Colonial Penn Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1957 |

| Current Executives | CEO - James Prieur President - Joel Schwartz |

| Number of Employees | 290 |

| Total Sales / Total Assets | $345,000,000 / $1,031,300,000 |

| HQ Address | 399 Market Street, Philadelphia, PA 19106 |

| Phone Number | 1-866-235-3518 |

| Company Website | www.colonialpenn.com |

| Premiums Written - Individual Life | $296,600,000 |

| Financial Standing | $12,400,000 |

| Best For | Guaranteed Acceptance Whole Life |

Get Your Rates Quote Now |

|

You’ve might have seen Alex Trebek on television speaking about a great life insurance product from Colonial Penn Life Insurance Company or Colonial Penn for just $9.95 per month and wondered exactly how it worked.

Established in Philadelphia, Colonial Penn has been providing affordable options for older Americans to get life insurance for over 60 years.

This review of Colonial Penn will guide you through policy options and help you determine whether the $9.95 rate lock product or any of the company’s other offers, are right for you.

If you want to jump right in to get a FREE quote, enter your ZIP code above.

Table of Contents

Colonial Penn’s Ratings

Colonial Penn is one of many options you might come across as you shop for affordable coverage. This summary of Colonial Penn’s ratings can help you understand how the company fares with customer service, whether the company is stable and financially capable of withstanding any tough times, and whether they meet your needs.

A.M. Best

A.M. Best is a rating service dedicated exclusively to the insurance industry.

As a rating provider, they look at a company’s financial well-being and their credit strength. As a consumer, you want to make sure you’re picking an insurance company that’s structured for longevity. When you need to make a claim, you want to make sure your provider will be there.

A.M. Best provides Colonial Penn an A- (Excellent) financial strength rating and an A- (excellent credit rating). This indicates that Colonial Penn is well-structured and stable.

Better Business Bureau (BBB)

The Better Business Bureau (BBB) provides company ratings based on customer complaints. Colonial Penn is not an accredited BBB company but does have a very high A rating. The company has only four complaints filed from customers in the Philadelphia area, and all complaints are marked as answered.

Moody’s

Moody’s is a financial rating service used by investors to determine the structural strength and financial viability of a company. The most recent rating, provided in October 2018, indicates Colonial Penn Insurance is currently an A3.

The company has received consistent rating upgrades since 2018. This is a good sign that Colonial Penn’s business outlook is stable and improving.

Standard & Poor’s (S&P)

Another well known financial rating provider, S&P Global Ratings, affirmed a BBB+ rating for Colonial Penn in August of 2018. The BBB+ rating indicates S&P Global Ratings has an opinion that Colonial Penn has a stable financial standing.

NAIC Complaint Index

The National Association of Insurance Commissioners (NAIC) provides annual data that tracks the number of complaints filed against leading insurance companies. Knowing the number of complaints can provide consumers some insight into how an insurance provider manages issues.

The latest report in which Colonial Penn appears is from 2016. In this complaint index, Colonial Penn has one complaint logged, giving the company an index rating of 2.45.

In subsequent years, Colonial Penn does not appear in the report. When companies do not register reports, they aren’t listed in the index.

Company History

Colonial Penn has been offering affordable life insurance direct to consumers for over 60 years.

Unlike many of their competitors who operate through a network of independent agents, Colonial Penn services sales and support directly through the mail, or through call centers and online channels.

Founded in Philadelphia by philanthropist Leonard Cohen, the company’s original mission was to provide life insurance to people over 65. Since then, the company has expanded to provide options for consumers ages 50 to 85 specializing in guaranteed-acceptance whole life insurance.

Colonial Penn has been through several organizational transitions.

In 1985, the company was purchased by a utility holding company called NextEra Energy.

The company was again sold in 1991 to the Jefferies Financial Group, an independent investment bank, and most recently sold to CNO Financial Group in 1997.

Today, Colonial Penn still operates from its headquarters in Pennsylvania and services 49 states, Washington D.C., Puerto Rico, and the Virgin Islands. The company is not licensed to operate in the state of New York.

Colonial Penn’s Market Share

According to the Insurance Information Institute, the life insurance industry in the United States generates about $600 billion in revenue from direct premiums written. According to 2018 annual reports from parent CNO Financial Group, Colonial Penn Insurance generated $794.8 million from life insurance premiums written.

This places Colonial Penn under a 1/2 percent market share, keeping the company well out of the top 10 in the industry.

However, Colonial Penn is a well-reputed brand. Annual financial reporting shows year-over-year growth in the life insurance sector.

Colonial Penn’s Position for the Future

Colonial Penn markets directly to consumers through mail and television advertisements.

Although they have found success in growing the business through this method, marketing expenses have fluctuated and in some years, increased marketing expense has resulted in overall revenue loss.

The CNO 2018 annual report does attest to the company’s commitment to managing these marketing expenses to keep Colonial Penn on an overall growth trajectory.

The annual report also mentions a commitment to growth for Colonial Penn through investment in new product development and expanding markets. However, the report does not go into further detail for specific products or markets.

Colonial Penn’s Online Presence

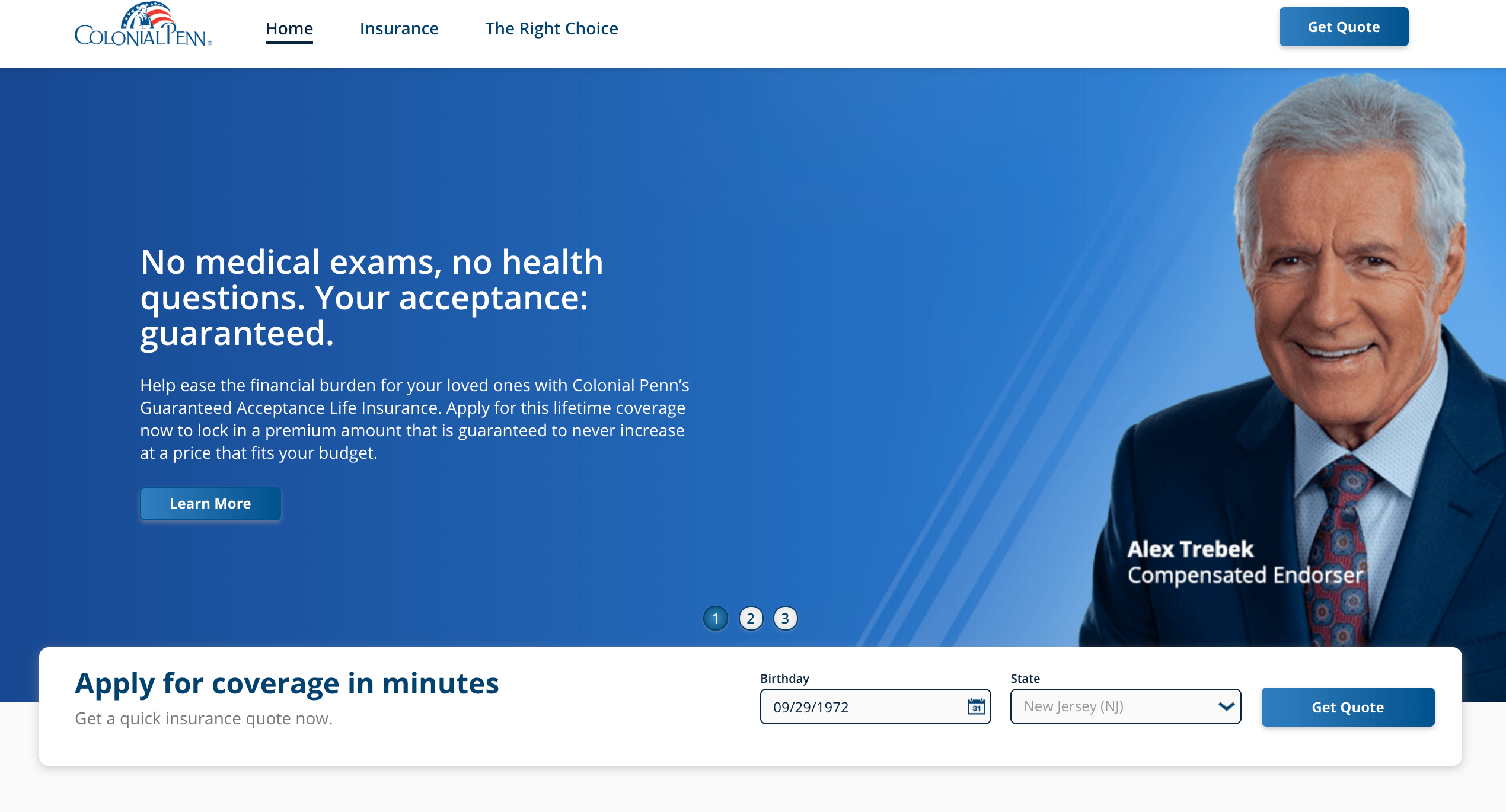

Colonial Penn has two websites. The first is a website that provides consumers with information on products and services provided by Colonial Penn. The website features TV personality Alex Trebek, host of the popular game show “Jeopardy!”, as its paid endorser.

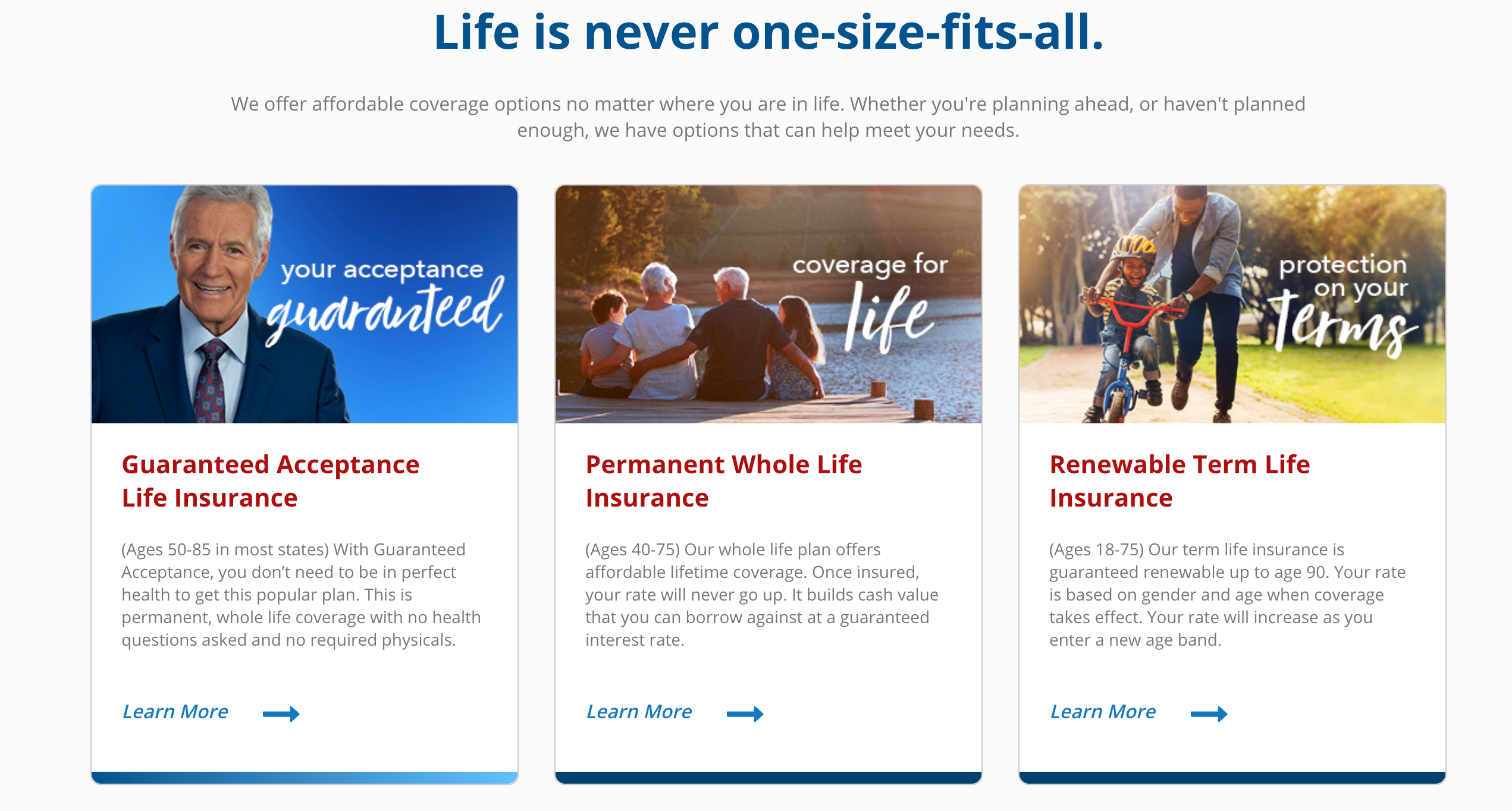

The website is focused on providing general information on products and services with links to each of its featured products. Colonial Penn specializes in guaranteed acceptance, permanent whole life, and renewable term life products.

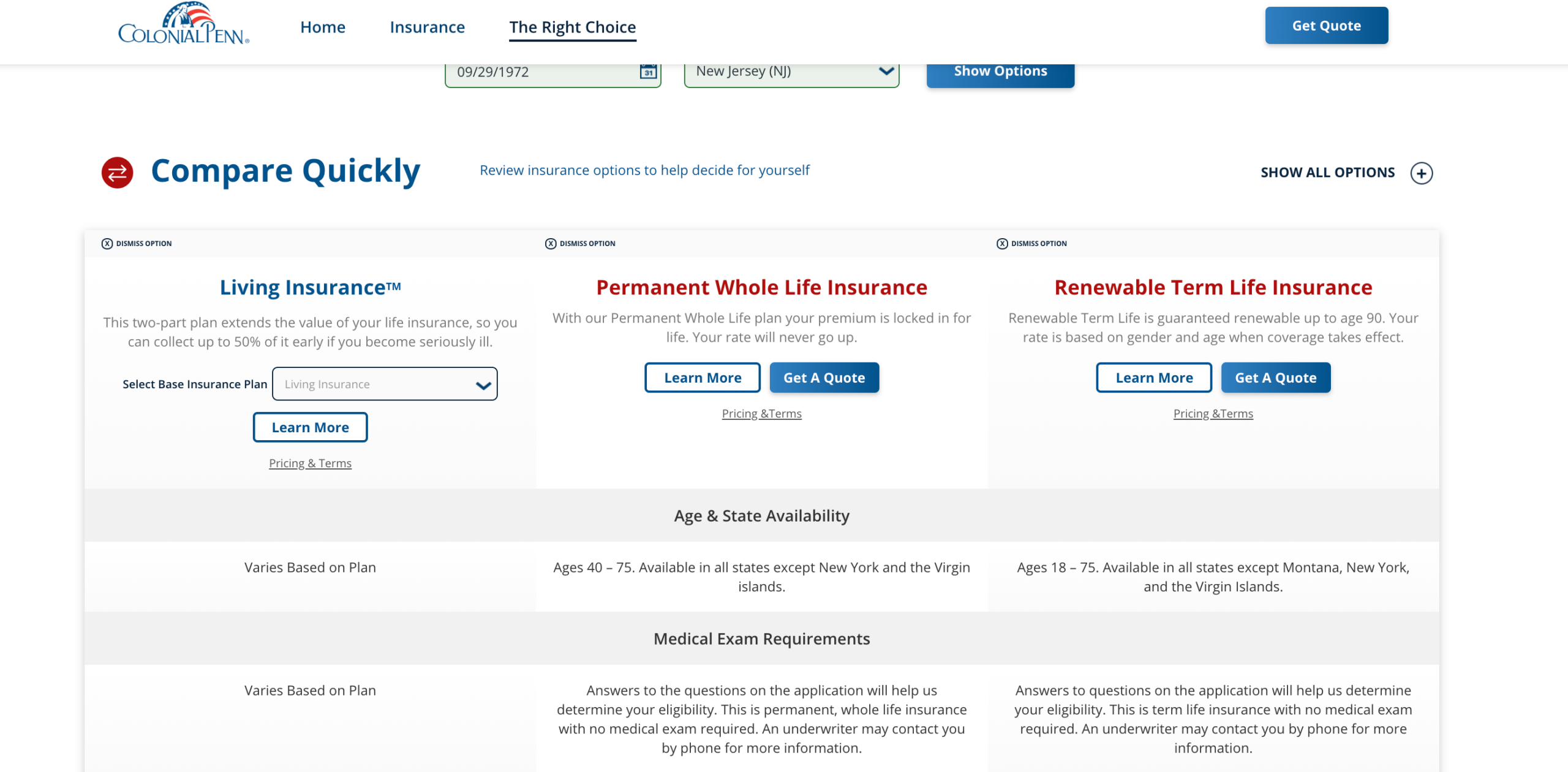

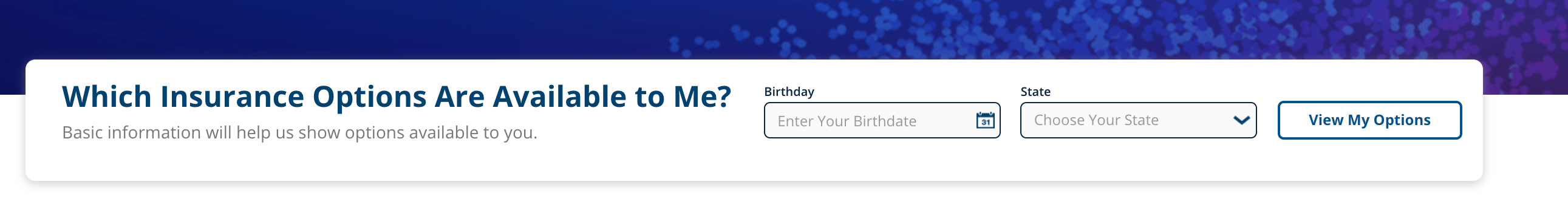

As you navigate through the types of insurance, various links take you to Colonial Penn’s “The Right Choice” page. This page prompts you to enter a birthdate and state of residence. It returns information on the plans that Colonial Penn offers that are relevant to you.

For policyholders, Colonial Penn hosts a separate site that requires login access. Customers can manage their accounts, review their policies, and file claims directly through this site.

Overall, Colonial Penn’s online resources are well designed and seem easy to navigate and understand, but actual sales and service seem to be conducted directly by phone.

Colonial Penn’s Commercials

Colonial Penn’s target demographic is customers who are over the age of 55. Although the company offers term life insurance for ages 18 to 75, and universal life policies to customers between the ages of 40 to 75, most of their advertising is focused on their guaranteed-acceptance life insurance product.

This commercial features paid endorser and “Jeopardy!” host Alex Trebek.

Although commercial advertising is singularly focused, Colonial Penn also provides renewable term and whole life insurance solutions.

Colonial Penn in the Community

Colonial Penn is an active member of the Philadelphia community. The company donates time and advocacy each year to support the Children’s Scholarship Fund Philadelphia.

Associates from Colonial Penn reach out to families that have qualified for tuition assistance for private elementary schools.

Colonial Penn’s Employees

Glassdoor.com gathers feedback and ratings from employees of various companies to give an indication of the conditions and environment of the workplace.

Colonial Penn received a 2.2 rating out of five stars from over 50 employees that provided feedback. Many responses were from members of Colonial Penn’s telesales team, and much of the negative feedback was related to high-pressure sales goals.

On the positive side, employees indicated that Colonial Penn helped employees obtain licensing and offered some employees the ability to work remotely.

Colonial Penn does not have its own employee recruitment site. Parent company CNO Financial Group provides recruiting resources and a careers page that includes listings for career opportunities at Colonial Penn.

CNO Financial Group strives to provide a culturally rich and diverse work environment for its insurance professionals. This video provides some insight into the culture within the overall CNO group.

Colonial Penn has two main locations for its employees: Philadelphia, Penn., and Carmel, Ind. However, employees seem to be located throughout the United States.

Shopping for Life Insurance

It takes a bit of work to find an affordable life insurance policy. Depending on your age and lifestyle, you may be looking for only specific types of insurance.

Before we break down the types of products from Colonial Penn that might be for you, you should first determine why you are buying life insurance.

The first question most consumers have is when is the right time to buy life insurance? The video below provides a quick overview of why you may not want to wait any longer to start shopping for life insurance.

Buying a life insurance policy is a good idea if you have responsibilities such as:

- Having a home mortgage or student loan, credit card, or car loan debt. You wouldn’t want to burden family members with any debts if something happens. Also, some policies can help you make ends meet if you’re disabled and can’t work or are temporarily unemployed.

- Living with a loved one or family.

- Caring for your family after a divorce or separation.

- Providing care or financial help for an elderly family member.

- Having a business or partnership that would suffer losses if you could no longer work.

- Protecting your estate and passing your inheritance to your heirs with some tax protection.

The second question to answer is how much insurance you might need or be able to afford. If you’re younger and generally in good health, you can find affordable term solutions to fit your needs.

Colonial Penn focuses on providing solutions for older consumers who may have difficulty qualifying for cheaper term insurance.

For instance, a 60-year-old with high blood pressure may not be able to qualify for an affordable term or universal plan.

In this case, they may want to look at only no-exam insurance products. These may be slightly costlier, but no-exam insurance could provide benefits quickly without the hassle of submitting to a physical exam.

Finally, you’ll want to determine how much insurance you need. A good way to figure this out is to add up about seven years of your income, include mortgage, car loan, credit, and any other debt, and include any amount that you need to allow your loved ones to continue to live in comfort.

From there, you can determine how much insurance you would like versus how much you can reasonably afford.

Once you’ve answered these questions, you’re ready to start looking at rates.

Average Colonial Penn Male vs Female Life Insurance Rates

Colonial Penn offers three types of insurance:

- Renewable term

- Permanent life

- Guaranteed acceptance

In each instance, rates for female consumers are cheaper than rates for male consumers. This is simply because women have a higher life expectancy. For renewable term and permanent life insurance, the rate difference is obvious.

For instance, generating quotes for a 57-year-old male and female living in New Jersey from the Colonial Penn quote tool provides a clear difference in rates when comparing the same amount of coverage.

For a $10,000 benefit, renewable term policy, the male rate generated was $21.16 versus the female rate of $15.49. For a permanent life policy for the same people, the male rate generated was $43.52 versus the female rate of $30.52.

Where the rate comparison gets tricky is when you look at the guaranteed acceptance plan. Colonial Penn offers a $9.95 rate lock guarantee, stating that all customers will pay $9.95 with no medical qualifications.

However, the fine print indicates the $9.95 is a “per unit” price. So even though one unit, regardless of male versus female, is quoted at $9.95, the variable is the unit.

A unit of coverage can vary depending on the age, gender, or health condition of a customer.

Also, the amount of coverage can fluctuate within the definition of a unit.

This means although a unit is the same price, regardless of gender, the number of units required for the same coverage will be higher for male customers.

Coverage Offered

Most life insurance providers offer a wide range of products to accommodate consumers of all ages with different needs. In many instances, to provide competitive rates, a full underwriting process is necessary, which takes time and could require a medical exam.

Colonial Penn has a slightly different strategy. Although the company offers similar products, all the company’s products are no-exam insurance. This means a medical exam is never required for any policy offered by Colonial Penn.

Types of Coverage Offered

Colonial Penn breaks its offerings up into two main categories: life insurance and living insurance. Life insurance products are what you would expect.

Colonial Penn insurance products include:

- Guaranteed acceptance life insurance

- Permanent whole life insurance

- Renewable term life insurance

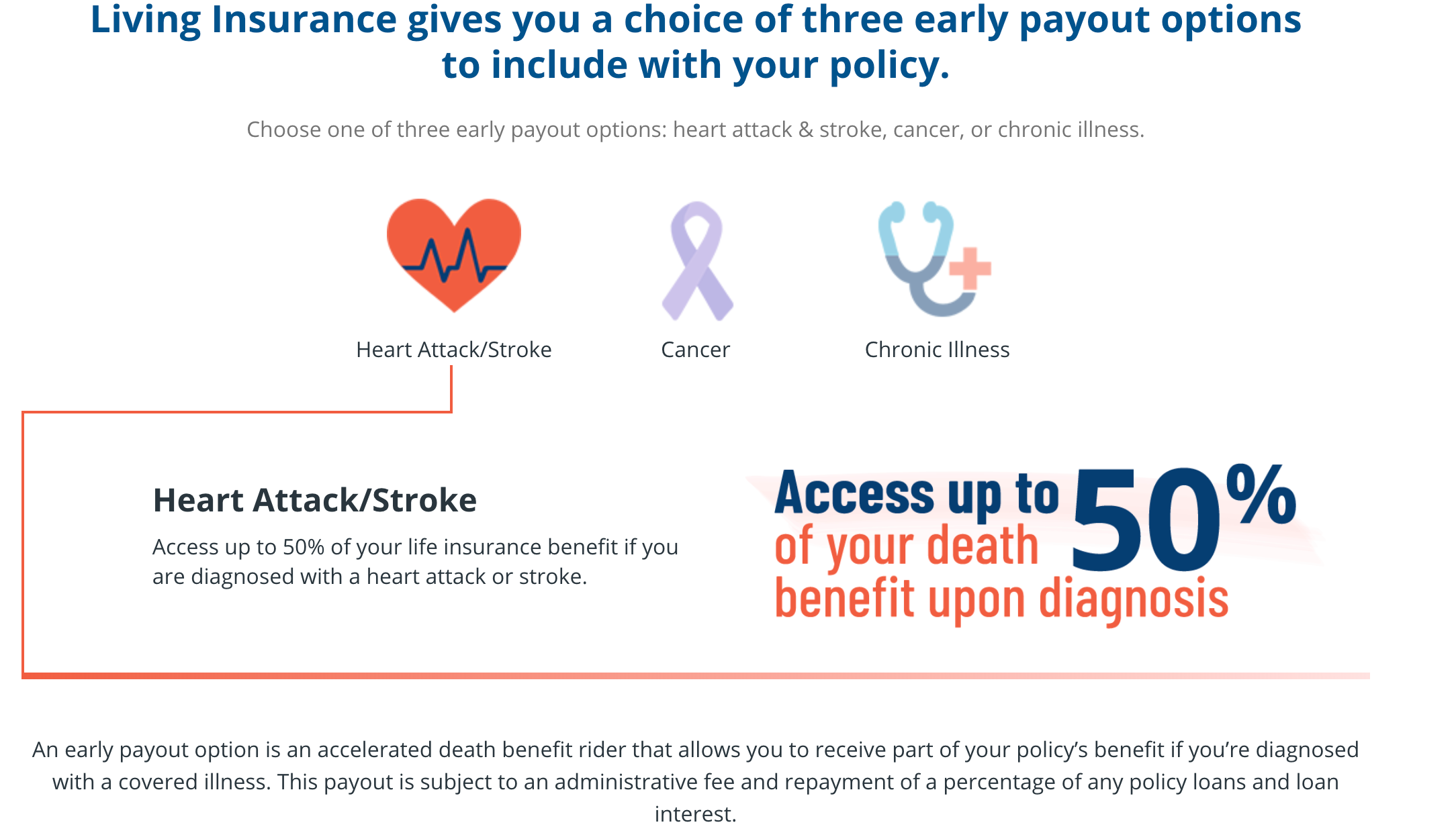

Under a separate category, Colonial Penn offers living insurance, which includes:

- Living insurance with permanent whole life

- Living insurance with renewable term life

The main distinction between life and living insurance is that Colonial Penn’s options for living insurance allow policyholders to receive an early payout of up to 50 percent of their death benefit if they’re diagnosed with cancer, heart attack, stroke, or a chronic illness.

Let’s take a look at specific features for Colonial Penn’s insurance offerings.

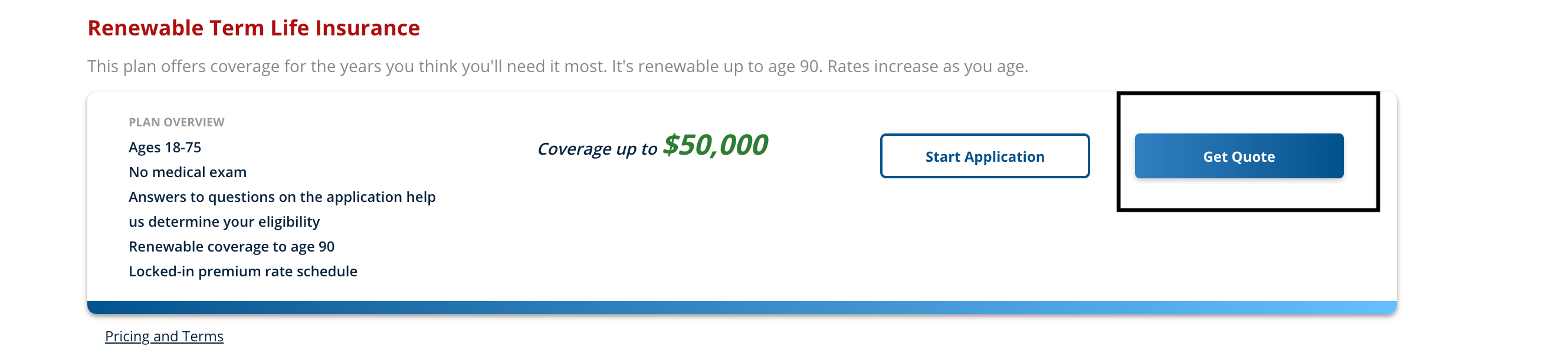

Term

While some companies offer various options for term insurance, Colonial Penn only offers a renewable term policy. This means instead of offering coverage for an extended-term length like 10, 20, or 30 years, Colonial Penn offers a level term policy that must be renewed each year.

Rates depend on your age, gender, and the state where you reside; coverage is available for ages 18 to 75, and policies are renewable until age 90.

To qualify, you’ll need to complete an application that will include some questions about your health. You may also be required to answer additional questions from the underwriter.

Although rates are determined specific to your situation, the chart below can give you an idea of what to expect if you are otherwise healthy.

The chart below provides some sample renewable term rates for a healthy male non-smoker of various ages and at different coverage rates. As you can see, getting insurance at a younger age is much cheaper.

| Age Range | $5,000 | $30,000 | $50,000 |

|---|---|---|---|

| 18-20 | $2.75 | $8.97 | $13.96 |

| 26-30 | $3.75 | $14.97 | $23.96 |

| 36-40 | $4.87 | $21.72 | $35.21 |

| 46-50 | $7.00 | $34.47 | $56.46 |

| 56-60 | $11.33 | $60.47 | $99.79 |

| 66-70 | $20.50 | $115.52 | $191.53 |

Get Your Rates Quote Now |

|||

This next chart provides some rates for female non-smokers, organized by coverage amounts.

| Age Range | $5,000 | $30,000 | $50,000 |

|---|---|---|---|

| 18-20 | $2.54 | $7.72 | $11.87 |

| 26-30 | $3.26 | $12.07 | $19.12 |

| 36-40 | $4.26 | $18.07 | $29.12 |

| 46-50 | $5.87 | $27.72 | $45.21 |

| 56-60 | $8.50 | $43.47 | $71.46 |

| 66-70 | $14.18 | $77.57 | $128.29 |

Get Your Rates Quote Now |

|||

The main thing to consider is that with a renewable term policy, your rates will increase over time. If you’re otherwise healthy and don’t mind submitting to a medical evaluation, you may be able to save by locking your premiums with longer level term insurance plans of 10, 20, or 30 years.

Colonial Penn also offers a maximum coverage cap of only $50,000. If you need more insurance, other providers might have options to consider.

However, if you have concerns that might limit your ability to get coverage, you might want to consider the ease and speed of the application process to have a policy in place with Colonial Penn.

Colonial Penn offers a slight variation of its renewable term insurance by offering living insurance renewable term.

With this insurance, you can withdraw up to 50 percent of your benefit early if you’re diagnosed with cancer or an approved chronic disease, or if you have a heart attack or stroke. This feature could help pay medical bills or meet other needs in these instances.

Whole

Colonial Penn offers a permanent whole life insurance plan that offers lifetime coverage. Eligibility is determined through a questionnaire and does not require a medical exam. Coverage is offered for people between the ages of 40 and 75.

As usual, rates are determined based on your age, gender, health, and the state in which you reside. The minimum coverage amount is $10,000 and the maximum is $50,000.

To get a sample of your rate, you can go to the Colonial Penn Quote page and put in your state, age, and gender and generate a quote. Generating quotes for a 57-year-old male or female looking for different coverage amounts produced the following chart.

| 57-Year-Old Non-Smoker | $10,000 | $20,000 | $30,000 | $40,000 | $50,000 |

|---|---|---|---|---|---|

| Male | $43.54 | $83.33 | $123.12 | $162.91 | $202.70 |

| Female | $30.52 | $57.28 | $84.05 | $110.81 | $137.58 |

Get Your Rates Quote Now |

|||||

You can see from the chart that changing the coverage amount can dramatically change your premium. Going from just $10,000 to $20,000 in coverage almost doubles the monthly premium for the 57-year-old male in the example.

Colonial Penn also offers the living insurance feature for its permanent whole life product. Additional riders for accidental death coverage are available in addition to the living benefit component.

Guaranteed Acceptance

Colonial Penn’s guaranteed acceptance insurance is a final expense insurance product. This means that coverage will last for your lifetime, and you can’t be turned down from qualifying for any reason.

Coverage is available for candidates between the ages of 50 and 85 and is available in most states.

Unlike other insurance products, the Colonial Life Penn guaranteed acceptance insurance is offered in units. Each unit is rate locked at $9.95. The number of units you buy determines the amount of benefit you receive.

Because of this, Colonial Penn can consider your age, gender, and health in determining the number of units you might require to get the coverage benefit you want.

For example, a healthy 50-year-old non-smoker might need to purchase only two units per month to get $15,000 in coverage benefit, making his monthly premium $19.90. For a 75-year-old male, the same coverage might require five units, making the monthly premium $49.75.

Because this is not transparent, you need to understand exactly how much benefit you qualify for and exactly how much it will cost before you sign a policy agreement. Unfortunately, the only way to get real quotes is to speak to a Colonial Penn sales agent.

If you’d like to compare the rates outlined in this article with a FREE quote, enter your ZIP code below and get an instant quote.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

At the end of the day, you want to know exactly how much you’ll have to pay for insurance. The tables and rates quoted in this article and from the quote tool on the Colonial Penn site provide a good starting point when you begin shopping.

However, final rates aren’t usually established until you go through a process called underwriting. Underwriters compile several factors around your life to determine overall risk, and in some cases, they might deny coverage. The higher the risk, the higher your rate.

For Colonial Penn, medical exams are not required. However, for renewable term insurance and permanent whole life, you’ll still need to submit an application and go through an underwriting process. Here are some things that the underwriter will evaluate.

Demographics

Underwriters want to know common statistical information about you.

Whether you are male or female could affect your life expectancy, and in turn, your rate. Your height, weight, and age are important for an underwriter to assess your risk.

If you’re outside of the normal ranges for your weight, you may be considered a higher risk.

Underwriters will also factor where you live and where you work. Insurance companies want to know if you have a physically demanding occupation and whether where you live could affect your health. Your financial well-being could be a factor.

Current Health & Family Medical History

Your health and family medical history is an important factor in determining risk. Even if you’re otherwise healthy, insurance companies will want to look at whether you have any family history of diseases such as various types of cancer, hereditary heart disease, mental health issues, or Type 1 or Type 2 diabetes.

Most companies will want to know if you have a history of high blood pressure and will ask whether you exercise regularly and watch your diet.

Taking care of yourself with good exercise and diet could help keep your rates low. In some instances, you might have to submit blood work or undergo a full physical exam.

Some policy types require certain pieces of information. For instance, even for life insurance that requires no exam, you might still be required to complete a medical history questionnaire.

High-Risk Occupations

If you have a dangerous occupation, you may find it difficult to get an affordable policy. Your job may not seem high-risk, but jobs that are high-stress could be a high risk for insurance companies. Insurance companies may even factor in whether your overall day leads to higher health risks.

In some instances, you may be required to carry an accidental death rider with your policy to get insurance.

High-Risk Habits

Risky behaviors will cost you when it comes to getting insurance. If you smoke cigarettes or vape, drink alcohol regularly, or use illegal substances, you may not be able to get a life insurance policy.

At the very least, you’ll have to shop around to get a decent rate. If you’ve ever received a DUI conviction, you may find it difficult to get affordable insurance.

Colonial Penn offers guaranteed acceptance life insurance, but this insurance is intended primarily for final expenses, and coverage amounts are limited.

Even hobbies that seem benign could affect your rate. Something a simple as taking your motorcycle out on sunny days could affect your risk and make getting a policy costlier. Underwriters factor in the risks of hobbies such as hunting, mountain climbing, skydiving, and surfing.

Veteran or Active Military Status

If you’re a military service member, whether you’re a veteran or on active duty will affect your policy rates. Most companies that offer coverage to active members and veterans will have different policy types.

Military active duty and veterans can get coverage through the Veterans Administration, but supplemental options are available.

Getting the Best Rate with Colonial Penn

Colonial Penn has only three main products. Because of this, determining whether you’ll get a good rate compared to other similar products is easy.

To get the best rate with Colonial Penn, you should determine the type of insurance you’re looking for, the amount of coverage you need, and how quickly you’d like a policy in place.

Since Colonial Penn doesn’t require a medical exam, if you’re healthy and don’t mind submitting to a medical exam, you may want to shop around for other term and permanent insurance providers.

However, if you have pre-existing conditions or are looking for simple affordable final expense insurance, speaking with a Colonial Penn agent might be beneficial.

It’s always a great idea to shop around with three or four providers that offer similar products before committing to any program.

Colonial Penn’s Programs

Colonial Penn offers a 30-day “Try-It-On” period. If you sign up for any policy and you change your mind, you can cancel without any penalty and get a full refund. This is a nice option if you made a hurried decision and find a better policy afterward.

Although Colonial Penn has a useful website with helpful information, most of its customer service resources and interactions seem to be conducted by phone.

Canceling Your Policy

Canceling your life policy can be as easy as stopping your premium payments or taking advantage of the 30-day trial. However, it may not be the best thing for you. It’s always best to understand your risks.

Also, you should understand why canceling your current policy is necessary. Perhaps you’ve found a better, more affordable option with a new provider, or your needs have changed and your current policy is insufficient.

How to Cancel

If you’re thinking about canceling your policy, you’ll want to make sure that you understand the risks for potential fees or lost benefits.

In some instances, canceling your policy is as easy as stopping premium payments, but before you do anything drastic, review the steps below to determine how to cancel your policy to avoid getting hit with fees and penalties.

#1 – Read Your Policy

Go over your policy and read the fine print. Check to see if there are any fees or fines for early termination. For term policies, you won’t get back any premiums paid to date.

For universal, you’ll have to check your policy to see whether you can retrieve the cash value or have any premium payment amounts returned. You’ll also lose final expense insurance premiums if you cancel.

#2 – Contact Your Financial Advisor

Work with your financial advisor to understand any risk you might be assuming and any tax liability you might get from early termination. For a term policy, canceling early just means you’ll lose your benefits. Since there is no cash value, you won’t have tax implications.

However, for universal life, you might receive a return of premiums and have the cash value of the policy returned. An advisor can speak to you about whether you’ll need to pay taxes on any payout.

A financial advisor can also help you understand your risk exposure. If you’re canceling your policy and don’t have another one in place, you might not want to go do something dangerous such as skydiving.

If you’re getting a new policy to replace your current policy, your advisor can help you determine whether your policy needs have changed.

#3 – Reach Out to Your Agent

Contact your insurance sales agent. They may be able to help you with the cancellation process. If you’re looking to replace your policy, an agent can help time the cancellation to align with creating the new policy.

#4 – Submit a Letter in Writing and Keep a Copy

Always request a policy cancellation. Provide specific dates informing when you last paid premiums and when you expect your coverage to end. Keep copies for yourself.

#5 – Cancel Auto-Payments

Don’t forget to cancel any automatic payments that might be set up. Check to make sure that you don’t have a credit card or bank account with an automatic payment setup. You may have to log in to the MyColonialPenn.com site to change any account payment information.

How to Make a Claim

To make a claim with Colonial Penn, you’ll need to gather a few documents first.

You’ll need to visit the MyColonialPenn.com site to get the right claim form for the state in which the policy was bought. You can download the form right from the site or call the company to have a form sent to you.

You’ll also need a certified death certificate for the insured and the original insurance contract.

Once you have these documents collected, you can submit the claim by sending the forms to:

Colonial Penn Insurance Company

Life Claims Dept

PO Box 1918

Carmel, IN 46082-1918

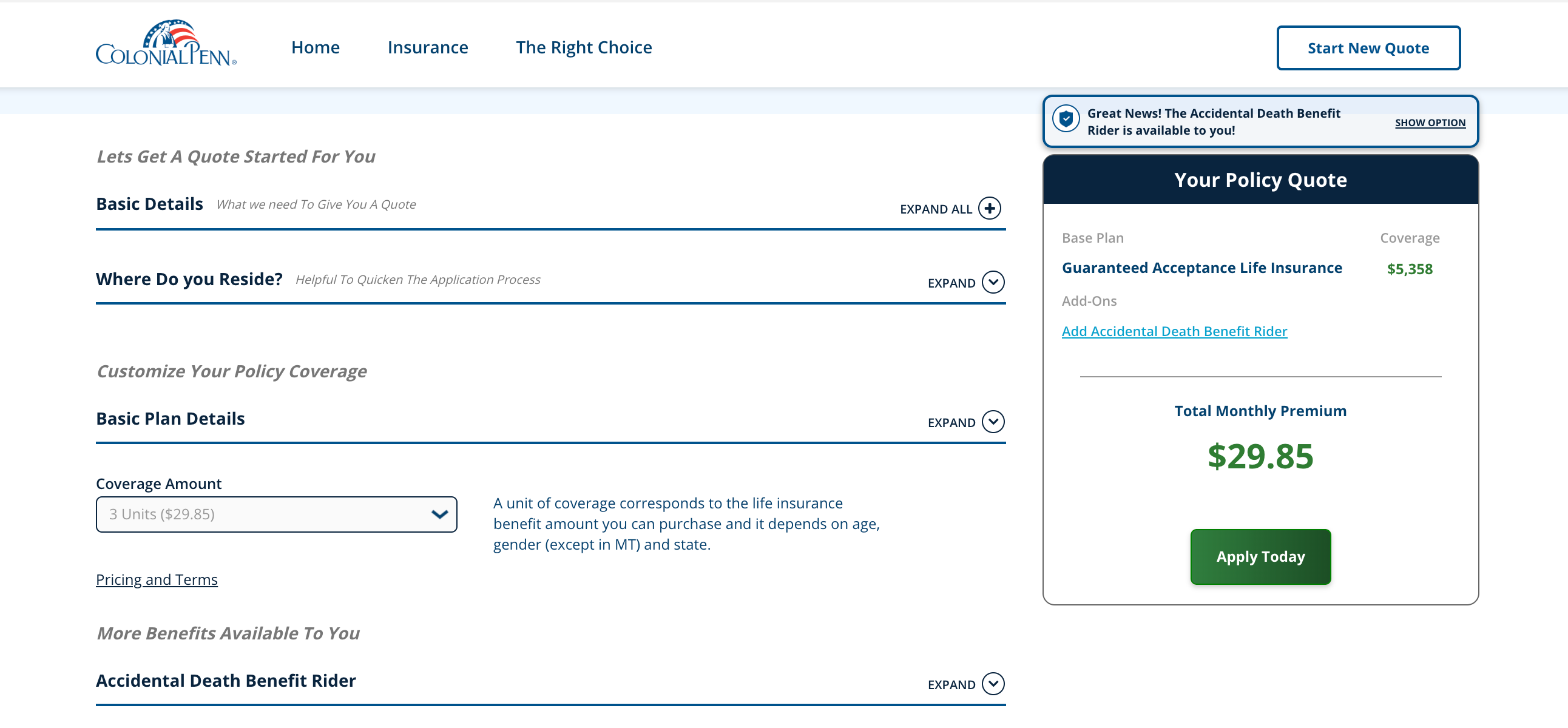

How to Get a Quote Online

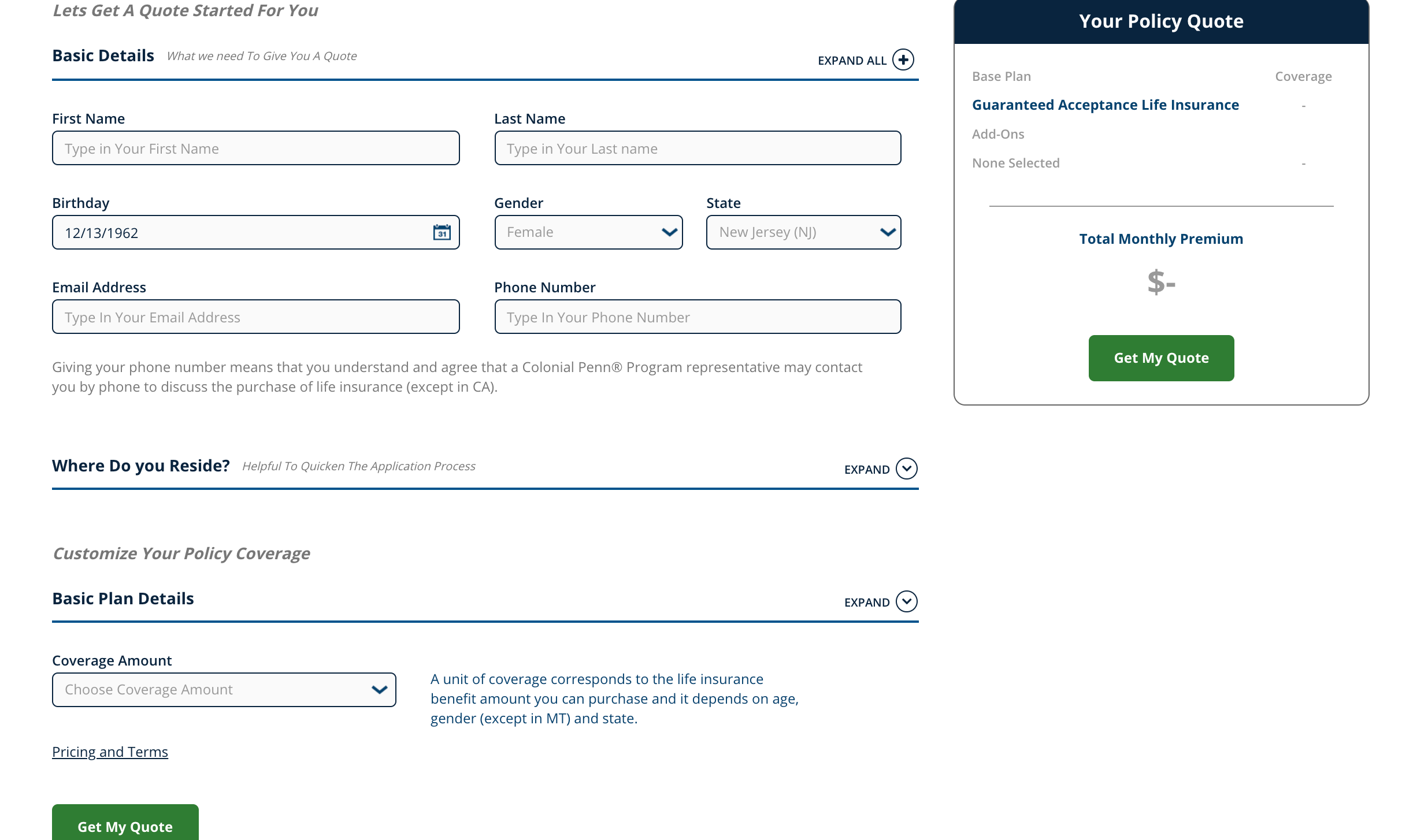

Getting a quote from Colonial Penn is simple. With just a few clicks around the Colonial Penn site, you can generate a sample quote, and you don’t need to provide a lot of personal information.

#1 – Find the “Get a Quote” Button

Step one is to find the “Get a Quote” button on the main page of the Colonial Penn site. After arriving at the home page, you will see a “Get a Quote” button right on the banner navigation on the page at the top right.

Click through here.

After clicking the button, you’ll be directed to a product page and prompted to enter your birthday and the state where you live.

#2 – Enter Your Info and Select a Product

On the plan selection page, you’ll see prompts to enter your birthday and state. Just under that, you’ll see a list of plan types.

After entering your birthday and state, the page will filter to only present the plans that are available to you. If you’re not old enough to qualify for guaranteed acceptance, the option won’t appear.

After entering your birthday and state, the page will filter to only present the plans that are available to you. If you’re not old enough to qualify for guaranteed acceptance, the option won’t appear.

#3 – Select a Plan and Click Get a Quote

From the items presented, select the plan you’d like and click Get Quote again.

You’ll now be redirected to the quote engine.

You’ll now be redirected to the quote engine.

#4 – Generate a Quote

Once you arrive on the quote page for your plan, you’ll be asked to enter as much information as you’d like to provide. However, the only required fields are your birthday, state, and the amount of coverage.

Once complete, you can modify any details or return to start a new quote.

Design of Website/App

Colonial Penn provides a decent web experience for customers researching the company online. However, there are a lot of instances where the same information is presented or the same information is requested from you.

For example, the quote generation tool asks that you enter your birthday and state on different pages. Although it saves the field information, it seems a bit unnecessary to request the info at multiple points.

With a primary customer base over the age of 50, Colonial Penn has not yet invested in apps or smartphone tools. Overall, it seems the company directs most of its resources to web users to call an agent or support person.

Pros & Cons

Colonial Penn was originally founded with the intent of providing older consumers or retirement age with the ability to get affordable insurance. Over time, the company product line has expanded slightly, but if you’re shopping for Colonial Penn, you’ll want to be aware of these pros and cons.

Pros

- Colonial Penn products don’t require a medical exam

- Colonial Penn products are available direct to consumers and aren’t sold through third-party agents

- The company provides guaranteed acceptance life insurance with a rate lock guarantee so your premium will never change

- Colonial Penn is available in 49 states but does not conduct business in New York

Cons

- Colonial Penn only offers renewable term insurance. Premiums could rise every few years

- The guaranteed acceptance life insurance pricing method is advertised as a $9.95 single price, but actual policy premium prices will vary

- Colonial Penn focuses mainly on marketing and selling its guaranteed acceptance life product, which may not be the right choice for you

- Most plans have a maximum coverage amount that may not be sufficient to meet your needs

The Bottom Line

Colonial Penn has a history of serving customers for over 60 years. The company’s main focus seems to be on providing insurance that is easy to obtain and affordable.

Unlike most companies, Colonial Penn doesn’t offer traditional term insurance and only offers a renewable term option. It also offers only one kind of whole life insurance, and all plans have maximum coverage amounts.

If you’re shopping for insurance and are healthy and young, Colonial Penn may not be for you. On the other hand, if you’re older and are looking to get solid insurance without much hassle that will cover any final expenses you might have, Colonial Penn seems to offer a competitive solution.

Colonial Penn seems to market its guaranteed acceptance insurance aggressively to older consumers. For some customers, the $9.95 rate lock might be a great choice, but consumers should compare quotes with other providers that sell final expense insurance.

Colonial Penn’s FAQs

#1 – Does Colonial Penn require medical information as part of their application process?

Although you won’t need to submit blood work or schedule a physical exam, if you’re applying for renewable term insurance or permanent whole life insurance, you’ll have to answer some questions regarding your medical history and family health history.

#2 – If I need more insurance than Colonial Penn offers, what should I do?

Colonial Penn offers great options for final expense insurance and coverage for people that might have issues qualifying for a traditional term or universal policy offered by other providers.

Because of this, benefit amounts may not be as much as you need. If this is the case, you can try to supplement your policy with a policy from a different provider.

#3 – How long will it take for my insurance to be approved?

Because Colonial Penn still requires an underwriter evaluation, the approval process will be quick but could take a few days. The more information you provide on your application, the quicker the process will be.

#4 – If I buy a policy and change my mind, what should I do?

With Colonial Penn, you have a 30-day trial period. If you decide to cancel your policy within 30 days, you’ll receive a full refund with no penalties or fees.

#5 – Where do I go to speak with an agent?

You can contact a Colonial Penn insurance agent by calling 1-877-877-8052 Monday through Friday from 8:30 a.m. to 10:30 p.m. EST or Saturday from 9 a.m. to 5 p.m. EST.

#6 – I live in New York State. What can I do?

Although Colonial Penn is licensed in 49 states, they don’t conduct business in New York. However, their partner company, Bankers Conseco Life Insurance Company, can help you. Call 1-877-891-0915 for more information.

#7 – Can I have multiple Colonial Penn policies at the same time?

Yes. In fact, you may want different policies to cover different aspects of your life. You may want guaranteed acceptance insurance to cover your final expenses while having a renewable term living insurance policy to help if you need the benefit to assist with expenses if you’re diagnosed with an illness.

#8 – If I want to compare quotes where should I go?

If you’re ready to start shopping for affordable life insurance, just enter your ZIP code in the FREE quote tool below to get started.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption