SBLI Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1907 |

| Current Executives | CEO & President - James A. Morgan COO - Rose Conneely |

| Number of Employees | 200-500 |

| Total Sales / Total Assets | $201,799,168 / $3,066,541,946 |

| HQ Address | 1 Linscott Road Woburn, MA 01801 |

| Phone Number | 1-888-630-5000 |

| Company Website | www.sbli.com |

| Premiums Written - Individual Life | $352,479,520 |

| Financial Standing | $201,799,168 |

| Best For | No Exam |

Get Your Rates Quote Now |

|

When shopping for life insurance, knowing what kind of coverage you need and which companies you should trust can be difficult. Understanding the ins and outs of life insurance helps you to have the information you need to protect your family later in life.

SBLI, a mutual life insurance company, offers flexible and affordable plans to make sure your family is protected.

Founded on the idea that life insurance should be available to everyone regardless of their economic status, SBLI has a wide range of accessible life insurance policies.

Read on to learn more about SBLI and see if it’s the right choice for you and your family.

Get FREE life insurance quotes now by clicking the quote tool above.

Table of Contents

SBLI’s Ratings

The following ratings indicate the status of SBLI’s financial standing and its relationship with customers.

A.M. Best

A.M. Best’s crediting ratings are objective opinions regarding a company’s credit risk. SBLI has received an A rating from A.M. Best for the past four years. This shows that SBLI is in excellent financial standing and is able to handle its financial obligations.

Better Business Bureau (BBB)

Ratings from the BBB provide an overview of how a business interacts with its customers.

The ratings are based on information from both business and public data. The ratings don’t factor in customer reviews, but they do factor in customer complaints filed with the bureau.

SBLI has an A+ rating from the BBB and is a BBB-accredited business. This indicates that SBLI has received minimal complaints. In the last three years, three complaints were filed against SBLI. All three complaints have been resolved.

Standard & Poor’s (S&P)

Similar to A.M. Best, S&P’s ratings measure an insurer’s creditworthiness. SBLI has received an A- rating from S&P, indicating the company has a stable financial outlook.

Company History

SBLI was founded in 1907 by future U.S. Supreme Court Justice Louis Brandeis. During this time, life insurance policies weren’t easily accessible unless you were wealthy. If you were able to get a policy, it was likely to be canceled before it was actually needed.

At the time, companies canceled eight out of every 10 policies issued to working families, leaving them at risk.

Justice Brandeis founded SBLI to provide low-cost, trustworthy policies to families. SBLI’s mission is to make life insurance accessible and affordable for anyone who needs it.

In 2017, SBLI became a mutual insurance company owned by its policyholders. SBLI was previously a stock insurance company owned by 30 shareholder banks.

SBLI’s Market Share

Here’s a look at SBLI’s performance in the market.

| Year | Market Share |

|---|---|

| 2016 | 0.22% |

| 2017 | 0.21% |

| 2018 | 0.21% |

Get Your Rates Quote Now |

|

In 2016, SBLI was responsible for 0.22 percent of the market share, with $336,337,658 in direct premiums.

The following year, SBLI’s market share dropped slightly to 0.21 percent of the market share, with $335,879,388 in direct premiums.

In 2018, SBLI’s market share marginally decreased again, with 0.21 percent of the market share and $335,854,527 in direct premiums.

SBLI’s Position for the Future

Although their market share has decreased over the last three years, SBLI is still in a good place for the future.

With a major transition from a stock insurance company to a mutual insurance company, SBLI was still able to generate revenue and write more than $335 million in direct premiums.

As noted above, SBLI also has several excellent credit ratings showing that they are in strong financial standing and have a stable outlook for their financial future.

The National Association of Insurance Commissioners has reported an industry increase in net income, net premiums, and deposits in the first six months of 2019. With a strong financial standing in a profitable industry, SBLI is in a good position for the future.

SBLI’s Online Presence

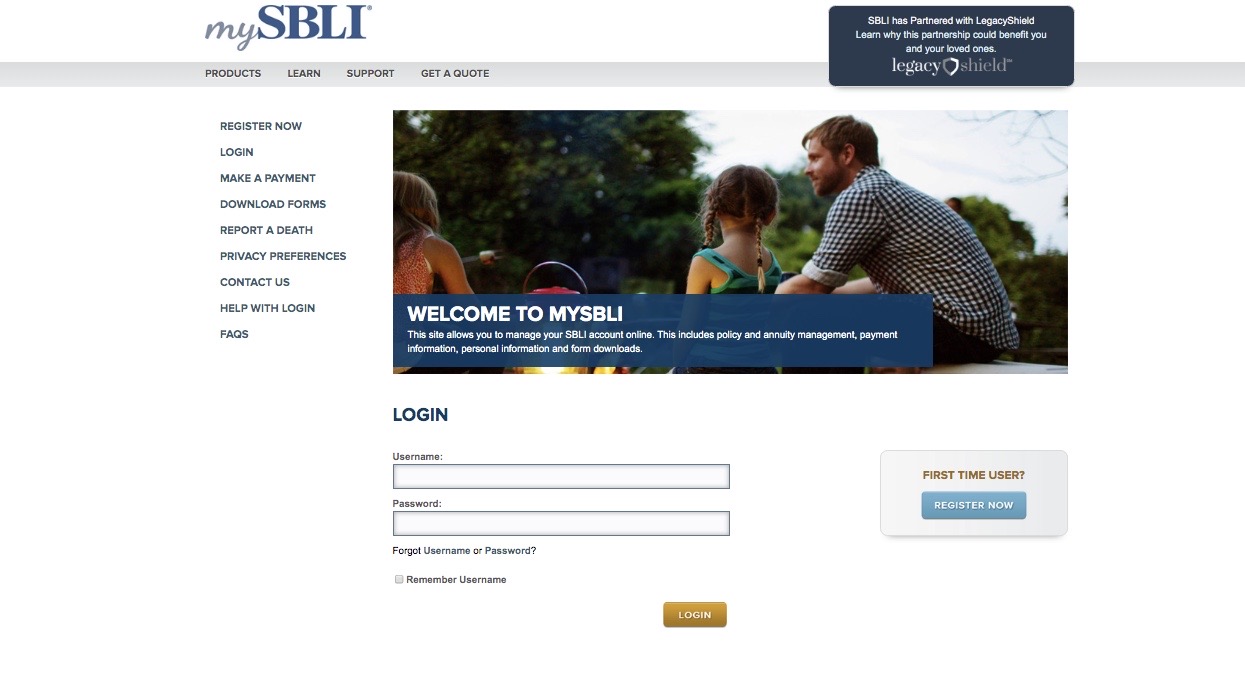

SBLI’s website offers many features for customers. MySBLI is an account management portal in which you can make a payment, download forms, and report a death.

The company has recently introduced an online life insurance application on its website. The application is accessible on all digital devices and can be completed in under 10 minutes.

You don’t need to talk to an agent to complete the application, but you can chat with one during business hours if you need help during the application process.

No follow-up call or physical exam is necessary for the application, and the coverage takes effect immediately after you complete the application.

The website also has a quote tool and a coverage calculator to help you determine how much coverage you need.

SBLI’s website also has a Life Insurance Solutions Center for customers. The center puts you in touch with a life insurance professional to answer any questions or concerns you may have about your application or policy.

You can chat with a life insurance professional Monday-Friday from 8 a.m. to 9 p.m. and Saturday from 10 a.m. to 1 p.m.

SBLI’s website also has a blog hosting a variety of articles. The blog is composed of press releases, background stories about the company, and articles that help you choose the best life insurance policy for you and your family.

For example, the blog has articles about figuring out how much life insurance you need and how you can choose the right life insurance company.

In addition to the company website, SBLI also has a Facebook page, a Twitter account, and a YouTube channel. SBLI posts every one to two days on their Facebook and Twitter accounts.

The SBLI YouTube channel has several videos, many of which are commercials. Let’s take a look at the company’s advertisements over the last few years.

SBLI’s Commercials

A common theme in SBLI’s commercials is the importance of family. These commercials emphasize how important it is to protect your family and how SBLI can help you achieve that.

This commercial from 2014 focuses on the idea of the foundations of a family and how families are the foundation of the work done at SBLI. Even when statistics are listed in the ad, they’re framed as, “Why more than one million families have chosen us.”

This ad again emphasizes the importance of family and how you can protect them when you choose a life insurance policy with SBLI.

Unlike the other two ads, this commercial features testimonials from actual SBLI customers. This ad also focuses more on the policies and premiums available through SBLI.

SBLI in the Community

As part of their commitment to helping the families they serve, SBLI is active in the community. The SBLI Charitable Foundation works with a variety of organizations.

SBLI is a sponsor of the Boston Marathon Jimmy Fund Walk, which raises money in the fight against cancer.

The SBLI Charitable Foundation works with organizations that help foster healthy lifestyles for families and children.

SBLI works with the following organizations:

- American Heart Association

- Alzheimer’s Association

- United Way

- American Red Cross

- American Diabetes Association

- National Multiple Sclerosis Society

- The J.J. Watt Foundation

- The Jimmy Fund

- The National Brain Tumor Society

- American Parkinson Disease Association

- Boston Children’s Hospital

- National Breast Cancer Foundation

- Reid’s Ride

SBLI’s Employees

SBLI has between 200-500 employees. On Glassdoor, employees give the company an overall review of 3.5 out of five stars. Work/life balance and senior management have both been rated almost four out of five stars.

According to Glassdoor, the average salary range for a policy account manager is between $72,000 and $79,000. An underwriting assistant at SBLI can expect to make $29-$31 an hour.

Shopping for Life Insurance

According to the 2018 Insurance Barometer Study, Life Happens and LIMRA, one in five people who have life insurance say they do not have enough coverage.

Before you begin shopping for a life insurance policy, you should know what you want to be covered so you don’t end up with too little or too much coverage.

When determining how much life insurance coverage you will need, you should consider short-term and long-term needs.

Short-term needs are the expenses your family will need to cover immediately, such as funeral costs or medical bills. Long-term needs include mortgages, child care costs, and college tuition.

You also need to determine if you want to provide your family with income, and if so, how much of your income you want to be replaced.

SBLI offers a coverage calculator to help you estimate how much life insurance coverage you’ll need. On the company’s website, fill out the following information to get your coverage estimate:

- Your age

- Annual income

- Savings and investments

- Spouse/partner status

- Number of children

- Income replacement

- Mortgage debt

- Other debt

- Existing insurance

After you determine how much coverage you need, you’ll have a much better idea of what life insurance policies will best fit your family’s needs.

Average SBLI Male vs Female Life Insurance Rates

The table below shows the average monthly rates for $100,000 10-year and 20-year term policies for non-smokers with SBLI.

| Age | Male: $100,000/10-Year | Female: $100,000/10-Year | Male: $100,000/20-Year | Female: $100,000/20-Year |

|---|---|---|---|---|

| 25 | $8.71 | $7.53 | $9.50 | $8.67 |

| 30 | $8.74 | $7.58 | $9.50 | $8.75 |

| 35 | $8.74 | $7.69 | $9.72 | $9.07 |

| 40 | $9.87 | $9.16 | $11.64 | $11.05 |

| 45 | $12.47 | $11.99 | $17.14 | $14.05 |

| 50 | $16.01 | $14.28 | $23.59 | $19.31 |

| 55 | $20.81 | $18.17 | $36.31 | $26.76 |

| 60 | $31.76 | $24.93 | $61.63 | $39.41 |

Get Your Rates Quote Now |

||||

Women have lower premiums than men because they’re expected to live longer. The longer your life expectancy, the lower your premiums will be.

Coverage Offered

SBLI offers a variety of life insurance policies to help you get the coverage you need to protect your family. The company also has optional riders you can add to your policy to fit your coverage to your needs.

Types of Coverage Offered

SBLI offers two main types of life insurance policies: term life and whole life. Within those two categories, SBLI offers SmartTerm 360, flex whole life insurance, and LifePace policies.

Let’s break down what each of these policies has to offer:

Term

Term life insurance lets you choose how much protection you want and how long you want it for. Term life policies are a low-cost option because your premium will remain the same during your coverage period.

SBLI offers policies covering the following terms:

- 10 years

- 15 years

- 20 years

- 25 years

- 30 years

When the term is over, you can keep the coverage until you turn 85, but the premium will increase each year. SBLI term policies can also be converted into a whole life or universal life policy if you want permanent coverage.

Policies totaling under $500,000 for customers aged 18-60 don’t require a medical exam.

SBLI also offers a one year, non-renewable term life insurance policy. The policy has an affordable, one-time premium.

The one-year option gives you an alternative when you need long-term coverage but aren’t sure if it’s the right time to buy a permanent policy — for example, if you’re waiting for estate issues to be resolved or you can’t afford to buy a policy with longer coverage.

You can convert the one-year non-renewable term policy to a permanent SBLI life policy with lifetime coverage and a guaranteed cash value.

A medical exam is not required to convert a term policy to a permanent policy.

SBLI also offers a SmartTerm 360 policy that is designed to fit your coverage needs as they change over time. SmartTerm 360 is a group of term life policies arranged to fit your needs during phases of your life.

For example, a traditional 30-year term life policy with $1,500,000 coverage at $109.75 per month will end up costing you $39,510.

With SmartTerm 360, this is broken down into three different phases with different expenses.

| Phases | Expenses |

|---|---|

| Years 1-10 | - 30 years of mortgage costs - Education costs - 30 years of replacement income |

| Years 10-20 | - 20 years of mortgage costs - Education costs - 20 years of replacement income |

| 10 years of replacement income | - 10 years of mortgage costs - Education costs - 10 years of replacement income |

Get Your Rates Quote Now |

|

Let’s break this down further by monthly costs.

| Phases | Costs |

|---|---|

| Years 1-10 | - $1,500,000 coverage - $89.70 per month |

| Years 10-20 | - $1,000,000 coverage - $70.07 per month |

| Years 20-30 | - $500,000 coverage - $43.37 per month |

Get Your Rates Quote Now |

|

Over 30 years, the SmartTerm 360 policy would cost $24,386, saving you $15,124 over the traditional term life policy.

By using the SmartTerm 360 policy, you can adjust your coverage to fit your needs as they evolve over your lifetime. On average, SmartTerm 360 can save you between 30 percent and 50 percent compared to traditional term life insurance.

Whole

Whole life insurance policies are permanent policies that give you lifelong protection with the potential for cash value growth.

These policies will never expire as long as you pay the premiums. Whole life insurance premiums are guaranteed not to increase.

One of the advantages of a whole life insurance policy is the cash value. The cash value of your policy takes a portion of your premiums and lets it grow. You can borrow from the cash value at any point during your lifetime.

For example, you may need to borrow from the cash value if you have unexpected medical expenses or your retirement savings plan has been maxed out.

Whole life policies also allow you to choose how frequently you make payments.

The company offers Flex whole insurance, which allows you to choose a term life insurance rider for 10, 15, 20, 25, or 30 years with premiums that won’t increase during the selected period.

By blending a whole life insurance policy with a term life rider, you get a cash value and extra coverage.

SBLI also offers a LifePace whole life insurance policy that combines a whole life policy with a term life rider or a 30-year cashout rider. This rider lets you get back the money for the premiums you paid for the rider after 30 years.

Riders

SBLI also offers a variety of riders to help you further tailor your life insurance policies to better suit your needs. The following riders are available for policyholders:

- Accelerated death benefit

- Children’s level term

- Accidental death benefit

- Waiver of premium

- Single-pay paid-up additions

- Guaranteed level premium

An accelerated death benefit rider pays up to $250,000 if the person has a terminal illness that will result in death within a year. A verified physician’s statement is needed to receive the benefit. The rider is automatically included with all SBLI life insurance policies at no charge.

The children’s level term rider provides coverage for children who aren’t married and depend financially on the insured. Children must be older than 15 days and less than 23 years old when the policy is issued. The rider can be converted to a permanent SBLI life insurance policy.

An accidental death benefit rider will pay the rider’s face amount and the base policy’s death benefit if the insured dies within 180 days of an accident. A physician’s statement or death certificate is needed to receive the benefit.

The waiver of premium rider waives premiums if the insured becomes disabled and is unable to work.

The guaranteed purchase option rider allows the insured to expand their coverage at chosen ages or life events. No medical exams or health questions are required.

A single-pay paid-up additions rider allows the insured to make a single additional cash deposit when the policy is issued to strengthen the policy’s death benefit and cash value.

The guaranteed level premium term rider can be added to whole life policies to provide additional term coverage for 10, 15, 20, 25, or 30 years. The premiums will not increase during the term you choose.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

When you’re shopping for life insurance, you need to understand all the factors that could affect your premium. Many variables, including your age, gender, health, and occupation, can have an impact on the price of your policy.

Let’s take a closer look at the way these factors can change your premium:

Demographics

Demographics such as age and gender can have a significant effect on the price of your premium. The older you are, the higher your premiums are because it becomes more likely the company will have to pay out your policy.

Therefore, the younger you are, the lower your premiums will be.

Gender also can affect your premium. Women have a longer life expectancy than men, so their premiums are generally lower. Women’s’ life expectancy is 86.5 years, while men have a life expectancy of 84 years.

Current Health & Family Medical History

The state of your overall health also has an impact on your life insurance premium. Essentially, since healthy people have a longer life expectancy, their premiums are lower.

Usually, insurance companies will have you submit a medical history as part of the application process. Some companies require a medical exam when you apply for a life insurance policy.

Family medical history can also play a role in the price of your premium. If there’s a history of serious illness or hereditary conditions in your family, your premium could be higher.

Some of SBLI’s life insurance policies require medical exams. If a medical exam is required for your policy, a paramedical exam partner will schedule an exam time and location.

SBLI offers the following tips for a successful medical exam:

- Get plenty of rest

- Avoid salty foods

- Avoid strenuous exercise

- Don’t consume caffeine

- Fast for two hours before the exam

- Drink plenty of water

- Have a detailed list of your medications

By keeping all these things in mind, you’ll get the most accurate exam.

However, many of SBLI’s policies don’t require a medical exam. SBLI has an accelerated underwriting process that helps expedite the application process and allows you to get a policy without a medical exam.

Anyone aged 60 and under with a policy of $500,000 or less is eligible for the accelerated underwriting process.

SBLI also doesn’t require a medical exam if you convert from a term life insurance policy to a permanent policy.

High-Risk Occupations

Certain jobs and industries such as construction have a higher number of fatal work-related injuries. These jobs fall under the category of high-risk occupations because they’re considered more dangerous than average occupations.

Having a high-risk occupation, such as a police officer, can cause your insurance premium to increase significantly.

In 2017, the Bureau of Labor Statistics reported that the construction, transportation, warehousing, and agriculture industries had the highest number of fatal injuries.

High-Risk Habits

Like occupations, certain habits are considered high-risk by life insurance companies. One of the most common high-risk habits that can affect your premium is smoking. Smokers will have a much higher premium than non-smokers.

If you smoke, your premium will be higher, regardless of your age or gender.

SBLI’s rates increase significantly for smokers. For example, a 30-year-old male non-smoker with a $100,000 10-year term policy will pay $8.74 a month. A smoker with the same background and policy will pay $20.36.

A 60-year-old female non-smoker with a $100,000 20-year term life policy will have a premium that starts at $24.93 a month. A smoker with the same policy will pay $101.20.

As you can see with SBLI’s rates, smoking can have a drastic effect on the price of your premium.

Other habits life insurance companies consider high-risk include skydiving, private aviation, racing, and rock climbing. If you participate in these events once, your premiums won’t change.

However, if it’s a regular hobby and there is a pattern of you participating in high-risk activities, your premium will be affected.

Veteran or Active Military Status

Active military members are considered to be in a high-risk occupation. Since they hold a high-risk occupation, members of the military pay higher premiums.

Some insurance companies do not provide policies at all for active military members.

Getting the Best Rate with SBLI

While you’re shopping for life insurance, you want to get the best price possible while making sure the needs of your family are met. Here’s how you can get the best rate possible with SBLI:

The first step to getting the best rate is to know exactly what kind of coverage you need. You can use SBLI’s coverage calculator to help you determine the short-term and long-term expenses your family will need to be covered.

This way you know what you need to be covered and don’t overpay for coverage you don’t need.

You also need to buy life insurance as soon as possible. If you’re younger, you may not be thinking about life insurance. However, the older you get, the more your premiums will go up. Start looking for life insurance policies as soon as possible so you can get locked into a lower rate.

Another way to make sure your premiums stay low is to take care of your health. When you’re in good health, your premiums are lower and remain stable. If your health changes or you develop a serious illness, your premium could increase.

Consider these factors when you’re shopping for insurance to make sure you’re getting the best rate possible.

SBLI’s Programs

The company’s SBLI Advantages Program is a group of products and services provided by SBLI partners for its customers.

Through this program, you can get access to Life’s Mission Control from Legacy Shield, which is a group of online tools that allow you to store documents, photos, and your final wishes. You can also create the documents needed for your estate plan.

The program brings together all of your financial accounts in one dashboard. You can also use it to estimate tax refunds and retirement needs.

SBLI customers have access to HealthPlan Services, which helps you get information on Medicare supplement plans when you need coverage beyond an existing Medicare plan.

You can also get information on Medicare Advantage or the Prescription Drug Plan. HealthPlan Services will help you determine your eligibility and help you choose and enroll in the best plan.

Pet insurance is also available through an SBLI partner. Healthy Paws Pet Insurance and Foundation will allow you to insure your cats and dogs and be prepared in case of an unexpected veterinarian bill.

Canceling Your Policy

SBLI offers many ways to alter your current policy if it’s no longer working for you and your family.

You can transfer your term life policies into permanent whole life policies. You can also add or remove riders to tailor your policy to your needs. If you aren’t able to adjust your policy to fit your needs, you can cancel your policy.

How to Cancel

Follow these steps to cancel your life insurance policy with SBLI:

#1 – Log Onto MySBLI

Log onto your MySBLI account to access the form directory.

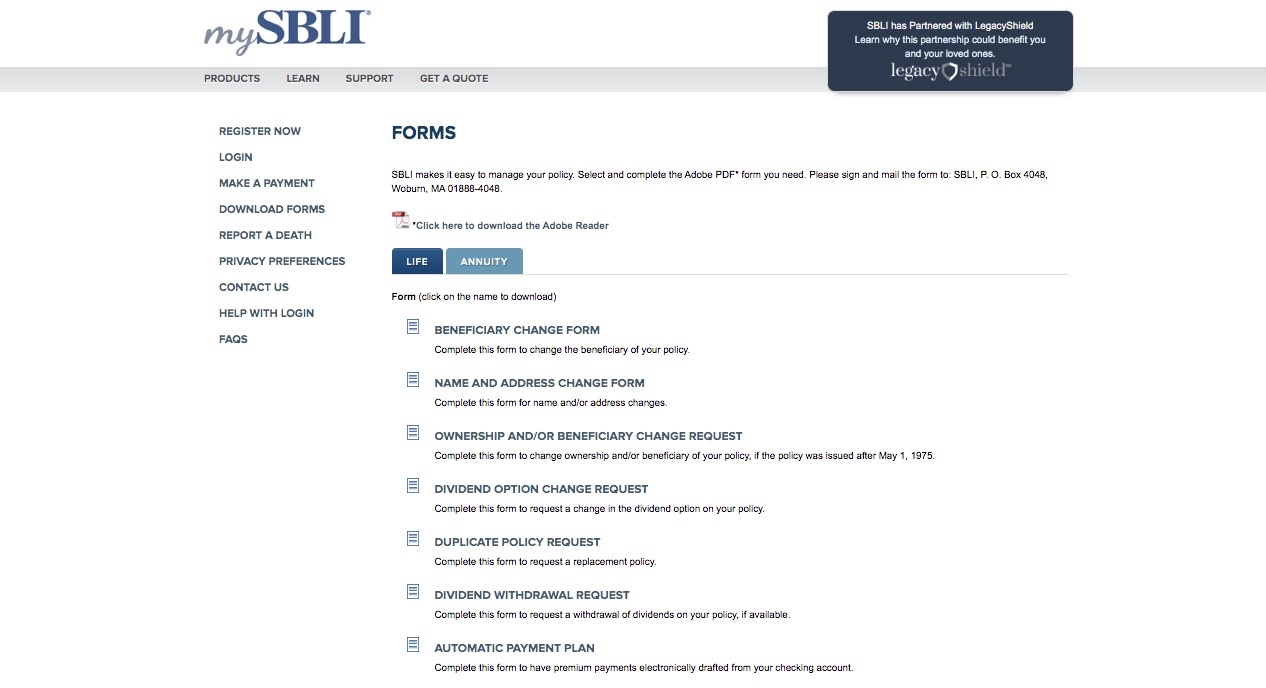

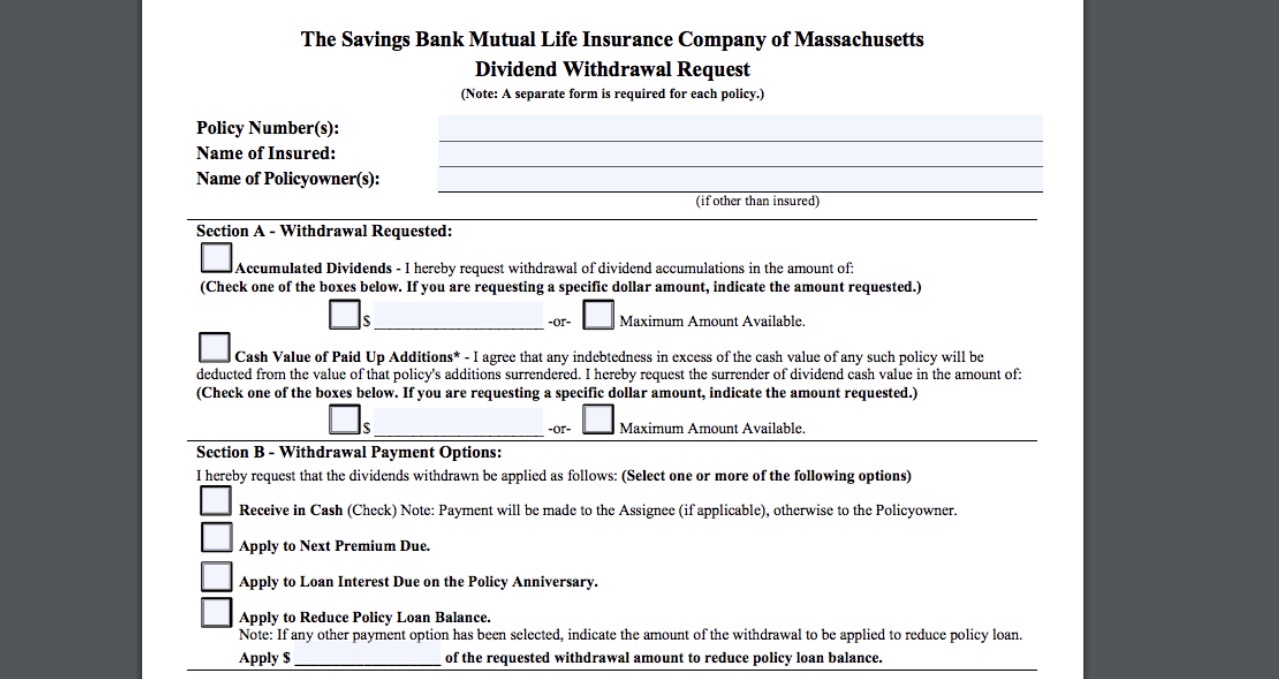

#2 – Click on Dividend Withdrawal Request Form

Access the Dividend Withdrawal Request form from the directory.

#3 – Fill Out the Form

The form will have information about the number of dividends you want to withdraw and how you want to receive the payment.

#4 – Submit the Form

You can submit the form online through MySBLI.

How to Make a Claim

You also make a claim through MySBLI by filling out claims process forms on the website. Once you complete the form and any requested supplemental forms, you can submit the claim online. If you have problems filling out the form, you can call the SBLI Customer Service line at 1-800-694-7254.

How to Get a Quote Online

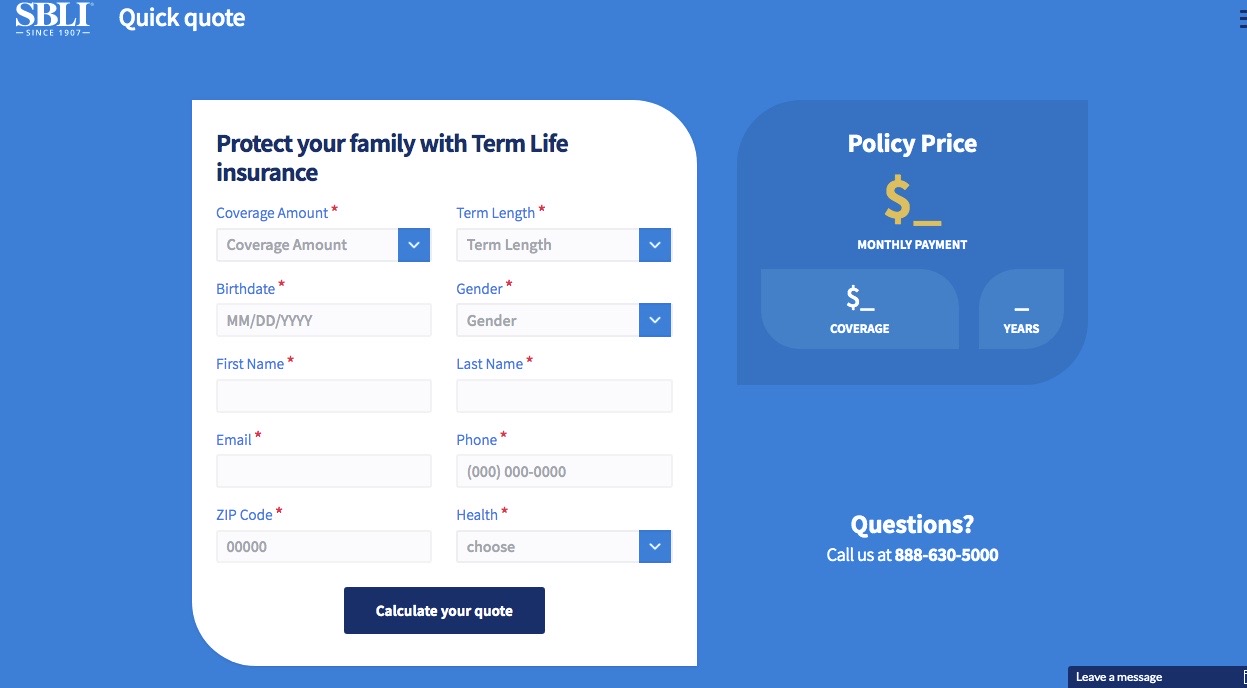

Now that you know about SBLI’s policies, here’s how you can get a quote online:

#1 – Click the “Get Quote” Icon

Click on the “Get Quote” icon in the upper-right-hand corner of the homepage to start the process.

#2 – Fill Out the Information Form

After you click on the “Get Quote” icon, you will be taken to an information form. The form asks for you for the following information:

- Coverage amount

- Term length

- Birthdate

- Gender

- First and last name

- Phone

- ZIP code

- Health status

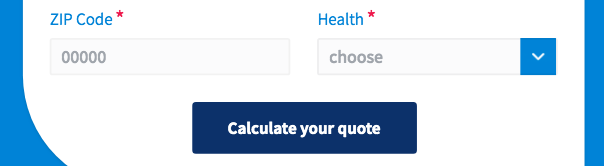

#3 – Calculate Your Quote

Once you’ve filled out the required information, click the calculate your quote button and receive your estimate.

Design of Website/App

Overall, the SBLI website is easy to read and navigate. The pages to get your quote and apply online for a life insurance policy are in the upper-right-hand corner of the homepage and easy to find.

The website also has an option to chat with a representative of the company. It’s located at the bottom of the screen and will pop up as you navigate the pages.

The only major drawbacks of the website’s design are that the social media icons are hard to find and the homepage has a large amount of white space with small text.

SBLI currently does not have an app.

Pros & Cons

Now that you have an overview of what SBLI has to offer, let’s break down the pros and cons of the company:

Pros

SBLI recently became a mutual insurance company and is now owned by policyholders. This means the company answers to you and has customer-driven policies.

The company offers multiple policies that don’t require a medical exam, making their policies more accessible and easier to get approved.

SBLI also offers flexible policies, such as their SmartTerm 360, LifePace, and Flex Whole Insurance, that let you tailor your policy to best fit your family’s needs.

Cons

SBLI doesn’t assign policies to people over 60. Most insurance companies have a wider age range. This cap limits the customers SBLI can serve.

The Bottom Line

Overall, SBLI offers affordable, flexible policies that serve customers with a wide variety of needs. The company is also in great financial standing with strong credit ratings, meaning it’s reliable and trustworthy.

With its transition to a mutual insurance company, SBLI is putting its customers first. If you’re looking for reliable and affordable policies that give you both protection and flexibility, SBLI may be the company for you.

SBLI’s FAQs

#1 – How do I notify SBLI of a name change?

You can request a name change by filling out a name and address change request form or by submitting a letter signed by the policy owner with your full previous name, full new name, and information on the policies affected by your name change.

#2 – Who owns SBLI?

SBLI has recently transitioned to a mutual company, which means it’s owned by the policyholders. The current president and CEO is James A. Morgan.

#3 – What is SBLI term insurance?

SBLI offers term life insurance for 10-, 15-, 20-, 25-, and 30-year terms. The company also offers a one year non-renewable term policy.

Get life insurance now in your ZIP code by clicking on our FREE online quote tool.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption