Top Pointers on Final Expense Insurance (Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Final expense policies have low face values meant mostly to cover funeral costs

- Most offer guaranteed acceptance with no medical exam

- Premiums tend to be higher relative to the death benefit than term policies

- Final expense is a good option for those who don’t qualify for term insurance

Dying isn’t cheap. The average funeral costs upwards of $7,000, a number that continues to climb year after year.

A report by the Bureau of Labor Statistics shows that the price of funerals in the United States has risen nearly twice as fast as consumer prices for all other items over the past 30 years. From 1986 to 2017, funeral prices rose nearly 230 percent while the price for all other items only rose around 120 percent.

A 2018 survey from the Federal Reserve found that 40 percent of Americans would struggle to pay an unexpected $400 bill.

How much more would they struggle with having to pay a $7,000 funeral bill after the death of a spouse? Today, more and more people are turning to crowdfunding to pay the final expenses for their loved ones.

To avoid extra headaches on top of heartache, you should make a plan to pay those expenses. The death benefit from a life insurance policy is commonly used to cover those costs.

If you’ve been denied for traditional life insurance or don’t have any financial obligations that would necessitate buying a high-value policy, a final expense policy could provide you the peace of mind you need.

Final expense insurance is guaranteed, low-value coverage specifically designed to cover funeral costs and small, miscellaneous expenses associated with an unexpected death.

We’ve designed this guide to give you a complete overview of this unique form of insurance to help you decide if this coverage is right for you and your family.

Start comparing life insurance rates now by using our FREE quote tool above.

Table of Contents

What is final expense insurance?

Life insurance policies fall into one of two general categories: term or whole.

- Term life insurance provides coverage for a limited period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you opt to renew at a new, higher rate.

- Whole life insurance (sometimes called permanent insurance) provides coverage for as long as you live. If you pay all of your premiums, the insurer will pay a guaranteed benefit, no matter when you die.

Final expense insurance (sometimes called burial insurance) is a special type of whole life policy.

These policies offer the same guaranteed, lifetime coverage of a traditional whole policy, but with much smaller face values.

Final expense coverage is also easier to obtain than most whole insurance because of the limited benefits. Face values typically range from $2,000-$25,000, with no medical exam required.

There is no rule stating what your beneficiary must use the money for, but final expense insurance is designed specifically to provide a guaranteed death benefit, regardless of age and health, to cover the funeral costs immediately upon your passing.

What Final Expense Insurance Covers

The death benefit from a life insurance policy is meant to cover two types of obligations: immediate and future.

Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all the expenses (either planned or unexpected) that you want to pay for after your death. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

Final expense insurance focuses solely on the smaller of those immediate obligations.

People typically use the benefit to cover funeral costs first, with any leftover money used to cover smaller debts such as associated medical bills or credit card balances.

Who Should Buy Final Expense Insurance

Because of their limited face values, final expense insurance is best suited for people in the following situations.

People without major debts:

One of the key reasons for purchasing life insurance is to protect your family from financial hardship after your passing. Term life insurance is the most commonly purchased.

Term insurance is designed to provide coverage while you pay down large debts such as mortgages or car loans. Once that debt is paid, a large life insurance policy isn’t as necessary.

Those who have worked their way out of debt might instead buy a smaller final expense policy, so their family isn’t burdened with a significant funeral bill immediately upon their death.

People with large savings:

Another key reason for buying term insurance is to provide coverage while saving for future obligations, such as college tuition for a child, retirement income, and a general emergency fund.

For people who have already met those goals, a small final expense policy can cover the cost of a funeral and burial without affecting those hard-earned savings.

Singles without dependents:

Life insurance is meant to provide financial protection for those we leave behind. Someone who is single without any children doesn’t have that obligation.

For them, a final expense policy can pay for their own funeral and burial without involving any extended family or friends.

Seniors:

Likewise, people past retirement age with grown children who are no longer dependent on them have less need to leave behind a large death benefit. Final expense insurance can ensure that all funeral arrangements are paid for so that a spouse or adult child has one less reason to worry.

It’s also a good option for those who have decided they want life insurance coverage but have aged out of a traditional term policy.

Some companies stop writing new policies at age 60, especially for terms longer than 10 years. However, many will write final expense policies up to age 85.

People in bad health:

One of the main benefits of final expense insurance is that acceptance is often guaranteed with no medical exam.

Certain health conditions can disqualify people from getting traditional life insurance. For them, a final expense policy might be their best option.

It might not give them the amount of coverage they really need, but at the very least, it gives them some form of protection. And when it comes to the financial security of your family, something is better than nothing.

Final Expense Insurance for Seniors

As previously discussed, final expense insurance can be an ideal solution for seniors without major debts or any dependents. Because of that, many policies are marketed directly toward those at or near retirement age.

Some companies only offer final expense policies to those 60 years of age or older. Like most life insurance, the cutoff age for applying for a new final expense policy is typically 85 years old.

You generally can’t take out life insurance on another person. The insured must be the owner of the policy. However, the person paying for the policy can be different.

If you have a senior in your life for whom you want to purchase final expense insurance, you can have them apply for the policy and name beneficiaries, then set your own bank account to pay the premiums.

Average Cost of Final Expense Insurance

Final expense policies have guaranteed premiums. Your payments never go up, and your coverage never goes down.

The drawback is that those premiums will start at a level higher than most term policies.

Factors That Affect Your Rates

There is no industry-standard price for life insurance. Rates vary for everyone. Your personal premiums are determined by several factors, primarily the following.

- Age: Age is one of the most important factors in determining insurability. The older you are, the closer you are to death. Every year you wait to buy a policy can mean a higher premium.

- Gender: Statistically, men have shorter life expectancies than women. Because of that, women typically pay lower premiums.

- Health history: Healthy people live longer. Longer life expectancy translates to lower premiums. To determine your overall health, insurers may require a complete medical exam and ask you to submit bloodwork.

- Family medical history: Because many diseases are hereditary, most insurers will also examine the health history of your immediate family for things such as cancer, heart disease, and high blood pressure.

- Occupation: Some jobs come with higher risks than others. The more dangerous the profession, the more likely an insurer is to pay out an early death benefit, which means higher premiums.

- High-risk habits: Insurers will inquire about high-risk habits such as mountain climbing, flying, or any other regular activity that has a high potential for injury or death.

- Tobacco use: The most common high-risk habit that insurers look for is tobacco use. Smokers almost universally pay higher rates than their non-smoking counterparts in every demographic.

Because final expense policies guarantee acceptance with no medical exam, the insurer assumes you are in a higher risk pool in all those categories, whether it’s true or not.

For the insurer to make a profit off of a risky, guaranteed payout, they charge high premiums relative to their low death benefits.

Final expense policies can sometimes cost 10 times as much as comparable term policies.

For example, a $5,000 final expense policy for a 50-year-old with top insurer AIG costs around $30 per month. A 10-year, $100,000 policy for a non-smoker of the same age only costs $17 per month.

That’s $95,000 more in coverage for almost half the price. A 20-year, $100,000 policy is still $4 less per month than the final expense policy.

Rates vary by insurer and also depend on age and face value. However, as a general rule, final expense policies will always have a higher proportional cost than term policies.

This table compares monthly rates on a 10-year $250,000 term policy versus a $25,000 final expense policy with top insurer Transamerica.

| Age | $250,000 Term: Male | $25,000 Final Expense: Male | $250,000 Term: Female | $25,000 Final Expense: Female |

|---|---|---|---|---|

| 40 | $16.99 | $54.70 | $15.27 | $51.28 |

| 45 | $21.93 | $62.54 | $18.06 | $57.95 |

| 50 | $30.96 | $71.46 | $26.45 | $67.62 |

| 55 | $50.53 | $84.64 | $40.21 | $78.94 |

| 60 | $77.62 | $104.17 | $63.86 | $98.71 |

| 65 | $133.52 | $135.96 | $105.78 | $129.63 |

Get Your Rates Quote Now |

||||

Sample Rates

To give you an idea of how much final expense insurance might cost, we’ve compiled the cumulative average monthly rates of some of the top 10 insurers by market share for a $10,000 policy.

| Age | $10,000 - Male | $10,000 - Female |

|---|---|---|

| 40 | $24.02 | $20.43 |

| 45 | $27.16 | $22.65 |

| 50 | $43.20 | $32.91 |

| 55 | $50.06 | $38.89 |

| 60 | $57.86 | $45.98 |

| 65 | $71.02 | $55.60 |

| 70 | $88.55 | $69.69 |

| 75 | $114.80 | $91.51 |

| 80 | $163.18 | $126.89 |

| 85 | $230.74 | $181.52 |

Get Your Rates Quote Now |

||

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

How much coverage do you need?

The face values on final expense insurance are low, so there won’t be enough of a death benefit to cover a lot of financial obligations.

Your main concern should be buying enough coverage to pay for your funeral costs.

Then, if necessary, buy additional coverage to pay for some smaller obligations.

Average Funeral Costs

There are a lot of variables that influence funeral costs. Your personal choices — casket type, facility, service, and burial site — can either raise or lower the price.

You don’t need to have those choices made when shopping for final expense insurance. You can use average funeral costs to figure out a minimum face value. The National Funeral Directors Association has a breakdown of median funeral costs by region, which take into account all of your different choices.

This table gives the median cost of a funeral with a viewing and ceremony followed by either burial or cremation.

| Region | Funeral & Burial | Funeral & Cremation |

|---|---|---|

| New England (CT, ME, MA, NH, RI, VT) | $7,469 | $6,598 |

| Middle Atlantic (NJ, NY, PA) | $7,421 | $6,431 |

| South Atlantic (DE, FL, GA, MD, NC, SC, WV, VA) | $7,078 | $6,078 |

| East South Central (AL, KY, MS, TN) | $6,921 | $5,973 |

| West South Central (AR, LA, OK, TX) | $7,196 | $5,921 |

| East North Central (IL, IN, MI, OH, WI) | $7,595 | $6,364 |

| West North Central (IA, MN, KS, MO, ND, SD, NE) | $7,816 | $6,763 |

| Mountain (AZ, CO, ID, MT, NV, NM, UT, WY) | $6,681 | $5,721 |

| Pacific (AK, CA, HI, OR, WA) | $6,626 | $5,611 |

| National Average | $7,360 | $6,260 |

Get Your Rates Quote Now |

||

Cosigned Debts

Laws vary from state to state, but generally, you aren’t responsible for the debts of a deceased spouse. The only debts you are obligated to pay are cosigned debts.

If your spouse is a cosigner on any loan, they are responsible for the debt.

The same is true if they are a joint account holder on your credit card. Authorized users are not usually responsible for credit card debt, but if the card was opened jointly in both names, they are.

If you have any of these shared debts that are small enough to be covered under a final expense policy, you should add them to your overall need when choosing a face value.

Types of Final Expense Insurance

Final expense insurance has multiple variations, each with the same general purpose. Read on for a brief overview of each to help you determine which, if any, is best suited for your financial situation.

Level

Level policies are sometimes called immediate benefit policies. The entire face value of the policy is in effect the day the application is approved. When the insured person dies, the beneficiary receives the full death benefit immediately.

The main drawback of these policies is that they can be more expensive for healthy people than a term policy, as previously discussed.

Graded Benefit

Graded policies have a waiting period before the death benefit is paid in full. If you die immediately after purchasing the policy, your beneficiary will be paid only a partial amount.

The waiting period is typically two years. During that time, the insurer will pay a percentage of the full benefit, which increases every year until it reaches 100 percent at the end of the waiting period.

In the event of a suicide, premiums are typically refunded, with no benefit paid. Some may pay a small percentage of the benefit in addition to the refund, but most do not.

The main drawback of a graded policy is that the benefit may not be enough to cover final expenses if you die during the waiting period.

Modified Benefit

A modified policy is a hybrid of level benefit and graded benefit. These policies pay the full face value for accidental death from the day the application is approved.

However, they have a waiting period for non-accidental deaths (age and health-related). The limited value is typically a refund of the premiums paid to date plus an additional 10 percent.

Once the waiting period is over, they pay full value for both accidental and natural deaths. Like graded policies, insurers typically refund premiums in the event of a suicide.

Modified policies have less of a drawback than a graded policy if you die an accidental death, but more if you die a non-accidental one.

If you die of age or health-related causes during the waiting period, you run a much greater risk of the benefit falling short of your final expenses since modified policies pay a lot less.

Guaranteed Acceptance

The most common form of final expense insurance is the guaranteed acceptance policy. It provides coverage with no medical exam. If you apply, you’ll be approved.

Like graded policies, they pay out a limited death benefit during an initial waiting period. The main drawback is the price.

Because they don’t require a medical exam, insurers automatically assign you to the highest health risk category. As a result, these can be the most expensive form of final expense insurance.

Pre-Need Funeral Insurance

An internet search for final expense life insurance will often return results for pre-need funeral insurance. These plans are less traditional insurance and more of a layaway plan for funeral services.

Instead of paying regular premiums for the promise of a guaranteed death benefit, you either pay a funeral home the full price of a funeral in advance or set up a payment plan to pay over one to 10 years.

There is no real beneficiary of this policy. Instead, the funeral home itself is the beneficiary.

Pre-need funeral insurance has significant drawbacks compared to a traditional final expense policy.

First, if you don’t pay in full before you die, you won’t receive the full amount of services you desired.

Second, you’re guaranteed to pay the full price of the funeral. With a traditional policy, there is always the chance of you passing before actually paying the full cost of a funeral in premiums.

Lastly, these policies are inflexible. If your plans change or you move away from the area where you prepaid your funeral expenses, you may not be covered.

Pre-need insurance is often non-refundable.

Changing Your Policy

Final expense policies are not as flexible as traditional life insurance. Because most policies assume a high risk with no medical exam, you typically can’t increase your face value.

You’re free to cancel at any time, but you won’t be refunded any of your premiums unless you do so within the traditional 30-day free trial period.

Shopping for Final Expense Insurance

Final expense insurance is whole insurance that is as easy to purchase as term insurance. You can do so in several ways: online, directly with the insurer, or through an independent agent.

How to Get a Quote

All life insurance shopping should start with a quote. Sample rates allow you to compare prices across multiple insurers to make sure you’re getting the best policy for the best price.

There are two main ways to get quotes: online or through an agent.

Online:

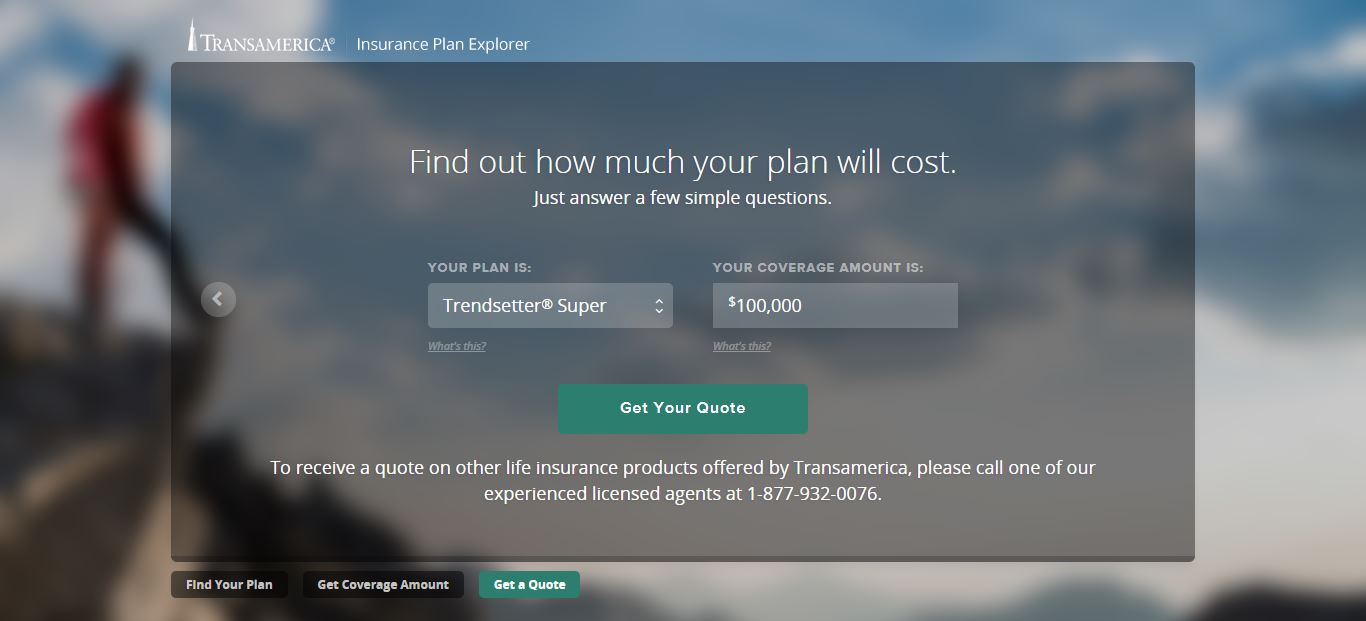

Many insurers have quote tools on their website. You simply choose your desired coverage, enter some basic personal information, and the tool will return an estimated cost.

There are also independent quote tools (such as the ones on this page) that will provide you with quotes from multiple insurers at once, allowing you to compare prices quickly.

Most quote tools give prices for term policies rather than for whole. However, because final expense policies are much simpler versions of whole policies, some insurers quote them.

Some also let you apply for the policy directly online without ever having to talk to an agent, which isn’t typically true of permanent insurance.

Agents:

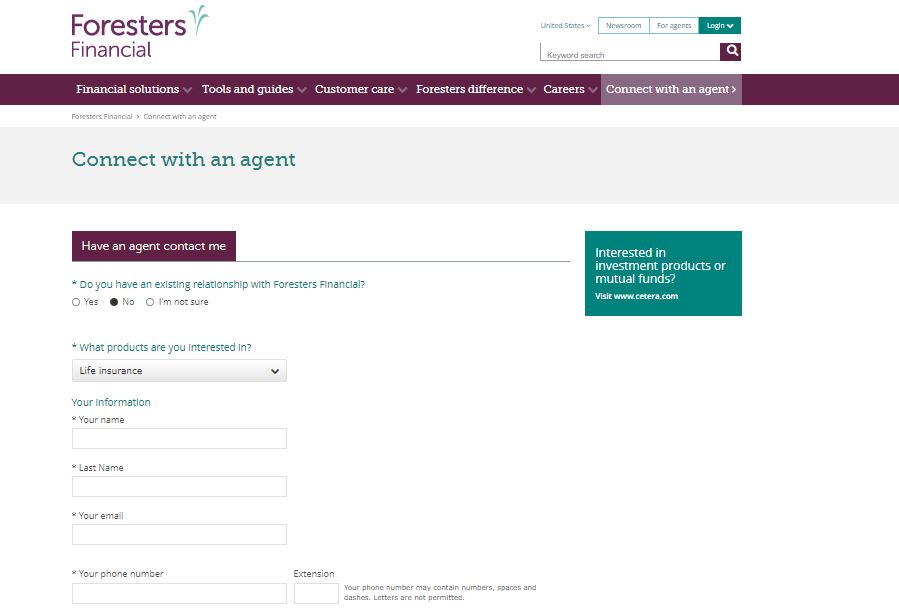

Most life insurance products are sold through agents, even if the insurer provides online quotes. Insurance agents fall into one of two categories: independent agents or captive.

Independent agents are free to shop and sell policies from multiple insurance companies to find the best policy for their clients. A captive agent works for a single insurer, and will only market and sell their employer’s policies. They are more like customer service agents than brokers.

If you want to compare costs and policies across multiple insurers, you can only do so with an independent agent.

If you’ve already done your research and have decided on a specific insurer, the captive agent can help you choose the right policy and tailor it to your financial needs.

Many insurers have agent finder tools on their websites. Just like the quote tool, you enter your personal information and coverage needs, and an agent will contact you to discuss your options.

How to Get the Best Rate

Before you start shopping for a final expense policy, here are some tips to keep in mind.

#1 – Buy from a Reputable Company

Make sure the company writing your policy is reliable. A good place to start is with the top insurers by market share.

From there, read reviews on each that focus on policy offerings, financial stability, and reputation. You can do your own research by using the following resources:

- Third-party rating agencies such as A.M. Best Company, Moody’s Investors Service, and Standard & Poor’s (S&P) measure an insurer’s financial strength and its ability to pay all of its policy obligations.

- J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

- The Better Business Bureau uses 13 factors, such as time in business, open complaints, resolved complaints, and legal action against a company to assign one of 13 letter ratings, A+ through F.

- The National Association of Insurance Commissioners Complaint Index lists the number of complaints registered against an insurer each year and compares it to that of other companies.

If the company has a good reputation, start looking at their product offerings.

#2 – Compare policies

Compare the policy offerings of each company to find the one that best meets your financial needs. Some companies may offer level policies, while others only offer graded benefits.

Also, research the maximum face values. Some companies have much lower limits than others. Make sure the company offers enough coverage to cover the average funeral cost in your area.

#3 – Get Quotes

Compare prices between companies by getting quotes. Quotes are available online or through local insurance agents. Try to find the policy with the highest benefit for the lowest annual cost.

Pros & Cons

As with any product, final expense insurance comes with benefits and drawbacks.

| Pros | Cons |

|---|---|

| Guaranteed acceptance | Limited benefits |

| No medical exam | More expensive than traditional term |

| Easy application | Not flexible |

Get Your Rates Quote Now |

|

You should weigh all of the pros and cons before making a purchase decision.

The Bottom Line

Final expense insurance provides simple, low-value coverage to anyone. You are guaranteed acceptance, your payments never go up, and your coverage never goes down as long as you live.

Those who don’t qualify for traditional life insurance due to health conditions can get the coverage they need with a final expense policy. They are also a good option for aging seniors with no financial concerns outside of funeral costs.

The major drawback is the high price compared to the low face value. While these policies can be beneficial to a select group of people, most should get quotes on a traditional term policy before exploring this option.

Start comparing life insurance rates now by using our FREE quote tool below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption