Fidelity Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1946 |

| Current Executive | CEO- Abigail Johnson |

| Number of Employees | 50,000 |

| Total Sales / Total Assets | $18,200,000,000 / $1,414,352,545 |

| HQ Address | 245 Summer Street, Boston, MA 02210 |

| Phone Number | 1-800-972-2155 |

| Company Website | www.fidelity.com |

| Premiums Written - Individual Life | $1,425,807,029 |

| Financial Standing | $91,296,123 |

| Best For | Strong Financial Ratings |

Get Your Rates Quote Now |

|

Shopping for life insurance can be overwhelming, and you may not know where to start. You should be well informed when it comes to buying a life insurance policy that will protect your family later in life.

Fidelity Investments, a wealth management firm, also offers life insurance policies. Fidelity is a large company, with over 50,000 employees and $7.8 trillion in customer assets.

Keep reading to decide if Fidelity is the right choice for you and your family.

Get FREE life insurance quotes now by clicking the quote tool above.

Table of Contents

Fidelity’s Ratings

The following ratings give you an overview of Fidelity’s financial standing and the complaints filed by customers against the company.

A.M. Best

A.M. Best ratings are objective opinions that indicate the creditworthiness and financial strength of a company. The ratings are determined by an analysis of qualitative and quantitative data, including the overall performance of the business.

Fidelity has received an A+ rating from A.M. Best for the last five years. This shows that Fidelity is a trustworthy company that is able to handle its financial obligations.

Better Business Bureau (BBB)

The Better Business Bureau’s ratings are based on the interactions between a business and its customers.

Fidelity currently has a C- from the BBB. This lower rating is due to the number of unresolved complaints. Over the last three years, 321 complaints against Fidelity have been filed with the BBB. Of those complaints, 45 remain unresolved.

The majority of the complaints involve issues regarding a particular product or service and billing.

Fidelity is not a BBB accredited organization.

NAIC Complaint Index

The NAIC’s Complaint Index records complaints filed by consumers with state insurance departments.

Since 2016, eight complaints have been filed against Fidelity. Most of the complaints in the NAIC Index are regarding annuities and life insurance policies.

Company History

Fidelity was founded in 1946 as Fidelity Management and Research Company with Edward Johnson II as president.

Over the next several years, Fidelity continued to grow as a company and also expanded its role in local communities. The company created the Fidelity Foundation in 1965 to help provide funding for non-profit organizations.

In the 1970s, Fidelity began to expand its offerings to customers with the installation of a toll-free number to answer questions and the launch of 403(b) plans for governmental, nonprofit, and educational organizations.

Fidelity’s first investor center opened in Boston in 1983, allowing customers to receive information and investment guidance.

The company has often been at the forefront of technological developments.

Fidelity purchased its first computer in 1965. Many years later, as the internet emerged, Fidelity became the first mutual fund company to create a website.

In 2008, the company launched Fidelity WealthCentral, which was the first web-based wealth management portfolio in the industry.

Since Fidelity’s founding in 1946, it has grown into a company with over 50,000 employees and $7.8 trillion in total customer assets.

Fidelity’s Position for the Future

Fidelity is in strong financial standing and is in a good position for the future. The company had a significant increase in net income from 2017 to 2018.

In 2017, Fidelity’s income was $73.6 million in 2017 and increased to $91.3 million in 2018. Fidelity is also continuously expanding its products. In the fall of 2019, the company launched four new thematic investment products.

Fidelity’s Online Presence

Fidelity has a large online presence with an audience of more than 950,000 users across their social media platforms.

The company posts daily on their social media accounts.

Fidelity also uses Twitter to provide customer service and address any questions or concerns users may have.

The Fidelity website has a chat option that allows you to send questions to a virtual assistant. The chat is available Monday through Friday from 8 a.m. to 10 p.m. and 9 a.m. to 4 p.m. on the weekends.

Fidelity also has several YouTube channels where videos are uploaded regularly. In addition to the main company channel, Fidelity has the following channels:

- Fidelity Clearing and Custody Solutions

- Fidelity Labs

- Fidelity Jobs

The Fidelity Clearing and Custody Solutions channel focuses on content relating to brokerage, trading, practice management, and consulting.

Videos on the Fidelity Labs YouTube page are about the technological innovations Fidelity uses to help their company evolve.

The Fidelity Jobs channel gives new and potential employees an inside look at what it’s like to work at Fidelity. The videos feature current employees sharing their stories about their time with the company and information about programs and benefits available to employees.

Fidelity’s Commercials

Fidelity has two commercials on their official YouTube channel. The commercials focus on retirement planning.

Here’s another one.

Fidelity is also quite active in the community.

Fidelity in the Community

Fidelity helps serve communities across the globe with the company’s Fidelity Charitable organization. Fidelity Charitable is a public charity that helps streamline the donation process, allowing you to contribute to multiple organizations.

The charity uses donor-advised funds to create tax-efficient ways to donate to organizations, which is an investment account entirely dedicated to supporting charities.

When you contribute cash or other assets to the fund, you’re eligible for a tax deduction.

To date, Fidelity has worked with 200,000 donors to help support more than 278,000 charities. In 2018, the company donated $4.8 billion in grants through donor-advised funds.

The company also has a Fidelity Cares volunteer program for employees. Through Fidelity Cares, employees can volunteer their time to help in schools, donate books and supplies, and teach financial literacy.

In 2018, more than 12,000 employees participated in community projects through Fidelity Cares. Overall, Fidelity Cares has participated in more than 1,200 community projects.

Fidelity is also committed to sustainability. Since 2007, the company has decreased its total paper use by 48 percent. Fidelity has decreased greenhouse gas emissions and power consumption by 23 percent.

Many of Fidelity’s offices have become certified by Leadership in Energy and Environmental Design (LEED). LEED-certified buildings are designed to be energy- and resource-efficient.

In 2018, Fidelity pledged to generate 10 percent of its electricity through solar and other renewable energy sources.

Fidelity’s Employees

Fidelity has more than 50,000 employees at 10 regional offices and 190 investor centers in the United States. The company also has employees in Europe, Asia, and Australia.

Fidelity has jobs in the following areas:

- Artificial Intelligence

- Business Strategy and Operations

- Customer Service

- Finance and Accounting

- Financial Planning

- Human Resources

- Investment

- Marketing and Communications

- Product Development and Management

- Risk Management

- Sales and Relationship Management

- Technology

On Glassdoor, Fidelity has an overall employee rating of 3.9 out of five stars. CEO Abigail Johnson has a 93 percent approval rating from Fidelity employees.

Fidelity has the following employee resource groups:

- Enable: A support network for family caregivers that promotes disability awareness and accessibility in the workplace.

- Fidelity Veteran Employees (FiVE): A support network for veterans hired at Fidelity and their families.

- Women’s Leadership Group: A community focused on the professional development and success of female employees.

- Asian Employee Resource Group (AERG): A community of support and mentorship designed to enhance awareness of Asian culture.

- ASPIRE: A professional network of Fidelity’s Latinx and African American associates.

- Fidelity Pride: A support network for LGBTQ Fidelity employees.

In 2018, CareerBliss named Fidelity one of the 50 happiest companies in America. The award recognizes companies that are creating a happier, more positive work environment for their employees.

Shopping for Life Insurance

There are several factors to consider when buying life insurance. Do you want permanent coverage or coverage for a particular amount of time?

You also need to determine what expenses you want to be covered. There are short-term and long-term expenses to consider when shopping for life insurance.

Short-term expenses can include funeral costs and medical bills, whereas long-term financial needs include mortgages and child care costs.

You also need to decide if you want to leave your family with income replacement, and if so, how much income replacement you want in your policy.

By determining exactly which expenses you want to be covered, you can make sure you have a policy with the right amount of coverage, so your family is protected.

Average Fidelity Male vs Female Life Insurance Rates

The table below shows the average non-smoker rates for Fidelity term policies.

| Age | $100,000/10-Year: Male | $100,000/10-Year: Female | $100,000/20-Year: Male | $100,000/20-Year: Female |

|---|---|---|---|---|

| 25 | $10.44 | $9.57 | $12.96 | $12.27 |

| 30 | $10.53 | $9.57 | $12.96 | $12.44 |

| 35 | $10.88 | $10.35 | $13.66 | $13.40 |

| 40 | $11.31 | $10.88 | $15.49 | $14.18 |

| 45 | $14.70 | $13.92 | $20.79 | $18.18 |

| 50 | $19.84 | $17.49 | $30.89 | $24.71 |

| 55 | $29.32 | $23.23 | $42.80 | $33.06 |

| 60 | $42.72 | $30.80 | $77.69 | $51.24 |

Get Your Rates Quote Now |

||||

As you can see from the table, men have higher premiums than women. This is due to the fact that men have a shorter life expectancy than women. The premiums also increase as you age because it becomes more likely the company will have to pay out your policy.

Coverage Offered

When you’re shopping for life insurance, you need to know what kind of coverage a company has to offer and whether their policies will work for your family’s needs.

Let’s take a closer look at the types of coverage Fidelity has to offer:

Types of Coverage Offered

Fidelity offers policies for term, whole, and universal life insurance.

Term

Term life insurance guarantees the payment of a death benefit during a specific time period. A death benefit is the amount of money an insurance company pays when the policyholder dies.

One of the benefits of choosing term life insurance is the flexibility. You can choose the term that best fits the needs of your family. Fidelity’s term life offers policies for 10-, 15-, or 20-year terms.

[table “94” not found /]As noted in the table above, the length of terms available to you can change depending on your age.10-year term policy is available for ages 18-70. A 15-year term policy is available for ages 18-65, and 20-year term policies are available for ages 18-60.

Term life insurance is also a more affordable option. Your premium will remain the same during your covered term. Payments for Fidelity’s term life insurance can be made monthly, semi-annually, or annually.

The minimum coverage for term life insurance with Fidelity is $250,000.

Whole

Whole life insurance policies are guaranteed to last for the person’s lifetime. Fidelity provides a whole life insurance policy through Massachusetts Mutual Life Insurance Company.

The MassMutual CareChoice One plan combines a single premium whole life insurance policy with a qualified long-term care insurance rider.

This plan allows you to prepare for your future long-term care needs and protect other assets from being used to take care of long-term care expenses.

If you take out the policy and never need long-term care, a death benefit will be paid to your heirs. You also have the ability to cancel the policy and receive the surrender value. Under the plan, the policy surrender value increases over time.

The minimum long-term care benefit period for the policy is four years. The long-term care benefit is paid in monthly reimbursements.

The policy is available for ages 35-69. For tobacco users, the age cap is 65. MassMutual CareChoice One has a single premium with a $25,000 minimum premium.

Universal

Universal life insurance is a cash-value policy with a guaranteed death benefit. Fidelity provides two universal life insurance policies through Massachusetts Mutual Life Insurance Company:

- MassMutual UL Guard

- MassMutual SUL Guard

The MassMutual UL Guard policy is designed for one person who wants life insurance coverage. The MassMutual SUL Guard policy insures two people under one policy, with one premium.

MassMutual UL Guard policies are available for ages 0-85. SUL Guard policies are available for ages 18-85. Both policies have a coverage minimum of $100,000.

The SUL Guard policy allows two people to be covered under one policy, which usually costs less than having two separate, permanent life insurance policies.

Under the SUL Guard policy, a death benefit will be paid to your beneficiaries after both insured parties have died.

The SUL Guard policy is designed to help ease the tax burden on your beneficiaries.

Current tax laws allow assets from estates to pass from one spouse to the other without any estate or gift taxes.

While this protects your spouse, it can cause a tax burden later for your heirs. The SUL Guard policy will give you the liquidity needed to protect your family.

Universal life insurance policies allow you to choose how long you want to be covered. You can also change how frequently you pay your premiums and have the option to pay the premium in one lump sum.

The following types of rates are available for universal life policies:

- Ultra Preferred Non-Tobacco

- Select Preferred Non-Tobacco

- Non-Tobacco

- Select Preferred Tobacco

- Tobacco

Riders

There are also multiple riders available for these policies.

The Accelerated Death Benefit rider will pay part of the death benefit to the insured if they become chronically or terminally ill.

A Substitute of Insured rider allows you to substitute a new insured person under the policy in place of the currently insured person.

A Waiver of Specified Premium will waive the policy premium if the insured becomes disabled for six months. This rider is only available as an add-on to the UL Guard policy.

An Estate Protection rider provides additional coverage for a specified amount of time to help offset any additional estate taxes. This rider is only available as an add-on to the SUL Guard policy.

The Policy Split Option gives you and the other policy owner the option to exchange your shared policy for two individual policies in case of an event such as divorce.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

Many factors can change the price of your premium. Your age, gender, job, and health can all affect your rate.

Let’s examine how each of the factors can affect your premium.

Demographics

Your age and gender are important factors in determining your rates. As you become older and it becomes more likely a company will have to pay out your policy, your premium will increase.

This is why it’s better to buy a life insurance policy when you’re younger. The younger you are, the lower your rates are.

Your gender also affects your life insurance policy rate. Women pay less for insurance than men because they have a longer life expectancy. The average life expectancy of a woman is 86.5 years, while the life expectancy of a man is 84 years.

Current Health & Family Medical History

Your current health is also important in determining your premium. Healthy people have a longer life expectancy, making their premiums lower.

An insurance company will have you fill out a health questionnaire and may request your medical records as part of the underwriting process. Some companies require a medical exam.

An attending physician statement is usually required as part of the underwriting process, as well. This allows insurance companies to get the most accurate information about your overall health.

An underwriter will still have access to public prescription and Medical Information Bureau records if a medical exam is not required. Current health issues or a history of serious illnesses can cause your premium to increase.

Your family’s health history is also a factor in the cost of your premium.

A history of serious or hereditary illnesses could cause your premium to go up.

High-Risk Occupations

Jobs fall into the category of high-risk occupations when they have a much higher number of fatal work injuries. High-risk occupations are considered more dangerous than your average job.

Industries with a higher number of accidental deaths are also considered to be high-risk.

According to the Bureau of Labor Statistics, the following industries had the highest rate of fatal work injuries in 2017:

- Construction

- Transportation

- Warehousing

- Agriculture

- Forestry

- Fishing

- Hunting

If you have a high-risk job, the price of your premium will go up.

High-Risk Habits

Certain habits and activities are also deemed high-risk.

One of the most common high-risk habits that result in a more expensive life insurance policy is smoking. Regardless of your age or gender, smokers will pay a higher insurance premium than non-smokers.

Other high-risk hobbies that can drive up your premium include skydiving, racing, bungee jumping, and private aviation.

A one-time experience does not automatically place you in a high-risk classification. Instead, insurers are looking to see if there’s a pattern of high-risk activities.

Veteran or Active Military Status

Active military status is also considered a high-risk occupation.

Those currently serving the military face much higher premiums than the average customer. Some insurance companies don’t sell policies to active military members.

Getting the Best Rate with Fidelity

Now that you have an overview of Fidelity and its life insurance policy options, let’s discuss how you can get the best rate possible.

The first step in the process of purchasing life insurance is getting a quote. While you’re getting a quote, you can assess your current and future needs so you can figure out how much coverage you need.

This way, you can get the amount of coverage your family needs without overpaying.

You should buy life insurance as soon as possible.

Purchasing a life insurance policy is probably not a top priority for most young people, but it’s best to get coverage earlier in life.

As we previously stated, the younger you are, the lower your rates are. Buying life insurance at a younger age will lock you into a lower premium.

For example, a 30-year-old male non-smoker will pay $10.53 a month for a $100,000 10-year policy. A 60-year-old male non-smoker with the same policy would pay $42.72

Another way to make sure your premiums remain affordable is to keep yourself in good health. People in good health have premiums that cost less and remain stable.

Fidelity’s Programs

Fidelity has multiple programs designed to help customers and growing businesses.

The company has a Fidelity Cares Teacher Financial Literacy Training program that trains educators on financial literacy. The training sessions are free and offered across the United States.

The program trains K-12 teachers in the basics of personal financial management. The goal of the program is to give teachers effective ways to share their financial literacy training with their students.

More than 1,000 teachers have participated in the program so far, reaching 100,000 students. Over the next 10 years, Fidelity hopes the number of students reached by the program will top 750,000.

Fidelity’s Boundless program is designed to help high school and undergraduate women choose a career path by identifying their strengths and ideas they are passionate about.

Boundless also has a college mentor program. The program connects a Boundless college student with a mentor at Fidelity. Students will learn about work experience and receive advice on their professional development.

Fidelity’s Design Thinking program brings innovative problem-solving skills directly to elementary school classrooms.

Design Thinking is a problem-solving process that involves users experimenting with many ideas as they work toward a solution.

The goal of the program is to create more supportive learning environments for students while helping them to develop problem-solving skills.

Canceling Your Policy

If your life insurance policy is no longer fitting your family’s needs, you can cancel your policy. Fidelity’s whole life insurance policy can be canceled at any time with no cost.

How to Cancel

Here’s how you cancel a life insurance policy with Fidelity.

#1 – Gather Documents

Make sure you have filled out the required forms and have any requested supplemental documentation.

#2 – Contact an Agent or Case Manager

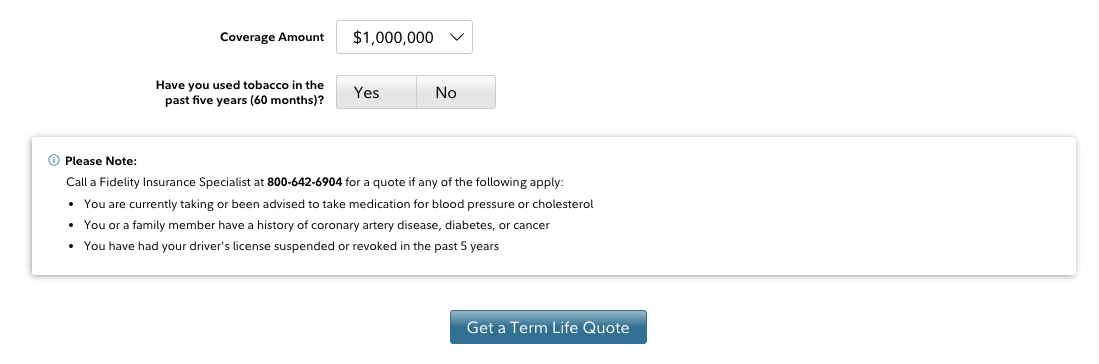

Fidelity does not currently have an option to cancel your policy online. To cancel your policy, contact Fidelity at 1-800-642-6904.

How to Make a Claim

Claims for whole life and universal life policies are made through MassMutual, who provides the policies.

To make a claim, you complete an online form. The form asks for personal information about the deceased, such as their name, date of birth, and date of death.

The form also asks if the death was accidental or natural. You will also need to provide the policy number and personal information for the person filling out the form.

After you submit the form, the company will send you a death claim packet via mail or email to complete the process.

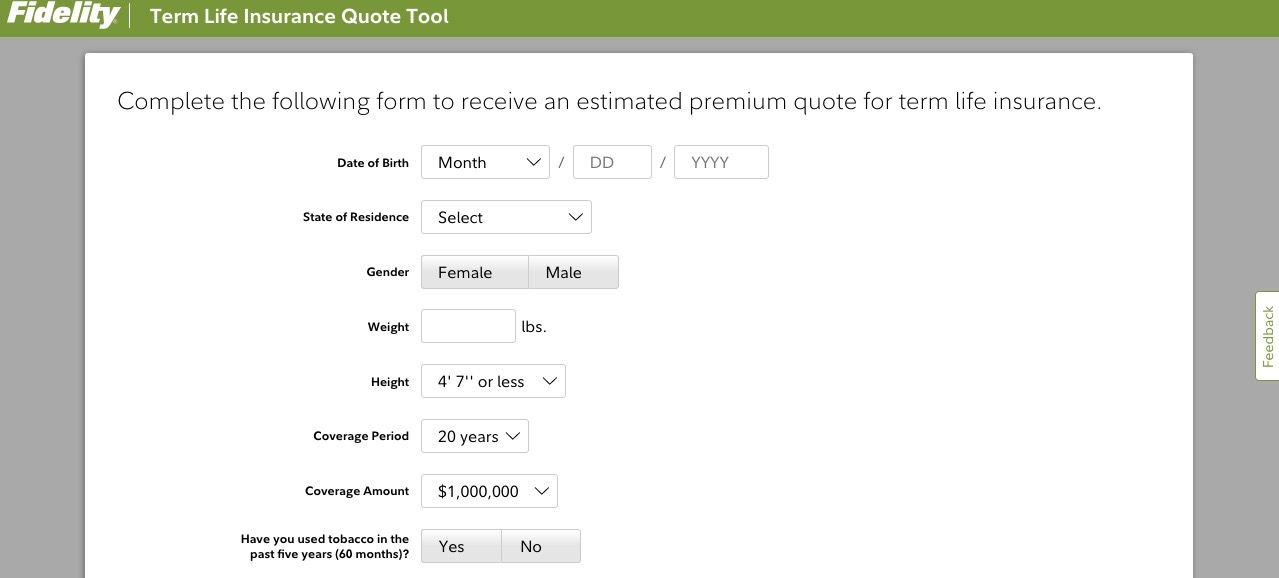

How to Get a Quote Online

Now that you have an overview of Fidelity, you can find out exactly what kind of policy and protection they can provide for you. Here’s how to get a quote on the Fidelity website.

#1 – Start by Filling Out Your Personal Information on the Page

Fidelity’s Term Life Insurance Quote Tool asks you to fill out the following information:

- Date of Birth

- State of Residence

- Gender

- Weight

- Height

- Coverage Period

- Coverage Amount

- Tobacco Use

#2 – After You Fill Out the Information, Click the “Get a Term Life Quote” Button to Receive Your Estimate

Next up is the website/app design.

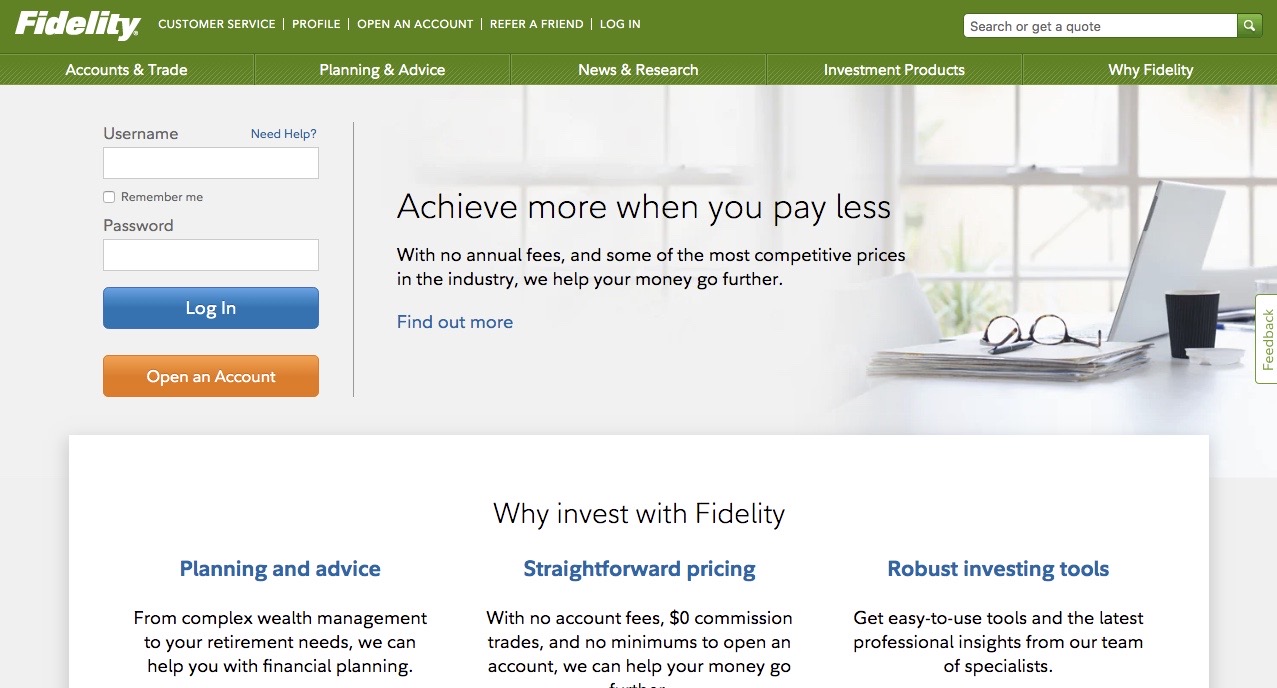

Design of Website/App

The company has an expansive website with a large amount of information. The website is hard to navigate because a large amount of text is placed in the center of the website.

As you scroll down the website, a substantial amount of disclaimer text appears. The text is small and difficult to read. Since it takes up so much of the screen, it also makes it difficult to find what you’re looking for.

The website can be tricky to navigate, and it’s not always easy to find what you’re looking for. For example, Fidelity’s “About” page is located on the bottom-left-hand side of the website and is hard to see.

Once you click on the “About” link, it takes you to a different landing page.

Most of the links on Fidelity’s webpage will take you to a different landing page or website, so you usually have to go through several links and websites before you find the information you’re looking for.

Overall, the website is not user-friendly and is so saturated with information that it’s difficult to find what you’re looking for.

Fidelity also has an app. The app lets you manage your accounts and also provides stock information and relevant news articles.

In the Apple App Store, the Fidelity app has 4.7 out of five stars across 995,000 reviews. The majority of the reviews are five-star ratings.

In the negative reviews, customers seem to be frustrated with a glitch with TouchID and FaceID that does not allow them to log into the app. Many of the reviews also suggest that the app is limited in what customers can do, and customers hope to see an expansion of content on the app.

Pros & Cons

Before you decide to buy a life insurance policy with Fidelity, you should have a complete understanding of the benefits and disadvantages of the company.

Pros

The MassMutual SUL Guard policy allows two people to be covered under the same policy, which is often more affordable than having the two separate policies.

The Guard policies come with multiple riders to help you tailor your life insurance coverage so it best suits your family’s needs.

There are also whole life policies that don’t require a medical exam and have a simplified underwriting process, making coverage more accessible.

Cons

Since Fidelity’s website is so difficult to navigate, it isn’t easy to find the information you’re looking for. Even if you just need a basic policy question answered, it can take a while before you find the information you need.

The application process for certain policies can take some time to process. The term life application process can take up to six weeks.

Several complaints have also been filed with the BBB and the NAIC, so Fidelity’s customer service is not always the most reliable and efficient.

The Bottom Line

Fidelity offers a wide range of policies to help make sure your family is protected later in life. The MassMutual SUL Guard policy offers the chance for you and a loved one to be protected under one policy. With the variety of riders available with Fidelity’s policy, you can make sure you have the exact coverage you need.

Since Fidelity is in a strong financial standing, you can be assured of the company’s stability and creditworthiness. As you set out to buy a life insurance policy, use this guide to help you determine if Fidelity is the right choice for you.

Fidelity’s FAQs

#1 – What life insurance policies does Fidelity offer?

Fidelity offers policies for term, whole, and universal life insurance. The company also offers policies through MassMutual.

#2 – How can I update my personal information?

You can update your name, number, email, mailing address, or other personal information in your online Fidelity profile.

#3 – Can I add account beneficiaries online?

Most accounts allow you to change or delete beneficiaries online. You have to provide the beneficiary type, beneficiary name, date of birth, and Social Security number.

If the account can be updated digitally, the changes will take effect a few minutes after you submit them.

Get a life insurance policy now in your ZIP Code by clicking on our FREE quote tool below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption