North American Company Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1886 |

| Company Executive | President, CEO & Chairman (Sammons Financial Group) - Esfandyar Dinshaw |

| Number of Employees | 1,000-5,000 |

| Total Assets | $27,330,486,000 |

| HQ Address | 4350 Westown Pkwy West Des Moines, IA 50266-1036 |

| Phone Number | 1-866-359-4617 |

| Company Website | www.northamericancompany.com |

| Premiums Written - Group Life / Individual Life | $16,384,519 / $553,239,864 |

| Financial Standing | $128,480,431 |

| Best For | Term Life, Indexed Universal Life |

Get Your Rates Quote Now |

|

If you’ve already started shopping for life insurance, you’ve probably found the number of product choices and range of prices all over the map. Sorting through the number of providers can be time-consuming. And let’s face it: reviewing life insurance options on your day off isn’t anyone’s idea of fun.

This review of North American Company for Life and Health Insurance or North American Company for short, can save you time and effort. We’ve highlighted the features that make North American Company stand out as a top insurance provider in the United States and Canada.

If you’re just starting to shop for insurance, this review will also help you to understand how to review your insurance options and provide you some insider tips on how to keep your rates as low as possible.

If you want to see how affordable life insurance can be for you, pop in your ZIP code above into our FREE quote generator.

Table of Contents

North American Company’s Ratings

If you’re in the market for life insurance, you understand that your investment today is meant to secure your family’s future. If you’re comparing insurance companies, understanding their credit and financial stability can help you determine whether your company will be with you for the long haul.

The good news is that you don’t have to look far to find how North American Company compares. We’ve broken down ratings from the most prominent independent services available.

The chart below provides a quick view of ratings from independent providers for North American Company.

| Ratings Agency | North American Company Rating | Date Affirmed |

|---|---|---|

| A.M. Best | A+ (Superior) | 2018 |

| BBB | A+ | 2018 |

| Moody's | A2 | 2004 |

| S&P | A+ | 2018 |

Get Your Rates Quote Now |

||

Let’s break these ratings down in more detail.

A.M. Best

When it comes to rating insurance services, A.M. Best is the first place to start. Although several rating services provide credit and financial ratings for companies, A.M. Best’s focus is entirely on the insurance industry.

Since North American Company is a subsidiary of Sammons Enterprises, Inc., A.M. Best provides a rating specific only to the parent company. In fact, all of North American Company’s financials roll up into Sammons Financial Group’s reporting.

A.M. Best affirms the following ratings for Sammons Enterprises extending to North American Company:

- Financial Strength Rating: A+ (Superior)

- Long-term Issuer Credit Rating: aa-

AM. Best ratings extend from the parent company through to any subsidiary businesses. These ratings imply that North American Company acts responsibly in its investment strategy and manages risks so that the company can make payments on claims as necessary.

Better Business Bureau (BBB)

The Better Business Bureau (BBB) is an agency most people may have come across. The BBB provides consumers with helpful information to protect against scammers and report unfair business practices that could take advantage of unwitting customers.

The BBB also tracks customer complaints against companies and provides accreditation for companies that meet the BBB criteria.

North America Company has been an accredited BBB business since September 24, 2018.

North American Company also has an A+ rating from BBB and a 4 out of 5 star rating from customer feedback. These high marks speak to the company’s attention to customer service.

Moody’s

In 2004, Moody’s Financial Ratings Service withdrew financial strength ratings for several life insurance companies for Moody’s own business purposes.

At that time, North American Company’s A2 rating was withdrawn by Moody’s.

Standard & Poor’s (S&P)

Another leading independent financial rating agency, Standard & Poor’s has given North American Company an A+ rating as recently as 2015. An A+ rating is the fifth-highest of 22 possible rating categories that S&P provides.

In October 2018, S&P affirmed its A+ rating for North American Company’s parent Sammons Financial Group, indicating that North American Company is maintaining a stable financial strength.

Company History

Since 1886, North American Company has operated as a privately owned business. While publicly traded companies are mired by short-term profit targets, as a private enterprise, North American Company remains independent to allow the company to focus on long-term goals, a conservative investment strategy, and customer care.

Originally founded as North American Accident Associations, the company was purchased by A.E. Forest in 1890.

Major milestones for North American Company include the company’s first disability insurance product for women offered in 1918 and the company’s entrance to the brokerage marketplace in 1981.

Keeping its eye on innovative solutions in life insurance, North American Company began offering universal life in 1984. The video below provides a brief commentary on North American Company’s history and company principle.

In 2001, the Sammons Annuity Group was established, eventually becoming the Sammons Financial Group. As part of the Sammons Financial Group holding company, North American Company, the Midland National® Insurance Company, and the Sammons Institutional Group combined to become a leading life insurance provider in the United States and Canada, according to LIMRA, an insurance industry research provider.

Although company leadership is consolidated under the control of Esfandyar Dinshaw, CEO and chairman of Sammons Financial Group, Steve Palmitier has been the acting president and chief operations officer for North American Company since 1996.

North American Company’s Market Share

As part of the Sammons Financial Group, information for North American Company market share isn’t individually indicated. However, the Sammons Financial Group appears in the 2018 NAIC Market Share Data Report, ranked 21st for life insurance.

Sammons Financial Group garners 1.4 percent market share across the United States, all U.S. territories, and Canada.

Sammons Financial Group also reported $2.3 billion in overall new business in its annual 2018 financial report. The North American Company 2018 annual statement reports the company with $870.7 million in total premiums written. This implies that North American Company makes up nearly 40 percent of the total life premium business for Sammons Financial Group.

North American Company’s Position for the Future

The North American Company holds over 615,000 life and annuity policies throughout the United States, its territories, and Canada. To customers, however, having a reliable insurer that can make claim payments is more important than size and new business sold.

North American Company takes pride in its financial stability. With $27 billion in assets, the company paid $431 million in death benefits in 2018. As part of the Sammons Financial Group, the company maintains financial independence from public shareholder pressures and works to maintain a long-term vision of stability.

From the North American Company’s 2018 annual statement, the company reports life insurance premium sales growth from 2017 to 2018 of $242.9 million, which constitutes almost a 10 percent growth in just one year. This performance is an indication of the company’s strong focus on growth through sales.

North American Company’s Online Presence

North American Company maintains an online presence with a well-maintained website and an active presence on social media. The company’s homepage looks updated and provides a simple navigation to direct customers to its products and select marketing sections.

The company’s home page provides access for customers looking for general information, agents looking for secured access to their portal, and clients looking to manage their accounts.

Aside from the company website, North American Company has an active presence on Facebook, LinkedIn, and Twitter.

On Facebook, the company provides regular motivational posts and updates. It also fields customer feedback and complaints and engages with its community of nearly 2,000 followers.

The company’s Facebook feed also provides a quick link to the company’s customer call center.

The company’s Facebook feed also provides a quick link to the company’s customer call center.

On LinkedIn, the company takes on a more professional approach, engaging with its employees and the professional community.

The company has 98 employees engaged and active via LinkedIn.

Although North American Company also has a presence on Twitter, its following is insignificant and doesn’t seem to be a focused channel for the company to reach its customers.

North American Company’s Commercials

North American Company has a robust YouTube channel where the company posts informational and promotional high-quality content. Although we can’t tell if the company advertisements ran in any national or local television markets, the video below was produced for wide distribution through social media and online channels.

North American primarily markets through a network of sales agents, so investment in television and media marketing isn’t extensive.

North American Company in the Community

Sammons Financial Group, the parent and holding company of North American Company, seems to provide senior management oversight for the company as well as directing much of the company’s community and charity directives.

Articles posted in the North American Company Newsroom provide several links to articles reporting on charitable contributions made by the Sammons Financial Group to the community.

In 2015, Sammons Financial Group made a series of donations to help the underprivileged communities in West Des Moines, Iowa. The company made donations of $110,000 to the YWCA Emergency Shelter in West Des Moines and subsequently donated $50,000 each to the Youth Emergency Service Shelter and the Children and Family Urban Movement.

Sammons Financial Group extends its encouragement of a culture of volunteerism and gift matching to its employees at North American Company. The company helps organize volunteer events during workdays and provides charitable donations while matching employee donations for charities such as Make-A-Wish Foundation and Fraser, Ltd. – A Chance for Choice.

North American Company’s Employees

Similar to its corporate reporting structure, the employee and career component of North American Company falls under the umbrella of Sammons Financial Group. Although an employee might work directly for the North American Company, they are hired and managed by the Sammons Financial Group.

This is good news for North American Company hires. The Sammons Financial Group prides itself on making its culture welcoming and inclusive. The larger entity provides programs that help develop employees, encourage work-life balance, and provide benefits for the health, wellness, and long-term financial prospects of its employees.

In fact, Sammons Financial Group appears on the Glassdoor Best Places to Work list for 2020 at number five, moving up from number 22 the previous year.

Appearing on the Glassdoor list is especially rewarding since the awards are selected based on information provided directly from employee reviews.

Sammons also has a high rating on Indeed. The company received a four-out-of-five-star rating based on feedback from 79 employees.

The strength of management is also featured for Sammons Financial Group and North American Company. CEO Esfandyar Dinshaw appears on the Glassdoor list of top CEOs for his commitment to creating a positive work environment for company employees.

Shopping for Life Insurance

Shopping for life insurance isn’t an easy task. Sorting through the number of products, understanding insurance terminology, and wading through the oceans of providers offering similar but not exactly the same products can require some effort.

Figuring out the best options for you could be easier by working backward. For starters, let’s break down why you need life insurance and then determine how much insurance you need or can afford.

The answer to the first question — why you need life insurance — is a clear yes if you have any financial obligations, debts, or caretaking responsibilities such as:

- Carrying student debt, a car loan, credit debt, or a home mortgage

- Living and sharing financial responsibilities with a significant other

- Providing care or financial help for an elderly family member

- Having a business or partnership that would suffer losses if you could no longer work in your current capacity

- Having savings or assets that you plan to leave for your loved ones as an inheritance

- Providing alimony or having financial commitments to an ex-partner

Check out this video produced by the North American Company for some other valuable reasons to start thinking about life insurance.

If you’ve determined that you need life insurance, the next step is to determine how much insurance you need or can afford.

To estimate how much insurance you’ll need, a simple guideline is to add up the following:

- Seven to 10 years of salary

- Any outstanding debts including home mortgages, student loan debts, car loans, or other personal financing obligations

- Your total savings goal for your children’s education. You may be putting a bit away every paycheck for education, so estimate the total you will have saved when your child is ready for college.

- Any money you contribute to care for loved ones such as elderly parents or grandparents

Armed with the amount of insurance you need, you can start shopping for quotes, but remember, you still haven’t determined the type of insurance you’ll need. Before we look at insurance types and North American Company’s specific offerings, we can determine a baseline for what your pricing might be by shopping for an initial quote.

Since term life insurance is the cheapest form of insurance, let’s start with a free term quote. By entering your ZIP code, our FREE quote generator can provide a sample comparison quote instantly.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Now that you have a quote, let’s compare it against North American Company’s rates.

Average North American Company Male vs Female Life Insurance Rates

Life insurance is based on determining your longevity. A life insurance company considers several factors to determine how to price a policy for you. We’ll get into more detail about that later.

For now, it’s important to realize that because men have a shorter life expectancy than women, rates for life insurance will always be higher for men. Let’s break this down specifically with some sample quotes from North American Company.

The table below compares term life rates for $1 million in coverage for 30-year-old non-smoker candidates with super-preferred and preferred status.

Super-preferred applies to a candidate with no health concerns or medical history risk, while preferred applies to a candidate with no health concerns but some concern for medical history or other risk factors. Quotes are monthly premiums.

| Length of Coverage | Male: Super-Preferred | Male: Preferred | Female: Super-Preferred | Female: Preferred |

|---|---|---|---|---|

| 10-Year Term | $28.68 | $27.72 | $17.76 | $23.32 |

| 15-Year Term | $23.32 | $33.68 | $20.68 | $28.60 |

Get Your Rates Quote Now |

||||

As you can tell, male rates for a 10-year plan are about 20 percent higher than for women. For the longer-term 15-year plan, the rates are about 10 percent apart.

Let’s take a look at how rates compare for older people. This next table compares the same $1 million in coverage but for 50-year-old non-smoker males and females.

| Length of Coverage | Male: Super-Preferred | Male: Preferred | Female: Super Preferred | Female: Preferred |

|---|---|---|---|---|

| 10-Year Term | $68.20 | $87.56 | $56.76 | $73.48 |

| 15-Year Term | $99.00 | $115.72 | $70.82 | $91.08 |

Get Your Rates Quote Now |

||||

You can see that the difference between male and female rates continues to grow as candidates age.

Coverage Offered

North American Company provides an innovative way to help you determine what type of life insurance you need. Instead of defining a life insurance type and leaving the customer to click through for more details, North American presents you with a need and guides you to determine what priority concerns you might have.

These concerns are listed on the site as:

- Life insurance gap

- Serious illness

- Retirement gap

- Opportunity risk

Each category type will direct you to the type of life insurance that you may need the most. The chart below helps break out the type of life that might be worth investigating for each of the categories presented above.

| Category | Type of Life Insurance |

|---|---|

| Life insurance gap | Term Life Universal Life Guaranteed Universal Life |

| Serious illness | Term Life Indexed Universal Life |

| Retirement gap | Indexed Universal Life |

| Opportunity risk | Universal Life Indexed Universal Life |

Get Your Rates Quote Now |

|

As you can see from the chart, any particular insurance type can apply to multiple scenarios. Let’s dive deeper into each of North American Company’s products to see why.

Types of Coverage Offered

North American Company’s product catalog includes the following:

- Term life options for 10-, 20-, or 30-year term periods

- Universal life and guaranteed universal life

- Indexed universal life

Here’s why North American products are different from some of its competitors.

Term

Term life insurance is the most affordable life insurance available. Pricing for term life is discounted versus other types of life insurance because term life insurance isn’t permanent and offers no savings component or cash value.

Term life is no frills. What you pay for is exactly what you get.

For example, if you pay for a 10-year term policy with $100,000 in coverage, you remain covered during that 10-year term. If you pass away during the term, your insurance provider will pay $100,000 in benefits.

If you outlive your policy term, then the policy will expire, leaving you with options to renew, convert your policy, or remain uncovered.

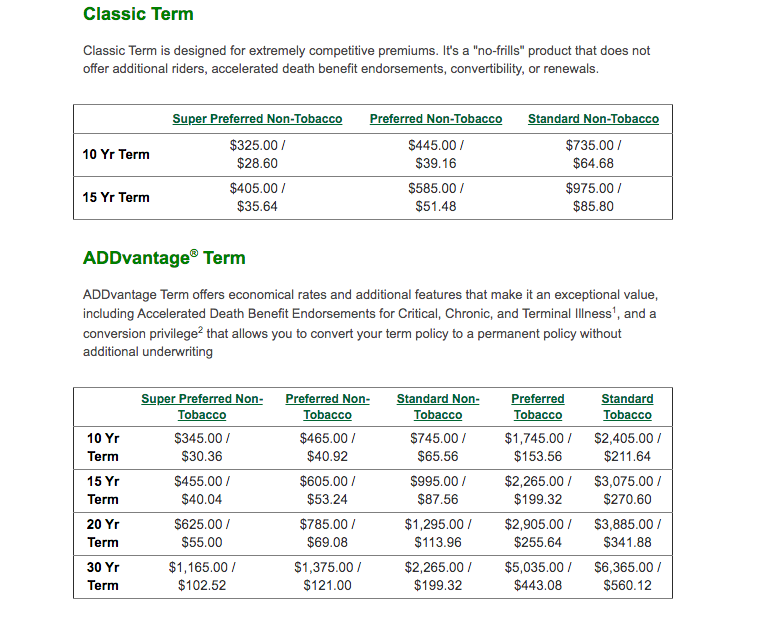

North American Company offers term coverage for 10-year, 15-year, 20-year or 30-year terms.

The chart below provides sample term rates from North American Company for its featured AADvantage Term® product for a 30-year-old non-smoking male, with benefits ranging from $100,000 to $1 million in coverage.

| Length of Coverage | $100,000 | $500,000 | $1,000,000 |

|---|---|---|---|

| 10-Year Term | $9.33 | $15.40 | $23.32 |

| 15-Year Term | $9.42 | $17.16 | $27.72 |

| 20-Year Term | $10.38 | $22.00 | $37.40 |

| 30-Year Term | $14.52 | $37.40 | $66.44 |

Get Your Rates Quote Now |

|||

The AADvantage Term® product is a step up from a basic term life policy. With AADvantage Term®, customers receive additional features, including an accelerated death benefit rider for critical, chronic, and terminal illness and the opportunity to convert the policy to a permanent option with no further underwriting.

This feature allows policyholders to use their benefits while they are battling any illnesses. It’s also a huge benefit for people who might have gaps in disability coverage or may not have disability coverage at all.

North American Company also offers a Classic Term policy that is priced a bit lower than the AADvantage Term®, but the classic policy doesn’t feature any riders and expires with no conversion option built into the policy.

The term quotes above are for super-preferred candidates. This means that a full underwriting process has been completed with a medical exam and the candidate has no health concerns or risk factors, placing the candidate in the most affordable pricing pool.

As risks are identified, rates could become more expensive.

Term life plans are good for people who want inexpensive insurance or have a need for higher coverage now that will eventually ease over time.

For example, if you’re in your mid-50s and have a mortgage, two car loans, and college tuition for one child today and one child in four years, you could take out a supplemental 10-year term policy to cover those costs. At the end of 10 years, you can let the policy retire and maintain a permanent life policy once the mortgage and car loans are paid and the kids are out of college.

Universal

If you’re shopping for permanent coverage, North American Company offers two universal life options: traditional universal life and indexed universal life. Universal life is permanent life insurance. This means once your policy is in place, you remain covered for life as long as your premiums are paid.

With traditional universal life, you can set up your premium so part of it is set aside as a savings component that will earn interest at a pre-determined rate.

Universal life plans also allow you to adjust premiums and benefits over time.

Traditional universal life plans are good options for people who are ready to get permanent coverage but require flexibility because their needs will change over time.

The savings component of a universal life plan also allows you to either pay lower or no premiums after a period of time or provide an additional cash benefit to the beneficiary of the policy.

For example, if you’re in your 30s and get a universal life plan while you have a good steady income, you can choose to pay a higher premium to maximize the value of the cash component of your premium. Each month, part of your premium will be set aside and will collect interest.

After a period of time, the cash value of the policy will be enough to be used to sustain monthly premium payments. This means when you’re in your retirement years, you can remain covered by your policy and allow the policy to pay for itself.

Of course, you might have a good income through retirement and choose instead to keep contributing to your policy. When you pass on, your beneficiaries will receive the death benefit and the additional cash value tax-free.

A third option is to use the cash value yourself. The policyholder can always withdraw any value in the plan. However, any gain on the contributions could be considered taxable income.

The other convenience of a universal plan is that you can adjust your benefit amount over time. If you’re younger and need more benefits to protect your family while you have a higher income, educational costs, and debt, you might opt to pay for a higher benefit. When you retire and the bills are paid, you can adjust the benefit to meet the needs of your current responsibility.

North American Company also offers an indexed universal life option. Much like traditional universal life, indexed universal life features a savings component and flexible premiums and benefits.

With indexed universal life, you can choose to allocate your cash component to earn a return in line with a chosen stock index, allowing the possibility of achieving a higher return.

North American Company allows you to select from various stock market indices like the S&P 500 or the Russel 2000. When the market performs well, these indices provide returns that can be much higher than interest rates allowing the money in your plan to grow at a faster rate.

The video below gives a bit of information on some of the features of the North American Company indexed universal plan.

The North American Company plan also features a 0 percent floor, which means that your plan will never have a negative return. Even if the market goes negative, your plan will be protected.

However, North American Company also has a max earning cap, so if your choice of index performs at a higher percentage, your gains will be capped at the max rate.

Not a lot of detail is provided by North American Company for the indexed universal life plan fees and expenses. You should speak to a financial advisor and an agent to clarify the terms of the index plan.

Because of high fees and expenses and maximum caps on earnings, universal life plans are never a substitute for retirement funds.

Factors That Affect Your Rate

At the end of the day, you want to know exactly how much you’ll have to pay for insurance. Although sample tables and rates will give you a good range to compare against, the rate your insurance company quotes will depend upon a full underwriting assessment of your individual risk factors.

North American Company’s online information indicates that a full underwriting process is required to qualify for any coverage. North American Company groups its customers into three buckets:

- Super Preferred Non-Tobacco

- Preferred Non-Tobacco

- Standard Non-Tobacco

Tobacco users are separated into rate pools and qualified as either preferred-tobacco or standard tobacco customers.

Although specific information isn’t provided for each category, it’s safe to assume that Super Preferred indicates a healthy customer with no risk factors or family medical history concerns.

Regardless of whether you complete a medical exam, the underwriters will assess each of the factors below to build out your individual risk profile. Once they’ve established a risk score for you, they’ll put you in a risk pool with other customers that fall in the same range. This risk pool will determine your final quoted rate.

Let’s take a look at the factors that affect your risk profile.

Demographics

Underwriters want to know common statistical information about you. Some of the prominent characteristics an insurer might ask about are:

- Your gender

- Where you live

- Whether you’re single, married, or divorced

- Whether you have children

Each of the characteristics above provides information for the insurer to assign you to a risk pool, which will then determine your quoted rate.

Underwriters have data for millions of people like you and, based on these characteristics, can identify whether you’re prone to a higher risk of particular diseases, or whether your profile is a good indication that you’ll live a long, healthy life.

Current Health & Family Medical History

Your health and family medical history are important factors in determining risk. Even if you’re otherwise healthy, insurance companies will want to look at whether you have any family history of diseases such as various types of cancer, hereditary heart disease, mental health issues, or Type 1 or Type 2 diabetes.

If you have a family history that indicates certain preventable diseases such as diabetes or heart disease, you’ll want to pay extra attention to your medical evaluation to show you take care of yourself.

Your medical evaluation will include bloodwork. Before you take your life insurance physical exam, you’ll want to make sure you’re eating well, exercising, and avoiding alcohol and tobacco products.

Submitting a clean bill of health to the insurer could help counteract any concerns with your family’s medical history.

High-Risk Occupations

Your underwriter will want to know what you do for a living. If you have a dangerous job, you may not qualify for coverage with some providers. If you’re a first responder, construction worker, farmer or any other high-risk occupation worker, getting life insurance might be difficult.

For the person with the average 9-to-5 cubicle job, other indicators may affect your rate. Factors such as the length of your commute and the amount of stress your occupation imposes on you could be relevant to your risk profile.

High-Risk Habits

Risky behaviors will cost you when it comes to getting insurance. If you smoke cigarettes or vape, drink alcohol regularly, or use illegal substances, you may not be able to get a life insurance policy.

At the very least, you’ll have to shop around to get a decent rate. If you’ve ever received a DUI conviction, you may find it difficult to get affordable insurance.

Insurance companies do check the Department of Motor Vehicle records, so even a lead foot or a few tickets for talking on your cell phone while driving could cost you.

Veteran or Active Military Status

If you’re a military service member, whether you’re a veteran or on active duty will affect your policy rates. Most companies that offer coverage to active members and veterans will have different policy types.

Military active duty and veterans can get coverage through the Veterans Administration, but supplemental options are available.

Getting the Best Rate with North American Company

To keep your rates low, you’ll want to manage any risk factors discussed in the previous section so that they are under control. Outside of your underwriting assessment, getting a good rate with North American Company will mean doing your homework.

Since you’ll be working with a North American Company agent, you should assess how much insurance you need today, in 10 years, and then into retirement. By understanding your needs and how your life insurance requirements will change over time, you can develop a strategy to buy the right plans at the right time.

By knowing how much insurance you’ll need, you can also be assured that you aren’t buying too much coverage. Premium payments add up over time.

Finally, you should make sure that you can afford your premiums today and well into the future. Having a policy canceled because of missed payments is never a good thing, and you’ll want to avoid expensive late fees.

Finally, ask whether there’s a discount for paying annually or monthly, or a discount if you set up an auto-payment process.

North American Company’s Programs

As part of the Sammons Financial Group, North American Company has access to partner companies that provide financial advice and can help clients plan a life insurance strategy as part of a holistic financial plan.

Additionally, North American Company supports a blog for customers with advice and guidance on topics ranging from lifestyle and health and fitness to financial planning and retirement guidance.

Additional programs are available to employees as part of the Sammons Financial Group. The company supports and encourages programs that provide community leadership and volunteerism, a complete benefits package, and an employee stock ownership program.

Canceling Your Policy

Canceling your life policy can be as easy as stopping your premium payments. However, it may not be the best thing for you. It’s always best to understand your risks and determine if canceling your policy is the best option.

Perhaps you’ve found a better, more affordable option with a new provider, or your needs have changed and your current policy is insufficient. Before you make any immediate changes, you’ll want to follow these steps to help understand and avoid fees or additional expenses that you may not know about.

How to Cancel

In some instances, canceling your policy is as easy as stopping premium payments. As we’ve mentioned, this isn’t the best way to go about quitting your policy. Follow the steps below to manage any risk and exposure you may have when you leave your policy.

#1 – Read Your Policy

Go over your policy and read the fine print. Check to see if there are any fees or fines for early termination. For term policies, any premiums paid to date will be forfeited. You’ll also remain uncovered from the time of your last payment until you have a new policy in place.

For universal and indexed universal life, you’ll have to check your policy to see whether you have any cash value. If you do, any value in the policy will be returned to you as a lump sum once you cancel the policy.

However, any money paid to premiums and expenses for the plan won’t be returned.

#2 – Contact Your Financial Advisor

Work with your financial advisor to understand any risk you might be assuming and any tax liability you might get from early termination. For a term policy, canceling early just means you’ll lose your benefits. Since there is no cash value, you won’t have tax implications.

However, for universal life, you might receive a cash value payment which includes some taxable capital gains.

An advisor can speak to you about whether you’ll need to pay taxes on any payout.

A financial advisor can also help you understand your risk exposure. If you’re canceling your policy and don’t have another in place, you might not want to go do something dangerous, such as skydiving.

If you’re getting a new policy to replace your current policy, your advisor can help you determine whether your policy needs have changed.

#3 – Reach Out to Your Agent

Contact your insurance sales agent. They may be able to help you with the cancellation process. If you’re looking to replace your policy, an agent can help time the cancellation by creating the new policy.

#4 – Submit a Letter in Writing and Keep a Copy

Always request a policy cancellation. Provide specific dates indicating when you last paid premiums and when you expect your coverage to end. Keep copies for yourself and send a copy to North American Company’s Life Insurance Department at this address:

North American Company

One Sammons Plaza

Sioux Falls, SD 57193

#5 – Cancel Auto-Payments

Don’t forget to cancel any automatic payment that might be set up. Check to make sure that you don’t have a credit card or bank account with an automatic payment set up.

How to Make a Claim

Making a claim with North American Company will require you to produce a certificate of death for the policyholder and the original life insurance policy document.

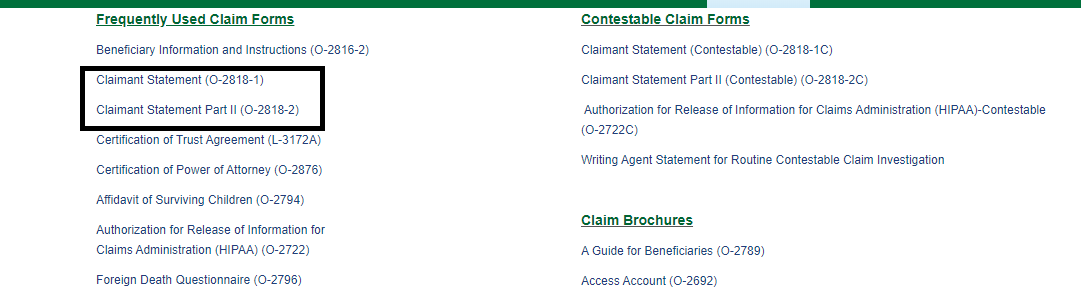

Once you have these documents, you’ll need to order a claims processing package from North American Company. You can download them directly online by clicking on the Claims tab under Life Insurance in the banner menu, which will direct you to the claims page.

The claims page will provide links to various documents. You’ll need to download a copy of the Claimant Statement and Claimant Statement Part II.

The claims page will provide links to various documents. You’ll need to download a copy of the Claimant Statement and Claimant Statement Part II.

Once you’ve completed the claim forms, you’ll need to download a copy to sign, and then mail it to North American Company at:

North American Company for Life and Health Insurance

ATTN: Claims Department

PO Box 5088

Sioux Falls, SD 57117

For questions about special beneficiary circumstances or for any inquiries to the claim process, you can contact the North American Company claims department at 1-800-733-2524, ext. 32063.

Claims processing time at North American can vary, but the company tries to process claims within 10 days of receiving all the necessary information. However, if you have special circumstances or considerations — for instance, if the beneficiary is a trust — processing could take longer.

How to Get a Quote Online

North American Company has a quote generator on its site for term life insurance. For universal life or indexed universal life pricing, you’ll need to contact an agent.

Here’s a step-by-step guide on how to find and use the quote tool on the North American Company site.

#1 – Navigate from the North American Company Home Page to the Calculator

From the homepage, use the banner navigation to click on “Life Insurance” and then select “Free Term Quote.”

You’ll be directed to the North American Company Term quote calculator.

#2 – Enter the Requested Information

Enter your date of birth, gender, state of residence, and the coverage amount you would like to obtain.

Note that coverage amounts for select programs have minimum coverage requirements. If you select less than the minimum amount of coverage, a quote won’t be provided for that product.

#3 – Click Submit and Page Down to Find Your Quote

A quote for all applicable term products will be generated and will appear below the calculator.

You can change the parameters in the calculator to generate multiple quotes for various coverage amounts, genders, states, and ages.

Design of Website/App

North American Company has an updated site but is undergoing a brand refresh. They’ve just rolled out a new brand logo in the banner of their website that reflects their alignment under Sammon Financial Group.

Although the brand is updated, most of the functioning and navigation of the site remains unchanged.

As mentioned earlier, North American Company doesn’t label its product pages with simple product descriptions but instead provides scenario-based icon labels to provide the user with context for where to go. This makes for a nice design feature in the site navigation.

Customers and agents can access internal sites from the North American home page. At this time, apps aren’t available for North American Company customers.

Pros & Cons

Overall, North American Company is a highly rated and highly respected insurance provider. Here’s a breakdown of some pros and cons to consider when evaluating their products versus the competition.

Pros

- North American Company has very strong financials and has maintained a consistent record of financial stability.

- The company has a strong record of timely claims payouts, boasting over $431 million in death benefit claims paid 2018.

- Employees have a high level of respect for management and consider the company a top place to work.

- North American Company has a strong record of addressing customer complaints with a low complaint index from NAIC and a great rating from the BBB.

- The company has a variety of options for affordable term insurance and for both universal and index universal life.

Cons

- The company product line seems a bit narrow with no options for final expense or variable life products.

- A full underwriting process including a medical exam seems required to qualify for any plan.

- The process for filing a claim seems a bit dated and could be modernized with updated online form submissions and status tracking.

- To purchase products, you have to find an accessible North American Company sales agent near you.

The Bottom Line

North American Company provides consumers with bundled solutions that eliminate some of the guesswork in determining which options and riders are necessary. Although North American Company isn’t the cheapest provider, the additional features and riders built into the AADvantage Term® Plan and their options for indexed universal life provide significantly more value than no-frills insurance.

Life insurance should provide you with peace of mind and dependability. While North American Company has a history of great customer service and focuses on providing quality insurance solutions to its customers, how can you be sure North American is the right provider for you?

The bottom line is that it will take a bit of effort to find what is right for you.

A good place to start is by comparing quotes from different providers. Getting an instant quote is convenient and takes seconds. Simply enter your ZIP code below to get your FREE quote.

North American Company’s FAQs

#1 – How do I contact North American Company to speak to an agent?

If you have a web browser handy, simply go to https://www.northamericancompany.com/find-an-agent and complete the form. If you don’t have a browser available, you can contact the company at 1-800-800-3656.

#2 – What if I need more coverage than my current term policy provides?

You can speak to a North American Company agent about purchasing a supplemental term policy that will cover the difference between what you currently have and what you need.

Having multiple policies can get complicated but may be necessary. Work with a financial advisor and agent to ensure you’re getting enough coverage for what you need but not purchasing more than you need.

You can use the calculator here to help you calculate your insurance needs.

#3 – I need to file a life insurance claim, but I can’t find the original policy. What should I do?

Since you need the original life insurance policy to file a claim, you might start by reaching out to the insurance provider to get a copy. However, if you think there is a policy out there somewhere and have no information on the provider or any other details, you can reach out to the NAIC for help here.

#4 – I quit smoking last year. Can I qualify for insurance as a non-smoker?

This might be up to the provider, but general requirements to qualify are that you’ve stopped for a full year and you may need to provide bloodwork for up to two years to maintain the discounted rates.

#5 – Can I get insurance without a medical exam?

Yes, some providers offer no-exam insurance. However, rates might be higher. You should be aware that you’ll still need to provide any medical history and answer questions regarding your health to qualify.

#6 – I have disability and health insurance. Why do I need life insurance?

Having a full insurance profile includes coverage or health, disability, and life insurance. Health insurance can cover your medical expenses, while disability will ensure you have income coverage if you can’t work. Life insurance is meant to protect your loved ones financially after you’re gone.

#7 – What happens if I can no longer make my insurance premium payment?

Speak to your agent or insurance provider’s customer service center. Your policy could have a rider that keeps you covered while you’re temporarily unable to pay. For permanent insurance plans, you might have cash value available to cover premium payments until you can resume making payments again.

#8 – Can I buy insurance for a loved one like a spouse or parent?

Although you can buy insurance for someone else, you’ll ultimately need their signature on the policy.

#9 – How long will my claim with North American Company take until I receive payment?

It will take some time to submit all the paperwork. Once the paperwork is submitted, North American tries to complete processing within 10 days. However, it may require more time if there are special circumstances.

#10 – I plan to shed a few pounds, should I wait to get insurance until I am in better shape?

If you are responsible for your family and loved ones, then you should not wait to obtain insurance. Work with your insurance provider to discuss ways you can meet your goals and keep your rates low.

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption