Is whole life insurance a good investment? (Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

- Whole life policies build a cash value similar to a traditional investment account

- The cash value can provide retirement income through withdrawals and policy loans

- Tax benefits make whole life insurance a good supplemental investment strategy

- Can be too cost-prohibitive as a primary investment strategy

If you have a family, a life insurance policy is one of the best ways to ensure their financial security in the event of your death. The benefits from a policy can pay outstanding debts such as mortgages, credit cards, and medical bills so your loved ones don’t have to worry about them. But you may be wondering — is life insurance an investment?

Well, life insurance can also be used as an investment tool. In addition to providing debt protection and peace of mind to your family, certain policy types also provide benefits that you can take advantage of during your lifetime, such as retirement income.

There are benefits and drawbacks to using life insurance as an investment. The strategy might not be the best option for everyone.

This guide will give you a complete overview of how the investment component of life insurance works, the best policies to use, and how to find the best providers. After reading it, you should have a good idea of whether life insurance as an investment is the best choice for you and your family.

Start comparing life insurance rates now by using our FREE quote tool above.

With nearly 1,000 life insurance companies in the United States offering multiple policy types, different customization options, and varying prices, there is much to consider. However, if you’re looking for a reputable company, it’s always best to begin with the top-ranking companies and then go from there.

| Rank | Companies | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | MetLife | $10,877,337,000 | 6.7% |

| 2 | Northwestern Mutual | $10,550,806,000 | 6.5% |

| 3 | New York Life | $9,385,843,000 | 5.8% |

| 4 | Prudential | $9,170,883,000 | 5.6% |

| 5 | Lincoln National | $8,825,314,000 | 5.4% |

| 6 | MassMutual | $6,874,972,000 | 4.2% |

| 7 | Transamerica | $4,867,311,000 | 3.0% |

| 8 | John Hancock | $4,657,312,000 | 2.9% |

| 9 | State Farm | $4,636,147,000 | 2.9% |

| 10 | Securian | $4,426,864,000 | 2.7% |

| 11 | Guardian Life | $4,055,519,000 | 2.5% |

| 12 | Pacific Life | $3,770,584,000 | 2.3% |

| 13 | Nationwide Mutual | $3,365,469,000 | 2.1% |

| 14 | AIG | $3,346,570,000 | 2.1% |

| 15 | AXA | $3,097,395,000 | 1.9% |

| 16 | Voya | $2,668,108,000 | 1.6% |

| 17 | Brighthouse | $2,525,047,000 | 1.6% |

| 18 | Protective Life | $2,406,629,000 | 1.5% |

| 19 | Primerica | $2,376,601,000 | 1.5% |

| 20 | Torchmark | $2,367,072,000 | 1.5% |

Get Your Rates Quote Now | |||

The top 20 companies represent nearly 65 percent of all life insurance business, so chances are that one of them will be able to meet your specific needs.

Average Monthly Life Insurance Cost

To give you an idea of how much whole life insurance coverage might cost you compared to term, here is a look at monthly sample premiums for a non-smoker with one of the top 10 life insurers in the country.

20-Year Term

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $11.03 | $10.02 | $22.10 | $12.91 | $23.19 | $19.04 |

| 30 | $11.12 | $10.07 | $15.31 | $13.02 | $23.85 | $19.26 |

| 35 | $11.12 | $10.07 | $15.42 | $13.02 | $24.07 | $19.26 |

| 40 | $12.65 | $11.12 | $17.94 | $15.21 | $29.10 | $23.63 |

| 45 | $14.57 | $13.31 | $21.55 | $19.69 | $36.32 | $32.60 |

| 50 | $18.60 | $17.20 | $30.19 | $27.02 | $53.60 | $47.26 |

| 55 | $24.51 | $20.61 | $42.88 | $34.35 | $78.98 | $61.91 |

| 60 | $35.88 | $27.48 | $71.10 | $50.86 | $135.41 | $94.94 |

| 65 | $51.06 | $37.76 | $109.82 | $75.14 | $212.85 | $143.51 |

Get Your Rates Quote Now | ||||||

Whole

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $93.70 | $84.91 | $201.90 | $179.97 | $396.07 | $352.22 |

| 30 | $107.71 | $97.35 | $238.33 | $211.60 | $468.50 | $415.25 |

| 35 | $128.24 | $112.93 | $289.26 | $251.86 | $569.70 | $495.33 |

| 40 | $153.90 | $132.15 | $350.98 | $299.62 | $692.47 | $590.19 |

| 45 | $190.79 | $156.17 | $434.71 | $365.30 | $859.29 | $720.90 |

| 50 | $234.90 | $191.66 | $538.74 | $449.58 | $1,066.47 | $888.81 |

| 55 | $294.84 | $243.17 | $678.64 | $574.34 | $1,344.73 | $1,137.02 |

| 60 | $399.24 | $311.63 | $895.65 | $735.39 | $1,777.01 | $1,457.58 |

| 65 | $528.00 | $421.69 | $1177.24 | $978.84 | $2,338.00 | $1,942.51 |

Get Your Rates Quote Now | ||||||

As you can see, premiums on whole policies are anywhere from 200 to 600 percent higher than term policies at the same age and face value.

Now that you’ve seen some rates, let’s discuss some necessary details about whole life insurance as an investment, starting with the basics.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

What is whole life insurance?

A life insurance policy is a contract between you and the insurer. In exchange for a regular fee, the insurance company promises to pay a guaranteed lump-sum payment to your loved ones upon your death.

Whole life insurance is a type of policy that provides permanent coverage for as long as you live. In addition to the guaranteed death benefit, many whole life policies also include an investment component.

Every month, a portion of your premiums are invested into either a fixed-interest savings account, variable index, or market account. The gains from those investments are known as the cash value.

The cash value is separate from the death benefit. You can access it during your lifetime, and any amount left after you die is paid to your beneficiary along with the normal life insurance payout.

Whole vs Term Life Insurance

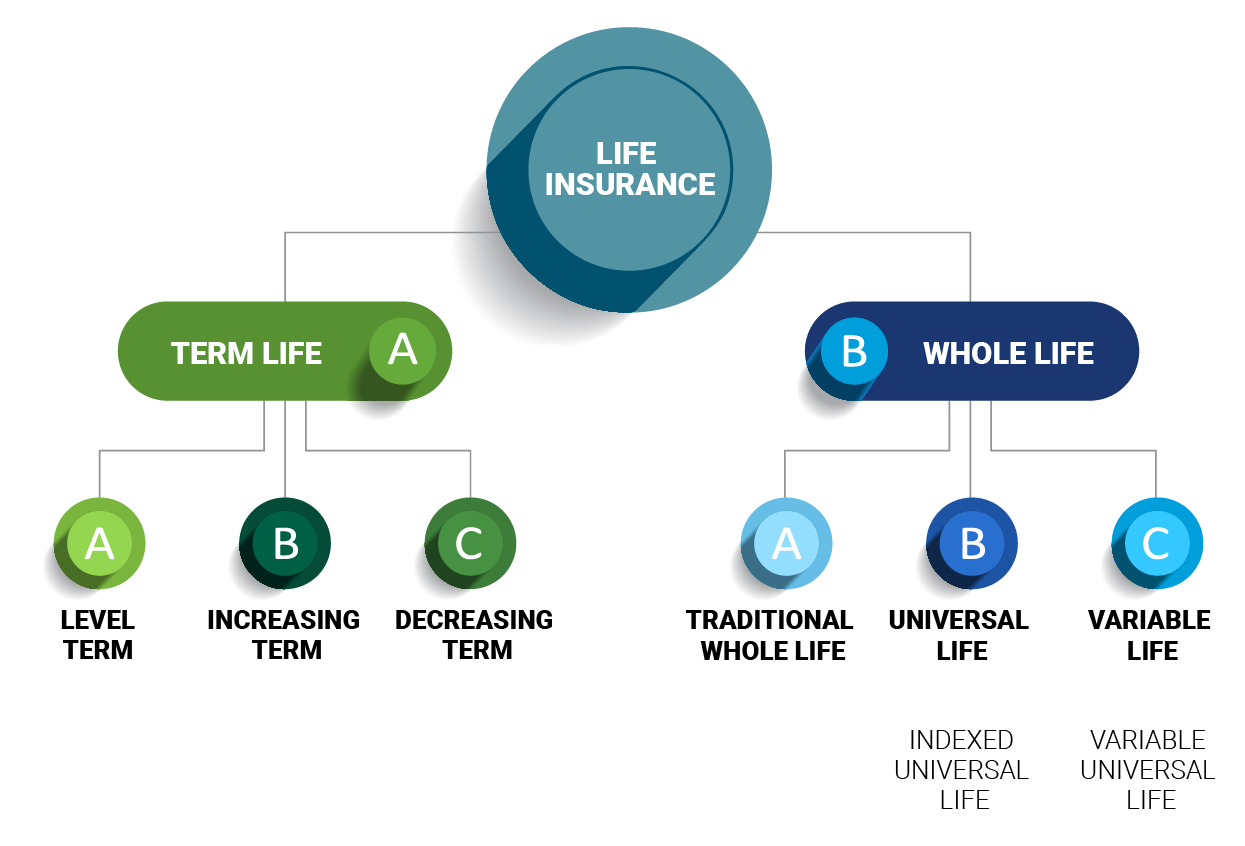

Life insurance policies fall into one of two general categories: term or whole. The chart below breaks down the different types of term life and whole life insurance even further.

Term life insurance provides temporary coverage for a specified period, usually between 10 and 30 years. Once that term expires, the insurer cancels the coverage unless you opt to renew for a new term.

Whole life insurance provides permanent coverage for as long as you live.

For example, if a 40-year-old woman buys a $500,000, 20-year term policy, that coverage ends at age 60. If she dies before 60, the insurer pays her beneficiaries $500,000. If she dies any time after, they don’t pay anything.

If the same woman purchased a $500,000 whole life insurance policy, the coverage would never end. As long as her premium payments were current at the time of her death, the insurer would pay her beneficiaries $500,000, regardless of her age.

Term policies have no cash value component. Because of that, they can’t be used as an investment in the same way as a whole policy.

Why buy whole life insurance?

Life insurance policies are generally meant to cover two types of obligations: immediate and future.

Immediate obligations are those expenses that need to be paid soon after your death. They include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are expenses (some planned, some not) that need to be paid in the years following your death. They might include:

- Income replacement

- Spouse’s retirement

- Children’s college tuition

- Emergency savings fund

Whole policies focus more on those future obligations.

Except for funeral costs, the immediate obligations are all bills that you pay regularly. If you had a term policy, you’d ideally pay those bills down over the term so that they’re paid off before it expires. Once they’re paid, you have less need for insurance coverage.

A whole policy will still be in effect after most of those obligations are paid. Therefore, most people use them for what comes after.

Watch the video below for a quick overview of whole life insurance:

Whole life insurance is intended to be used less like a safety net in the event of an unexpected death, and more as a way to leave behind wealth.

The cash value can also be used during your lifetime through policy loans and withdrawals, so in addition to a guaranteed death benefit, they can also provide supplemental retirement income.

Who should buy whole life insurance?

An insurer will always have to pay on a whole policy, while a term policy might expire before they have to. Because of that, whole life insurance is the more expensive of the two options.

A whole policy will always cost more than a term policy with the same face value.

Whole policies are often marketed as investments rather than just insurance, as they allow you to save and grow money while paying for a life insurance policy that you were likely to buy anyway.

While true, the returns on whole life policies are often smaller than those of more traditional retirement options such as a 401(k) or IRA and can have additional related costs.

Because of that, some financial planners and consumer advocacy organizations suggest that a term policy is a better choice for a majority of families.

They advise buying a term policy and then investing the difference in a traditional retirement or savings account.

For most people, whole life insurance is too cost-prohibitive to be their sole investment strategy. However, people in the following situations could benefit from whole life insurance as an investment.

Estate Planning

If you’re leaving behind a large estate, your heirs might be faced with a large tax bill. The current maximum estate tax rates are nearly 40 percent.

That amount is due in cash within nine months of your passing. If you aren’t leaving behind cash assets, your heirs may have to use their own money to cover the tax debt.

Fortunately, the death benefit from a life insurance policy is tax-free in most situations. Instead of using their money, your beneficiaries can use the proceeds from a whole policy to pay the taxes and preserve the overall value of the estate.

If you’re leaving considerable cash assets, you may be able to shield them from taxes completely by depositing them into the cash account of a whole policy, rather than leaving them as an inheritance.

You can then establish an irrevocable life insurance trust that owns the policy for you, thereby removing it from your estate.

Watch the following video for an overview of life insurance trusts:

A life insurance trust ensures that the proceeds from the life insurance policy pass tax-free to your beneficiaries, both the death benefit and the large cash value funded by your assets.

Asset Protection

If you need to protect your assets against liens and creditors, life insurance could be an important part of your strategy.

Laws vary from state to state, but most consider the proceeds from a life insurance policy to be uncollectible assets.

Establishing a Trust

Similar to asset protection, the proceeds from a whole life insurance policy can be used to establish a strong trust. Trusts are commonly used to transfer large assets such as real estate or businesses.

A trust can also help protect assets from creditors.

In some states, creditors can collect on the cash value of a life insurance policy, but not the death benefit. If you live in one of those states, you can use the previously discussed irrevocable life insurance trust to protect your cash value from creditors.

Preserving a Business

If you own a business, the proceeds from a whole life policy can be used to cover any financial losses resulting from your death and provide the funds necessary to keep it running into the future.

It can also be used to equalize your estate. If you have a conflict among heirs who want to continue the business and heirs who don’t, the heirs who do want the business may be forced to liquidate it to fairly divide the assets among everyone.

The proceeds from a whole life policy can be used to buy out the uninterested heirs so that the others can keep the business.

Retirement Planning

Whole life insurance policies aren’t subject to limits like an IRA or 401(k). You can contribute as much premium as you’d like to increase your cash value.

If you’ve already reached your maximum contribution to traditional retirement savings accounts, you can take advantage of tax-deferred growth through your whole life policy.

Establishing Long-Term Care

If you’re the primary caregiver for a spouse or loved one with special care needs, the proceeds from a whole life policy can be used to fund a long-term care plan.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Types of Whole Life Insurance

All whole life insurance policies are the same in that they come with the promise of coverage for as long as you live. Nearly all of them also include a savings account that builds a cash value.

Whole life has the following variations:

- Traditional whole life

- Universal life

- Indexed universal

- Guaranteed universal life

- Variable life

- Variable universal life

- 7702 plans

Traditional Whole Life Insurance

A traditional whole life policy (sometimes called ordinary life) is the most common form of permanent insurance. It’s also one of the simplest.

Your cash account operates similar to a traditional savings account. A portion of your annual premiums is placed in an account that grows at a fixed interest rate (typically around 3–8 percent).

This makes it the least risky option. You are always guaranteed to see positive growth in your cash value. It isn’t dependent on the stock market, which could experience a downturn at any time.

That simplicity and safety do come at the cost of flexibility. You often can’t change your death benefit or adjust your premium payments like you can with other whole life options.

You also don’t have any option on how your cash value is invested. Because of that, it’s one of the least popular options for those intending to use a whole policy as an investment.

Universal Life Insurance

Universal life policies offer the flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low while maximizing cash value.

The cash value of a universal policy grows at a fixed rate, similar to a traditional whole life policy.

These policies offer more flexibility than the traditional option, but less than other universal and variable options. Just as with traditional whole life, you don’t have any choice in how your cash value is invested.

Indexed Universal Life Insurance

Indexed universal life policies offer all the flexibility of a universal policy, with the additional benefit of choosing how you invest your premiums.

These policies allow the owner to allocate the cash value amounts to an equity index account such as the S&P 500 or the Nasdaq 100, rather than simply growing at a rate set by the insurer.

Your growth isn’t guaranteed like it is with a fixed-interest account, so indexed universal policies are a riskier investment.

While the risk is higher, these policies come with the potential for higher returns than a traditional whole or universal policy. Some policies also come with the option to take a break from the index and temporarily invest in the stable, traditional savings account.

Indexed Universal Life policies are among those most commonly used as an investment.

Guaranteed Universal Life Insurance

Guaranteed universal life policies lie somewhere between a term policy and a traditional whole policy. They offer fixed premiums and guaranteed no-lapse coverage.

Unlike most permanent life insurance policies, guaranteed universal policies don’t accumulate a cash value that you can access.

They are more like term policies that simply don’t expire as long as you pay your premiums. That means they have no real value as a traditional investment, though they could still be helpful in some aspects of estate planning.

Variable Life Insurance

Variable policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401(k). These policies come with the greatest risk, but also some of the highest growth potential.

Depending on how the stock market performs, you could lose some of your cash value and possibly see your face value decrease.

Fortunately, many policies do come with a minimum death benefit guarantee.

Variable policies are the most popular type for those who want to use their policy as an investment. They most closely resemble traditional investment and retirement accounts.

Variable Universal Life Insurance

As their name suggests, variable universal policies combine the benefits of a universal and a variable policy.

Variable universal policies come with the adjustable premiums and face values of a universal policy, along with a variable policy’s potential for high investment returns.

Along with the same benefits, they also come with the same investment risks. Again, they are among the most popular life insurance investment options.

Should I set up a 7702 plan?

Some life insurers and financial advisors have started to market 7702 life insurance plans. Here’s a secret: There is no such thing as a 7702 plan.

7702 refers to the Internal Revenue Code that defines a legitimate life insurance contract and establishes how those contracts are taxed.

Calling a life insurance policy a 7702 plan is similar to the way a 401(k) is named for subsection 401(k) of the Internal Revenue Code, which establishes permission for companies to provide tax-deferred retirement accounts to their employees.

7702 Plans are just universal and variable policies that have been re-branded to sound more like a retirement savings plan than a life insurance policy. It’s a marketing gimmick, not a unique policy type.

This isn’t to say that you should avoid them if an agent suggests one; just don’t write off an insurer when you’re shopping for a policy because they don’t offer the 7702 plan you heard about. They probably do. They just sell it under its traditional name.

Whole Life Insurance as an Investment

Whole life insurance is often marketed as an investment strictly because of the cash value which grows similar to a retirement account. However, whole policies also come with additional tax benefits that make both the cash value and the death benefit a potential investment.

Cash Value Component of Whole Life Insurance

Just like a 401(k) or an IRA, whole life policies allow you to make tax-deferred contributions. You can make as many additional payments as you want to increase your cash value. You can then access those funds later in life as an income supplement through the right combination of withdrawals and policy loans.

Under current law, withdrawals from the cash value of the insurance policy are first considered a tax-free return of the premiums you paid into the plan and then taxable earnings on anything extra.

That means you can fully withdraw an amount equal to the premiums you paid without paying any tax. Any withdrawals after that will be taxed as income.

For example, imagine you’ve made $10,000 in premium payments to date, but have a cash value of $20,000 from a combination of investment returns and additional contributions. If you made a $15,000 withdrawal, you’d only have to pay taxes on $5,000.

You can avoid taxes on that additional amount by also combining policy loans with your withdrawal. Loan distributions are tax-free.

Once you’ve fully withdrawn an amount equal to your premium payments, you can then take out a policy loan for the additional funds you need.

Using the previous example, you’d make a $10,000 withdrawal, then request a $5,000 loan against your cash value. The only drawback is that the loans need to be paid back with interest.

The most common strategy for accessing funds this way is to build up enough of a cash value that you can stop paying premiums into the policy at some point and have the cash value pay the insurance charges instead.

From there, you take tax-free withdrawals and loans from the plan for the rest of your life. When you die, the death benefit is used to pay off the outstanding loan. After that, any remaining balance will be paid tax-free to the beneficiaries.

The biggest drawback is that you could end up leaving your heirs a severely decreased death benefit depending on the growth of your cash value and how large of a loan you took out against it.

If you have large outstanding debts that you’re relying on the death benefit to pay, or if your beneficiaries are largely dependent on that benefit, they could be negatively impacted.

This strategy is best for those who just want the debt protection of a life insurance policy during their working years, and then retirement income after. You accumulate during your working years, then decumulate during retirement.

With this strategy, your death benefit starts to go away once you switch over to retirement income. Therefore, it is less about leaving a legacy and more about you and your spouse living comfortably in your later years.

How Life Insurance Payout Works

The death benefit from a life insurance policy is generally exempt from taxes. Therefore, they can be used to shield your beneficiaries from large tax bills if you’re leaving behind significant assets.

For example, if you’re passing on a large estate, the death benefit from a life insurance policy (especially one padded with a significant cash value) can be used to pay the estate taxes, thereby preserving the overall value of the estate.

Similarly, significant cash assets can be funneled into the cash account of a life insurance policy. That death benefit can then be passed tax-free into a trust, which can then pay interest income to the beneficiaries.

In these scenarios, you’d want to avoid withdrawals and policy loans to preserve the overall death benefit. Using the policy in this way is more of an investment in your beneficiary’s future than your own.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Accessing Your Whole Life Insurance Policy Investment Gains

In addition to those already discussed, there are several ways to access your life insurance investment gains.

Watch the following video for some quick tips on how to get money from your life insurance policy:

Now, here are even more ways.

Making a Withdrawal

Many insurers allow you to withdraw funds from your cash value, up to a certain limit. As discussed, these withdrawals are considered a tax-free return of premium. However, they will likely come with withdrawal fees imposed by the insurer.

Taking out a Policy Loan

You can take out a loan against your cash value, but it must be paid back with interest. Any outstanding balance at your time of death will be deducted from the death benefit.

Taking Dividends as Cash

If you have a participating whole life policy from a mutual insurer, you are likely entitled to annual profit-sharing dividends. Your life insurance dividends can either be contributed to your cash value every year, used to pay your premiums, or taken as cash.

Selling Your Policy

If you no longer need permanent life insurance, you can sometimes sell your life insurance policy to an outside buyer for an amount greater than your cash value, but less than your overall death benefit.

When you sell your policy, the buyer takes over the premiums on your policy and becomes the beneficiary, while you cash out early.

Keep in mind that any profit you make on the sale is subject to income or capital gains tax.

Exchanging Your Policy

Some life insurance policies that are sold through full-spectrum financial service companies can be exchanged for one of the company’s other retirement products, such as a tax-free exchange into an immediate payout annuity.

Surrendering Your Policy

If you no longer need your policy (or can’t afford the premiums) and selling isn’t an option, you can surrender your policy. When you surrender, you cancel the policy, forfeit the death benefit, and walk away with your cash value.

If you surrender your policy, the insurer will impose a fee against the cash value. Those fees tend to be very high in the early years of the policy.

Accelerated Benefits

You can sometimes receive a portion of your death benefit early if you’re diagnosed with a terminal illness.

This option isn’t unique to whole insurance. It is often available as a rider on term policies as well.

The Cost of Whole Life Insurance as an Investment

When used primarily as an investment, whole life policies can be more expensive than traditional investment accounts because of premiums and fees.

As previously mentioned, whole life insurance is more expensive than term insurance for every age and demographic.

If you want to use whole life insurance as an investment, you’re already going to be paying much more than a term policy before you factor in any additional contributions, management fees, or withdrawal costs.

Factors That Affect Your Rates

There is no industry-standard price for life insurance. Rates vary for everyone. Your premiums are determined by several factors, primarily the following.

- Age – Age is one of the most important factors in determining insurability. The older you are, the lower your life expectancy. The longer you wait to buy a policy, the higher your rate will be.

- Gender – Statistically, women live longer than men. Because of that, they typically pay lower premiums.

- Health history – Healthy people live longer lives, which translates to lower premiums. To determine your overall health, insurers may require a complete medical exam.

- Family medical history – Because many diseases are hereditary, most insurers will also inquire about the health history of your immediate family.

- Occupation – Some jobs are more dangerous than others. If your job has a high risk of injury and accidental death, you can expect higher premiums.

- High-risk habits – Insurers will also inquire about high-risk habits such as flying, racing, mountain climbing, or any other regular activity with high injury risk.

- Tobacco use – The most common high-risk habit that insurers look for is tobacco use. Smokers pay higher rates than their non-smoking counterparts in every demographic.

Account Fees

Whole life policies come with significant fees that could cut into your cash value growth, particularly universal and variable policies that have more complicated investment components.

Management Fees

Management fees include regular administration fees and fund management fees for universal and variable policies.

- Administration fees – These fees are used to pay the costs of maintaining the policy, such as accounting and recordkeeping. They are usually are deducted from your cash value once a month.

- Fund management fees – These fees pay the fund managers for their work. They are usually incorporated into the price paid for the shares of your fund options, and not deducted directly from your cash value.

Sales Commissions

Many insurers pay commissions to agents who sell their policies. These charges are deducted from your premium payment before it is applied to the policy.

The insurer pays the fee, not you, but an agent could push a more expensive policy to receive a higher commission.

Surrender Fees

Surrender fees are charges imposed on a policyholder for early withdrawal of funds or cancellation of a policy. For example, many insurers charge fees if you cancel your policy within the first 20 years.

Surrender fees are assessed against the cash value. If you cancel your policy completely, the insurer will pay you a surrender value, which is your cash value minus any surrender fees.

Is whole life insurance a good investment?

Whole life insurance as an investment is more expensive and complicated than more traditional investments. Many financial advisors suggest that people simply buy term insurance and invest the difference in more traditional accounts.

For example, take a look at the following scenario:

A 30-year-old non-smoker can get a $500,000, 20-year term policy for around $355 per year, or $7,000 paid over the entire term. A whole policy would cost $5,500 per year and $110,000 over 20 years. That’s an extra $5,145 per year extra for the whole policy.

After 20 years, the whole policy would have a guaranteed cash value of around $105,000 (assuming guaranteed growth of 2–5 percent).

If that person bought the cheaper term policy and invested the additional $5,145 per year into a savings account with a low-interest rate of 1 percent, after 20 years that account would be worth around $115,000. At an interest rate of 2 percent, it would be worth around $130,000.

The savings account has a higher return without all of the withdrawal restrictions of a whole life policy.

You could also end up draining your cash value to cover your premiums later in life.

If you have limited income during those retirement years, you could have trouble paying the high premiums of a whole policy since they’re designed to be paid until you die. When that happens, most people use their cash value to pay the premium.

Using the above example of a policy with a guaranteed cash value of $105,000 after 20 years, a $5,500 annual premium would burn through half that amount in 10 years.

Therefore, a whole life insurance policy probably shouldn’t be your only investment. It is best suited as a supplemental investment for high-income individuals who already have a traditional retirement plan in place.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Shopping for Whole Life Insurance Quotes

If you do want to purchase a whole life policy as an investment, here is some information that can help you get the best policy from the best provider at the best price.

Medical Exams

When applying for whole life coverage, insurers will require you to fill out a health questionnaire and may request your medical records. Nearly all will also require a complete medical exam and bloodwork.

The basic life insurance medical exam process looks like this:

- The customer fills out a life insurance application and medical questionnaire

- The insurer schedules an in-home medical exam

- The medical examiner conducts a brief oral interview

- The examiner measures height, weight, and vitals, then takes a urine sample, blood sample, and oral swab

- Lab results are sent to the underwriter for review

- The insurer will assign a risk classification and inform the applicant of final premiums

Watch the video below for some tips on taking the medical exam:

Some life insurance policies advertise the fact that they don’t require a medical exam, which could be beneficial for those with preexisting conditions. However, if you’re healthy, it might cost you more.

A young person might not see much difference in rates between a regular and a no-exam policy, but older people will most likely get a much higher rate.

When a policy doesn’t require a medical exam, the insurer automatically assumes you are in a higher risk pool, whether you should be or not. That risk gets passed along to you in the form of increased premiums.

Depending on your health, taking the exam could get you placed in a lower risk category than the insurer might otherwise assign you.

Life Insurance Tips & Strategies

Here are some important tips to remember when it comes time to purchase a policy.

#1 – Buy from a Reputable Company

Make sure the company you’re buying from is reliable. Start by researching an insurer’s market share. If they have a lot of policies in force, they’re more likely to be an established, respectable company.

If you’ve never heard of them and you can’t find much info about them in the first few pages of an internet search, you might want to look elsewhere.

The easiest thing to do is to start with the top-ranking companies in the country.

From there, read company reviews that focus on policy offerings, financial stability, and reputation. You can also research those metrics yourself by using the following resources.

- Third-party rating agencies like A.M. Best, the Moody’s Investors Service, and Standard & Poor’s (S&P) measure an insurer’s financial strength and its ability to pay all of its policy obligations.

- J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

- The Better Business Bureau uses 13 factors such as time in business, open complaints, resolved complaints, and legal action against a company to assign one of 13 letter ratings, A+ through F.

- The National Association of Insurance Commissioners Complaint Index compiles the number of complaints filed against an insurer each year and compares it to that of other companies.

#2 – Compare Policies

Once you have a list of reputable companies, compare the policy offerings of each to find the one that fits your needs. Even the number one company in the country might not be the best for you if they don’t offer a policy with the investment options you want.

#3 – Get Quotes

Quotes are an easy way to compare policy costs between insurers. Quotes are available online through convenient quote tools or local insurance agents.

Try to find the policy with the greatest benefit for the lowest price.

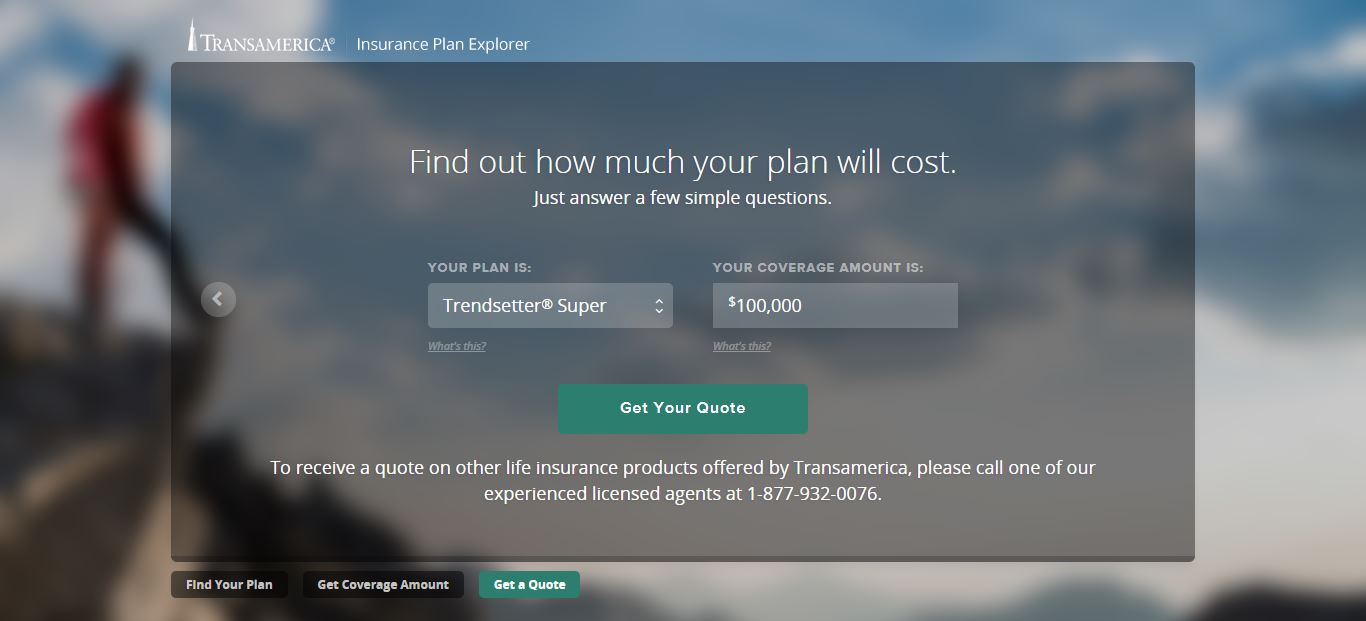

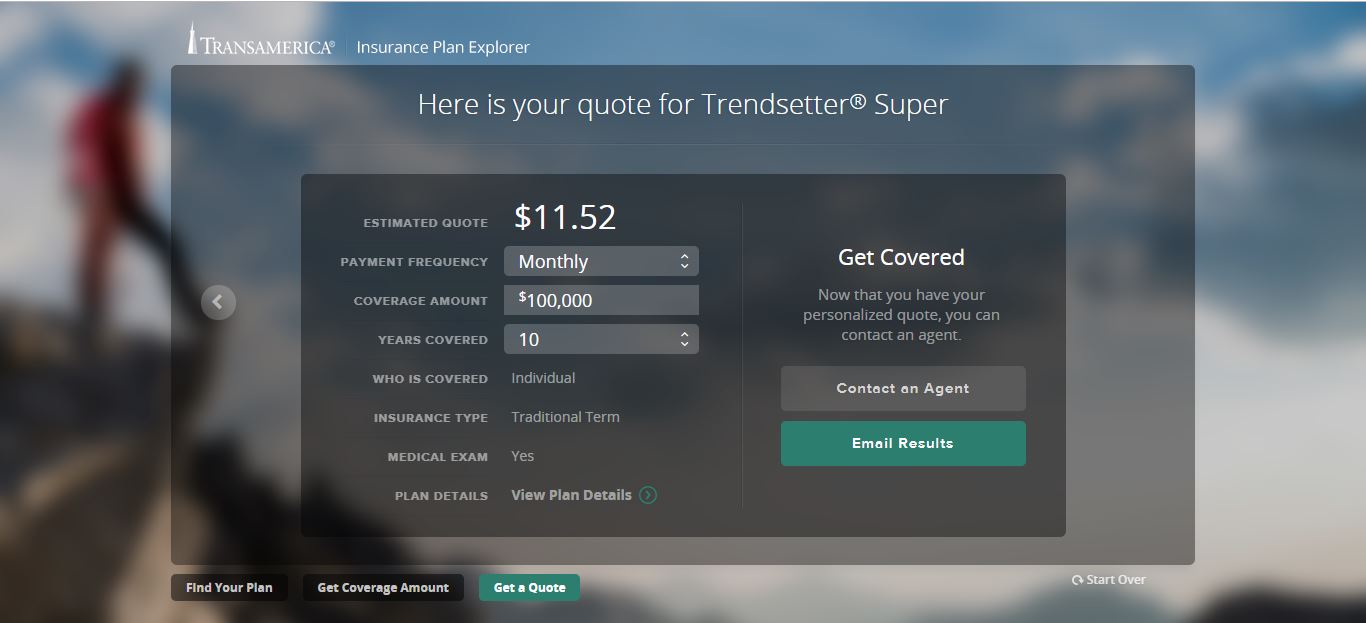

Whole life insurance has a lot of additional factors that influence its premiums. Because of that, few companies give online quotes for permanent coverage, but some do.

Many insurers have quote tools on their website.

You simply choose your desired coverage, enter some basic personal information, and the tool will return an estimated cost.

There are also independent quote tools (such as the ones on this page), which will provide you with quotes from multiple insurers at once. You can quickly compare prices without having to visit multiple websites.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Pros & Cons of Whole Life Insurance as an Investment

Using a whole life insurance policy as an investment can be an effective strategy for some, but it does have its drawbacks.

| Pros | Cons |

|---|---|

| Guaranteed death benefit with no term | More expensive than a traditional savings account |

| The policy builds cash value | Cost/return ratio is lower than traditional retirement investments |

| Guaranteed minimum interest return on many policies | High administrative fees |

| Tax-deferred growth | High commission fees |

| Tax-free access to your funds via policy loans | Surrender fees |

| Not subject to limits like an IRA or 401k, so no limit on tax-deferred growth | Can lose coverage from missed premium or loan payments |

Get Your Rates Quote Now | |

You should carefully weigh these pros and cons before making a decision.

The Bottom Line

Whole life insurance is best used as a supplement to more traditional investment options. Most people would be better served to buy a term policy for risk management, and investing the additional cash in a more traditional account for retirement savings.

The cash value should also come second to the actual life insurance coverage. Life insurance should be used as primarily as debt-protection and investment accounts should be used for retirement.

You probably shouldn’t buy a whole life insurance policy if all you’re looking for is an investment opportunity.

However, if you need life insurance anyway, and your financial situation justifies it, the cash value component of a whole policy can be a beneficial bonus.

If you don’t have an estate plan in place, you should consider making one that incorporates a whole life policy. If you already have a plan, maybe it’s time to reassess and see what role, if any, life insurance can play.

Do you still have questions on the benefits of whole life insurance? Want to know more about the insurance process in general? Check out our many in-depth guides on the site. You’ll find complete information on every topic discussed here.

You can also use the quote tool at the bottom of this page to instantly compare quotes from multiple insurers to see how they compare to the average sample rates in this guide.

Start comparing life insurance rates now by using our FREE quote tool below.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption