market account is an investment option where the majority of your invested assets will be placed into an economy that is seen as emerging onto the scene.

- A bond is a loan that a company takes out through investors instead of the bank and it pays it back with added interest over pre-determined intervals.

Your insurer might offer choices outside of these, so it’s important to discuss your choices with an adviser. Some investments also come with extra fees, so be aware of what you’re signing up for.

As with all investments, you should know that you might lose as much as you’ll gain — or more if you’re not careful. Here’s a quick video to learn more:

Now, let’s see how variable life insurance stacks up against other types of life insurance.

Variable Life vs Other Policies

Variable life insurance is unlike any other policy on the market due to its investment components and the ability to get more than you paid into the policy.

Term life insurance is the most different from a variable life insurance policy.

Unlike any permanent life insurance, a term policy will only last for a predetermined period in your life. There’s no option to attain additional cash value or any wealth that you will be able to use later in your life. If your term runs out while you have the policy, you will lose out entirely on your investment.

Whole life is a policy that gives you coverage over your whole life while also allowing you to accrue additional cash value to use later in your life for whatever expenses may come up. Unlike variable life, however, your cash value is not invested and will only be a portion of the premiums that you paid over the years. While you don’t have the option to earn more, you won’t lose your cash value due to potential losses.

Universal life is the most similar to a variable life policy, and even has a subset policy called variable universal.

This policy allows for the option to invest a portion of your premiums, your cash value, into an insurer’s internal investment account. While you won’t have to worry about losses thanks to guaranteed increase, you may not be able to gain as much as a variable policy.

All of these are good options and may fit your life better than a variable life insurance policy. Even if you buy one and stack with another company variable life as supplemental coverage and investment, you will be all the better for it.

Who should consider variable life insurance?

Variable life insurance is a great idea for anyone who wants to cover their whole life while also putting up a long-term investment. Your family will get the coverage when you pass away, and you’ll have some cash value that you can use later in your life for anything you want.

The longer you have the investment, the more beneficial it can be to you when it’s finally time to collect. Since it’s more ideal for a long-term investment, it will benefit some situations more than others.

This policy is most suited for those who like the guaranteed coverage with the flexibility of the investment component.

Keeping that in mind, there are a few groups who can benefit more than others:

- Investors – Those who spend their days watching the stock market go up and down will enjoy the guaranteed coverage with the ability to do what they do best — invest.

- Savers – This policy is best over the long term. This is best for those who like the idea of putting their money into an account that mainly depends on the length of time they leave it alone.

- Retirees – The invested amount can be used to support you in retirement for any expense that you want to use it on. The sooner you start it, the more you can make.

- Young adults – As with most insurance policies, if you start your policy sooner you’ll automatically get better rates, plus you have longer to max your investment.

While these are a few examples, you can see how this might benefit your life, especially if you don’t mind the potential risk that comes with this policy. The potential earnings can carry you comfortably into your later life.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Types of Variable Life Insurance

Inside of the variable life policy, there are more options to customize the kind of coverage that you want even further. These policies can be broken down into different subtypes.

Traditional or fixed-premium variable life insurance guarantees that you’ll get a death benefit and that your investment will be placed into a market-based account that is susceptible to the highs and lows that a stock market investment brings.

All of this comes at level premiums that you’ll pay every month for the life of the policy.

With variable universal life insurance, you get the same investment opportunities with the flexibility to adjust your premiums and death benefit during the life of your policy.

What both of these policies share is the higher risk that comes with this type of investment opportunity. Both of these policies are also typically more expensive than whole or term life policies due to extra fees that come up.

Traditional Variable

A traditional variable policy allows for the benefit of an investment component while guaranteeing that you’ll know what you’re going to pay every month for the life of the policy.

You’ll start your policy by discussing your options with your advisor to determine if the variable policy is right for you. Next, the insurance agent will likely break down what this policy covers to keep you informed.

You’ll pay a guaranteed equal premium every month for the life of the policy.

A portion of that premium will be taken out and invested in an account that depends wholly on the performance of the stock market. As your policy continues, your investment will grow because of the cash value you put into it as well as the investment.

Your cash value is the amount that gets taken from what you pay each month and put into a separate account — in this case, your investment account. As you continue to pay your policy, the investment account will continue to grow based purely on the cash value you continue to put into it.

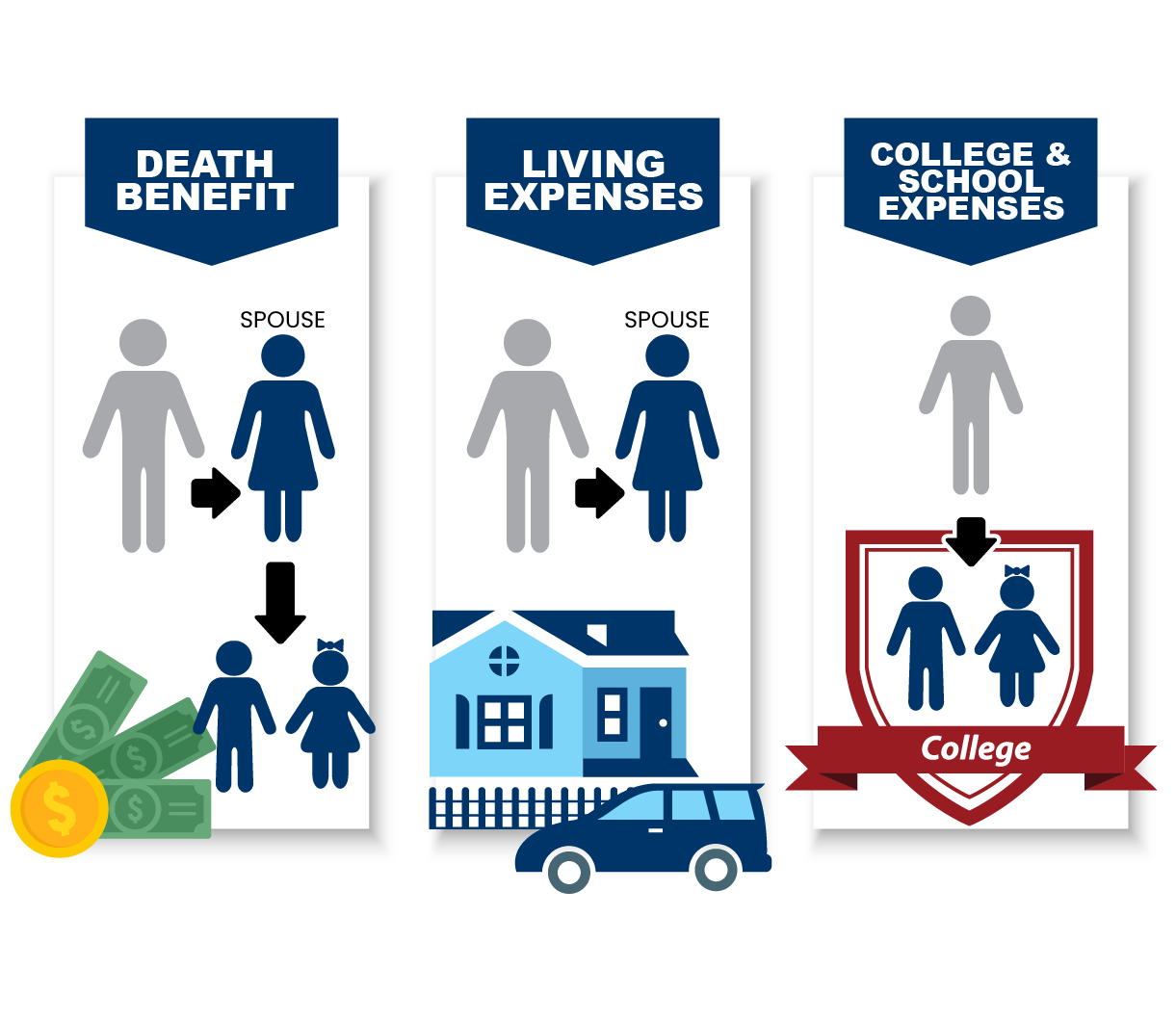

The death benefit is what your loved ones will receive when you pass away. The image below shows how your loved ones might use a death benefit.

If there is any cash value, that will be added to the death benefit as well, once any fees have been removed. The payout can be used for everything from college, medical bills, and even as an inheritance. You can split the death benefit among different people or even set it up to pay monthly to replace your income.

Your beneficiary is the person or people who will receive the death benefit when you pass away. You choose who this person is and how the death benefit will be paid out to them, and even what it will be spent on, in some cases. They are guaranteed to receive this no matter what you owe, because not even the IRS can seize your death benefit.

Another appeal of variable life insurance is the tax benefits that come with this type of policy.

The growth of the policy is tax-deferrable, meaning that you don’t have to claim the earnings on your yearly taxes. If your beneficiaries receive the investment along with the death benefit, they will also not have to pay taxes on it.

Variable Universal

Variable universal life insurance takes from both a universal and variable policy. You will be able to invest your cash value from your premiums while also getting to adjust and choose when to pay those off.

With variable universal life insurance, your premiums can be adjusted to raise or lower how much you pay each month.

This is useful for those who aren’t sure how their financial situation will be in the future.

Just as you can adjust your premiums, your death benefit coverage can also be increased and decreased depending on what you need at that time. In some cases, you may have to prove your insurability to get the higher coverage.

If you choose to adjust your premiums or coverage, your cash value will also be affected. For lower-cost premiums, your cash value will not be as much as it would be if you were paying more into the policy.

As you pay more each month, both your coverage and cash value will increase.

Beneficiaries follow the same rules with this policy as they are with variable life insurance. You may choose one or multiple, to split up the death benefit or have it given to your loved ones as a lump sum. Your beneficiaries will receive your invested cash value as well as the death benefit.

The tax benefits available with this policy are also very similar to variable life insurance. The investment growth’s tax deferrable status allows you to grow your portfolio without having to add it to your yearly taxes. Even when the cash value amount is given to your beneficiaries, they won’t have to pay any tax on the payout.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Shopping for Variable Life Insurance Quotes

When deciding to purchase a new policy, you should always keep your wits about you in knowing what you’re looking for. This will make you appear more informed and will earn you better life insurance quotes. Follow our tips and you’ll become a life insurance calculator in no time.

With any life insurance policy, you’re probably wondering, how much life insurance do I need? According to the 2018 Life Insurance Barometer Study, one out of five people thinks they don’t have enough coverage after signing up for their policy. You can avoid making this same mistake by planning ahead. (Although you can always apply for more coverage through a variable life policy.)

Most experts recommend that your policy should be at least six to 10 times the amount of your annual salary.

So if you make around $50,000 a year, you should look for a policy that has coverage anywhere between $300,000 to $500,000. This will make sure your family’s financial needs are met for the foreseeable future with the addition of an adequate cushion to support anything else that they would need.

That being said, the more coverage you have, the more you’ll pay each month. Variable life insurance is known for having extra fees that you have to pay, so it’s best to be educated going in. It’s important to know how much you’ll pay so that you aren’t surprised when you have to pay a little more than expected.

Keep in mind that the more you pay, the more cash value will be allocated into your investment.

As long as you continue to pay your premiums, your cash value will continue to increase independent of the investment, as with a typical whole life policy. However, the potential of an increasing percentage will also allow for even more growth and may allow for more cash value than you would have received with a whole life policy.

How do I calculate life insurance needs?

As discussed above, how much coverage you would need depends a lot on your life and what would happen to your loved ones if you were to pass away. There are two types of needs that need to be taken care of: immediate and future needs.

The immediate needs are what your family would need to be provided for if you were to pass away this second.

First, you should consider any medical bills that may come up as well as the options for your final expenses. Some policies will even let you plan some of your funeral expenses inside of the policy itself so that they will be taken out of the death benefit when you pass.

Another immediate need is planning for the salary that will need to be replaced when you pass away. Those who are the main providers for their family should especially keep this in mind.

The death benefit can be split into multiple payments, monthly, or given as one lump sum, giving you full control over how your family can use the death benefit.

If you have debt, you should also add that as an immediate expense, as that will be transferred to your next of kin. If you have any young children, you should also plan for the expenses it would take to raise them properly before they are out on their own.

You should also keep in mind what you’ll need in the future because it’s better to be prepared than to regret it later on.

A good example of a future expense to plan for is college tuition. With how expensive the classes are, plus books, housing, and food, your future graduates are going to need all the help they can get.

You can set up special payment arrangements that can be used by your loved ones to fund their best educational years.

While not about coverage and more about the type of policy, you should also plan ahead for your retirement if you haven’t already. A variable policy or another cash-value type policy can help provide some extra cushioning for you in retirement. As long as you make the educated choice early enough, you’ll find it will help you a lot in your future.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

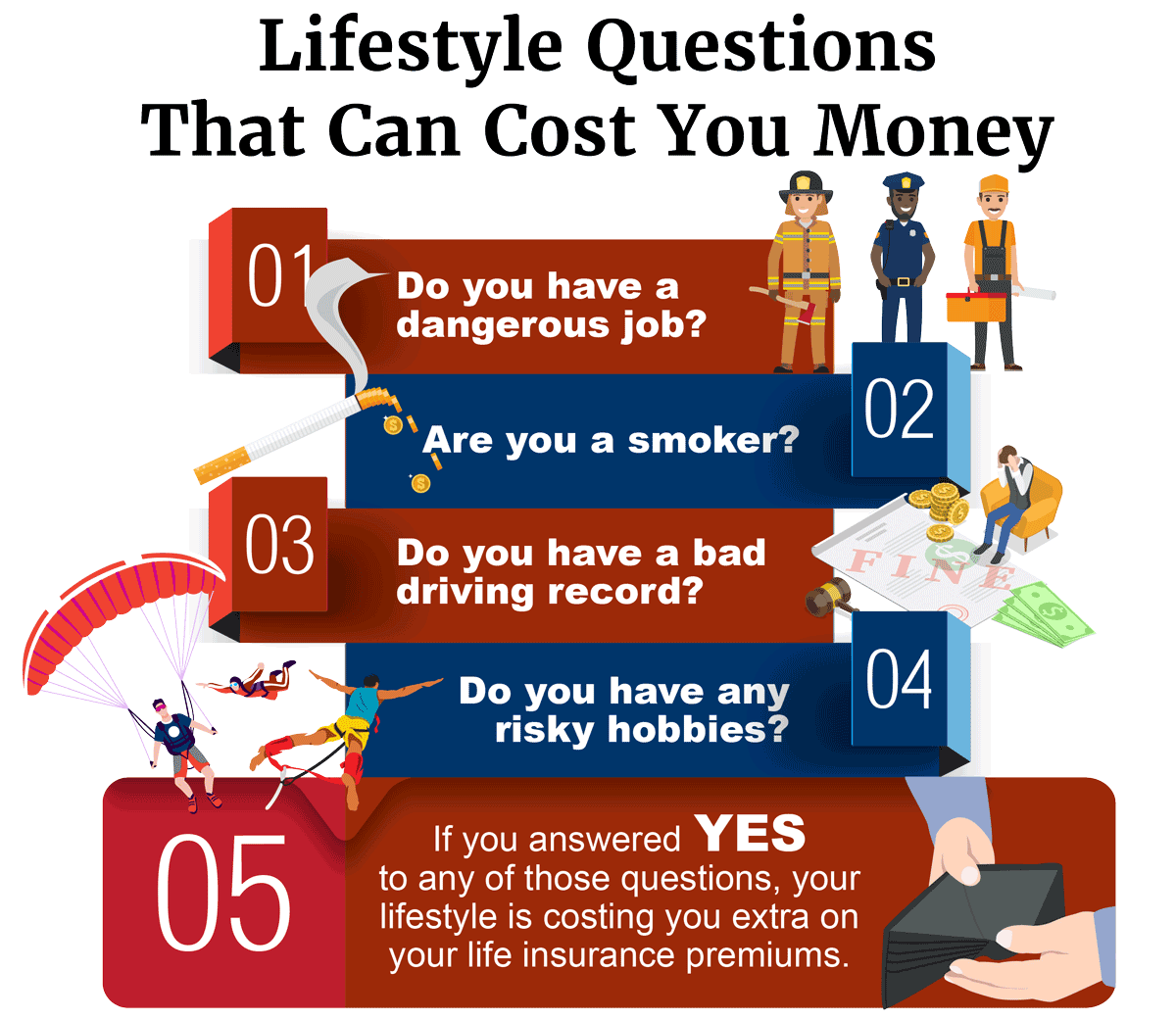

Factors That Affect Your Life Insurance Premium

If an insurer gave every person who applied to the policy the same flat rate, then they would be out of money by the end of the month. Instead, the insurer will subject you to a life insurance medical exam.

An underwriter will look at the things that affect your life such as your demographics and your health. They will ask you questions about your lifestyle to assess how often you might file a claim.

They’ll also look for any bad habits or risks in the workplace that would make it more likely they would have to pay out. After determining your risk factors, they’ll place you into a grouping with others who have similar risks.

Once they have a better idea of how risky your life is, they’ll tell you how much you’ll have to pay to maintain your coverage.

That being said, there are options to keep yourself from giving an arm and leg to your insurer every month, year, or whenever you have to pay. Lucky for you, we’ve done the research and found ways to ensure that you get the best prices that you can.

Demographics

Age and gender are the two most common factors that are used when determining life insurance premiums.

It should not come as a shock that the older you get, the more your rates will be. Because of this, your rates will be higher every year you wait to start your policy. This is why it is imperative to start your policy as soon as you can to get the best rates available.

No matter your other risk factors when you apply, your rates will be lower the earlier you start your policy.

Your gender also plays a huge role in your premiums. On average, men die sooner than women, so they have to pay a little more each month as opposed to their female counterparts. This translates into monthly savings for women on almost every type of life insurance policy.

Since you can’t determine how the life insurance company will view your gender, your best bet is to sign up for a policy as soon as you can.

For example, Tom and Susan Collins both decide that they want to sign up separately for life insurance policies to provide for their newly forming family, with a baby on the way.

Tom is 32 and Susan is 30, and because Susan is younger and a woman, she finds out that she won’t have to pay as much as Tom, who applied later than his wife.

Health Status & Medical History

Believe it or not, your health also plays a huge role in your life expectancy. Because of this, an insurer will pay special attention to your health and the likelihood that you will get a serious disease later in your life.

This can include everything from a voluntary questionnaire to a physical and blood work before you get accepted to the policy. Depending on what they find during this process, you may find your rates will go up even higher.

The underwriter will also look at your and your family’s medical history to determine if you’re more likely to have any genetic diseases or other severe illnesses based on your weight and health.

You could potentially find out that you have a predisposition for diabetes and that you’ll have to pay much higher rates in the same visit.

To ensure that you get better rates, you should make sure that you are in the best physical shape you can be in. Not only will this ensure that you get the best rates available, but it will also ensure that you have the most time before your family has to ever think about collecting the death benefit at all.

This also ties into signing up earlier, as your health will obviously be better at 28 than it would be at 50. Once you’re diagnosed with a new condition, it will be that much harder to get the life insurance rates that you’re looking for.

Even if you do have a major medical condition, there may still be options.

So if you find yourself facing illness, there is hope. It’s best to discuss your options with a financial adviser before dismissing the idea of a policy altogether from fear of being denied outright.

High-Risk Occupations

Those who work dangerous jobs for the betterment of society keep the world turning, and their importance cannot be stated enough. However, those who face more risk in the workplace are well aware of the dangers they face every day. Because of this inherent danger, life insurers are sometimes wary to give people the rates they need.

Here are some examples: some you may know and some you may not.

There are a number of jobs that pose more of an inherent risk than others.

One example of such a job is trash and recyclable material collectors. Since these employees work out of a vehicle every day, an insurer will see that they are more prone to transportation and other occupational accidents. The dangerous chemicals and other substances used on the job also make those in this profession more prone to illness.

Roofers are another group of workers that do hard work that only someone who’s carried a stack of shingles up a ladder can truly respect. However, whether it be hubris or lack of supplies, most roofers work without any kind of security system to stop their fall. This, of course, leads to injuries and death in the workplace as people will naturally make mistakes on the job.

Working in the heat during the summer also makes roofers and laborers more prone to dehydration and heatstroke.

Pilots and flight engineers, much like waste management workers, find themselves victims of transportation accidents via planes and runways. While these mostly occur in the private sector, military and commercial pilots are known to have accidents on the job as well.

Demanding schedules and the stress of the responsibility can also get to a pilot’s head and cause them to make mistakes. That being said, the occupational risks are well rewarded with a great annual salary and benefits.

Next up are logging workers, who have to work with heavy machinery and even heavier trees. With such dangerous equipment, the utmost care must be taken while on the job, and even then, accidents are bound to happen.

Most accidents come from the falling of a heavy oak tree or an accident with a harvester or chainsaw.

Since most of these trees are located in remote areas, far away from medical care, when accidents do happen, there may not be enough time to get somewhere they need for medical attention.

However, while all of these jobs pose a risk to your health and life, none of them are considered to be the most dangerous job in the country. Fishers and fishing-related workers brave the dangerous high seas looking for food and sometimes get hurt in the process.

For those who have seen “The Deadliest Catch” on the Discovery Channel, this will come as no surprise. Large-scale fishing on boats is a very physically demanding job that requires all sorts of netting and other associated fishing gear.

When accidents do occur, such as an injury or someone falling overboard, there may not be accessible to the proper medical facilities while they are out on the ocean.

Getting a life insurance policy while working one of these occupations is not impossible by any means.

You may just find yourself paying more each month to cover this risk that something will happen on the job.

As always, it’s important to speak with a financial adviser before you decide against getting a policy altogether. If your employer offers group life insurance, it may be worth considering to save on your premiums.

High-Risk Habits

Just like your occupation, what you do in your free time can have a negative impact on your life. Any hobbies or habits that endanger you will be looked at negatively by your insurer.

The most common negative habit to tell your insurer about is smoking and using other types of tobacco. In some cases, when combined with age, your rates can be twice as much as they would be if you were a non-smoker.

Did you switch to an e-cigarette in hopes of curbing your tobacco addiction?

Insurers may now start charging vapers the same as smokers — if they aren’t placed into their own ranking altogether.

This is due to the recent media coverage and professional studies being conducted around the use of e-cigarettes and other related nicotine products.

Adrenaline junkies, watch out. Another kind of high-risk habit that your insurer will look at is your pension for seeking extreme sports. Some examples of these activities are base jumping, skydiving, and rock climbing, among others.

Part of the appeal to these activities is the adrenaline that you feel being that close to danger. However, this danger is seen as a red flag by insurance companies and will cause your rates to go up if you’re not excluded from the policy entirely.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Pros & Cons of Variable Life Insurance

As with all policies, there are positives and negatives to consider.

Pros of Variable Life Insurance

- Premiums are fixed or variable depending on which company you choose. Fixed premiums let you know what you will be paying for the life of the policy.

- Minimum guaranteed death benefit. In the event of your death, your family will get a certain death benefit, even if your cash account has not performed well.

- If you are able to invest well, you will earn more money for the cash value account than if you had purchased a whole life plan. Whole life policies cash accounts are invested very conservatively, earning very little. Eventually, your policy could pay for itself if your investment returns are high enough.

- The gains in the cash account grow on a tax-deferred basis. For those in a high tax bracket, this can help build cash value quicker than, if they were paying taxes on the gains each year.

- The death benefit can grow to a much larger amount if the investment account is doing well. This obviously allows you to pass on more to your beneficiaries.

Cons of Variable Life Insurance

- You are the one responsible for the investment side of the contract. If you do not feel confident with the stock and bond markets, this can be a problem when they become volatile.

- Fees and contract costs are higher than other types of life insurance contracts because you have the ability to control your own investments.

- If you make investing mistakes, your cash account will lose value and your death benefit will decline, potentially to the minimum level.

If you don’t mind the added risk, this type of policy may be exactly what you’re looking for.

Variable Life Insurance: The Bottom Line

Protecting your loved ones’ future after you’re gone is a wise yet daunting decision.

Deciding what kind of policy or company to go with can feel impossible when you’re confronted with all the options. When everyone guarantees that they offer the best deal, you may not know where to start.

A variable life insurance policy is a good idea for those who want to make sure their family is protected for the future but also like the idea of an investment.

This cash value investment will allow you to pay for expenses in your retirement, and the sooner you start your investment, the more it will be worth.

But be sure to read the prospectus. When considering a variable life contract, it is important to read all the details of the prospectus so that you understand exactly what you are getting. It will lay out all the costs and fees associated with the contract. It will spell out the guarantees as well.

Whether you decide to go with a variable life policy or one of the many other options available, your family will be well protected into your final days.

Ready to start looking for your variable policy rates? Use our FREE quote tool to find the best rates for you.

Frequently Asked Questions: Variable Life Insurance

With such a complex type of policy, it is natural to have questions.

#1 – What is the best life insurance to have?

The right policy for you will depend heavily on your life and preferences. If you just want simple coverage with no added benefits, then a term life policy might be perfect for you. If you wanted a savings component with the option to grow additional wealth through investment, then a variable life insurance policy might better suit you.

#2 – Can you negotiate life insurance rates?

Unfortunately, because the life insurance prices are often regulated, there is no way for you to get a better rate from another company for the same type of policy. The agent cannot, nor has a reason to, barter with you for a better price.

#3 – Is variable life insurance taxable?

As long as you structure your policy correctly, both the cash value and your death benefit will not be taxable when it comes time to collect. This is unique to a variable life insurance policy.

References:

- https://www.iii.org/article/what-are-different-types-permanent-life-insurance-policies

- https://web.stanford.edu/~wfsharpe/art/talks/indexed_investing.htm

- https://www.investor.gov/introduction-investing/investing-basics/investment-products/bonds-or-fixed-income-products/bonds

- https://ourworldindata.org/why-do-women-live-longer-than-men

- https://www.va.gov/life-insurance/options-eligibility/sgli/

- https://www.benefits.gov/benefit/281

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption