Kansas City Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1895 |

| Company Executives | CEO & Chairman - R. Philip Bixby Executive Vice President and Vice Chairman - Walter E. Bixby |

| Number of Employees | 2,900 |

| Total Sales / Total Assets | $461,032,000,000 / $4,971,486,000,000 |

| HQ Address | 3520 Broadway St. Kansas City, MO 64111-2502 |

| Phone Number | 1-816-753-7000 |

| Company Website | www.kclife.com |

| Premiums Written - Individual Life | $28,617,360,000 |

| Financial Standing | $15,672,000,000 |

| Best For | Return of Premium Term, Variable Universal Life |

Get Your Rates Quote Now |

|

If you’re shopping for life insurance, then you’re probably the type of person that makes responsible and thoughtful financial decisions.

This review of Kansas City Life Insurance Company also known as Kansas City Life will not only help you learn more about the company’s innovative and customizable insurance options but will also give you some helpful tips to arm yourself with as you enter the vast field of providers and products.

If you haven’t looked into life insurance quotes before, then don’t wait a minute longer. Get started with a personalized, individual quote using the free quote tool above. Just enter your ZIP code to get started.

Table of Contents

Kansas City Life’s Ratings

You might be wondering how to get started comparing life insurance companies. A good first step is to review any ratings available for the company.

If you’re looking into purchasing life insurance, you’ll sleep better knowing your life insurance provider is highly rated and stable as both an insurance provider and an organization. Kansas City Life has been a family-run business for almost its entire history and holds its reputation in high regard.

As a publicly-traded company, Kansas City Life provides transparent reporting of its business, allowing rating agencies to give shoppers a good idea of the health of the business.

The ratings below are provided by third-party organizations and will provide you a good indication for how Kansas City Life maintains its financial health and customer service standard.

A.M. Best

A.M. Best is the only rating agency on the list that focuses only on the insurance industry. The rating service provides insight into the credit and financial strength of insurers, which can help you determine if your provider is in shape to be a good partner for the long term.

A.M. Best awarded Kansas City Life an A (Excellent) rating in September 2019. However, the rating provider also affirmed an outlook for Kansas City Life as negative.

Although the company is still deemed financially stable with an excellent rating designation, the Kansas City Life’s outlook received a downgrade specifically due to changes in the amount of capital and surplus available on Kansas City Life’s balance sheet.

These financial terms may seem unrelated to your insurance policy, but at some point in time, you’ll want to make sure your life insurance policy claim will be paid. To pay for your insurance, a company has to have the money available.

Simply speaking, capital and surplus is the amount of money a company has that isn’t allocated to other needs such as paying employees, rent, and utilities and is available for use in paying on insurance claims.

For Kansas City Life, this downgrade doesn’t seem to be an issue in the near term. Although they do have less in available surplus as disclosed in recent financial reports, part of this is because Kansas City Life recently made some large acquisitions.

Overall, Kansas City Life is rated by A.M. Best as a stable insurance provider.

Better Business Bureau (BBB)

It’s important to review a company’s Better Business Bureau (BBB) review when you’re considering an insurance provider. The BBB tracks customer complaints directly from disgruntled consumers.

Kansas City Life has an A+ rating. This is the highest possible rating the BBB provides. Additionally, Kansas City Life has only one customer complaint lodged against it in the last three years. The single complaint was marked as answered on the BBB site.

This is a good indication that Kansas City Life is attentive to servicing its customers.

Moody’s

Until 2004, Kansas City Life was covered by Moody’s research service. As a financial research firm, Moody’s primarily researches publicly traded companies to indicate how the company’s stock will perform in the stock market.

In 2004, Moody’s withdrew its A3 rating for Kansas City Life, explaining that life insurance and annuities were not part of the rating agency’s focus.

NAIC Complaint Index

When someone has a complaint against an insurance company, whether it’s for claims handling, claims settlement, or claims denials, state agencies will track the complaint. The National Association of Insurance Commissioners (NAIC) compiles the complaint data from individual states against specific companies and ranks the companies on a complaint index.

As a consumer, you should want to know how an insurance company ranks on the NAIC Complaint Index. An insurer with a high complaint index ratio offering a low rate could be a red flag.

In 2018, 10 complaints were filed against Kansas City Life with the Missouri Department of Insurance. However, the NAIC Complaint Index only registers two complaints in 2018 and assigns Kansas City Life with an index of 0.07, which is below the industry standard of 1.00.

Company History

Kansas City Life was originally founded as Banker’s Life Association in 1895 by Major William Warner, who previously served as Kansas City’s mayor and as a congressman. The company was renamed Kansas City Life in 1900. In 1904, J.B. Reynolds became the company’s third president, kicking off a legacy of interconnected company presidents.

In 1939, Walter E. Bixby became president. The elder Bixby was succeeded by J.R. Bixby, and then Walter E. Bixby II. The family legacy continued with R. Philip Bixby taking the helm in 1998. R. Philip Bixby is the great-grandson of J.R. Reynolds and the current president of the company.

Although the company continues to be a family-run operation, it has issued stock that is publicly traded under the symbol KCLI.

During this time, Kansas City Life maintained operations from downtown Kansas City and grew business through a series of acquisitions, including Sunset Life Insurance Company of America, Old American Insurance Company, Grange Life Insurance, and GuideOne Life insurance Company.

In 2018, Kansas City Life purchased Grange Life Insurance from Grange Mutual Casualty Company, allowing Kansas City Life to expand even further within the 15 states Grand Life had been servicing.

Kansas City Life has made a considerable mark on history, both nationally and locally. The video below explains how Kansas City Life purchased the original manuscript for Einstein’s Theory of General Relativity.

And as part of local history, the video below shows the Kansas City Life building’s part in celebrating Christmas in downtown Kansas City.

Kansas City Life continues to operate from its historical location in central Kansas City since 1924.

Kansas City Life’s Market Share

Kansas City Life has $28.6 billion of life insurance in force. Compared to Prudential Financial, which ranks as the largest insurance company when ranked by insurance in force and boasts $1.745 trillion of life in force, Kansas City Life is a blip on the radar.

However, it’s not a fair comparison. While Kansas City Life is a smaller insurance provider, serving 48 states and the District of Columbia, Prudential Financial is a global monolith.

In its home state of Missouri, Kansas City Life has a 0.36 percent market share with $10,229,998 in premiums written. This puts Kansas City Life at about the middle of the pack in the list of companies on the Missouri list.

Kansas City Life’s Position for the Future

Kansas City Life is a smaller insurer that’s been growing in two distinct ways since it was founded in 1895. The first is by growing its own network of agents and increasing its insurance sales.

The Kansas City Life agency network is made up of over 2,400 employees. The company continues to recruit agents and agencies to its team across all states except New York.

Kansas City Life also has made a series of acquisitions allowing the company to expand quickly in many markets, primarily in the Midwest. The most recent acquisition was made in 2018, when Kansas City Life purchased the life insurance service component of Grange Insurance.

In its 2018 annual market report, Kansas City Life acknowledges that long economic periods of low interest rates can be difficult for insurance companies. Insurance companies will usually take money from premiums and look to turn a profit by investing in low-risk securities.

When interest rates are low, investment returns can be as well, which affects profitability. However, Kansas City Life continues to look for opportunities to grow with safe, risk-averse strategies.

Kansas City Life’s Online Presence

For a smaller, regional insurance company, Kansas City Life maintains a decent online presence. Although the company website may not be as robust as those presented by larger competitors, it provides a good history of the company, a summary of its product offerings, an agency locator, and a link to its customer site, which requires a login.

The homepage presented below shows the landing page for kclife.com.

Kansas City Life is also active on three major social media networks. On Facebook, the company has just under 1,600 followers and regularly posts messages.

On Twitter, the company connects with over 1,200 followers and provides frequent updates with memes and posts intended to inspire its followers to consider making responsible financial decisions.

Kansas City Life is also active on LinkedIn, where it engages with the professional community to share information, recruit talent, and post job opportunities.

Kansas City Life’s Commercials

Kansas City Life markets its products through its network of agents. Because the company doesn’t market directly to consumers, it doesn’t spend on television or online commercials. However, in local markets, you may see a Kansas City Life agent with a television ad for its individual agency.

Kansas City Life in the Community

Kansas City Life is an active contributor to the local and wider community. Locally, Kansas City Life honors its family history and sponsors efforts such as the Christmas tree lighting mentioned earlier. On a more national level, Kansas City Life sponsors the Life Lessons Scholarship Program.

Life Lessons Scholarships are college scholarships awarded to students with parents that passed away with little or no life insurance. Kansas City Life has been sponsoring and funding these scholarships since 2005.

Additionally, Kansas City Life supports the non-profit organization Life Happens. Life Happens’ mission is to help Americans understand the need and awareness of life insurance and related products for financial security and insurance.

By providing education and media outreach to consumers, Life Happens works to help consumers understand which products are available and necessary to them.

Kansas City Life Employees

Kansas City Life has about 400 non-agency employees. Employees for Kansas City Life and its subsidiary companies, Sunset Life and Old American Insurance Group, are consolidated into the headquarters in Kansas City, Mo.

Company review site Glassdoor.com aggregates employee reviews and provides assessment ratings for companies across numerous industries. Glassdoor designates Kansas City Life with an overall 2.4 out of 5.

This rating breaks down into specific categories. Of the key ratings, only 40 percent of employees would recommend Kansas City Life as a place to work. CEO approval is also low, at 37 percent.

Most of the anonymous employee reviews indicate that pay, benefits, and office perks are well-received. However, employees indicated a need for more management engagement and career development opportunities.

On the popular Indeed.com job search engine, Kansas City Life has a much higher rating of 3.7 out of 5. Management ranking still trends low, but work-life balance earns four out of five stars.

Shopping for Life Insurance

Your current lifestyle, future family plans, and family obligations are just a few factors that can dictate your life insurance needs. Unlike other types of insurance, the benefits of a life insurance policy are not intended to benefit the policyholder. When you shop for life insurance, you are shopping for financial security for your loved ones.

Because of this, the first question most consumers have is when to start thinking about life insurance.

Buying a life insurance policy is a must when you begin to amass any financial obligations. Even if you may not have a household full of responsibility, you should consider a policy for any scenario where you might leave a financial burden behind for loved ones to inherit. Consider the following examples:

- Having a home mortgage or student loan, credit card or car loan debt. You wouldn’t want to burden family members with any debts if something happens. Also, some policies can help you make ends meet if you’re disabled and can’t work or are temporarily unemployed.

- Living with a loved one or family.

- Providing care or financial help for an elderly family member or an ex-spouse.

- Having a business or partnership that would suffer losses if you could no longer work in your current capacity.

- Protecting your estate and passing on an inheritance to your heirs with some tax protection.

Check out the video below from the financial television channel CNBC explaining why shopping for life insurance even in your 20s isn’t a bad idea.

As you can see from the video, life insurance can protect you whether you are young or old. Once you realize you need life insurance, the next step is to determine how much life insurance you need and what type of insurance you should procure.

To estimate how much insurance you’ll need, a simple guideline is to add up the following:

- Approximately seven to 10 years of salary.

- Any outstanding debts including home mortgages, student loan debts, car loans, or other personal financing obligations.

- Your total savings goal for your children’s education. You may be putting a bit away every paycheck for education, so estimate the total you will have saved when your child is ready for college.

- Any money you contribute to care for loved ones such as elderly parents or grandparents.

To determine the type of insurance, you’ll have to consider your own situation. Much of your decision will be defined by your age, health, and income.

Average Kansas City Life Male vs Female Life Insurance Rates

Although specific rate information is not available from Kansas City Life, rate quotes for male candidates can range from 5 to 10 percent higher than quotes for female candidates with the same age and risk profile.

For example, the table below shows the average rate across leading insurers for male non-smokers of various ages.

| Age | $500,000 / 10-Year | $500,000 / 20-Year | $500,000 / 30-Year |

|---|---|---|---|

| 30 | $25.18 | $39.77 | $64.35 |

| 40 | $39.35 | $58.10 | $103.10 |

| 50 | $83.51 | $138.93 | $333.50 |

Get Your Rates Quote Now |

|||

Compare that with the average rates from women in the same age groups.

| Age | $500,000 / 10-Year | $500,000 / 20-Year | $500,000 / 30-Year |

|---|---|---|---|

| 30 | $19.35 | $28.93 | $51.85 |

| 40 | $35.60 | $58.10 | $91.43 |

| 50 | $71.01 | $129.76 | $289.76 |

Get Your Rates Quote Now |

|||

You can see rates are significantly discounted for female candidates.

Coverage Offered

The table below provides a quick summary of the features for each of the most common insurance types.

| TYPE | Permanent or Expiring | Cash Value | Key Features |

|---|---|---|---|

| Term life | Expiring | No | - Most affordable - Easiest to obtain - Premiums do not change - Benefits paid are not taxable income |

| Whole life | Permanent | Yes | - Premiums don't change - Can borrow against Cash Value - Benefits paid are not taxable income |

| Universal life | Permanent | Yes | - Premiums and benefits are adjustable - Can borrow against cash value - Customizable to your needs |

| Final expense or burial | Permanent | No | - Easy to obtain - Faster claim processing |

Get Your Rates Quote Now |

|||

Let’s drill down into each insurance coverage type to see what the right option is for you.

Types of Coverage Offered

The most common types of life insurance coverage are term, whole, universal, and final expense or burial insurance.

Kansas City Life expands upon the traditional offerings to include some innovative variations of coverage. Kansas City Life also offers return of premium life, indexed universal life, and variable life insurance options.

Term

Term life insurance covers the policyholder for a specific period of time. Common term lengths can range anywhere from one year to 35 years but are usually defined at 10-, 20-, or 30-year term lengths. Term insurance that expires yearly is renewable insurance, which means each year, the insurance company can reset the premium pricing and make adjustments to the terms of the policy.

For common term policies, the premium and benefit amount won’t change for the duration of the term.

If a policyholder lives past the term, the policy will expire and coverage will stop. Kansas City Life policies offer policyholders the option to continue with the policy, although a higher premium adjustment might be required. Policyholders can also convert to a permanent policy option at the end of a term.

Term insurance makes sense for consumers that only need coverage for a specific amount of time.

For instance, if you’re in your 30s, have a mortgage, and your children aren’t in college yet, you may take a higher benefit term policy to ensure that if anything happens to you, your policy will pay off your mortgage and college expenses.

When you’ve paid off your mortgage and your home is an empty nest, you can let your term policy expire and take on a lower benefit policy to cover the lower expense amount.

Return of Premium Life

Kansas City Life offers an option for consumers who are uncomfortable with the possibility they might outlive their term policy with no return. Although term policy is the cheapest type of coverage, some consumers would pay slightly more to have some of their money back at the expiration of their policy.

Kansas City Life’s return of premium life policy offers 20-year and 30-year term options with death benefit coverage during the term and a return of eligible premiums at the expiration of the policy.

Additionally, the return of premium plans features a non-forfeiture provision.

This means that at the end of the term you don’t have to cancel your policy but can use the cash value of any premiums that would have been returned to you to continue coverage.

The value of premiums that would have been returned to you would be allocated to maintain the policy. Here’s the best part: return of premium term life coverage allows you to build cash value in a term policy.

At Kansas City Life, you can borrow against this value tax-free, help fund policy conversion to a permanent policy at the end of the term, or extend coverage at the 20-year or 30-year term.

Whole

Whole life policies offer permanent life insurance coverage with guaranteed set premiums and guaranteed death benefits. Although whole life insurance is more expensive than term life options, whole life plans also feature the ability to accumulate cash value. This means a component of your premium will be set aside to gain interest at a set rate.

Over time, this allocation of your premium will build up a significant cash value.

Kansas City Life offers a favorable loan feature that provides customers the ability to access a policy’s cash value tax-free without sacrificing life insurance protection.

Whole life policies are a great option for consumers who are looking to build a nest egg for loved ones. Beneficiaries of a whole life policy receive the benefit tax-free when a policy is executed.

Kansas City Life also offers additional riders for accidental death coverage, coverage of children or grandchildren, and more. You’ll need to speak to a Kansas City Life agent to review the options that are right for you and customize your policy.

Universal

One of the constraints of a whole life policy is that you can’t change your premium of benefit amounts over time. For most people, your needs today won’t match your needs in 10 or 15 years. Universal life coverage is permanent life insurance that offers a solution to this dilemma.

Like most universal life policies, Kansas City Life allows policyholders to change their premium contributions over time within the limits of minimum and maximum coverage requirements. Since your insurance needs might change over time, you can also adjust your death benefits.

This flexibility is valuable. Let’s say you have a mortgage, two car loans, and a child in college and you’re about 10 years from retirement. Your insurance needs today will be much higher than your needs after you retire when your mortgage is paid off, you only need one car, and your child is no longer dependent upon you for income or tuition.

A universal life policy allows you to make adjustments so you’re paying only for what you need.

Kansas City Life offers several options for universal life plans. The most common is traditional universal life.

With traditional universal life, your cash value will earn interest at a rate determined in line with competitive market rates. Interest will be credited monthly to your account, and over time your policy will build cash value.

With universal life, you have the same favorable loan options to borrow against any cash value tax-free. You can also customize your policy with additional available riders. Over time, you can even accumulate enough cash value that the policy has enough value to support all future premium payments.

This is a great option for people who expect to be living on a fixed income in retirement. If you set up your policy to pay in premiums now, it can retain enough cash value so when you’re in your later years, you no longer have to make expensive premium payments but can maintain the same benefits.

Kansas City Life also offers two variations on traditional life to help consumers. Indexed universal life and variable universal life options provide consumers with options to maximize the potential returns on the cash value component of their policy. However, universal life is not a substitute for retirement investments.

Where traditional universal life allows you to set aside a component of your premium into a safe account that compounds interest, indexed universal life and variable universal life policies allow you to allocate the cash component of your premium into riskier options that can produce higher return value over time.

Indexed universal life will provide an option to invest your cash component in a fund that’s modeled after a stock market index such as the S&P 500 or Russell 2000 index. Typically, index variable life funds are also hedged so that you’re protected from market losses.

Variable universal life funds allow you to allocate your cash component into even riskier funds or stocks. For variable universal life funds, you typically aren’t protected from loss of value if your investment choices lose money.

Universal life policies are a good way to maximize life insurance benefits, but high fees and expenses with limited returns make these plans uncompetitive with true IRA and 401(k) retirement options.

Kansas City Life offers select features for its indexed and universal life plans.

- Kansas City Life’s indexed universal life option

- A component of your premium is allocated between a fixed account and indexed account based on your choice.

- The indexed amount is invested for 12 months with returns tracked to the S&P 500.

- The cash value is always protected from negative returns.

- At the end of the 120-month period, the index amount will roll over to a new period unless you request a change.

- Money is invested from your premiums on a quarterly basis.

- Maximum gains are capped based on the participation rate and growth cap. Speak to your agent to understand these components clearly before you purchase a policy

- Kansas City Life’s variable universal life option

- A component of your premium is invested in a fund tied to equity markets.

- Downside risk in not being protected — you can experience negative gains.

- You can increase or decrease coverage at any time without new proof of insurability.

- You have the potential to increase value from positive returns.

To purchase a Kansas City Life policy, you’ll need to work with one of the company’s registered agents. Before you do, it’s a good idea to arm yourself with information on competitive market rates for different policy types.

The table below provides the average term rates from the top 10 insurance providers.

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $11.03 | $10.02 | $22.10 | $12.91 | $23.19 | $19.04 |

| 30 | $11.12 | $10.07 | $15.31 | $13.02 | $23.85 | $19.26 |

| 35 | $11.12 | $10.07 | $15.42 | $13.02 | $24.07 | $19.26 |

| 40 | $12.65 | $11.12 | $17.94 | $15.21 | $29.10 | $23.63 |

| 45 | $14.57 | $13.31 | $21.55 | $19.69 | $36.32 | $32.60 |

| 50 | $18.60 | $17.20 | $30.19 | $27.02 | $53.60 | $47.26 |

| 55 | $24.51 | $20.61 | $42.88 | $34.35 | $78.98 | $61.91 |

| 60 | $35.88 | $27.48 | $71.10 | $50.86 | $135.41 | $94.94 |

| 65 | $51.06 | $37.76 | $109.82 | $75.14 | $212.85 | $143.51 |

Get Your Rates Quote Now |

||||||

These sample rates will vary based on your profile. To see how you compare, enter your ZIP code here and get a free custom quote.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

At the end of the day, you want to know exactly how much you’ll have to pay for insurance. Although sample tables and rates will give you a good range to compare against, the rate your insurance company quotes will depend upon several factors.

Final rates aren’t usually established until you go through a process called underwriting. Underwriters compile several factors around your life to determine overall risk, and in some cases, they might deny coverage.

For all of Kansas City Life policies, a full underwriting process is required. If you’re young, healthy, and don’t have pre-existing conditions or family history that may be of concern, you might request an accelerated underwriting process where you can bypass a medical exam and bloodwork, but you’ll still be required to submit information on your health history and family’s medical history.

Whether you complete a medical exam or not, the underwriters will assess each of the factors below to build out your individual risk profile. Once they’ve established a risk score for you, they’ll put you in a risk pool with other customers that fall in the same range. This risk pool will determine your final quoted rate.

Let’s take a look at the factors that affect your risk profile.

Demographics

Underwriters want to know common statistical information about you. Some of the prominent characteristics an insurer might ask about are:

- Whether you’re male or female

- Where you live

- Your ethnicity

- Whether you are single, married, or divorced

- Whether you have children

Each of the characteristics above provides information for the insurer. Underwriters have data for millions of people like you and, based on these characteristics, can identify whether you’re prone to a higher risk of particular diseases, or whether your profile is a good indication that you will live a long healthy life.

Current Health & Family Medical History

Your health and family medical history are important factors in determining risk. Even if you’re otherwise healthy, insurance companies will want to look at whether you have any family history of diseases such as various types of cancer, hereditary heart disease, mental health issues, or Type 1 or Type 2 diabetes.

If you have a family history that indicates certain preventable diseases such as diabetes or heart disease, you’ll want to pay extra attention to your medical evaluation to show you take care of yourself.

Your medical evaluation will include bloodwork. Before you take your life insurance physical exam, you’ll want to make sure you’re eating well, exercising, and avoiding alcohol and tobacco products.

Submitting a clean bill of health to the insurer could help counteract any concerns with your family medical history.

High-Risk Occupations

Your underwriter will want to know what you do for a living. If you have a dangerous job, you may not qualify for coverage with some providers. If you’re a first responder, construction worker, farmer or another high-risk occupation worker, getting life insurance might be difficult.

For the person with the average cubicle nine-to-five job, other indicators may affect your rate. Things like the length of your commute and the amount of stress your occupation imposes upon you could be relevant to your risk profile.

High-Risk Habits

Risky behaviors will cost you when it comes to getting insurance. If you smoke cigarettes or vape, drink alcohol regularly, or use illegal substances, you may not be able to get a life insurance policy.

At the very least, you’ll have to shop around to get a decent rate. If you’ve ever received a DUI conviction, you may find it difficult to get affordable insurance.

Insurance companies do check the Department of Motor Vehicle records, so even a lead foot or a few tickets for talking on your cellphone while driving could cost you.

Veteran or Active Military Status

If you’re a military service member, whether you’re a veteran or on active duty will affect your policy rates. Most companies that offer coverage to active members and veterans will have different policy types.

Military active duty and veterans can get coverage through the Veterans Administration, but supplemental options are available.

Getting the Best Rate with Kansas City Life

If you’re shopping for any major life purchases, whether it’s a car, a house, a new dishwasher, or life insurance, the more you know, the better off you are. To get the best rate with Kansas City Life, you’ll need to work with a Kansas City Life agent.

However, even before you meet with an agent, you can save time and money by determining what you need. The last thing you want is to be sold too much or too little insurance. Getting value in your policy means paying a premium for the benefit you need.

Aside from calculating how much insurance you need using an insurance calculator or the guide provided earlier in this article, you should be able to answer the following questions. Use these questions to help narrow down the insurance options you want to consider.

| Question | Type of Insurance |

|---|---|

| Are you younger and looking for the cheapest insurance possible? | Term or return of premium term |

| Do you want to build cash value in your policy over time? | Whole life or universal life |

| Are you concerned your needs will change from what you need today and what you need in the future? | Term |

| Do you have coverage through your employer but are concerned it's not enough? | Term life |

| Are you looking for a way to build tax free benefit to leave for your loved ones? | Whole life, universal |

| Do you have a longer timeline to take on risk with the possibility of building more cash value over time? | Indexed universal or variable universal life |

Get Your Rates Quote Now |

|

Review any insurance options your employer might provide. Purchasing life insurance through an employee benefit program can save you money. If it isn’t enough to cover your full need, you can purchase the supplemental insurance from Kansas City Life to complete your coverage.

After determining the amount and type of insurance, the last step is to identify what your actual budget is for premiums. It may be that you can’t afford full coverage, or you may realize that you can pay higher premiums now but want to make lower premiums in the future.

When you’ve narrowed down exactly what you’re looking for, a good agent can help you get a great rate.

Kansas City Life’s Programs

Since Kansas City Life works through a network of agents to reach its customer base, the company promotes programs for developing and supporting new and existing agents.

In addition to awarding leading agents with prizes and trips for outstanding performance, the company awards leading employees with the President’s Quality Service Award and the Agency Building Award for outstanding commitment to customers.

Customer outreach and educational services are provided through local agencies. Any educational programs for consumers are also provided at a local level.

Canceling Your Policy

Kansas City Life customers are provided a customer login that can be accessed from a login tab on the top right corner of the company’s home page.

From your login, you can either navigate to find your policy and cancel online or follow the steps below to cancel without login access.

How to Cancel

Before you start canceling your policy, you’ll want to make sure that you understand the risks for potential fees or lost benefits.

In some instances, canceling your policy is as easy as stopping premium payments, but before you do anything drastic, review the steps below to determine how to cancel your policy to avoid getting hit with fees and penalties.

#1 – Read Your Policy

Go over your policy and read the fine print. Check to see if there are any fees or fines for early termination. For term policies, you won’t get back any premiums paid to date.

For universal, you’ll have to check your policy to see whether you can retrieve the cash value or have any premium payment amounts returned. You’ll also lose final expense insurance premiums if you cancel.

#2 – Contact Your Financial Advisor

Work with your financial advisor to understand any risk you might be assuming and any tax liability you might get from early termination. For a term policy, canceling early just means you’ll lose your benefits. Since there is no cash value, you won’t have tax implications.

However, for universal life, you might receive a return of premiums and have the cash value of the policy returned. An advisor can speak to you about whether you’ll need to pay taxes on any payout.

A financial advisor can also help you understand your risk exposure. If you’re canceling your policy and don’t have another one in place, you should be aware of any risks and exposures.

If you’re getting a new policy to replace your current policy, your advisor can help you determine whether your policy needs have changed.

#3 – Reach Out to Your Agent

Contact your Kansas City Life agent. They may be able to help you with the cancellation process. If you’re looking to replace your policy, an agent can help time the cancellation to align with creating the new policy.

#4 – Submit a Letter in Writing and Keep a Copy

Always request a policy cancellation. Provide specific dates informing when you last paid premiums and when you expect your coverage to end. Keep copies for yourself.

#5 – Cancel Auto Payments

Don’t forget to cancel any automatic payments that might be set up. Check to make sure that you don’t have a credit card or bank account with an automatic payment setup.

How to Make a Claim

To prepare for making a claim, you should get a certified copy of the policyholder’s death certificate and the original life insurance policy. You can begin to file your claim with Kansas City Life by accessing the “Contact Us” page from the bottom of the company’s home page.

From there you’ll land on a page with a web form. You will need to select the right contact subject as depicted below.

The policy claim form will require your information and the information of the policyholder. Once submitted, you’ll be contacted by a support person to help you throughout the rest of the claims process.

Once your claim is submitted, it can take anywhere from 10 days to more than 30 days to receive any payments. In many cases, the payment timeline could depend on whether you choose to receive a lump-sum or through annual disbursements.

How to Get a Quote Online

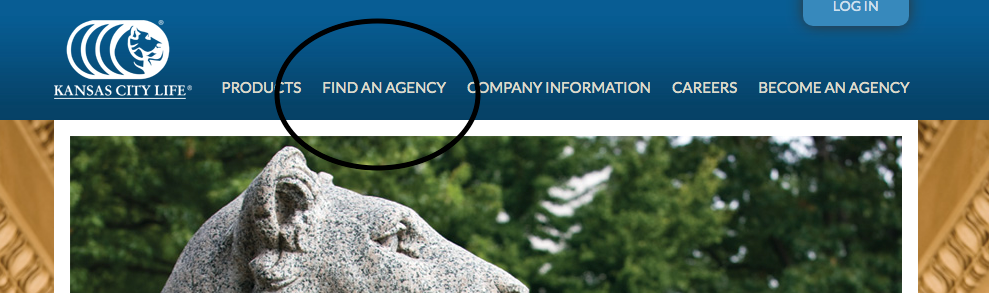

Kansas City Life doesn’t provide online quote tools. To get a quote from Kansas City Life, you’ll have to contact a registered agent. Follow the steps below to help you find an agent online.

#1 – Visit the Kansas City Life Find An Agency Page

You can find the company’s site at KCLife.com and navigate to the “Find An Agency” page by clicking the tab in the banner navigation.

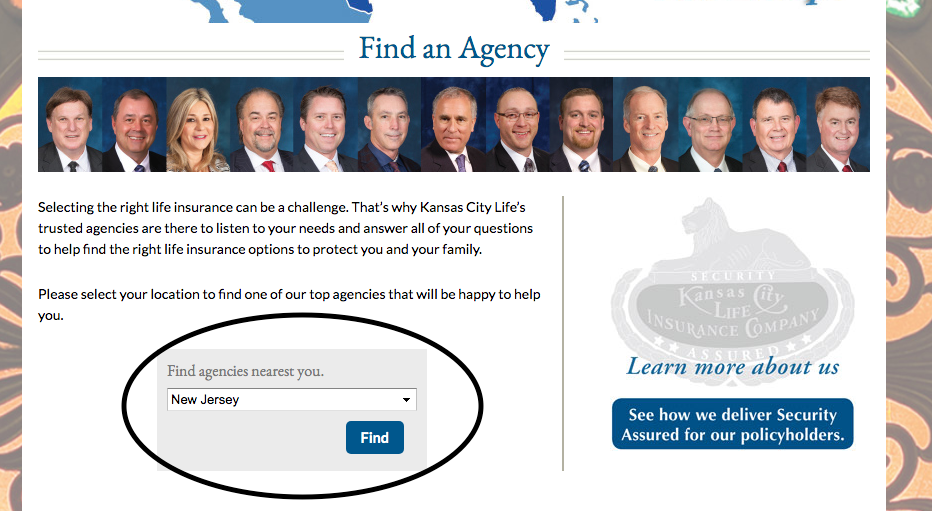

Once you’ve navigated to the “Find An Agency” page, you’ll be asked to select your state.

#2 – Select Your State

Click on Find Agencies Nearest You to select your state from the drop-down menu.

From here you’ll be presented with a few options for locations in your state.

#3 – Select the Agent or Agency of Choice

You may be presented with a number of agency options. Select the agent or agency that seems best for you. Locations are listed for your convenience.

#4 – Contact an Agent

When you contact an agent, be prepared to present the information you’ve gathered from reading this article. Having an idea of how much insurance you’d like, the type of insurance you require, and any additional information will help expedite the process.

#5 – Review and Compare your Quote

The initial quote a Kansas City Life agent provides will be preliminary. You should gather at least three or four quotes to compare before you make a final decision.

Also, be aware that the initial quote is preliminary. You won’t receive a final quote until you finish the application process and submit any required medical exams and proof of insurability.

Design of Website/App

Kansas City Life grows its business by acquiring new business and established life insurance businesses. Although earlier acquisitions were for companies that had a traditional insurance company setup, two more recent acquisitions seem to be in businesses with an eye for investing in technology.

Kansas City Life’s subsidiaries, Old American Insurance Company and Sunset Life Insurance, operate as separate brands and have their own webpages, but do not support apps. In fact, their websites look similar to the Kansas City Life site.

Check out the landing page for Sunset Life Insurance Company below.

You can immediately see the similarity to the Kansas City Life home page.

However, for Kansas City Life’s newer acquisitions, Guide One and Grange Life Insurance, Kansas City Life seems to be looking for fresh and new presentations. Although GuideOne Life Insurance doesn’t have a new web profile ready for its life insurance services, Grange Life Insurance appears to have a new look.

Grange Insurance also supports a smartphone application for life insurance policyholders to use for managing their accounts.

The Grange App has a 4.2-out-of-five customer rating. Clients can check account balances, organize policies, and contact an agent. However, remember that only Grange Life Insurance policyholders are supported by this app. Direct Kansas City policyholders don’t have access to this tool.

Pros & Cons

Kansas City Life might be a smaller player in the insurance industry, but they are staying on the leading edge of innovation when it comes to life insurance products.

Offering a range of options, from traditional term to return of premium, as well as access to indexed and variable universal life, Kansas City Life is a good option for customers looking for personalized agency experience with a diverse product catalog.

Here are some of the benefits and disadvantages of Kansas City Life.

Pros

- Kansas City Life is a smaller company that can offer a more personalized experience for the customer.

- Kansas City Life is available in all states excluding New York.

- Customers have access to customizable insurance products such as variable universal life and return of premium term insurance.

- High credit ratings and liquidity ratios ensure the company’s stability and ability to manage claims.

- Kansas City Life seems to be growing is business to meet the needs of more tech-friendly customers.

Cons

- Kansas City Life doesn’t provide online rates. You must meet with an agent to get any quote information.

- Company employee ratings of management show the need for improvement.

- The company doesn’t support technology-friendly tools like smartphone apps.

- The company’s profitability has been down in recent years, but this could be more indicative of a period of low-interest rates.

The Bottom Line

Kansas City Life is a smaller insurance provider, but it works to offer a wide selection of products to its customers. As a publicly-traded company, it largely flies under the radar without making huge news headlines, good or bad.

As a family-controlled business, the company seems to have a good reputation with customers, avoiding the NAIC index and BBB complaint lists. If you’re looking for personalized service from an agency, Kansas City Life might be a worthwhile consideration.

Quite possibly the main selling point for working with Kansas City Life is their willingness to work with your needs.

So how does all this information help you? Using the information in this review, you are now armed with the tools to ask smart questions, define your needs, and ultimately get the right insurance policy in place for you and your family, whether you decide upon Kansas City Life or another provider.

The bottom line is that shopping for insurance isn’t as horrifying a task as we all make it out to be. Take the next step right here by entering your ZIP Code to obtain an instant quote from our free quote tool.

Kansas City Life FAQs

Whether you’re shopping for life insurance from Kansas City Life or another provider, the answers to these common questions will help you make great insurance decisions.

#1 – Is Kansas City Life available outside of Missouri?

Yes. Kansas City Life is available in most states, either directly from Kansas City Life or through a subsidiary company. Kansas City Life is not available in New York State.

#2 – If I have a life insurance plan through my employer benefits, why would I need to shop for life insurance?

Odds are, your insurance through your employer is renewable term insurance and is capped at a certain amount. Although you may be able to increase or decrease coverage, for many heads of households with a mortgage, credit debt, and tuition payments to consider, your employer plan may not cover enough.

Typically an employer plan aligns with a few years of your salary. If you need to cover more for your own financial security, you’ll want to look at a supplemental plan.

#3 – Should I get term or permanent insurance?

Whether you get term or permanent insurance will depend upon your personal needs. For instance, if you know you need to cover a wide range of expenses now, but in 10 years will only need to cover a quarter of what you have today, you may want to look at a convertible term policy right now.

This way, you can maintain the maximum amount of benefit coverage for the cheapest cost but will able to get permanent insurance for a lower coverage amount later.

The best way to figure this out is to consult a good sales agent or work with your financial advisor.

#4 – I’m the beneficiary of a policy and would like to make a claim. When will I receive payment?

Once you file a claim, you’ll need to wait for the claim to be processed. To file a claim, you’ll need the original policy document, a certificate of death for the policyholder, and information to verify yourself as the beneficiary. If there are multiple beneficiaries, or the beneficiary is a trust, additional steps might be required.

Once the claim is filed, a review can take weeks or months. If a larger benefit is claimed, the insurer will want to make sure there are no mistakes. Additionally, payment on the claim could take longer if you’re looking for payment as a lump sum instead of annual distributions.

#5 – Do I need to submit medical information or take a physical to obtain a Kansas City Life policy?

Your application will require you to submit information on your current medical history and family history. In most instances, you’ll be required to submit for a physical exam and bloodwork to be approved.

#6 – Can I purchase a life insurance policy for my parent or spouse?

Yes. You can purchase life insurance for someone else, but you’ll need their signature and acknowledgment of the policy.

#7 – Is my life insurance benefit tax-free?

If you’re the policyholder and you cash out on the cash value of your policy, any returns in excess of premiums paid can be considered taxable income. If you’re the beneficiary of a policy, though, any benefit payments are usually tax-free and aren’t considered for income tax purposes.

However, you should always consult with a financial advisor or accountant to ensure your policy is set up to handle payments appropriately.

#8 – What do I do if my term policy is about to expire?

To avoid any lapse in coverage, speak to your agent or insurance provider. Chances are your term coverage is either renewable or convertible. If not, speak to your provider to see if you have any options to purchase gap insurance, which will help you remain covered until you can find a solution that meets your current needs.

#9 – What happens if I miss a premium payment?

If you miss premium payments, your policy can be canceled. If you have term insurance, this means you’ll lose coverage and you won’t have any money returned from premiums paid. If you have a permanent policy, you may have your policy canceled and any cash value returned to you.

If you do have cash value returned, you may trigger a tax event. Before letting your policy lapse, speak with your insurance provider or agent to see if there are options to postpone payments or use your cash value in a permanent policy to help cover premiums temporarily.

#10 – Can I purchase more than one life insurance policy?

Yes, and in some cases, you should. Since your needs and responsibilities change over time, you may want to add supplementary term policies during times when you have more responsibility and then allow the policies to expire as your situation changes. You can work with an agent or financial advisor to create a policy strategy that works with your goals.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption