Midland National Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1906 |

| Current Executives | CEO – Esfandyar Dinshaw COO – Steve Palmitier CFO – Don Lyons |

| Number of Employees | 1,500 |

| Total Sales / Total Assets | $593,000,000 / $53,185,124,654 |

| HQ Address | 4350 Westown Parkway West Des Moines, IA 50266 |

| Phone Number | 1-800-923-3223 |

| Company Website | www.midlandnational.com |

| Premiums Written – Group Life / Individual Life | $25,900,527 / $2,286,932,731 |

| Financial Standing | $401,605,343 |

| Best For | Strong Financial Ratings, Term, Universal Life |

Get Your Rates Quote Now |

|

Purchasing a life insurance policy is one of the most important decisions you can make for your family, but shopping for it can be intimidating.

There are nearly 1,000 life insurance companies in the United States competing for your business. Each of them has multiple policy types, different customization options, and varying prices.

Midland National Life Insurance Company might not have the name recognition of some of its larger competitors, but they are one of the oldest life insurers in the country.

With over 100 years of experience, they are ready and willing to provide you with the peace of mind that comes from knowing your family will be financially secure after your death.

This review will give you a complete overview of the company and guide you through all of their policy options to help you decide if Midland National is the right insurer for you.

Start comparing life insurance rates now by using our FREE tool above.

Table of Contents

Midland National’s Ratings

The following third-party ratings give insight into Midland National’s financial strength, business practices, and quality of customer service.

A.M. Best

A.M. Best ratings measure an insurer’s financial strength and its ability to pay all of its policy obligations.

Midland National has an A+ rating, meaning they have a superior ability to meet their financial obligations.

Better Business Bureau (BBB)

The Better Business Bureau assigns one of 13 letter grades based on factors such as time in business, open complaints, resolved complaints, and federal action against a company.

Midland National currently holds a perfect A+ rating.

Moody’s

Similar to A.M. Best, Moody’s long-term obligation ratings measure an insurer’s credit risk. Midland National holds a high-quality Aa rating.

Standard & Poor’s (S&P)

Standard & Poor’s (S&P) ratings also measure an insurer’s credit risk. Midland National holds an A+ rating, representing a strong ability to meet its financial obligations.

NAIC Complaint Index

The National Association of Insurance Commissioners Complaint Index compares the number of complaints registered against an insurer each year with that of other companies.

The NAIC sets the index at an average score of 1.00. Midland National has a current score of 0.64, below the industry standard.

J.D. Power

J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price.

Midland National scored a two out of five in the 2018 study, with its highest marks in policy offerings and customer interaction.

Company History

Midland National was founded in 1906 as Dakota Mutual Life Insurance Company in Watertown, S.D. In 1909, the company abandoned the mutual company model and became a publicly-traded company.

In 1925, the company rebranded itself as Midland National Life Insurance Company to reflect its ambition to be a nationwide insurer. In 1958, the rapidly expanding company was bought by Reserve Life Insurance Company, which owned eight other life insurers at the time.

Today, Midland National is a privately owned company as part of the Sammons Financial Group, which also owns the North American Company for Life and Health Insurance.

Midland National is licensed to sell policies in all U.S. states (except New York) as well as in the District of Columbia, the Virgin Islands, Puerto Rico, and Guam.

Midland National’s Market Share

As of 2018, Midland National is a top 20 writer of life insurance with a 1.6 percent market share, representing $2.28 billion in direct written premiums.

| Rank | Company | Direct Premiums Written | Market Share |

|---|---|---|---|

| 1 | Northwestern Mutual | $10,547,469,000 | 8.2% |

| 2 | Lincoln National | $7,467,869,000 | 5.8% |

| 3 | New York Life | $7,331,015,000 | 5.7% |

| 4 | MassMutual | $6,171,213,000 | 4.8% |

| 5 | Prudential | $5,806,118,000 | 4.5% |

| 6 | John Hancock | $4,651,894,000 | 3.6% |

| 7 | State Farm | $4,593,999,000 | 3.6% |

| 8 | Transamerica | $4,567,999,000 | 3.6% |

| 9 | Pacific Life | $3,770,584,000 | 2.9% |

| 10 | Met Life | $3,724,165,000 | 2.9% |

| 17 | Midland National | $2,286,932,731 | 1.6% |

Get Your Rates Quote Now |

|||

The company saw a slight decrease in direct written premiums from 2017–2018, resulting in a 0.2 percent drop in market share and a drop in rank from 15 to 17. However, that is still significantly higher from where the company was just two years earlier in 2016.

| Year | Direct Premiums Written | Market Share | Rank |

|---|---|---|---|

| 2016 | $891,943,283 | 0.7% | 23 |

| 2017 | $2,699,242,386 | 1.8% | 15 |

| 2018 | $2,286,932,731 | 1.6% | 17 |

Get Your Rates Quote Now |

|||

Despite the drop, the company still has over $1 billion more in direct written premiums than it did just a few years ago.

Midland National’s Position for the Future

While Midland National doesn’t have the sales or market share of some of its larger competitors, they still have a positive outlook for the future.

Their parent company, Sammons Financial Group, has nearly $60 billion in assets between its life insurance and retirement solutions businesses.

Midland National has been a constant presence in the life insurance market for over 100 years, and there’s no reason to believe that won’t continue for many more years to come.

Midland National’s Online Presence

Midland National offers the ability to get a quote, pay your premiums, and file a life insurance claim on its website.

They also have an active social media presence on Facebook.

And on Twitter.

Both their Facebook and Twitter pages are actively updated with information on the company and its offerings.

Midland National’s Commercials

Midland National doesn’t currently have a national television ad campaign like some of its largest competitors, but it does have an online campaign that seeks to answer the question “Do I need life insurance?”

Only a little over half of Americans have a life insurance policy, but everyone could benefit from life insurance.

Midland National in the Community

Midland National’s parent company, Sammons Financial Group, is committed to giving back to the communities in which it operates. It does so through the following three initiatives.

Volunteerism

The company organizes events during business hours which allow employees to use their paid time to volunteer with non-profit organizations that the Sammons Financial Group supports.

In 2019, employees contributed more than 5,000 hours in volunteer service.

Charitable Giving

In 2019, Sammons Financial Group donated $3.5 million to non-profit organizations, including the United Way and the Special Olympics.

Gift Matching

Sammons Financial Group regularly matches employee donations to non-profit organizations most important to them.

Midland National’s Employees

Midland National employs about 1,500 people.

Glassdoor employee reviews for Midland National averaged 4.8 out of five stars based on 270 reviews. An overwhelming 97 percent of current employees say they would recommend the job to a friend.

The company ranked fifth on Glassdoor’s list of Best Places to Work for 2020, and the CEO ranked 11th in their list of top CEOs for 2019.

Shopping for Life Insurance

If you’re reading this guide, you’ve probably already realized the importance of owning a life insurance policy.

If you’re still on the fence, consider these findings from the 2018 Insurance Barometer Study from Life Happens and LIMRA:

- 35 percent of households would be financially affected within one month of the primary wage earner’s death.

- 90 percent agree that the primary wage earner should carry insurance.

- 60 percent of all people living in the United States have life insurance.

- 20 percent of those with a policy feel their coverage is insufficient.

If you — like so many others — need coverage, here are some things to keep in mind while you shop. In general, life insurance needs to cover two types of obligations: immediate and future.

Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all of the expenses that you want to pay well after your death. They include:

- Income replacement

- Spouse’s retirement

- Children’s college tuition

- Emergency savings fund

Watch the below video from Midland National to see how life insurance can be used during your lifetime.

A life insurance agent can help you determine exactly how much coverage you’ll need to meet your immediate and future obligations, but for now, here is an example using a basic life insurance calculator.

A husband and father of one is the primary wage earner in his family, with an annual salary of $80,000. The family has a remaining mortgage balance of $100,000 and $10,000 in credit card debt.

His wife plans to work full time after their ninth-grader finishes high school. Therefore, he wants to leave her five years’ worth of his salary to cover expenses until that time comes.

He’d also like to leave behind $35,000 to cover the average cost of four years of in-state tuition at a public university for their child.

After factoring in an average funeral cost of around $7,500, the man’s insurance needs are as follows:

- Immediate need – $100,000 mortgage + $10,000 credit card + $7,500 funeral costs = $117,500

- Future need – $400,000 income replacement + $35,000 college fund = $435,000

- Total need – $552,500

That total means he should purchase a life insurance policy with a face value of around $550,000.

Average Midland National Male vs Female Life Insurance Rates

The following table illustrates how Midland National’s average annual rates on a 20-year, $100,000 policy in key demographics compare to the average of the top 10 insurers by market share.

| Demographic | Annual Premium – Male | Versus Average Top 10 Insurers | Annual Premium – Female | Versus Average Top 10 Insurers |

|---|---|---|---|---|

| 25-Year-Old Non-Smoker | $122.52 | -$56.02 | $106.68 | -$53.89 |

| 25-Year-Old Smoker | $252.36 | -$69.40 | $213.36 | -$35.39 |

| 35-Year-Old Non-Smoker | $125.64 | -$59.40 | $109.80 | -$56.11 |

| 35-Year-Old Smoker | $335.76 | -$24.47 | $325.20 | +$39.02 |

| 45-Year-Old Non-Smoker | $202.80 | -$65.09 | $165.84 | -$74.41 |

| 45-Year-Old Smoker | $634.68 | -$2.83 | $546.00 | +$52.80 |

| 55-Year-Old Non-Smoker | $441.36 | -$83.59 | $339.00 | -$67.94 |

| 55-Year-Old Smoker | $1,575.60 | +$211.51 | $1,109.88 | +$118.25 |

| 65-Year-Old Non-Smoker | $1,243.92 | -$29.20 | $1,010.64 | +$129.98 |

| 65-Year-Old Smoker | $3,474.24 | +$229.19 | $2,708.64 | +$473.33 |

| Average Non-Smoker | $427.25 | -$58.66 | $346.39 | -$24.48 |

| Average Smoker | $1,252.42 | +$66.69 | $982.73 | +$131.72 |

Get Your Rates Quote Now |

||||

Midland National has below-average premiums for most demographics except for older smokers. The rates for young smokers are significantly less than the average.

Coverage Offered

Midland National offers a variety of temporary and permanent insurance policies. You can also choose from several riders to further protect your family.

Types of Coverage Offered

Life insurance policies fall into one of two general categories: term or whole.

Term life policies only pay if the death occurs within a set time frame, usually between 10 and 30 years.

Whole policies have no term and pay whenever a death occurs, regardless of age. Some also build cash value by allocating a portion of your premiums into an interest-bearing account.

They can also come with two benefit options: fixed and increasing.

Whole policies have multiple variations: traditional whole life, basic universal life, guaranteed universal life, indexed universal life, and variable universal life.

Midland National offers term, universal, guaranteed universal, and indexed universal policies.

Term

A term policy is payable only if the death of the insured occurs within a specified time period, usually between 10 and 30 years.

Once the term has passed, the insurer cancels the coverage. There are generally no refunds on the premiums paid. Most policies can also be converted to a whole policy before they expire.

For more information on term life insurance from Midland National, watch their video below.

The details on Midland National’s term policy are as follows.

- Term – 10–30 years

- Renewability – Renews annually after the end of the term at an increased premium each year

- Convertibility – Convertible before end of the initial term or until age 75 for 10- to 20-year policies or 70 for 30-year (whichever comes first)

- Minimum – $100,000

- Maximum – Unlimited (based on individual consideration)

- Issue Age – 18–75 for 10-year, 18–65 for 20-year, 18–55 for 30-year policies

Midland National term policies can be customized with the following riders:

- Child protection – This rider provides life insurance coverage for all eligible children.

- Disability waiver of premium – If you become disabled, your premiums will be waived for the duration of the disability or to the end of the policy term.

- Accelerated death benefit – If you’ve been diagnosed with a terminal illness with less than six months to live, you can access up a portion of the policy death benefit up to a set maximum.

Universal

A traditional whole life policy (sometimes called ordinary life) is the most common form of permanent insurance. A portion of your annual premiums is placed in an account that grows at a fixed interest rate (typically around 3–8 percent).

That savings element means the policy has the potential to grow a tax-deferred cash value beyond the face value of the policy, payable to the policyholder.

Universal policies are a more flexible version of traditional whole life.

They offer the permanent coverage and cash value growth of a traditional whole plan, while also allowing you to adjust your monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low.

Your cash value grows at a fixed rate, similar to a traditional whole policy, so there is less risk than other universal options.

You can also take out loans against the cash value that must be paid back with interest. Any portion not repaid before the insured’s death will be deducted from the benefit.

The specifics of Midland National’s universal policy are as follows.

- Flexibility – Face amount increases and decreases are permitted, but subject to fees

- Interest – Guaranteed 3 percent in a fixed account

- Index options – Choose from 13 indexes

- Minimum – $25,000

- Maximum – Unlimited (based on individual consideration)

- Issue Age – 0–75

- Death Benefit Option – Level or increasing

The policies can also be customized with the following riders:

- Child protection – This rider provides life insurance coverage for all eligible children.

- Disability waiver of premium – If you become disabled, your premiums will be waived for the duration of the disability.

- Accelerated death benefit – If you’ve been diagnosed with a terminal illness with less than six months to live, you can access up a portion of the policy death benefit up to a set maximum.

Guaranteed Universal Life

Guaranteed universal life policies fall somewhere between a term policy and a traditional whole policy. It offers fixed premiums and guaranteed no-lapse coverage.

Unlike most permanent life insurance policies, guaranteed universal policies do not accumulate a cash value that you can access.

They are more like term policies that simply don’t expire as long as you pay your premiums.

The specifics of Midland National’s guaranteed universal policy are as follows.

- Flexibility – Face amount increases and decreases are permitted, but subject to fees

- Convertibility – Convertible to a cash value accumulation universal life policy any time before age 75

- Minimum – $50,000 for ages 0-59, $25,000 for ages 60 and above

- Maximum – Unlimited (based on individual consideration)

- Issue age – 0–75

- Death benefit option – Level or increasing

Indexed Universal

Indexed universal policies differ from basic universal policies in the way they grow their cash value.

Rather than growing at a fixed rate set by the insurer, they allow the owner to allocate the cash value amounts to an account that grows according to an equity index such as the S&P 500 or the Nasdaq 100.

For information on Midland National’s indexed universal policies, watch their video below.

The specifics of Midland National’s indexed-universal policy are as follows.

- Flexibility – Face amount increases and decreases are permitted, but subject to fees

- Interest – Guaranteed 3 percent

- Minimum – $25,000

- Maximum – Unlimited (based on individual consideration)

- Issue age – 0–75

- Death benefit option – Level or increasing

The policies can also be customized with the following riders:

- Child protection – This rider provides life insurance coverage for all eligible children.

- Disability waiver of premium – If you become disabled, your premiums will be waived for the duration of the disability.

- Accelerated death benefit – If you’ve been diagnosed with a terminal illness with less than six months to live, you can access up a portion of the policy death benefit up to a set maximum.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

Anything that increases your likelihood of dying early or unexpectedly also increases the chances an insurer will have to pay out on your policy. That higher risk translates to higher premiums for you.

Here are some of the most common factors that affect your life insurance costs.

Demographics

Demographics can have a significant impact on your life insurance premiums.

Age – Age is a key factor in determining insurability. Every year you live you are a year closer to dying. Therefore, the older you are when you first apply, the higher your rates.

Some insurers limit coverage amounts for people over certain ages.

Gender – Gender also plays a major role. Statistically, women live longer than men. Because of that, women in the same risk classification typically pay lower premiums than men.

Current Health & Family Medical History

Health and wellness generally lead to longer life expectancies, so the healthier you are, the lower your premiums.

To determine your overall health, insurers will require you to fill out a health questionnaire and may request access to your medical records. Some may require a full medical exam, including a blood test.

Key health measures underwriters look for are obesity, blood pressure, cholesterol, chronic diseases, and drug use.

Even if a policy doesn’t require a medical exam, insurers still have access to public prescription and Medical Information Bureau (MIB) records, so it’s important to be honest on your application.

Most insurers will also examine the health history of your immediate family to identify any potential hereditary medical issues such as a history of heart disease, diabetes, or cancer.

High-Risk Occupations

Some jobs are inherently riskier than others.

For example, police officers, firefighters, and construction workers all have a higher risk of accidental death than someone who works in the relative safety of a cubicle. A dangerous job will earn you a higher risk classification, which equals higher premiums.

If you’re curious where your job lies on the scale, the Bureau of Labor Statistics conducts a regular census of fatal occupational injuries.

High-Risk Habits

Similarly, high-risk habits outside of work can also result in more expensive life insurance.

The most common high-risk habit that insurers look for is tobacco use. Smokers pay higher rates than their non-smoking counterparts in every demographic.

Midland National’s rates are significantly higher for smokers at every age.

For example, the average 25-year-old male non-smoker pays around $250 per year for a 20-year, $500,000 policy with Midland National. A 25-year-old smoker pays $820 for the same policy.

That’s an increase of 227 percent, which equals an extra $11,400 paid over the life of the entire term.

In addition to smoking, insurers will also ask about any other high-risk hobbies, such as mountain climbing, skydiving, or any other activity that has a high potential for injury. A single experience won’t result in a higher rate, but a regular hobby could.

Veteran or Active Military Status

Military status falls under the category of high-risk occupations. Most insurers charge higher rates to active duty military service members, and some don’t sell them policies at all.

Getting the Best Rate With Midland National

Your risk classification determines whether an insurer will raise your price from their base premiums. Base premiums are influenced by three factors: mortality, interest, and company expenses.

Insurers use statistical mortality tables to estimate how many people are likely to die each year in various demographics.

So, if they insure people in categories with a high likelihood of death, they’ll raise rates on them across the board to minimize losses.

Premiums are also influenced by current interest rates. A significant portion of an insurer’s profits come from investing the premiums they receive in various bonds, stocks, and mortgages. A low expected return on those investments could result in higher premiums.

General operating expenses also come into play. The more an insurer spends maintaining its business, the more of that cost they pass onto their policyholders.

Rates can also vary from state to state, though the NAIC is encouraging states to adopt laws that would provide more uniformity nationwide.

With so many variables affecting premiums, how do you get the lowest possible rates?

You can’t control demographics such as gender, and your family’s medical history is beyond your control as well. Therefore, the best thing to do is to change the factors you can.

First, make healthy choices. Blood pressure level, body mass index, and cholesterol are key measures on a medical exam. Try to improve them through diet and exercise.

Also, read up on the medical exam process so you know what to expect.

If you do smoke, not only is it important to quit, but you should also do so as soon as you can. Most insurers require you to be tobacco-free for at least a year before you can claim a non-smoking rate.

Next, buy early. The longer you wait, the older you’ll be once you finally buy a policy. Older people pay higher premiums.

For example, the average 30-year, $500,000 policy for a 40-year-old male, non-smoker at Midland National is around $660 per year. That same policy for a 45-year-old costs $1,040. That five-year jump increases the price by 57 percent.

Lastly, pay your premiums on time. Like any bill, late payments result in costly penalties and could lead to the cancellation of your policy. If you have a policy canceled for non-payment, you can expect additional fees to get it reinstated, or higher rates at the next insurer.

To give you an idea of how much a term life policy might cost, we’ve compiled a list of monthly sample rates from Midland National for a non-smoking, 10-year term policy at key ages.

| Age | $100,000 – Male | $100,000 – Female | $250,000 – Male | $250,000 – Female | $500,000 – Male | $500,000 – Female |

|---|---|---|---|---|---|---|

| 25 | $9.24 | $8.54 | $10.78 | $9.90 | $14.52 | $12.76 |

| 30 | $9.24 | $8.54 | $11.00 | $9.90 | $14.52 | $12.76 |

| 35 | $9.33 | $8.62 | $11.44 | $10.12 | $15.40 | $14.08 |

| 40 | $10.03 | $9.50 | $13.64 | $12.32 | $19.80 | $17.60 |

| 45 | $12.76 | $11.44 | $18.92 | $16.50 | $29.92 | $25.96 |

| 50 | $16.37 | $14.17 | $25.96 | $22.00 | $44.00 | $36.52 |

| 55 | $23.67 | $20.42 | $41.14 | $31.24 | $72.16 | $54.56 |

| 60 | $37.66 | $27.54 | $65.12 | $45.10 | $117.04 | $79.64 |

| 65 | $57.55 | $40.22 | $111.98 | $71.06 | $207.24 | $130.24 |

Get Your Rates Quote Now |

||||||

These rates are significantly below average. Based on these sample rates, most people under age 50 can get up to $250,000 in coverage for less than one dollar per day.

Midland National’s Programs

Midland National has little in the way of additional life insurance resources on its website.

They have a blog that’s regularly updated, but it tends to focus more on retirement and investment strategies than information on life insurance.

If you need specific information on the ins-and-outs of life insurance, you’ll probably need to seek out a resource other than the Midland National website.

Canceling Your Policy

If you need to cancel your policy, you can do so at any time. There are generally no refunds on premiums when you cancel your life insurance unless you purchase a special rider on some permanent policies.

For a term policy, you’d only receive a refund on prepaid premiums for an upcoming period.

How to Cancel

The only way to cancel a Midland National insurance policy is to contact your sales agent or call customer service at 1-800-923-3223.

How to Make a Claim

The overall process of filing a death benefit claim with Midland National follows general industry-standard steps:

- Initiate a claim

- Fill out company-specific paperwork

- Submit the paperwork along with a death certificate and any other requested documents

- Choose a disbursement method

- Receive the benefits

To initiate a claim with Midland National, either call customer service at 1-800-923-3223, use their online claim form or contact your sales agent.

When initiating a claim, you’ll likely be asked to provide a policy number, the insured’s date of death, and a death certificate. If the insurer requires any other documentation, it will be listed in the claim package.

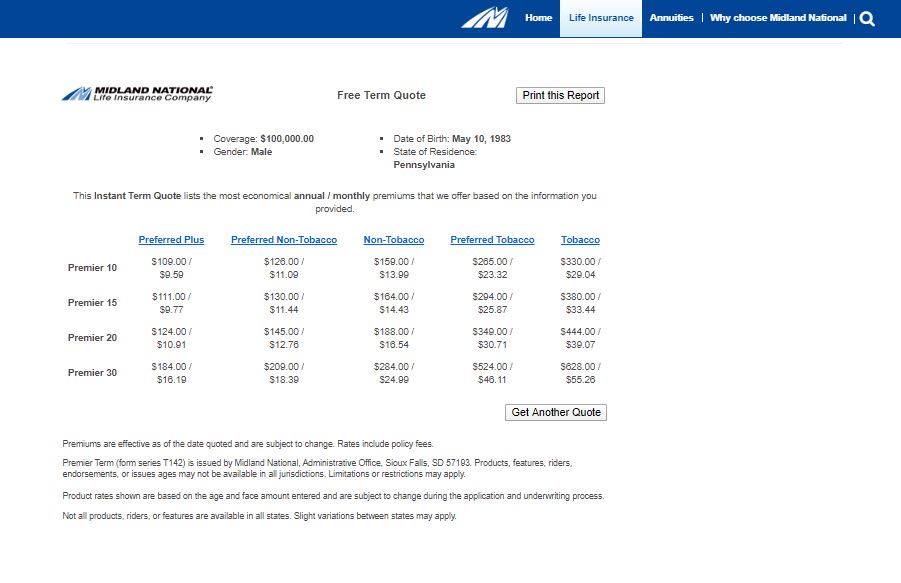

How to Get a Quote Online

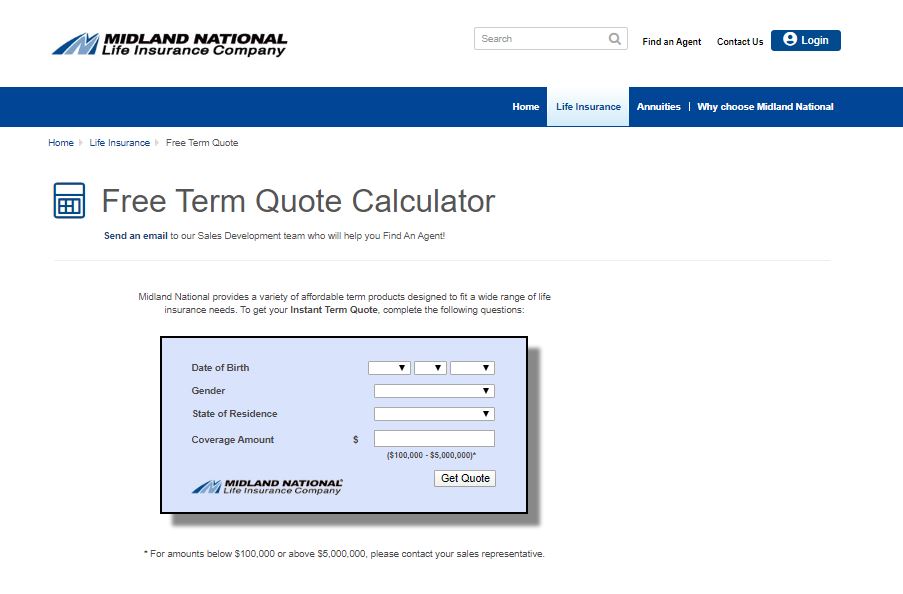

Midland National currently offers term quotes online.

#1 – Go to the Midland National’s Website

The link to the quote tool is located in the life insurance tab on the menu bar of the homepage.

#2 – Enter Your Personal Information & Desired Coverage

Clicking the link will take you directly to the quote tool. Enter some basic personal and demographic information, along with your desired coverage, then submit.

#3 – Get Your Quote & Apply

Once you submit your information, the tool will display estimated rates for various term lengths and smoking classes.

Design of Website/App

The Midland National website is well designed and simple to navigate, but light on information. Most pages are designed to preview policy options, and then guide you to an agent for more details.

Midland National doesn’t have an app for managing your policy.

Pros & Cons

As with any company, there are pros and cons to shopping with Midland National. Here are some of the biggest.

Pros

- Strong financial ratings

- Multiple coverage options

- Below-average rates for non-smokers

Cons

- No traditional whole life options

- No variable-universal options

- Above-average rates for smokers

The Bottom Line

Midland National is one of the oldest life insurers in the country, with the financial strength that comes from over 100 years in the business. They aren’t the most widely recognized name in life insurance, but they do have policies and premiums that can compete with many of the bigger names, especially for young smokers.

Their selection of policy offerings isn’t as wide as some, but those who need basic coverage can find it here.

One benefit of Midland National is that they sell their policies through independent agents, rather than in-house agents, which means you don’t have to make a separate appointment to find out more about their policies.

If you already have an agent, they can easily get you all the information you need. If not, Midland National has coverage worth finding an agent to talk to about.

Our hope is that this guide left you more informed than when you started and better prepared to choose a policy and provider. Now that you know all Midland National has to offer, you can decide if it’s the life insurer for you.

Did we leave any of your questions unanswered? If so, make sure to read the following FAQs where you’ll hopefully find the information you need. Afterward, you can use the quote tool at the bottom of this page to instantly compare quotes from multiple insurers to see how they compare to Midland National’s advertised rates.

Start comparing life insurance rates now by using our FREE tool below.

Midland National’s FAQs

Here are some frequently asked questions about Midland National and its policy offerings.

#1 – Does Midland National offer a no-exam life insurance policy?

Midland National doesn’t advertise a no-exam policy.

#2 – Does Midland National offer any supplemental coverage?

No. Midland National doesn’t currently offer any supplemental coverage such as a Medicare supplement plan or long-term care insurance.

#3 – Can I change my face value?

Midland National allows you to adjust your face value during specified periods on universal policies.

#4 – Can I change my term length?

No. You can’t change the term length on Midland National’s guaranteed level term policies.

#5 – Does Midland National offer group life insurance?

No. Midland National doesn’t sell employer-sponsored group life insurance, though they do still have a small number of group policies written from earlier periods in which they did.

#6 – How do I make a payment on my Midland National premiums?

You can have your payments automatically debited from your checking account every month by filling out an authorization form or make electronic payments from a savings or checking account online.

#7 – Can I make withdrawals on my Midland National insurance policy?

Midland National’s permanent insurance policies allow you to take out loans against your cash value. Loans must be paid back with interest, or you risk decreasing or forfeiting your death benefit.

#8 – How easy is it to change my beneficiary?

You’ll need to fill out a beneficiary change form, which can be filled and submitted directly online or by mail. You can also request a beneficiary change through your sales agent.

#9 – How long does it take for Midland National to pay death benefits on a life insurance policy?

Death benefits are typically paid within 30 days of processing the completed claim packet.

#10 – Are the life insurance benefits taxable?

Life insurance benefits are non-taxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits are subject to estate taxes.

#11 – Are all Midland National insurance policies available in all states?

No. Midland National is not currently licensed to sell life insurance policies in New York. However, they are available in the remaining 49 states as well as the District of Columbia, the Virgin Islands, Puerto Rico, and Guam.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption