AIG Life Insurance Review (Coverage Comparisons & More)

FREE Life Insurance Comparison

Secured with SHA-256 Encryption

Compare quotes from the top life insurance companies and save!

| Key Info | Company Specifics |

|---|---|

| Year Founded | 1919 |

| Current Executives | CEO – Brian Duperreault COO – Peter Zaffino |

| Number of Employees | 49,800 |

| Total Sales / Total Assets | $49,520,000,000 / $498,301,000,000 |

| HQ Address | 180 Maiden Lane New York, NY 10038 |

| Phone Number | 1-888-475-2452 |

| Company Website | www.aig.com |

| Premiums Written - Individual Life | $1,703,227,000 |

| Financial Standing | -5.4% from Previous Year |

| Best For | High-Risk Applicants, Flexible Term Policies |

Get Your Rates Quote Now |

|

Purchasing life insurance is one of the most important decisions you can make for your family. A good policy can be the difference between financial hardship and financial security in the event of your passing.

Life insurance isn’t always the easiest thing to talk about since the entire subject hinges on facing your mortality, but while thinking about death can be difficult, planning for it doesn’t have to be.

If you understand the basics of how life insurance works, what your coverage needs are, and the category of policy you want, shopping for life insurance can be as simple as shopping for any other product.

One of the largest life insurance providers in the world, AIG has been providing families with financial peace of mind for the past 100 years. This article will provide an extensive review of AIG to help you determine if it is the right company for you. We’ll also demystify the process of shopping for life insurance and cover some commonly asked questions.

Start comparing life insurance rates now by using our FREE quote tool above!

Table of Contents

AIG’s Ratings

The following third-party ratings give insight into AIG’s financial strength, business practices, and quality of customer service.

A.M. Best

A.M. Best ratings measure an insurer’s financial strength and ability to pay all of its policy obligations. AIG has an A rating, meaning they have an excellent ability to meet their financial commitments.

Better Business Bureau (BBB)

The Better Business Bureau assigns one of 13 letter grades based on factors such as time in business, open complaints, resolved complaints, and federal action against a company. AIG currently holds an A- rating.

Moody’s

Similar to A.M. Best, Moody’s long-term obligation ratings measure an insurer’s credit risk. AIG holds a rating of A2, meaning it represents a low credit risk.

Standard & Poor’s (S&P)

Standard & Poor’s (S&P) ratings also measure an insurer’s credit risk. AIG boasts an A+ rating, again representing a low credit risk.

NAIC Complaint Index

The National Association of Insurance Commissioners Complaint Index (NAIC) compares the number of complaints registered against an insurer each year with other companies. The NAIC sets the index at an average score of 1.00, and AIG has a current score of 3.58.

J.D. Power

J.D. Power’s annual U.S. Life Insurance Study measures overall customer satisfaction in four areas: annual statement and billing, customer interaction, policy offerings, and price. AIG scored two out of five in the 2018 study, with a two out of five in every category.

Company History

In 1919, American Cornelius Vander Starr established the general insurance company American Asiatic Underwriters in Shanghai, China. Two years later, the company started selling life insurance, quickly spreading throughout Asia and Europe and back into its namesake country of America.

Now operating under the name American International Group (AIG), the company has grown to become a multinational finance and insurance corporation operating in over 80 countries and employing nearly 60,000 people.

In 2001, the company acquired one of the leading domestic life insurance and annuities providers, American General Corporation, making them one of the top 10 providers of life insurers in the country.

AIG currently sells insurance life insurance through two subsidiaries: American General Life Insurance Company and the United States Life Insurance Company.

American General Life is licensed to issue policies in all states but New York as well as Washington, D.C., and Puerto Rico. Policies in New York are issued by The United States Life Insurance Company.

AIG’s Market Share

As of 2018, AIG is the 14th-largest writer of life insurance with a 2.1 percent market share, representing $3,346,570 in direct written premiums.

| Year | Direct Premiums Written | Market Share |

|---|---|---|

| 2015 | $3,417,214,000 | 2.2% |

| 2016 | $3,442,794,000 | 2.2% |

| 2017 | $3,492,327,000 | 2.1% |

| 2018 | $3,346,570,000 | 2.1% |

Get Your Rates Quote Now |

||

The company saw a slight increase in direct written premiums from 2015-2017 but then experienced a drop of $145 million in 2018, resulting in a decrease of 0.01 percent in market share.

AIG’s Position for the Future

While AIG has lost a little ground in the group life insurance market, they are still a significant presence.

The company is still one of the largest financial firms and life insurance providers in the world, ranking No. 60 on the Fortune 500 list and No. 207 on the Fortune Global 500 list. Considering AIG’s total of written premiums and current assets as a company (nearly $500 billion), that small decrease in written premiums is unlikely to have negative repercussions on future business.

AIG’s Online Presence

Visitors to AIG’s website can request quotes, pay premiums, and file life insurance claims.

AIG’s Commercials

AIG doesn’t have a current ad campaign but does advertise through sports sponsorships. The company is a major supporter of global sports, including rugby and organizations such as the Japanese Rugby Federation.

Since 2012, AIG has also been the major global sponsor and official insurance partner of New Zealand Rugby and the world-champion All Blacks.

AIG is also the insurance sponsor of the PGA and the key sponsor of the AIG Women’s British Open.

AIG in the Community

AIG is committed to giving back to communities. Below are some of the company initiatives.

Microinsurance

AIG is a proud member of Blue Marble, a consortium of nine companies that collaborates to extend socially impactful, commercially viable insurance (commonly referred to as microinsurance) to underserved communities.

Philanthropy

Last year, AIG made $11.7 million in monetary contributions through charitable giving initiatives and its employee grant-matching program; AIG matches employee donations to qualifying nonprofit organizations and schools two to one, up to $10,000 for each employee per year.

Employee Volunteerism

AIG holds a global volunteer month every April.

This year, upwards of 4,000 employee volunteers from 35 countries donated over 14,000 volunteer hours to various causes.

AIG’s Employees

AIG currently employs just over 1,000 people in North America, and Glassdoor employee reviews averaged 3.1 out of five stars based on over 4,000 reviews. Over 50 percent of current employees say they would recommend the job to a friend. AIG does not currently rank on any notable lists of best places to work.

Shopping for Life Insurance

If you’re reading this guide, likely you’ve already realized the importance of owning a life insurance policy. If you still haven’t, consider these findings from the 2018 Insurance Barometer Study from Life Happens and LIMRA:

- 35 percent of households would be financially impacted within one month of the primary wage earner’s death

- 90 percent agree that the primary wage earner should carry insurance

- 60 percent of all people living in the United States have life insurance

- 20 percent of those with a policy feel their coverage is insufficient

With that in mind, AIG’s own video will do a fine job summing up all the reasons you need life insurance.

In general, life insurance needs to cover two types of obligations: immediate and future. Immediate obligations are the things that need to be paid soon after your death. These include:

- Funeral costs

- Medical bills

- Mortgage balances

- Personal loans

- Credit card debt

Future obligations are all of the expenses that you want to pay for after your death. They include:

- Income replacement

- Spouse’s retirement

- Emergency savings fund

- Children’s college tuition

A life insurance agent or financial planner can help you determine exactly how much coverage you’ll need to meet all of those obligations.

For now, here is an example using a basic life insurance calculator: a wife and mother of two is the majority wage earner in her family with a husband who works full time. She has an annual salary of $80,000. The family has a remaining mortgage balance of $75,000 and a balance of $15,000 on a home equity line of credit.

The mortgage is the largest annual expense. With it paid, the husband will have less need for her income. Therefore, she plans to leave him only five years’ worth of her salary as an emergency savings fund. She would also like to leave their child $30,000 for college tuition. After factoring in an average funeral cost of around $7,500, her insurance needs are as follows:

- Immediate need: $75,000 mortgage + $15,000 HELOC + $7,500 funeral costs = $97,500

- Future need: $400,000 income replacement + $30,000 college fund = $430,000

- Total need: $527,500

That total means she should purchase a life insurance policy with a face value of $500,000 at the very least.

The above video further demonstrates the point.

Average AIG Male vs Female Life Insurance Rates

The following table illustrates how AIG’s average annual rates on a 10-year $10,000 policy in key demographics compare to the average of the top 10 insurers by market share.

| Demographic | Annual Premium: Male | Versus Average Top 10 Insurers | Annual Premium: Female | Versus Average Top 10 Insurers |

|---|---|---|---|---|

| 25-Year-Old, Non-Smoker | $120.36 | -$58.18 | $113.64 | -$46.93 |

| 25-Year-Old, Smoker | $271.92 | -$49.84 | $198.00 | -$50.75 |

| 35-Year-Old, Non-Smoker | $127.68 | -$57.36 | $113.64 | -$52.27 |

| 35-Year-Old, Smoker | $279.12 | -$81.11 | $216.48 | -$69.70 |

| 45-Year-Old, Non-Smoker | $178.32 | -$89.57 | $150.24 | -$90.01 |

| 45-Year-Old, Smoker | $572.40 | -$65.11 | $345.72 | -$147.48 |

| 55-Year-Old, Non-Smoker | $319.44 | -$205.51 | $319.44 | -$87.50 |

| 55-Year-Old, Smoker | $989.52 | -$374.57 | $729.48 | -$262.15 |

| 65-Year-Old, Non-Smoker | $660.84 | -$612.28 | $539.16 | -$341.50 |

| 65-Year-Old, Smoker | $2,220.24 | -$1,024.81 | $1,571.88 | -$663.43 |

| Average Non-Smoker | $281.33 | -$204.58 | $247.22 | -$123.65 |

| Average Smoker | $866.64 | -$319.09 | $612.31 | -$238.70 |

Get Your Rates Quote Now |

||||

For a basic term policy, AIG’s premiums are significantly below average.

Coverage Offered

AIG offers a full slate of term and permanent life insurance policies. You can also choose from several riders to further tailor your coverage.

Types of Coverage Offered

Life insurance policies fall into one of two general categories — term or whole. A term policy only pays if the death occurs within a set time frame, usually between 10–30 years.

Whole policies have no term and pay whenever a death occurs, regardless of age; some also build cash value by allocating a portion of your premiums into an interest-bearing account.

They can also come with two benefit options: fixed and increasing. With a fixed death benefit, the policy premiums decrease over time as the cash value increases so the payout is always equal to the initial face value.

With an increasing death benefit, the premiums and face value remain the same over time. As the cash value increases, the overall death benefit increases.

Whole policies have multiple variations: traditional whole life insurance, universal life insurance, guaranteed universal life insurance, indexed universal life insurance, variable life insurance, and variable universal life insurance.

AIG currently offers group term and universal life policies as well as a supplemental final expense whole policy.

Term

A term policy is payable only if the death of the insured occurs within a specified period, usually between 10–30 years. Once the term has passed, the insurer cancels the coverage.

There are generally no refunds on the premiums paid. Most policies can also be converted to a whole policy before they expire. AIG currently offers two different term options.

Select-a-Term®

Most insurers sell either 10-, 15-, 20-, or 30-year term policies. AIG offers 18 variations that allow you to customize your policy to the exact length you need. The specifics are as follows:

- Term: 10 years, any length from 15-30 years, or 35 years

- Convertibility: Convertible to a universal policy at any point during the term or until age 70 (whichever comes first)

- Minimum: $50,000

- Maximum: $1,000,000

- Issue Age: 20-75

The Select-a-Term® policy can be customized with the following riders:

- Accidental Death Benefit: Pays a benefit in addition to the death benefit of the policy if the insured dies as a result of qualifying accidental injuries

- Child Rider: Pays a death benefit to the insured parent upon the death of an eligible child

- Terminal Illness Rider: Gives early access to up to 50 percent of the death benefit if diagnosed by a physician as having 12 months or fewer to live

- Waiver of Premium: Waives the policy premiums if the insured becomes disabled

QoL Flex Term

The QoL Flex Term plan has all the benefits of the Select-a-Term® plan with the additional benefit of a no-cost Quality of Life Accelerated Benefits rider.

An Accelerated Benefits rider allows you to take an advance on a portion of your death benefit to pay for costs associated with a qualifying chronic, critical, or terminal illness.

The specifics are as follows:

- Term: 10 years, any length from 15-30 years or 35 years

- Convertibility: Convertible to a universal policy at any point during the term or until age 70 (whichever comes first)

- Minimum: $100,000

- Maximum: $2,000,000

- Issue Age: 20-80

The QoL Flex Term policy can be customized with the following riders:

- Accidental Death Benefit

- Child Rider

- Waiver of Premium

Universal

Universal policies offer the permanent coverage and cash value growth of a traditional whole plan while also allowing flexibility to set monthly premiums, change coverage amounts, and make lump-sum payments to keep premiums low.

Universal policies are adjustable and offer the flexibility to set monthly premiums and change coverage amounts. A portion of the premiums is invested at a fixed interest rate so it can grow to cover the payout.

That savings element means the policy has the potential to grow a tax-deferred cash value beyond the face value of the policy, payable to the policyholder.

Universal policies also allow for loans or withdrawals from the cash value that must be paid back with interest. Any portion not repaid will be deducted from the benefit upon the insured’s death.

Secure Lifetime GUL 3

AIG’s Guaranteed Universal Life policy guarantees the amount of the death benefit, even if the insured dies before the cash value has grown enough to cover it. It also features a guaranteed return of premium.

If your insurance needs to change, you can cancel your policy in year 20 and receive a refund on 50 percent of your premiums or in year 25 and receive 100 percent (up to 40 percent of the total face value).

The specifics are as follows:

- Flexibility: Increase available at any time, decreases available after the first year

- Guaranteed Interest: 2 percent

- Minimum: $100,000 ($50,000 in NY)

- Maximum: None (Subject to individual consideration and underwriting limits)

- Issue Age: 18-80

The Secure Lifetime GUL 3 policy can be customized with the following riders:

• Accidental Death Benefit

• Child Rider

• Terminal Illness Rider

• Waiver of Premium

Indexed Universal

Indexed universal policies differ from basic universal policies in the way they grow their cash value.

Indexed universal life policies allow the owner to allocate the cash value amounts to an account that grows according to an equity index such as the S&P 500 or the Nasdaq 100.

AIG offers the following indexed universal options.

Value+ Protector

AIG’s Value+ Protector policy offers all of the benefits of the GUL 3 policy along with the potential for significant cash accumulation. Policyholders can invest their cash value at any desired percentage in four different index accounts or a guaranteed 0.75 percent fixed growth account.

The specifics are as follows:

- Flexibility: Increase available at any time, decreases available after the first year

- Guaranteed Interest: 2 percent

- Minimum: $50,000

- Maximum: None (Subject to individual consideration and underwriting limits)

- Issue Age: 18-80

The Value+ Protector policy can be customized with the following riders:

- Accidental Death Benefit

- Child Ride

- Terminal Illness Rider

- Waiver of Premium

Max Accumulator+

AIG’s Max Accumulator+ policy offers all of the benefits of the Value+ Protector policy along with more cash access features and a nonmedical underwriting option. Policyholders can access their cash value through one of three loan types, each with different interest rates. They can also purchase an optional rider that converts their cash value into retirement income.

Also, policies for those aged 50 and under and with face amounts less than $500,000 do not require a medical exam before approval. The specifics are as follows:

- Flexibility: Increase available at any time, decreases available after the first year

- Guaranteed Interest: 2 percent

- Minimum: $50,000

- Maximum: None (Subject to individual consideration and underwriting limits

- Issue Age: 18-80

The Max Accumulator+ policy can be customized with the following riders:

- Income for Life Rider: Converts the cash value into a guaranteed income stream

- Accidental Death Benefit

- Child Rider

- Terminal Illness Rider

- Waiver of Premium

Variable Universal

Variable policies allow you to invest your cash value in stocks, bonds, and money market mutual funds, similar to an IRA or 401k. These policies come with the greatest risk but also some of the highest growth potential.

Variable-universal policies combine the benefits of universal and variable insurance. You get the flexibility of adjustable premiums and face values with the potential for significant growth.

AIG offers the following options.

Platinum Choice VUL 2

AIG’s Platinum Choice VUL 2 policy offers over 40 investment options including stocks, bonds, specialty funds, real estate investment funds, multiple index funds, and a socially responsible fund.

The portfolio automatically rebalances itself by periodically adjusting the policy values among variable investment options to match your original allocation.

The specifics are as follows:

- Flexibility: Increase available at any time, decreases available after the first year

- Guaranteed Interest: 2 percent

- Minimum: $100,000

- Maximum: None (Subject to individual consideration and underwriting limits)

- Issue Age: 0-80

The Platinum Choice VUL 2 policy can be customized with the following riders:

- Lapse Protection Benefit: Coverage is guaranteed not to lapse despite market performance as long as the required minimum premiums are paid to guarantee the death benefit

- Spouse Term Rider: Provides term insurance on the insured’s spouse, up to two times the base policy’s death benefit

- Accidental Death Benefit

- Child Rider

- Terminal Illness Rider

- Waiver of Premium

Burial & Final Expense

Burial and final expense policies are whole life policies with low face values meant only to cover funeral expenses and small financial obligations, like outstanding credit card debt.

AIG offers a no-exam policy with face values from $5,000-$25,000 for those ages 50-85. The current quoted monthly premiums for the policy are as follows.

| Demographic | Monthly Premium: $5,000 | Monthly Premium: $10,000 | Monthly Premium: $15,000 | Monthly Premium: $20,000 | Monthly Premium: $25,000 |

|---|---|---|---|---|---|

| 50-Year-Old, Male | $26.96 | $51.92 | $76.89 | $101.85 | $126.81 |

| 50-Year-Old, Female | $18.92 | $35.83 | $52.74 | $73.93 | $91.91 |

| 55-Year-Old, Male | $29.45 | $56.90 | $84.35 | $125.17 | $155.96 |

| 55-Year-Old, Female | $22.62 | $43.23 | $63.85 | $95.34 | $118.68 |

| 60-Year-Old, Male | $32.58 | $63.17 | $93.75 | $138.18 | $172.22 |

| 60-Year-Old, Female | $26.01 | $50.02 | $74.03 | $110.15 | $137.19 |

| 65-Year-Old, Male | $43.08 | $84.15 | $125.23 | $184.61 | $230.27 |

| 65-Year-Old, Female | $31.78 | $61.57 | $91.35 | $135.37 | $168.72 |

| 70-Year-Old, Male | $50.09 | $98.18 | $146.27 | $215.24 | $268.55 |

| 70-Year-Old, Female | $38.26 | $74.52 | $110.78 | $163.60 | $204.00 |

| 75-Year-Old, Male | $70.28 | $138.55 | $206.83 | $303.31 | $378.64 |

| 75-Year-Old, Female | $54.59 | $107.17 | $159.75 | $234.85 | $293.07 |

| 80-Year-Old, Male | $124.22 | $246.44 | $368.66 | $538.70 | $672.87 |

| 80-Year-Old, Female | $88.71 | $175.42 | $262.13 | $383.77 | $479.22 |

| 85-Year-Old, Male | $158.91 | $315.82 | $472.73 | $692.70 | $865.38 |

| 85-Year-Old, Female | $100.53 | $199.06 | $297.59 | $437.18 | $545.98 |

Get Your Rates Quote Now |

|||||

These policies are guaranteed. Your payments never go up, and your coverage never goes down as long as you live.

FREE Life Insurance Comparison

Compare quotes from the top life insurance companies and save!

Secured with SHA-256 Encryption

Factors That Affect Your Rate

Anything that increases your risk of an early death increases the chances the insurer will have to pay out on your policy. That higher risk classification will result in a higher premium. Let’s take a look at some of the most common factors that affect your rate.

Demographics

Several demographics can have a significant effect on your life insurance premium. Age is one of the most important factors in determining insurability.

Older individuals are closer to the end of their lifespan, which means that the insurer will be more likely to pay out on a term policy and there is a higher risk of paying out on a whole policy before it grows enough to be profitable for them.

Every year you wait to purchase life insurance could mean a higher premium. Some insurers also limit coverage amounts for people over certain ages.

Gender also plays a significant role. Statistically, women live longer than men. For that reason, women of the same age and health will almost always pay lower premiums than men.

Current Health & Family Medical History

Healthy people have longer life expectancies and therefore pay lower life insurance premiums. To determine your overall health, insurers will require you fill out a health questionnaire and may request access to your medical record. Some may require a complete medical exam as well as requiring bloodwork.

Even if a policy does not require a medical exam, underwriters still have access to public prescription and Medical Information Bureau (MIB) records.

It’s important to be honest on the questionnaire because the insurer does have access to accurate information.

If the underwriter discovers that you lied about your health, your application will likely be denied.

Most insurers will also examine the health history of your immediate family to identify any potential hereditary medical issues such as diabetes, history of heart disease, or cancer.

High-Risk Occupations

Some jobs are more dangerous than others. The Bureau of Labor Statistics’ Census of Fatal Occupational Injuries shows that police officers, firefighters, and many others have a higher risk of accidental death than someone with an office job. A dangerous job will earn you a higher risk classification, which equals higher premiums.

High-Risk Habits

Similarly, high-risk habits outside of work can also result in costlier life insurance.

The most common high-risk habit that insurers look for is tobacco use. Smokers almost universally pay higher rates than their nonsmoking counterparts in every demographic.

For example, the average 45-year-old male nonsmoker pays around $135 per year for a 20-year, $100,000 policy. A 35-year-old smoker pays $360 for the same policy — that’s an extra $4,500 paid over the life of the plan.

In addition to smoking, insurers will also look to see if you pursue any high-risk hobbies outside of your occupation, such as mountain climbing, skydiving, scuba diving, car racing, etc.

A single outing to check off a bucket list item won’t get you a higher premium, but a regular hobby could place you in a higher risk category.

Veteran or Active Military Status

Military status falls under the category of high-risk occupations. Most insurers charge higher rates to active duty military service members, and some don’t sell them policies at all.

Getting the Best Rate with AIG

Your risk classification determines whether an insurer will raise your price from their base premiums. Those base premiums are generally based on three factors: mortality, interest, and company expenses.

Insurers use statistical mortality tables to estimate how many people in every demographic are likely to die each year. If they insure people in demographics with a high likelihood of death, they’ll raise their rates on them to minimize losses.

Rates are also influenced by current interest rates. Insurers increase their profits by investing the premiums you pay in bonds, stocks, and mortgages. A low expected return on those investments could result in higher premiums.

They also factor in all of their operating expenses. The more a company spends maintaining their business, the more of that cost they pass onto their policyholders.

Rates can also vary from state-to-state, though the NAIC is currently encouraging states to adopt laws that would provide more uniformity nationwide.

With so many variables affecting premiums, the question becomes: How do you navigate them to get the best rates?

A lot of these factors, such as gender and family medical history, are beyond your control. The best way to lower your rates is to improve all of the areas you can.

First, make healthy lifestyle changes. Your blood pressure, Body Mass Index or BMI, and cholesterol are key measures on a medical exam. Do everything you can to improve them through diet and exercise. Also, read up on the medical exam process, so you know what to expect.

If you do smoke, not only should you quit, but you should do so as soon as possible. Some insurers require you to be tobacco-free for a specific length of time before you can claim a nonsmoking rate.

Second, buy early. As previously discussed, waiting to buy insurance will increase your premiums. Rates never go down with time.

For example, the average 10-year, $500,000 policy for a 35-year-old male, nonsmoker, is around $175 per year. That same policy for a 45-year-old costs $360. That 10-year jump doubles the cost.

Finally, it’s important to pay your premiums on time. Like any bill, late payments result in penalties and could even lead to the cancellation of your policy.

If you have a policy canceled for nonpayment, you can expect additional fees to get it reinstated, or higher rates at the next insurer.

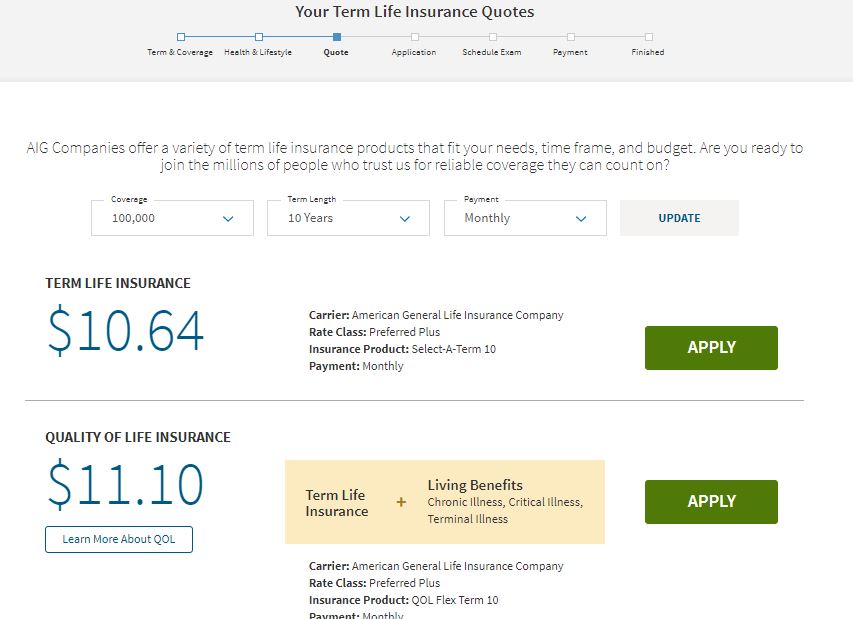

To give you an idea of how much a term life policy might cost, we’ve compiled a list of average monthly sample rates for a 10-year term for nonsmokers at key ages.

| Age | $100,000: Male | $100,000: Female | $250,000: Male | $250,000: Female | $500,000: Male | $500,000: Female |

|---|---|---|---|---|---|---|

| 25 | $10.03 | $9.47 | $10.34 | $9.57 | $13.98 | $11.97 |

| 30 | $10.03 | $9.47 | $10.34 | $9.57 | $13.98 | $11.97 |

| 35 | $10.64 | $9.92 | $11.67 | $11.08 | $14.70 | $13.42 |

| 40 | $12.48 | $11.00 | $13.81 | $13.59 | $21.71 | $18.38 |

| 45 | $14.86 | $12.52 | $17.95 | $16.46 | $30.13 | $24.53 |

| 50 | $17.01 | $15.04 | $25.86 | $22.33 | $44.88 | $36.59 |

| 55 | $26.62 | $20.96 | $41.68 | $31.68 | $73.65 | $55.36 |

| 60 | $38.22 | $25.58 | $63.70 | $46.08 | $117.60 | $83.57 |

| 65 | $55.07 | $44.93 | $113.71 | $84.00 | $202.63 | $136.37 |

Get Your Rates Quote Now |

||||||

AIG’s Programs

AIG offers little in the way of additional life insurance resources on its website. Nearly all of its resources are dedicated to understanding life insurance coverage.

Canceling Your Policy

If you do need to cancel your policy completely, you can do so at any time, though early termination of some term plans could result in penalties.

There are generally no refunds on premiums when you cancel a life insurance policy. For a term policy, you would only receive a refund on prepaid premiums for an upcoming period.

For a universal policy, you will be refunded any prepaid premiums as well as the surrender value of your policy. The surrender value is the cash value of your policy minus any surrender fees.

How to Cancel

The only way to cancel your policy is through your life insurance agent, or by requesting a cancellation form from customer support. The form will need to be filled out and submitted either electronically or via mail. Customer support can be reached through your member portal or by phone at 888-475-2452.

How to Make a Claim

The overall process of filing a death benefits claim with AIG follows general industry-standard steps:

- Initiate a claim

- Fill out company-specific paperwork

- Submit the paperwork along with a death certificate and any other requested documents

- Choose a disbursement method

- Receive the benefits

Claims can be initiated online on AIG’s website or over the phone at 1-800-362-4462.

Upon initiating a claim, you must provide a policy number, the insured’s date of death, and a death certificate. If the insurer requires any other documentation, it will be listed in the claim package.

How to Get a Quote Online

You can get an instant quote for term policies online through AIG Direct. As the name implies, AIG Direct also allows you to purchase the policy directly online. All other policies are sold through licensed, third-party insurance agents.

#1 – Go to the AIG Direct Website

The homepage at AIGdirect.com is a quote tool.

The main AIG website does have a link to a quote tool, but as of right now, it simply directs you to the AIG direct website once you enter your information, only to have to enter it again. To save time, go straight to AIG direct.

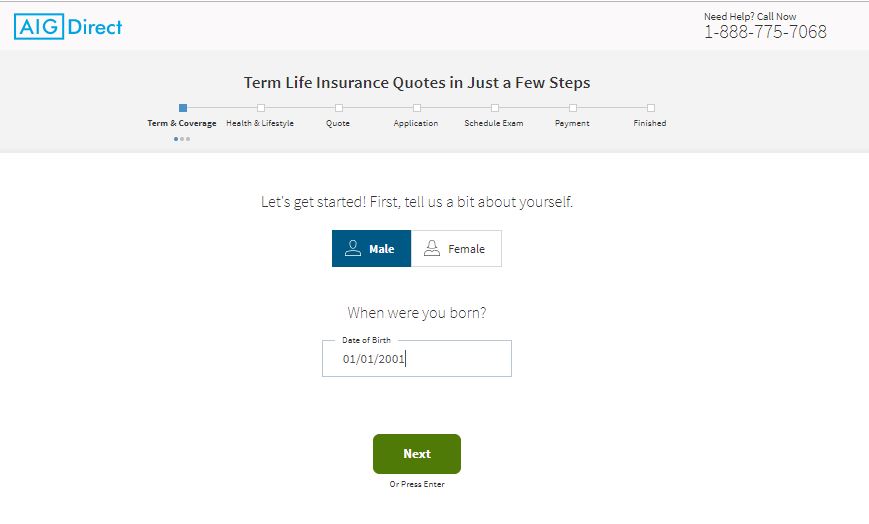

#2 – Enter Your Demographic Information

Once you’ve entered your personal information on the homepage, you’ll be taken to the self-service application, where you will provide more details to get a more accurate quote.

First, the tool will ask you to enter some demographic information.

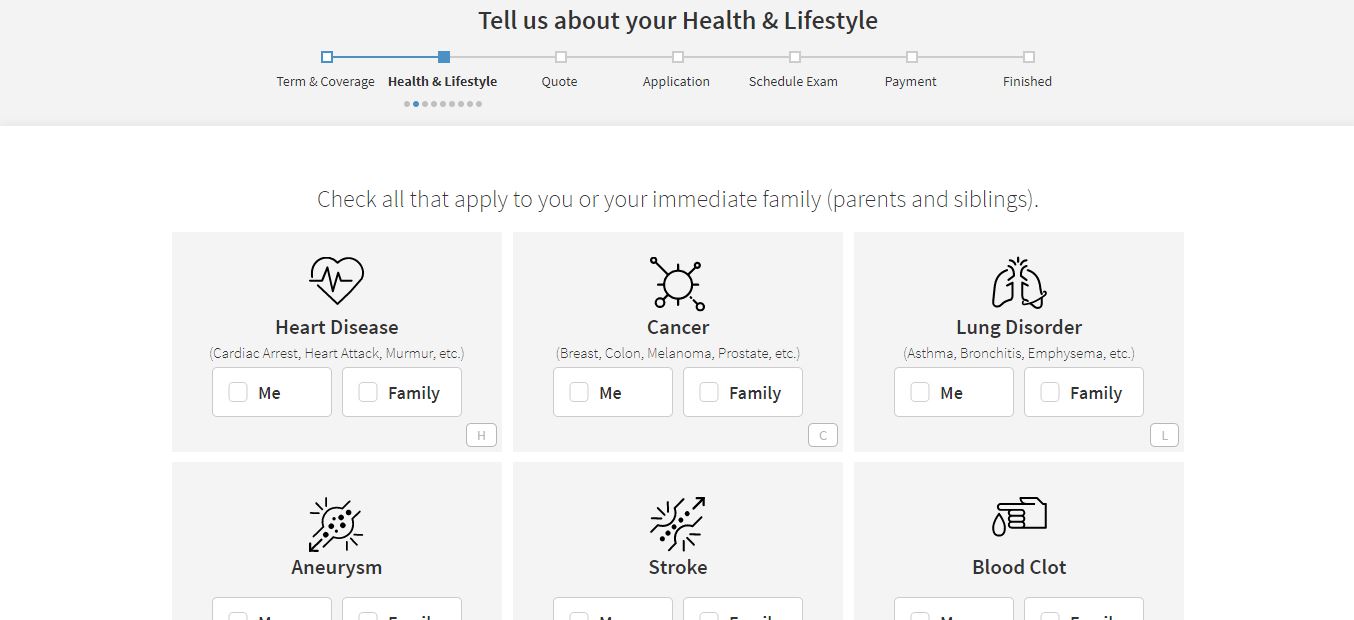

#3 – Give a Brief Medical History

Next, the tool will ask you to enter some medical information for both yourself and your immediate family (parents and siblings).

#4 – Get Your Quote and Apply

Once you submit your information, the tool will display quotes for a term policy. You’ll then have the option to continue with an official application.

Design of Website/App

The AIG website is simple to navigate, but low on information outside of some basic policy details.

The website is designed to preview their offerings, and then guide you to a licensed agent who can provide you with the complete information on each.

Pros & Cons

As with any company, there are pros and cons to shopping with AIG. Here are some of the biggest.

Pros

- Wide range of policy options

- Good selection of additional riders

- Term policies sold directly online

- Below average rates on term policies

- Some policies available with no medical exam

Cons

- High complaint ratio

- Low customer service scores

The Bottom Line

AIG is one of the largest individual life insurance providers and is among the most financially stable. They have as large of a selection of policy options as most competitors, with term policy prices below the average of most, even for smokers.

The NAIC Complaint Index and J.D. Power study suggest that their customer service might not be the greatest, but that shouldn’t keep you from at least seeing what they have to offer.

Their customizable term lengths make them a good fit for many people with unique life insurance needs, and their universal and variable policies are good for those who want to make life insurance part of a larger investment strategy. For all others, they still have multiple policies worth reaching out to an agent to discuss.

AIG’s FAQs

Here are some frequently asked questions about AIG and their policy offerings.

#1 – Does AIG offer a no-exam life insurance policy?

Several term and whole policies with a face amount less than $500,000 for those aged 50 and under do not require a medical exam before approval.

#2 – Does AIG offer any supplemental coverage?

Aside from their final expense insurance, AIG does not currently offer any supplemental coverage.

#3 – Does AIG offer group life insurance?

AIG offers some group health and accident insurance but does not currently offer employer-sponsored life insurance.

#4 – How do I make a payment on my AIG life insurance premiums?

You can have your payments automatically debited from your checking account every month by filling out an authorization form or make electronic payments from a savings or checking account online.

#5 – How easy is it to change my beneficiary?

You will need to fill out a beneficiary change form, which can be filled and submitted directly online or by mail. You can access the form through your member portal or directly on the customer service page of the website.

#6 – Can I make withdrawals on my AIG life insurance policy?

All of AIG’s permanent insurance policies allow you to take out loans against your cash value. Loans must be paid back with interest, or you risk decreasing or forfeiting your death benefit.

#7 – How long does it take for AIG to pay death benefits on a life insurance policy?

Death benefits are typically paid within 30 days of processing the completed claim packet. The benefit also accrues two percent interest between the day the claim is filed and the day it is paid.

#8 – Are the life insurance benefits taxable?

Life insurance benefits are nontaxable when they are paid directly to a beneficiary, such as a spouse or a child. However, if you name your estate as the beneficiary, the benefits become a part of the estate and are then subject to estate taxes.

#9 – Are all AIG life insurance policies available in all states?

Yes. AIG is licensed to sell all of its policies in every state through one of its two affiliates.

Start comparing life insurance rates now by using our FREE quote tool below!

Start Saving on Life Insurance!

Enter your zip code below to compare rates from the top companies in your area

Secured with SHA-256 Encryption